Sustainalytics’ ESG Risk Ratings issue – Business Ethics – focuses on the management of general professional ethics, such as taxation and accounting, anti-competitive practices and intellectual property issues. Business Ethics may include Bribery and Corruption for subindustries that do not have Bribery and Corruption as a separate material ESG issue. Additional subindustry-specific topics – such as Medical Ethics and Ethics regarding the provision of Financial Services, etc. – may also be included in this issue.

Business Ethics in the Spotlight

Based on industry data, between 2008 and 2018, global regulatory anti-money laundering fines reached USD 26 bn. To mitigate such illegal/unethical business practices, many regulators and authorities worldwide now require companies to have rigorous compliance systems and ethics policies in place. Against this backdrop, business ethics controversies can impact some of the most valuable companies in the world.

How Sustainalytics Assesses Business Ethics

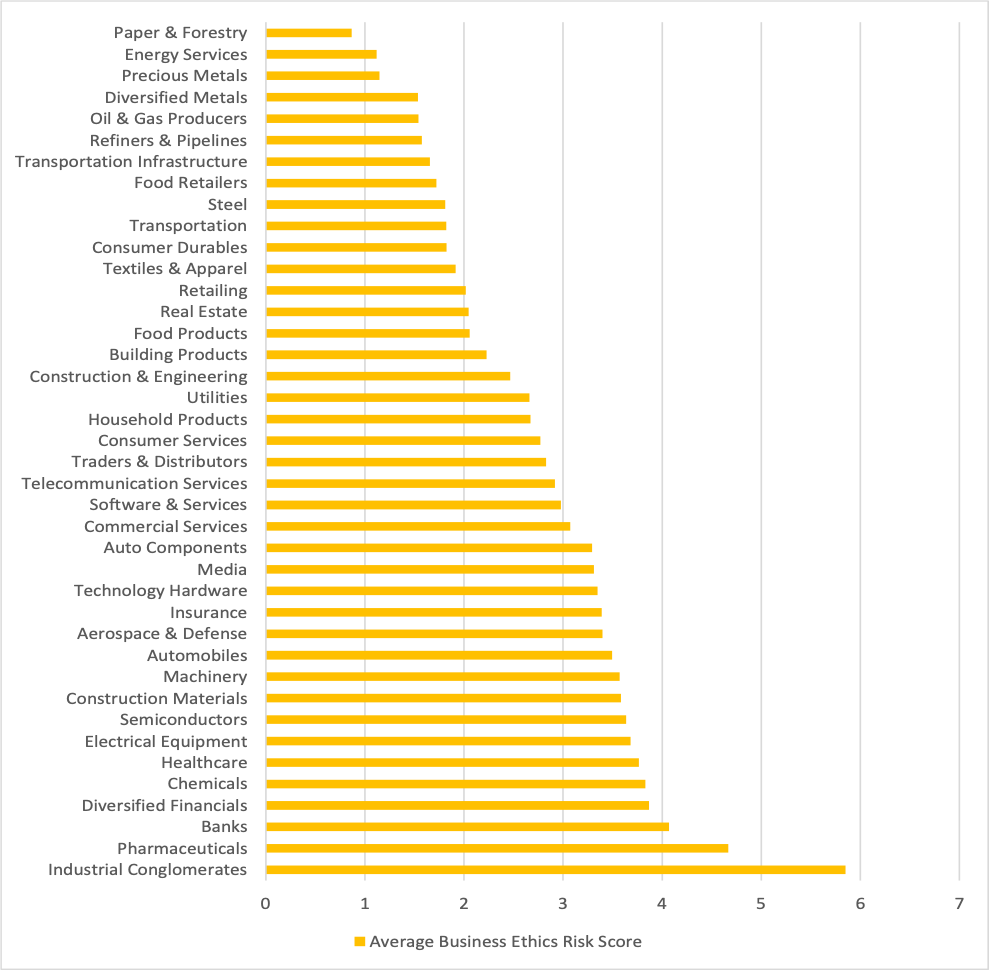

Sustainalytics’ ESG Risk Rating on a company’s business ethics includes the risk that the company is not actively managing with relevant policies, programs and systems in place. Based on our consistent ESG Risk Ratings framework, we observe that business ethics is a material issue for 40 out of 42 industry groups and covers more than 4600 companies in our comprehensive universe. As witnessed in the exhibit below, conglomerates have the highest unmanaged risk score, followed by pharmaceuticals, banks and diversified financials.

Exhibit 1: Unmanaged Risk by Industry

Source: Sustainalytics, Data as of October 2021

Regulators and authorities are placing more scrutiny on company compliance systems, as witnessed in the banking and financial industries. As such, being involved in legal or ethical misconduct not only has potential negative financial impacts, but also may pose severe reputational risks that might change the operational outlook and market presence for a company. Having a comprehensive ethical framework acts as a defense against business ethics issues. Leveraging Sustainalytics’ ESG Risk Ratings, investors can clearly see which companies are most exposed to this key issue and how well they are managing their related risks.