The sustainable finance market has seen an exponential increase in size and activity in recent years. Innovative offerings such as green, social, and sustainable bonds, green and sustainability-linked loans (SLLs),[i] and most recently sustainability-linked bonds, have contributed to the market’s incredible growth. In 2020, boosted by varied financial needs and mainstream recognition of environmental, social and governance (ESG) parameters, global sustainable debt capital surpassed US$700 billion, a 30% increase compared to 2019.[ii] Part of this capital was channelled towards tackling the effects of COVID-19 as government agencies, supranational bodies and corporates borrowed money to support areas most affected by the pandemic, such as healthcare. This shift in fund usage in 2020 resulted in the rapid growth of social bonds[iii] and a commendable first year for sustainability-linked bonds.

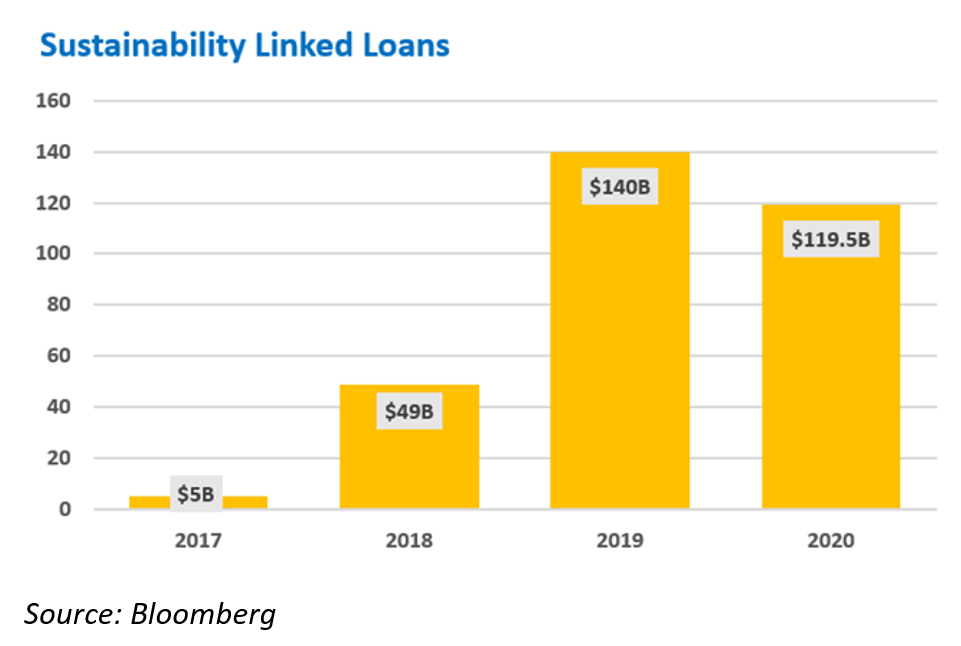

By early 2021, SLLs[iv] regained their positive trajectory after activity slowed through 2020 due to the economic shock of the COVID-19. The pandemic caused a dip in SLL deals as companies and lenders tried to pivot and focus more on short-term financing solutions. However, SLLs picked-up pace by late 2020 to stabilize at a global volume of about US$120 billion for the year (this followed a three-fold increase to US$140 billion in 2019 from US$49 billion in 2018). Further, the first two months of 2021 brought in an impressive volume of 41 SLLs deals globally, including the largest-ever SLL of US$10.1 billion by Belgian-based multinational drinks and brewing company Anheuser-Busch InBev (AB InBev).[v] Flexibility in how SLL funds can be used, incentivized pricing structures that bring sustainability and economic gains, and SLL’s applicability across sectors are key reasons why companies are increasingly using this funding mechanism – growing from just eight in 2017 to more than 250 in 2020.

Despite the slight slow down in 2020, there have been significant SLL deals across a variety of sectors, both in emerging and developed economies, indicating continued momentum and a long-term appetite for SLLs. At the same time, many such loans reached their first- or second-year annual review cycle in 2020. For instance, 2020 was a successful first year for COFCO International’s SLL as it hit its annual targets per the loan terms. In 2019, the China-based food and agriculture company signed a US$2.1 billion sustainability linked loan, the largest ever for a commodity trader.[vi] The facility’s targets included the year-on-year improvement of the company’s ESG rating from Sustainalytics and increasing traceability of agri-commodities. In 2020, the company achieved its annual target for the ESG rating and made positive progress on traceability for directly sourced soy.

SLLs and ESG Ratings

In May 2020, ICMA updated the Sustainability-Linked Loan Principles, which outline the fundamental characteristics of SLLs. These voluntary guidelines recommend that “borrower’s sustainability performance be measured using sustainability performance targets (SPTs), as set against key performance indicators, external ratings and/or equivalent metrics and which measure improvements in the borrower’s sustainability profile.”

With an expectation that SLLs would drive improvements in the borrower’s sustainability, loan agreements aim to link to ambitious targets and the loan margin will increase or decrease based on the borrower’s performance on the metric, typically measured annually. These SPTs can be internal metrics and linked to the borrower’s sustainability strategy or they can be external metrics, such as the ESG Risk Ratings by Sustainalytics. Generally, it is up to the borrower and the lender and/or sustainability coordinator to finalize which metric works best for the facility, taking into consideration the tenure and the past performance of the borrowing company.

Since 2017, several companies globally have used Sustainalytics’ ESG ratings as the key metric to assess their ESG performance and linked the interest rate of their SLLs to their most recent score. While most of these SLLs are based in Europe, a growing number of companies in the Americas and Asia-Pacific regions have started to link their financing to the Sustainalytics ESG Risk Rating. For instance, US-based Crown Holdings,[vii] agreed to track the year-on-year performance of its ESG management score (a component of Sustainalytics’ ESG Risk Ratings) for its US$3.25 billion sustainability-linked syndicated credit facility. While ESG ratings have historically been the most common SPT tied to SLLs, internal KPIs, targets linked to SDGs, or a combination of ESG ratings and KPIs as meaningful targets have also become prevalent.

Source: Sustainalytics

Continued popularity of SLLs globally

In 2020, Sustainalytics nearly doubled the number of clients using ESG ratings for SLLs or receiving SLL second-party opinions compared to the previous year. We anticipate continued popularity for this instrument given that SLL funds can be used for general corporate purposes and the loan terms are tied to the achievement of sustainability targets. In this way, SLLs present a win-win opportunity for companies and investors: Financial institutions and investors have another way of holding companies accountable while still supporting their long-term sustainability initiatives while companies, on the other hand, can seek preferential terms by aligning sustainability and financial objectives that affect their bottom line.

As a pioneer in the market, collaborating with ING on the first-ever SLL deal in 2017, Sustainalytics works with organizations globally providing a holistic and reliable metric for SLLs in the ESG Risk Ratings or an independent opinion on the relevance of any internal KPIs chosen for such loans. For more information on how Sustainalytics can support your SLL, please reach out to our Corporate Solutions team.

Sources:

[i] LSTA, “Sustainability Linked Loan Principles,” (2019), accessed at: https://www.lsta.org/content/sustainability-linked-loan-principles-sllp/

[ii] Mike Scott, Forbes, “Sustainable Debt Defies Gloom to Record Spectacular 2020 Growth,” (January 21, 2021), accessed at: https://www.forbes.com/sites/mikescott/2021/01/14/sustainable-debt-defies-gloom-to-record-spectacular-2020-growth/?sh=470990ab5355

[iii] Nathaniel Bullard, Bloomberg, “The Sustainable Debt Market is All Grown Up,” (January 14, 2021) accessed at: https://www.bloomberg.com/news/articles/2021-01-14/the-sustainable-debt-market-is-all-grown-up?sref=p7QKMWRn

[iv] Sustainability-linked loans are finance instruments in which the terms of the loan (usually the interest rate) are linked to the borrower’s performance on defined ESG metrics. For a typical SLL, an improvement in the borrower’s ESG performance could translate into a lower interest rate and failure to meet the set metric could lead to the borrower paying more interest.

[v] ING, “ING in largest-ever sustainability linked loan,” (February 18, 2021) accessed at: https://www.ing.com/Newsroom/News/ING-in-largest-ever-sustainability-linked-loan.htm

[vi] COFCO International, “COFCO International links sustainability performance to new USD 2.1 billion credit facility,” (July 16, 2019) accessed at: https://www.cofcointernational.com/newsroom/cofco-international-links-sustainability-performance-to-new-usd-21-billion-credit-facility/

[vii] BNP Paribas, “BNP Paribas Closes Sustainability-Linked Syndicated Credit Facilities with Crown Holdings,” (March 5, 2020), accessed at: https://www.globenewswire.com/news-release/2020/03/05/1995900/0/en/BNP-Paribas-Closes-Sustainability-Linked-Syndicated-Credit-Facilities-with-Crown-Holdings.html

Recent Content

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

Today’s Sustainable Bond Market: Boosting Confidence in Sustainable Bond Issuances

In this article, we examine the kinds of sustainable bonds offered in the market, some of the key regulations being developed in different markets and the current initiatives to improve the quality and credibility of issuances.

Webinar Recap: How Integrating ESG Can Drive Opportunity for Private Companies

Recently, Morningstar Sustainalytics hosted a webinar – ESG in the Lifecycle of a Private Company: How Stakeholder Demands Drive Sustainability in Private Markets – to address some of the questions private companies might have surrounding ESG and how it could impact their business.