The EU Taxonomy is a leading science-based classification system expected to become the global standard for determining whether an economic activity can be considered environmentally sustainable.

The EU is developing a set of regulatory reporting requirements that all EU funds with a sustainability objective have to comply with. Beyond these reporting requirements that are still being finalized, investors globally are looking to the framework to support their approach to sustainable investing and to report on the funds’ impact, regardless of where these funds may be situated.

Learn more about our Sustainalytics’ EU Taxonomy Solution, which provides investors with granular information on companies’ alignment to the EU Taxonomy’s Climate Change Mitigation and Climate Change Adaptation objectives.

Latest Insights

Regulating 'Forever' Chemicals: Examining Company Readiness and Investor Risk

EU's Iterative Approach to Sustainable Finance Regulations Isn't Perfect, But It's a Good Start

An Overview of the EU Taxonomy

One of the cornerstones of the EU Sustainable Finance Action Plan is to bring clarity to the market regarding which economic activities can be considered sustainable with the aim of encouraging sustainable investing and preventing greenwashing. The EU Taxonomy is an ambitious attempt to define these activities and the related technical standards for six environmental objectives (see diagram).

Sustainalytics’ EU Taxonomy Solution assesses companies’ alignment to the Climate Change Mitigation and Climate Change Adaptation objectives, supplementing reported data with sophisticated estimation and proxy approaches to give a holistic picture of a company’s overall alignment where reporting is limited. It will evolve to cover changes in the regulatory requirements as well as the additional environmental objectives.

Key Features and Benefits

Extensive Coverage

We cover ~9,500 companies across 89 Taxonomy activities for Climate Change Mitigation and 96 for Climate Change Adaptation. We collect and estimate data across all 3 key Taxonomy KPIs including revenue, capex and opex.

Research Quality

In 2022, we strengthened our existing research capabilities. The collection, qualification and integration of reported and estimated data is done by a team of over 100 analysts.

Clear Distinction Between Reported and Estimated Data

We have added dedicated fields to collect reported eligibility and alignment data. Our client systems show reported and estimated data side by side.

Holistic View of Alignment

Sustainalytics’ dataset includes Taxonomy-specific eligibility and alignment data as reported by companies. In cases where reported data is not available, Sustainalytics leverages its highly sophisticated estimation models using our industry leading Activity Based Research.

Team of Experts

Team of dedicated experts focused on monitoring regulation & policy and ensuring Sustainalytics research fits the regulatory requirements as they evolve. Senior team members participating in expert groups including Platform on Sustainable Finance, FinDatEx, ESMA and EUROSIF.

Ease of Access

Intuitive company reports with activity-level analyst write-ups, integration across Sustainalytics, Morningstar and 3rd party platforms, variety of reporting solutions.

Portfolio and Fund Expertise

As members of the Morningstar team, we utilized data to create a solution that offers investors extensive information on both fund and portfolio levels.

Transparency

We ensure investors have full view of our methodology, research processes and quality controls.

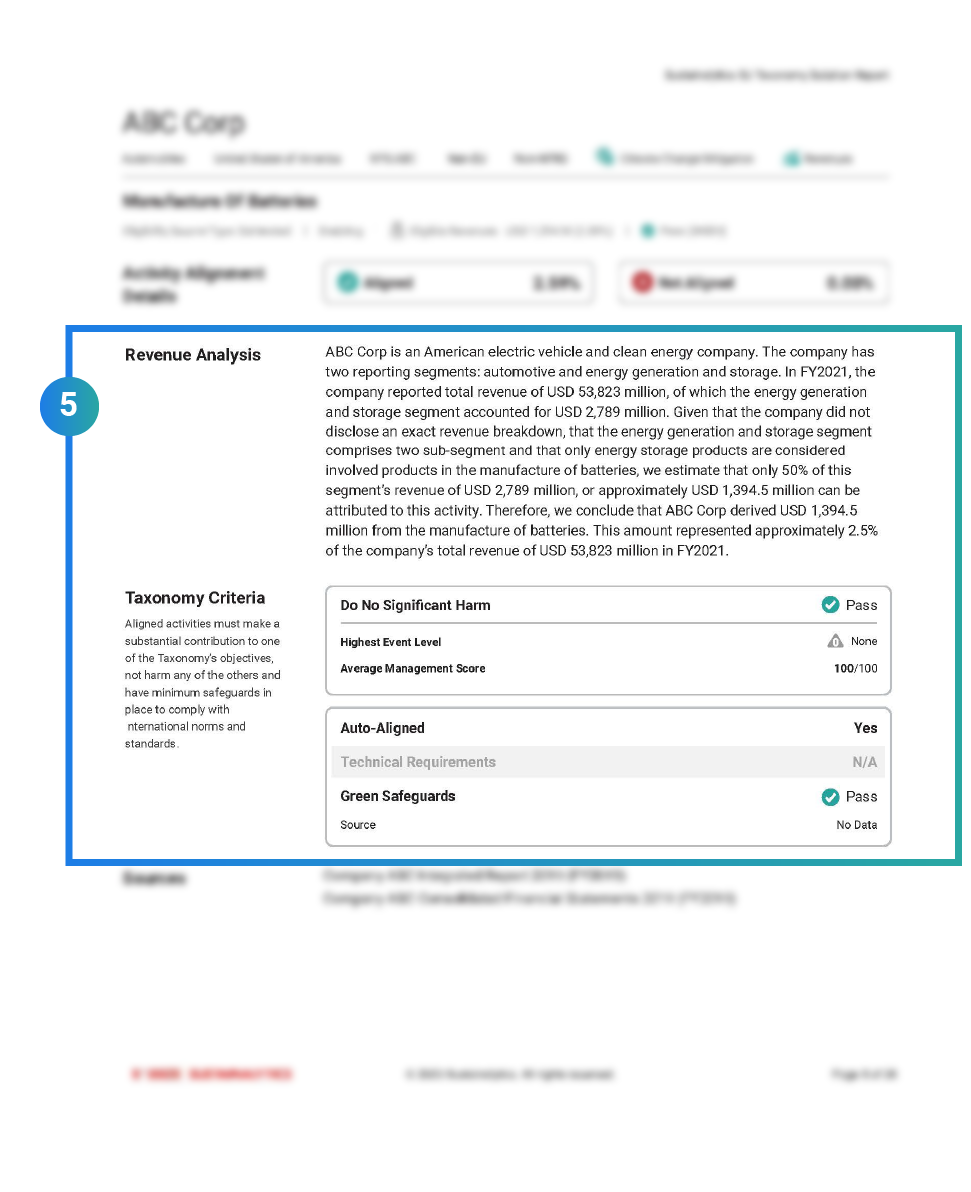

Sustainalytics’ EU Taxonomy Solution Assessment Framework

The EU Taxonomy introduces a new approach to assessing sustainability that focuses on economic activities.

Determine whether the company is involved in eligible activities that could make a Substantial Contribution to the EU Taxonomy’s Climate Change Mitigation and Climate Change Adaptation objectives. The list of activities we cover is based on the Climate Delegated Act and EU’s NACE Classification system.

Example: A company involved in the construction of buildings could contribute to climate change mitigation through the construction of green buildings.

Does the activity satisfy the “greenness” condition as set out by the Technical Screening criteria? We collect Taxonomy-specific data reported by companies or use proxies to determine what percentage of these activities meets or exceeds the minimum threshold to classify as making a substantial contribution.

Example: Assess the construction company’s green building activities against the EU Taxonomy’s technical criteria for the “Manufacture of low carbon technologies – Green buildings”.

For an economic activity to be aligned to one of the environmental objectives of the EU Taxonomy, , it is not sufficient to meet the technical screening criteria for that objective. It is also important to ensure that through the pursuit of this activity, the company does not detrimentally affect the other five environmental objectives.

Example: For the company to make a positive contribution through the construction of green buildings, it must do so in a responsible way, so it does not harm the other environmental objectives, such the EU’s objective of Pollution Prevention and Control.

Make sure the company operates in a responsible way and has Minimum Safeguards in place to avoid negatively impacting societal stakeholders. Sustainalytics assesses whether the company operates in a way that complies with global standards for responsible business, including the UN’s Global Compact Principles and OECD’s Guidelines for Multinationals.

Example: If the company is building new buildings in a “green fields” project, is it being done in a way that respects the local community’s rights, does it get the right permits without instances of bribery and corruption?

Report Insights

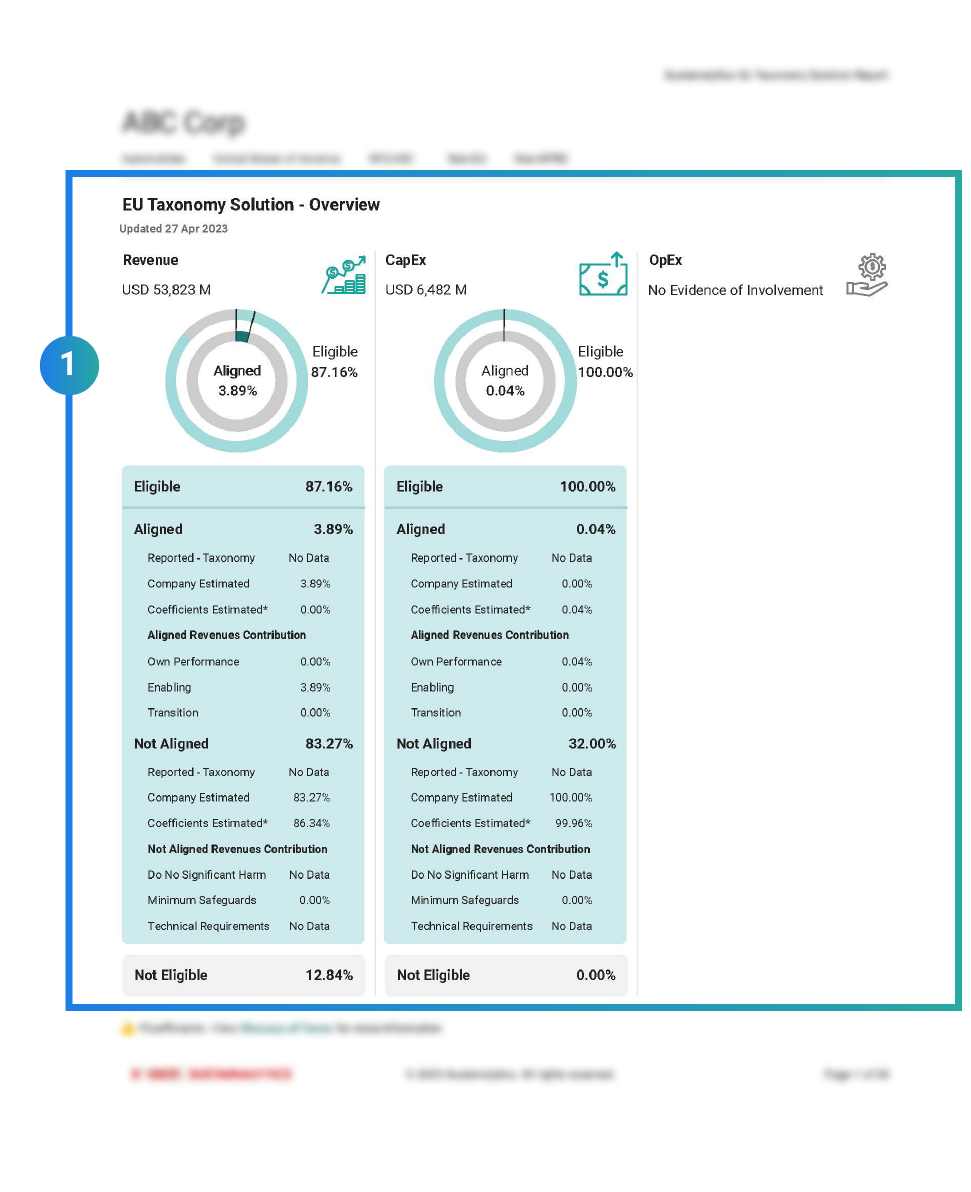

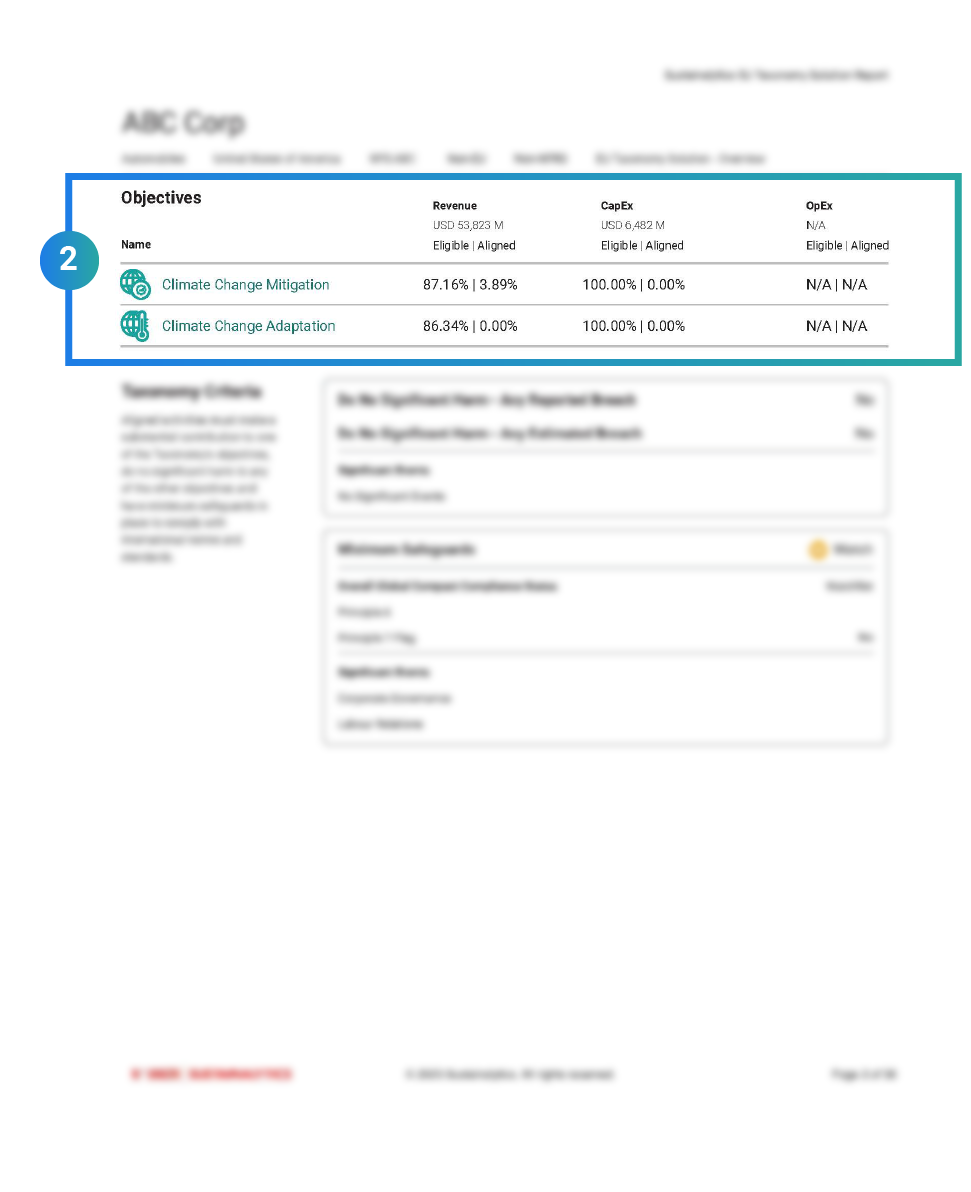

We also provide alignment aggregations (through cross-objective (CRO) indicators) on the performance of the company on both objectives (climate change mitigation and climate change adaptation) combined. It is also possible to select the type of data to see the aggregation for, for example only reported data or all our available data including estimates and coefficients.

The report shows alignment data in terms of revenue from products and services, investment measured by capital expenditure (capex) and in terms of its operational expenditure (opex).

For revenue, capex and opex, it shows the percentage of activities that are aligned, that are not aligned and that are not eligible. These overviews differentiate between reported data and estimated data. Aligned activities are broken down by “Own Contribution”, “Enabling”, and “Transition” activities. For not aligned activities the reason is provided. In other words, whether it is the “Minimum Standards”, “Do No Significant Harm” or “Technical Screening” criteria that are not being met.

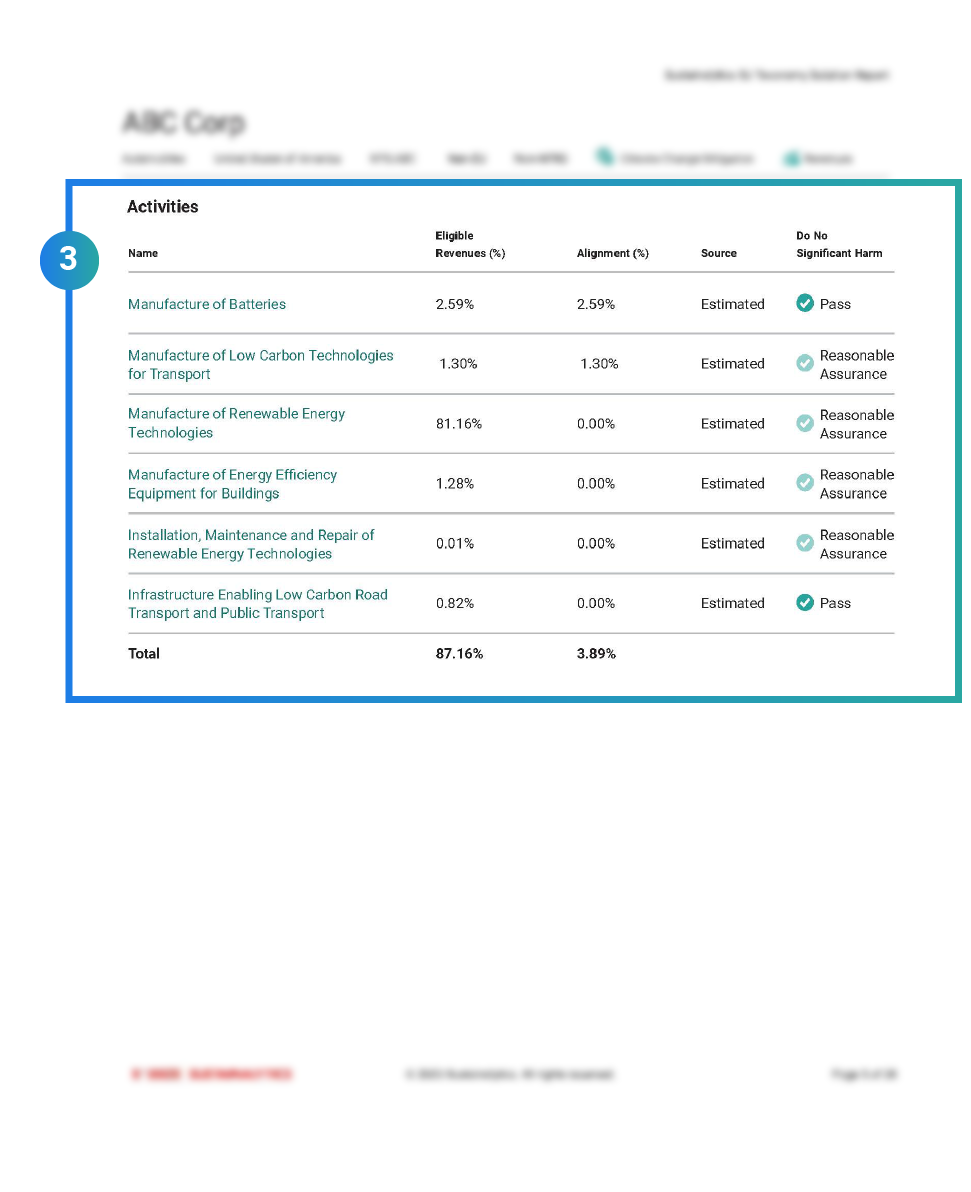

For revenue, capex and opex, it shows an overview of all the underlying activities and corresponding data on Eligibility (%), Alignment (%), Substantial Contribution Type, and Do No Significant Harm screening criteria.

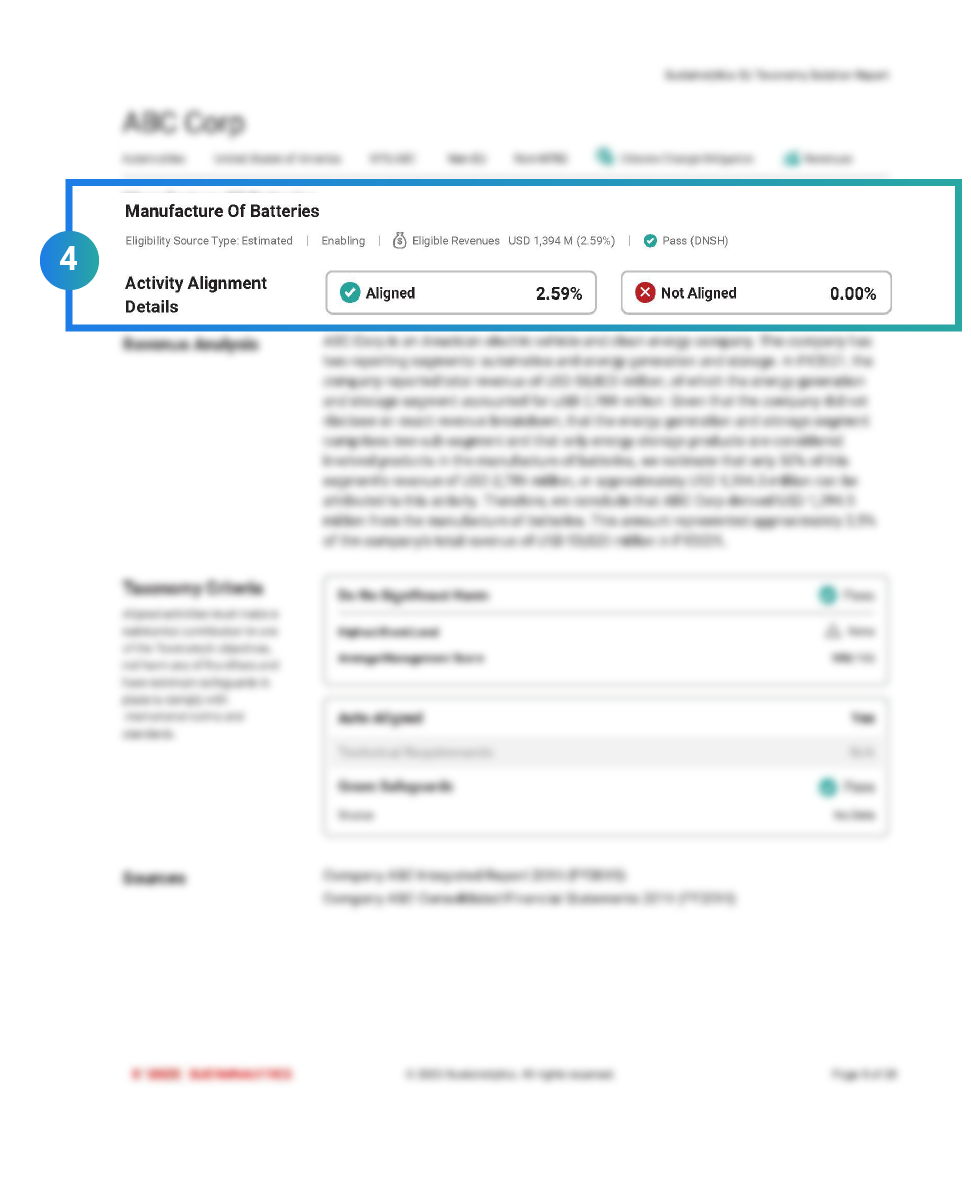

Deep dive into individual contributing activities with an overview of relevant criteria and a qualitative analysis of the activities’ contribution.

Investor Use Cases

The EU Taxonomy Solution is a rich data set that can be used for a range of purposes:

Regulatory Reporting

Report on portfolio alignment to EU Taxonomy framework and underlying criteria. The data set can be leveraged to comply with a broader regulatory requirements, including MiFID II and IDD.

Product and Fund Construction

Consider Taxonomy alignment in the construction and management of ESG & impact funds that focus on climate change.

Engagement

Leverage the research in your discussions with issuers when there is an indication of non-compliance with DNSH or MS criteria or data gaps related to SC criteria.

Company Screening

Create compliant investment universes by screening out companies that do not meet DNSH or MS criteria.

Delivery Options

Global Access

The company reports can be accessed via Global Access with user-friendly online tools.

Data Services

The research can be accessed as an Excel delivery or data file with three different data packages showing increasingly granular information.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Related Insights and Resources

Regulating 'Forever' Chemicals: Examining Company Readiness and Investor Risk

Chemical companies face growing pressure to phase out some of the most hazardous substances from their product portfolios. Learn how well companies manage related risks and what upcoming regulations could mean for them and their investors.

Inconsistent Definition of ‘Sustainable Investments’ Across EU Regulations Could Cause (Unintentional) Greenwashing

The absence of clear parameters to support the regulatory definition of sustainable investments has pushed market participants to make judgment calls leading to diverging investor approaches.

EU's Iterative Approach to Sustainable Finance Regulations Isn't Perfect, But It's a Good Start

The EU Action Plan for Sustainable Finance has kept the European investment market busy over the past year. In this blog post, we highlight the merits that we see in the EU regulatory package. While not perfect, the regulation is a good start.

Post-COP15 Outlook: Evolving Investor Responsibilities in Biodiversity

Awaiting COP15’s Global Biodiversity Framework negotiation outcomes, financial market participants could face new regulatory pressure sooner than expected to integrate biodiversity assessment into their investment, decision-making processes.

Related Products

Impact Solutions

Measure, manage and report on the social and environmental impact of your portfolio.

Climate Solutions

Identify and manage investment risks and opportunities with climate research, ratings and data for investors.

EU Action Plan

High-quality ESG research and data to help investors meet the new regulatory requirements