Explore Investor Solutions

Analytic & Reporting Solutions

Global Access (Investor Platform)API & Data Feed SolutionsPartner PlatformsMorningstar Sustainability Rating for Funds

Explore Morningstar's suite of products for investors here.

Explore Corporate Solutions

Sustainable Lending & Finance

| Second-Party Opinion Services | Sustainability Linked Loans |

| Published Projects | Bond Impact Reporting |

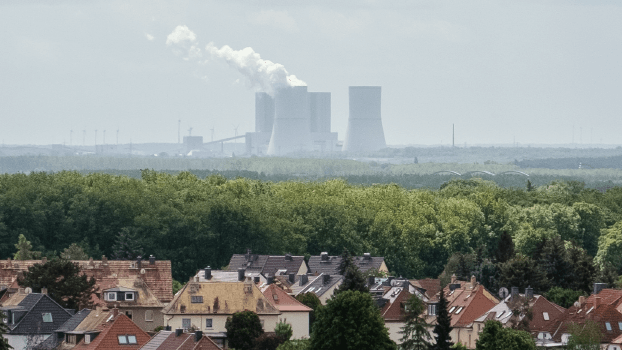

A Global Leader in ESG Research and Data

Morningstar Sustainalytics is a leading independent ESG and corporate governance research, ratings and analytics firm that supports investors around the world with the development and implementation of responsible investment strategies. For more than 30 years, the firm has been at the forefront of developing high-quality, innovative solutions to meet the evolving needs of global investors.

Today, Sustainalytics works with hundreds of the world’s leading asset managers and pension funds who incorporate ESG and corporate governance information and assessments into their investment processes. Sustainalytics also works with hundreds of companies and their financial intermediaries to help them consider sustainability in policies, practices and capital projects.

With 17 offices globally, Sustainalytics has more than 1,800 staff members, including more than 800 analysts with varied multidisciplinary expertise across more than 40 industry groups.