Navigating the EU Regulation on Deforestation-Free Products: 5 Key EUDR Questions Answered About Company Readiness and Investor Risk

The EUDR comes into effect in December 2024, marking an important step in tackling deforestation. In this article, we answer five key questions who the EUDR applies to, how companies are meeting the requirements, and the risks non-compliance poses to both companies and investors

Child Labor in Cocoa Supply Chains: Unveiling the Layers of Human Rights Challenges

Child labor remains a persistent issue in the cocoa supply chain. So can major food brands do to stop it? Discover the steps companies can take to address the issue and ways investors can engage with companies to mitigate it.

ESG Risk Ratings: Distilling for Enhanced Performance and Downside Protection

In Volume 2 of the Quantitative Investment Approaches for ESG Risk series created in partnership with Natixis, this report examines the impact of ESG risk on portfolio performance, volatility, downside risk and financial health.

Beyond 1.5 Degrees: What the LCTR Tells Us About Companies Managing Their Climate Risk

The LCTR rating of over 8,000 companies shows that global temperatures will rise 3.1 degrees Celsius over pre-industrial averages. This article looks at the overall performance of these companies and the industries that are leading on climate.

The SEC’s Climate Disclosure Rule: A Step in the Right Direction

The U.S. Securities and Exchange Commission (SEC) recently published the final version of its long-awaited Climate Disclosure Rule. The final rule differs significantly from its original draft and further departs from other standards about to be implemented around the globe.

ESG Risk Around the World: A Comparative Analysis Between Developed and Emerging Markets

This reports tracks and examines the ESG attributes of companies in emerging and developed markets from 2018 to 2022. It sheds light on recent developments, showing how companies in developed and emerging markets are improving their ESG Risk Ratings at different paces.

Automotive Workers and the EV Revolution: How the Pivot to Electric and Connected Vehicles is a Human Capital Risk

A rapid shift to scale the production of electric, connected vehicles demands significant changes to both the size and skillset of the auto industry’s workforce. This article examines how these challenges are impacting the automotive industry.

From Commitment to Action: Corporate Realities and Strategies for Biodiversity Stewardship

With global biodiversity goals established and science-based targets for nature developed, the scaffolding is in place for companies to begin changing course. This article highlights key areas to advance progress through stewardship initiatives in 2024.

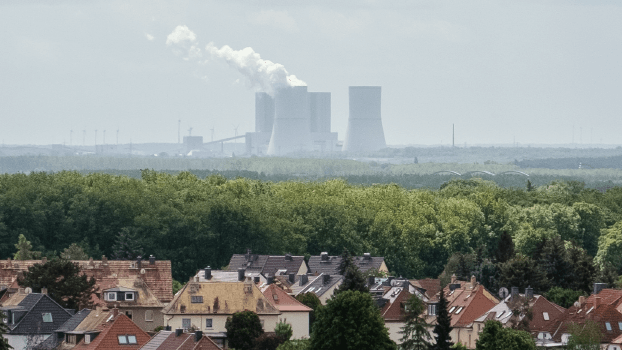

Reducing Emissions Through Sustainable Finance: A Guide for Companies in Carbon Intensive Industries

This corporate guide discusses the difficulties in measuring, reporting, and reducing GHG emissions in hard-to-abate sectors and provides key takeaways so that companies can take advantage of the opportunities sustainable finance offers.

Double Trouble: The Rise of Greenwashing and Climate Litigation for Banks

The fight against greenwashing is being taken to the courts. An analysis of Morningstar Sustainalytics data shows a 12-fold rise in climate-related litigation, including greenwashing claims, against banks over the past three years.

Artificial Intelligence for ESG Assessments

Learn how AI enables us to quickly analyze large, diverse datasets and provide a comprehensive view of a company's ESG analytics. Embracing AI for ESG assessments is not only a value added for investors, but also a crucial step for the ESG industry to foster a sustainable financial future.

Climate Transition Risk: 6 Investor Questions Answered

This video interview provides insight into the challenges institutional investors face as they struggle to comply with the growing slate of climate-related reporting frameworks and standards, while trying to identify, manage and mitigate climate transition risks in their portfolios.

-5-key-questions-answered-about-company-readiness-and-investor-risk.tmb-thumbnl_rc.jpg?Culture=en&sfvrsn=ee2857a6_2)