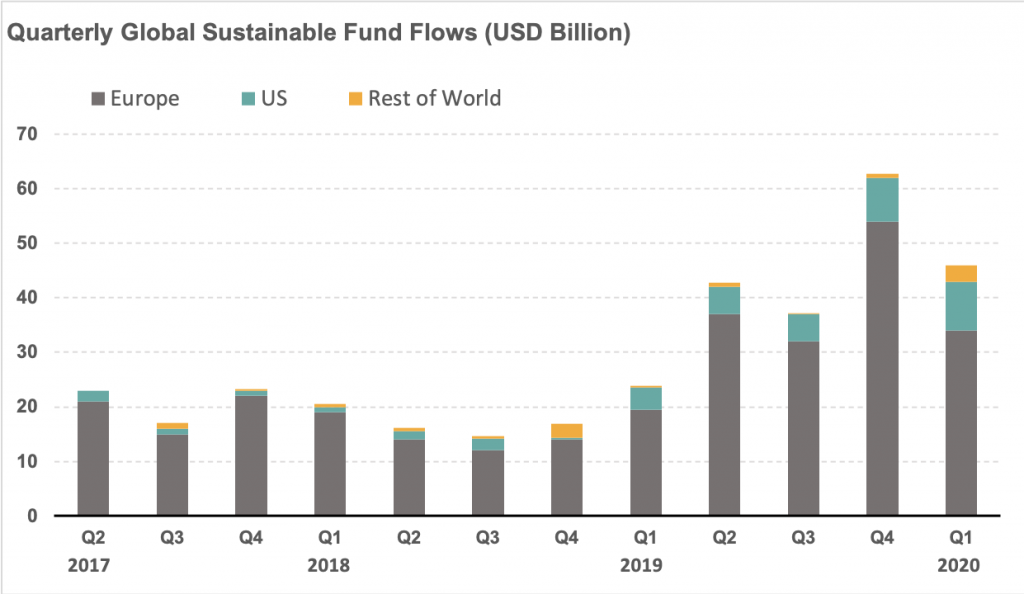

As the social and economic challenges of 2020 continue to unfold and markets remain in flux, the resilience of Environmental, Social, and Governance (ESG) investing marks a silver lining. In the context of today’s bear market, investors are demonstrating their preference for sustainable funds over traditional ones, with Q1 2020 seeing a global influx of USD 45.6bn, compared to outflows of USD 384.7bn for the overall fund universe. Europe has continued to account for the majority of this inflow into sustainable funds, while the U.S. has picked up pace with a 100% y-o-y increase, the highest regionally. Furthermore, Morningstar reported that 89%, or 51 out of 57, of its sustainable indices outperformed their market peers in Q1 2020. For ESG practitioners, this may not come as a surprise as experience has shown that companies with robust corporate cultures and sustainable business practices are best-positioned for long term resilience and growth, leading to stickiness of ESG investments.

Source: Morningstar, Global Sustainable Fund Flows

Sustainalytics has been supporting investors to integrate company-level ESG ratings and analysis into key investment processes for almost three decades, and per a recent ‘Rate the Raters’ study, was rated first amongst its peers for “investor usefulness” in 2020. The two-dimensional lens of Sustainalytics’ ESG Risk Rating supports investors in their identification and interpretation of financially material ESG risks at the security and portfolio level. With one lens assessing exposure, that highlights the material ESG risks the company is vulnerable too, while the second assesses how the company manages and mitigates that exposure and potential risks in the future.

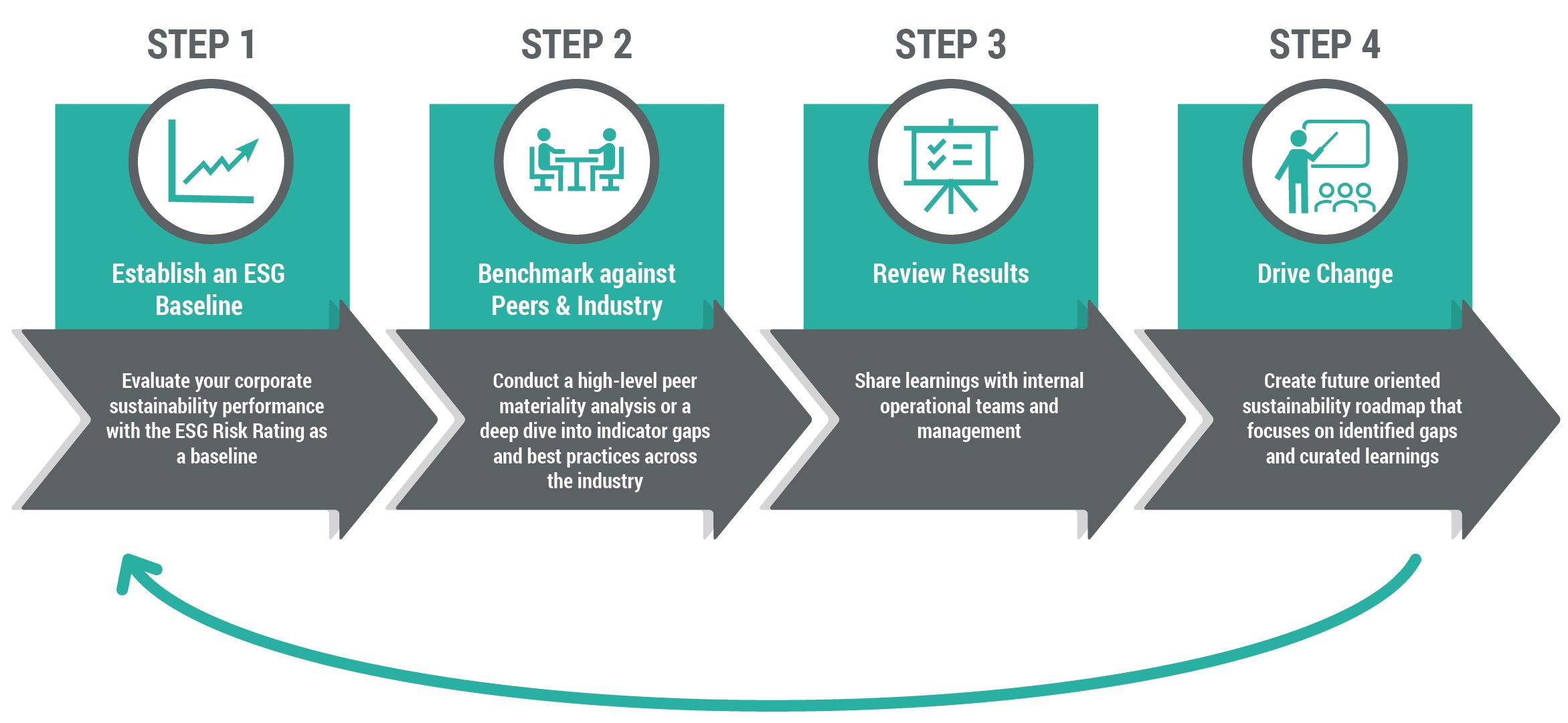

At the same time, forward-looking companies, now more than ever, are seeking deeper insights into their relative ESG performance and striving to assess their own sustainability challenges and opportunities as well as their peers’. A growing number of companies are leveraging Sustainalytics’ ESG Risk Rating as a baseline to understanding their ESG exposure and performance. Some companies are even licensing their ESG Risk ratings for capital raising activities such as sustainability linked loans, alongside marketing and internal KPI-setting (e.g. remuneration metrics).

Companies opting to take a deeper dive are keen to gain insight on their relative positioning and risks compared to their industry peers to get a holistic picture on their most relevant ESG issues. Such insights can guide their sustainability strategy, signalling to investors a focus on the most material themes and metrics.

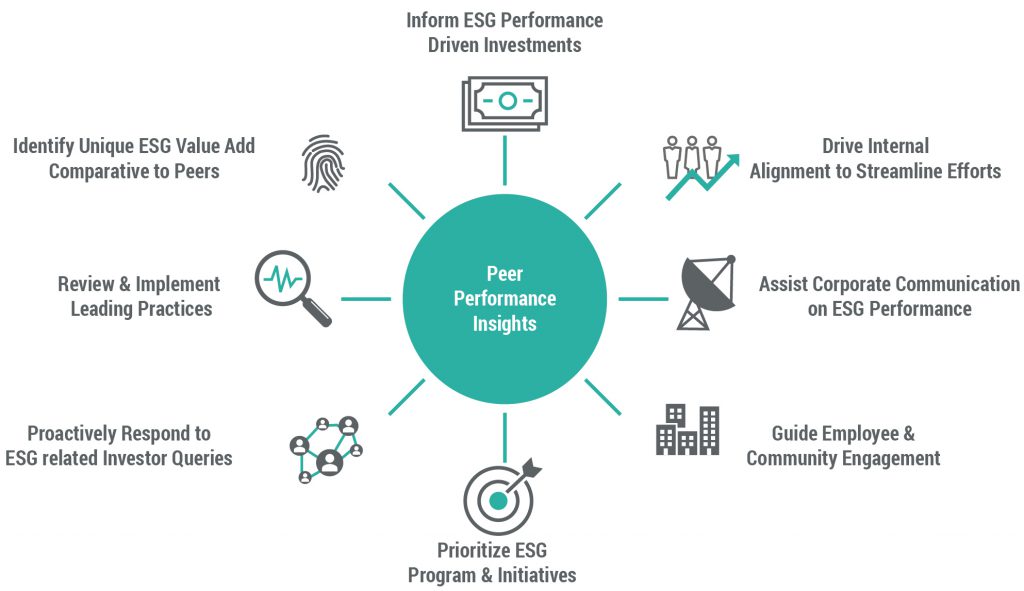

This is where Sustainalytics’ ESG Peer Performance Insights is used to guide issue specific and company-wide efforts. This suite of products offers outputs ranging from high-level to in-depth quantitative and qualitative assessments, evaluating material ESG issues across select peers and the broader industry. It provides leading practice examples in relation to gaps in management performance and includes an overview of the frequency and severity of controversies that impact rating scores. The resulting analysis identifies key risks and opportunities, to help guide the company’s sustainability strategy, evaluate effectiveness, and set meaningful targets.

Phases across Peer Performance Insights:

Source: Sustainalytics

Key benefits of Peer Performance Insights to your company

The value that Sustainalytics’ ESG Peer Performance Insights bring to clients is the emphasis on a company’s most material ESG issues and indicators relative to a select group of industry peers.

- In-depth qualitative and quantitative comparison through a management performance gap analysis helps companies evaluate how their current practice meets or lags industry practice, identifying actionable areas of improvement. Through comparison to industry leaders, a gap analysis identifies best practices in managing and diminishing ESG risks while displaying opportunities for success.

- Leading practice examples present a practical way to draw inspiration from other companies and gather intelligence on any industry specific adaptations needed for improvement. While certain material issues or indicators broadly apply to multiple industries, best practices within sub-industries capture key nuances which can help companies close gaps in their sustainability strategy and ESG reporting.

- A benchmarking study can be an integral tool in informing and supporting management decisions. Peer Performance Insights can function as guide management decisions in order to best prioritize material ESG/sustainability programs and initiatives with treasury teams playing a key role along with other departments.. Mismanagement of ESG issues can pose material risks to companies in both direct and indirect ways. While targeted ESG insights can help inform short-term management decisions and investments while uncovering potential long-term risks and opportunities.

- As external stakeholder scrutiny increases, particularly from investors seeking to understand how companies manage these risks and opportunities, ESG Peer Performance Insights can uncover competitive advantages and shortcomings. As companies gain insights into their relative ESG performance, they can transparently communicate to investors and other stakeholders on strategies that address ESG risks and opportunities, in effect building stakeholder goodwill and trust, and promoting access to capital.

Source: Sustainalytics

Going forward

Effective management of ESG issues has proven to be a key differentiator of corporate resilience in the wake of socio-economic uncertainty. Identifying material ESG risks, performance gaps and best practices relating to pressing social challenges, such as employee retention, access to healthcare and treatment of suppliers, can help promote competitive differentiation. Conversely, companies that fall short of evolving stakeholder expectations, risk facing operational and reputational costs.

Sustainalytics’ ESG Peer Performance Insights can help shed light on relevant gaps and leading practices relating to emerging social and environmental challenges as companies strive to mitigate unforeseen ESG risks and maximize resilience.

For more information on Sustainalytics’ ESG Risk Rating Licenses and Peer Performance Insights, please connect with our regional service desks.

Recent Content

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

Today’s Sustainable Bond Market: Boosting Confidence in Sustainable Bond Issuances

In this article, we examine the kinds of sustainable bonds offered in the market, some of the key regulations being developed in different markets and the current initiatives to improve the quality and credibility of issuances.

Webinar Recap: How Integrating ESG Can Drive Opportunity for Private Companies

Recently, Morningstar Sustainalytics hosted a webinar – ESG in the Lifecycle of a Private Company: How Stakeholder Demands Drive Sustainability in Private Markets – to address some of the questions private companies might have surrounding ESG and how it could impact their business.