As the Biden administration moves into the White House this week, the world is waiting to see if a promising focus on climate change along with a Democratic Congress will present plausible opportunities to cut carbon emissions. While the outgoing administration backed initiatives supporting coal energy[1], it doesn’t appear to have slowed industry decline.

Electricity production in the US was estimated to contribute 27 percent of the country’s total Greenhouse Gas (GHG) Emissions as of 2018[2], squarely placing utilities and power generation in the spotlight for potential climate change regulation and policies.

Sustainalytics’ Carbon Intensity (CI) of Generation indicator uses an estimation model based on the percentages of different types of generation assets owned by each company. The indicator looks at the portion of generation from 11 different types of generation, ranging from the carbon-intensive (coal and lignite) to the virtually carbon-free (nuclear and renewables), to determine an overall intensity for the company’s generation fleet [kgCO2(e)/MWh]. The indicator informs a utility’s management of its carbon risk exposure in Sustainalytics’ ESG Risk Rating. A utility with a greater proportion of coal and gas would have a higher CI of generation as compared to a utility with more renewable, hydro, or nuclear generation. As a result, Sustainalytics’ Carbon Risk Ratings shows that the composition of a utility’s power-generating asset portfolio impacts the company’s exposure to carbon-related ESG risks.

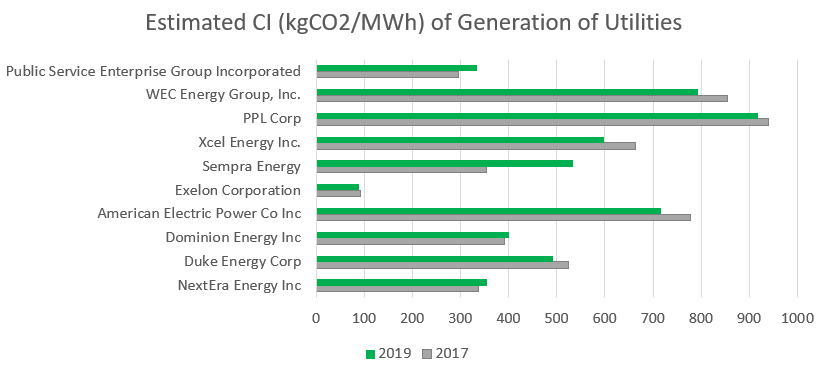

The ten largest utility companies by market capitalization in the country, where relevant data was available, have recorded noticeable changes in their carbon intensity between 2017 and 2019. The general trend indicates that majority of the companies have recorded a change in their CI of generation.

Source: Sustainalytics data, derived from the companies’ public disclosure of their asset generation data

Overall, renewable energy capacity has increased, with wind and solar comprising 8.8 percent[3] of the total power generated in 2019, driven by states’ Renewable Portfolio Standards, a production tax credit that boosted wind energy in its early days, and a dramatic decline in the solar and wind costs. Utilities have also mirrored the overall trend in demonstrating a higher percentage of generation from renewables. However, the distinct change in the carbon intensity of utilities’ own assets appears to a result of the retirement of old coal plants and increase in their gas capacity, as opposed to an increase in renewable capacity.

Source: Sustainalytics data, derived from the companies’ public disclosure of their asset generation data

Since 2010, old coal plant closures have been on the rise, with 95GW of coal capacity retired between 2011 and 2020; an additional 25GW is slated for closure by 2025.[4] The outgoing US federal administration oversaw the rollback of environmental regulations that included:

- Deadline extensions for complying with 2015 Environmental Protection Agency (EPA) regulations to manage coal ash[5]

- Limiting the protections afforded to water bodies by redefining the scope of the Waters of the United States (WOTUS) mandate[6]

- Withdrawing from the Paris Climate Accord, signaling that federal regulation directed at GHG emissions would be unlikely

Despite a climate of perceived advantages for coal power plants, the closure of old assets continued between 2017 and 2019. For instance, Duke and WEC both retired around 1.8GW of coal capacity in the period above.

The uptake of renewable asset ownership of Utilities between 2017 and 2019 is fairly limited. Incidentally, Sempra Energy sold its significant renewable portfolio. As of 2020, natural gas comprises over 80 percent of its existing portfolio, resulting in a significantly higher CI of Generation in 2019 compared to 2017. NextEra – one of few companies in the list above to record an increase in coal-powered generation – acquired Gulf Energy’s coal assets, resulting in generation from coal going up by one percent in 2019, compared to 2017. PSEG saw a seven percent decrease in its nuclear generation and a twelve percent increase in its share of Natural Gas-based generation in the same period. As a result, while the three companies recorded an increase in their CI of Generation, it is not attributed to the addition of newly built coal plants or a significant increase in generation from their existing ones.

Natural gas-based generation appears to have replaced the utilities’ retired coal capacity, rather than renewables. The growth in gas has been significant across the entire power sector, with its share in the national electricity mix increasing to 38 percent in 2019, up from 32 percent in 2017.[7] While power produced from natural gas, particularly combined cycle plants, has around half the GHG emission intensity of that of coal, it continues to leave companies exposed to some level of carbon-related risks, considering that an increasingly gas-heavy power grid would be inconsistent with the Paris Accord pledges. These risks are likely to be more pronounced with the incoming administration, helmed by Joe Biden and a Democratic Party majority in the Congress. The Biden campaign’s promises regarding climate change and the environment[8] include having the US re-commit to the Paris Accords, and initiate a 100 percent clean energy and zero net emissions by 2050 target. The plan aims to direct significant investment to clean energy and institute tight regulations on methane emissions to accelerate the transition to a predominantly renewable-driven generation portfolio and disincentivize oil and gas production.

While it is unclear how the transition will impact Utilities’ increasing gas capacity, coal-based power generation’s move towards obsolescence continued over the last few years, despite policies and regulations meant to benefit the sector. This transition is expected to accelerate if the new US federal administration is able to deliver on its campaign promises.

Sources:

[1] 2020, Trump’s Coal Resurgence Promise Has Gone Underground, forbes.com https://www.forbes.com/sites/chuckjones/2020/08/26/trumps-coal-resurgence-promise-has-gone-underground/?sh=315332a156d8

[2]2018, Greenhouse Gas Emissions, United States Environmental Protection Agency (EPA) https://www.epa.gov/ghgemissions/sources-greenhouse-gas-emissions

[3] 2019, US utility-scale electricity generation by source, US Energy Information Administration (EIA) https://www.eia.gov/tools/faqs/faq.php?id=427&t=3

[4] 2020, United States Energy Information Administration (EIA) https://www.eia.gov/todayinenergy/detail.php?id=44976

[5] 2020, United States Environmental Protection Agency (EPA) https://www.epa.gov/coalash/coal-ash-rule

[6] 2020, United States Environmental Protection Agency (EPA) https://www.epa.gov/sites/production/files/2020-01/documents/navigable_waters_protection_rule_prepbulication.pdf

[7] 2020, Net Generation by Energy Source (Total) 2010-2020, United States Energy Information Administration (EIA) https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=epmt_1_01

[8] 2020, The Biden Plan for a Clean Energy revolution and Environmental Justice, Biden https://joebiden.com/climate-plan/

Recent Content

Navigating the EU Regulation on Deforestation-Free Products: 5 Key EUDR Questions Answered About Company Readiness and Investor Risk

The EUDR comes into effect in December 2024, marking an important step in tackling deforestation. In this article, we answer five key questions who the EUDR applies to, how companies are meeting the requirements, and the risks non-compliance poses to both companies and investors

Child Labor in Cocoa Supply Chains: Unveiling the Layers of Human Rights Challenges

Child labor remains a persistent issue in the cocoa supply chain. So can major food brands do to stop it? Discover the steps companies can take to address the issue and ways investors can engage with companies to mitigate it.

Beyond 1.5 Degrees: What the LCTR Tells Us About Companies Managing Their Climate Risk

The LCTR rating of over 8,000 companies shows that global temperatures will rise 3.1 degrees Celsius over pre-industrial averages. This article looks at the overall performance of these companies and the industries that are leading on climate.

-5-key-questions-answered-about-company-readiness-and-investor-risk.tmb-thumbnl_rc.jpg?Culture=en&sfvrsn=ee2857a6_2)