In October 2019, China posted its lowest quarterly GDP growth rate (6.0%) in 30 years. While the country’s trade war with the US might have added to the economic headwind, the economic results are in line with a decade of cooling down following years of double-digital growth.

With China’s economic growth continuing to slow, in recent months we have observed an increase in the number of business ethics controversies among Chinese companies. In this article, we use China as a case study to discuss the possible links between economic downturn and business ethics risks and identify the gaps in companies’ management performance on related issues.

Figure 1. China's GDP Growth Rate

Source: worldbank.org

Increasing business ethics controversies

As China transforms from an export and investment driven economy to a consumption driven economy, a lower economic growth rate is inevitable, and probably more sustainable. In its latest World Economic Outlook, the International Monetary Fund predicts that China’s economic growth will continue to slow down to 5.8% in 2020.[i]

While China remains one of the fastest growing major economies in the world, this “new normal” of relatively moderate economic growth has already affected many industries. The financial sector is probably the first to feel the impact. In 2019, more than 20 small- and medium-size Chinese banks delayed reporting their 2018 results, and many of the postponed annual reports showed significantly lower profit and deteriorating asset quality. As of the end of August 2019, at least three banks have been bailed out by the government.[ii] Moreover, since 2016, thousands of online peer-to-peer (P2P) lending platforms in China have gone bust. The automobile industry is also struggling with contracting sales and dropping prices. It was reported that in 2019, four Chinese automobile companies have filed for bankruptcy.[iii]

Amid the disarray, we have observed an increase in the number of business ethics incidents within some industries in China in recent months. Again, taking the financial sector as an example, multiple banks have been scrutinized by Chinese regulators for irregularities in their operations, and many Chinese P2P platforms were involved in controversies including misallocating funds and embezzlement. According to Sustainalytics’ Controversy Research, business ethics incidents in China’s financial sector have been on the rise over the past five quarters, with the number in Q3 2019 reaching the highest in recent years.

Source: Sustainalytics Controversy Research

Are business ethics risks linked to a slowing economy?

Business ethics incidents are affected by multiple factors, including greater media scrutiny and regulatory changes. While the increase in the number of such incidents is not necessarily due to economic difficulties, there are several mechanisms that could potentially contribute to the rise of business ethics risks in weak economic environments:

- Financial difficulty could increase the incentive for unethical practices. Moreover, in tough growth conditions or financial distress, compliance risk management tends to become lax. According to the 15th Global Fraud Survey 2018 by EY,[iv] 13% of respondents would justify cash payments to win or retain business when helping a business survive an economic downturn. Contradictorily, 97% of respondents recognize it is important to demonstrate that their organization operates with integrity.[v]

- Internal control systems are often only seriously tested in adverse environments. Banks conduct stress testing to determine their financial resilience against adverse economic developments. Similarly, the effectiveness of risk management systems can only be fully demonstrated in difficult situations. Having enjoyed decades of non-stop high-speed growth, the effectiveness of many Chinese companies’ internal controls is unlikely to have been seriously tested.

- The impacts of previous irregular practices are more likely to be felt during economic downturns as irregular practices often do not have an immediate negative impact. When the company is doing well, untidy issues can be conveniently brushed under the carpet. However, this is not so easy to do when things are not going well, as the company will likely be under greater scrutiny from stakeholders and regulators.

Are Chinese companies prepared?

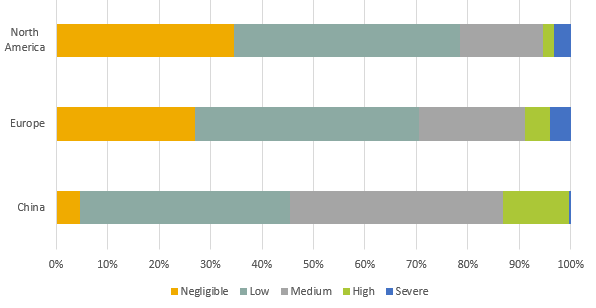

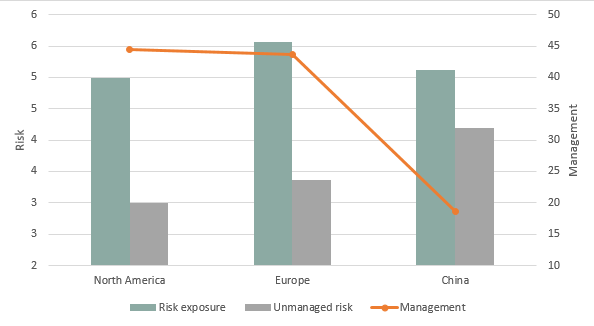

According to Sustainalytics’ ESG Risk Ratings, compared to companies in Europe and North America, more Chinese companies fall into the Medium and High categories of risk on the issue of Business Ethics. The higher unmanaged risk[vi] is mainly due to lower management scores on business ethics issues.

Figure 3. Performance comparisons on Business Ethics

Risk Category Distribution

Average Scores

Source: Sustainalytics ESG Risk Ratings

Our research and analysis show that although most Chinese companies state they have business ethics policies in place, details of these policies are often not publicly available. While the companies’ boards are ultimately responsible for managing business ethics risks, governance structures for compliance issues are often unclear and lack accountability at the executive team level. Most companies have initiatives to train their employees on ethical topics; however, few have committed to conducting the training regularly. Additionally, although most Chinese companies have setup some whistleblower channels, these channels are often not independent and not available to suppliers, customers and other third parties.

Summary

There appears to be some association between business ethics risks and economic difficulties, possibly due to greater incentives to engage in unethical practices, internal control weaknesses and heavier scrutiny. In the context of China’s slowing economy, the gaps in Chinese companies’ management of business ethics issues should draw investors’ attention.

Notably, this emerging issue is also affecting companies outside of China. After ten years of recovery from the global financial crisis in 2008, many of the world’s major economies have experienced one of the longest periods of economic growth in history. The next turning point is possibly not far away.

Whether an economy is booming or slowing, business ethics should be a consideration in all parts of the operation. Companies with high standards around business ethics issues could potentially create greater value for shareholders and society in the long term, as ethical practices and good reputation could help retain and attract customers and top talent, cultivate friendly local communities, build strong relationships with business partners and investors, as well as reduce legal risks.

Notes

[i] International Monetary Fund, October 2019, “World Economic Outlook, October 2019 – Global Manufacturing Downturn, Rising Trade Barriers,” accessed at: https://www.imf.org/en/Publications/WEO/Issues/2019/10/01/world-economic-outlook-october-2019

[ii] The Economist, 5 September, 2019, “After three Chinese banks are bailed out, how many more are at risk?” accessed at: https://www.economist.com/finance-and-economics/2019/09/05/after-three-chinese-banks-are-bailed-out-how-many-more-are-at-risk?fsrc=scn/fb/te/bl/ed/afterthreechinesebanksarebailedouthowmanymoreareatriskexpellingthepoison

[iii] Sina, 12 October, 2019, “Net exposure of four Chinese car companies filed for bankruptcy,” accessed at: https://finance.sina.com.cn/chanjing/gsnews/2019-10-12/doc-iicezuev1654537.shtml

[iv] The 15th Global Fraud Survey 2018 by EY conducted 2,550 interviews with senior decision makers in a sample of the largest companies in 55 countries and territories.

[v] EY, “Integrity in the Spotlight: The Future of Compliance. 15th Global Fraud Survey,” accessed at: https://www.ey.com/Publication/vwLUAssets/EY_Global_Fraud_Survey_2018_report/$FILE/EY%20GLOBAL%20FIDS%20FRAUD%20SURVEY%202018.pdf

[vi] The ESG Risk Ratings’ emphasis on materiality requires the assessment of two dimensions: ESG risk exposure and ESG risk management. Exposure reflects the extent to which a company is exposed to material ESG risks. Management can be considered as a set of company commitments, and actions that demonstrate how the company approaches and handles ESG issues.

Recent Content

Six Best Practices Followed by Industries Leading the Low Carbon Transition

In this article, we take a closer look at the leading industries under the Morningstar Sustainalytics Low Carbon Transition Rating (LCTR) and examine the best practices that have allowed them to emerge as leaders in managing their climate risk.

Navigating the EU Regulation on Deforestation-Free Products: 5 Key EUDR Questions Answered About Company Readiness and Investor Risk

The EUDR comes into effect in December 2024, marking an important step in tackling deforestation. In this article, we answer five key questions who the EUDR applies to, how companies are meeting the requirements, and the risks non-compliance poses to both companies and investors

-5-key-questions-answered-about-company-readiness-and-investor-risk.tmb-thumbnl_rc.jpg?Culture=en&sfvrsn=ee2857a6_2)