Overview

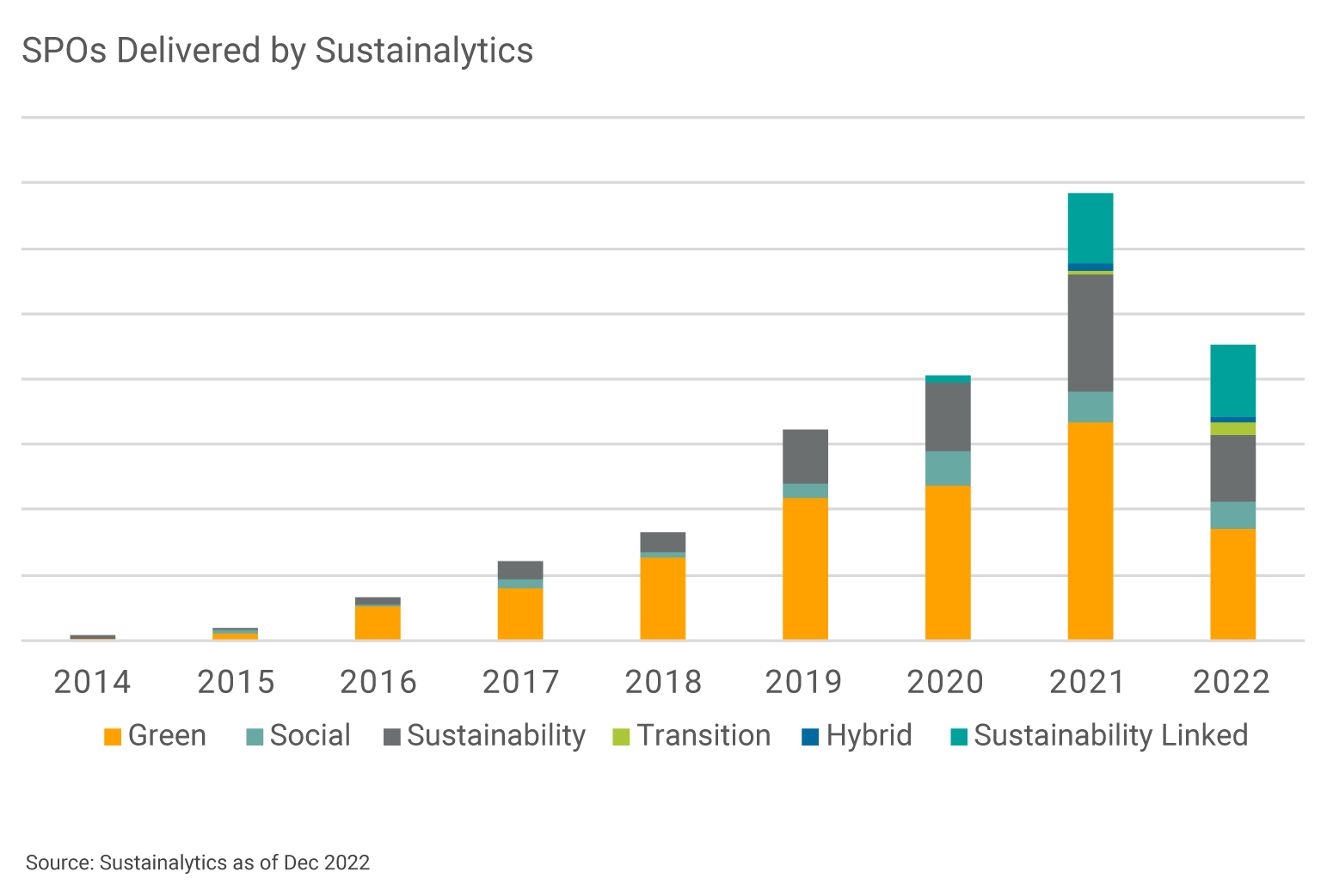

Morningstar Sustainalytics is proud to be recognized as the leading provider of second-party opinions (SPOs) for green, social and sustainability bonds and loans. In our company’s history, we have delivered over 1000 SPOs, completing our first report in 2014, our 500th in October 2020, and reaching our 1000th SPO milestone in April 2022, only 19 months later.

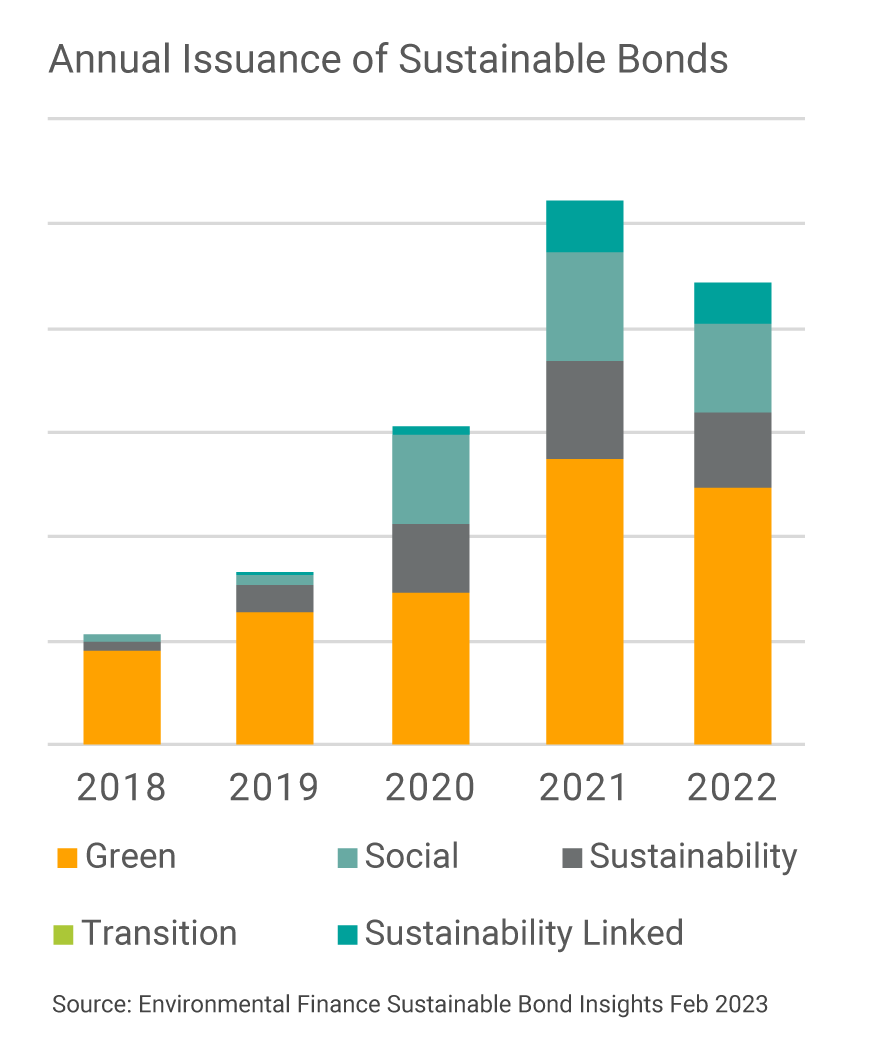

Last year was a challenging time for both the fixed income and sustainable bond markets. However, it is promising to see that the sustainable bond market was able to strengthen its share of global bond market to over 13.5%, an increase from the 12% in 2021, according to Environmental Finance report. According to Climate Bonds Initiative (CBI), over US$2 trillion in green bonds have been issued to date with sustainable bond labels .

Market Trends Since Our First 500 Second-Party Opinions

Green Bond Market still has an enduring appeal as the oldest sustainable bond label

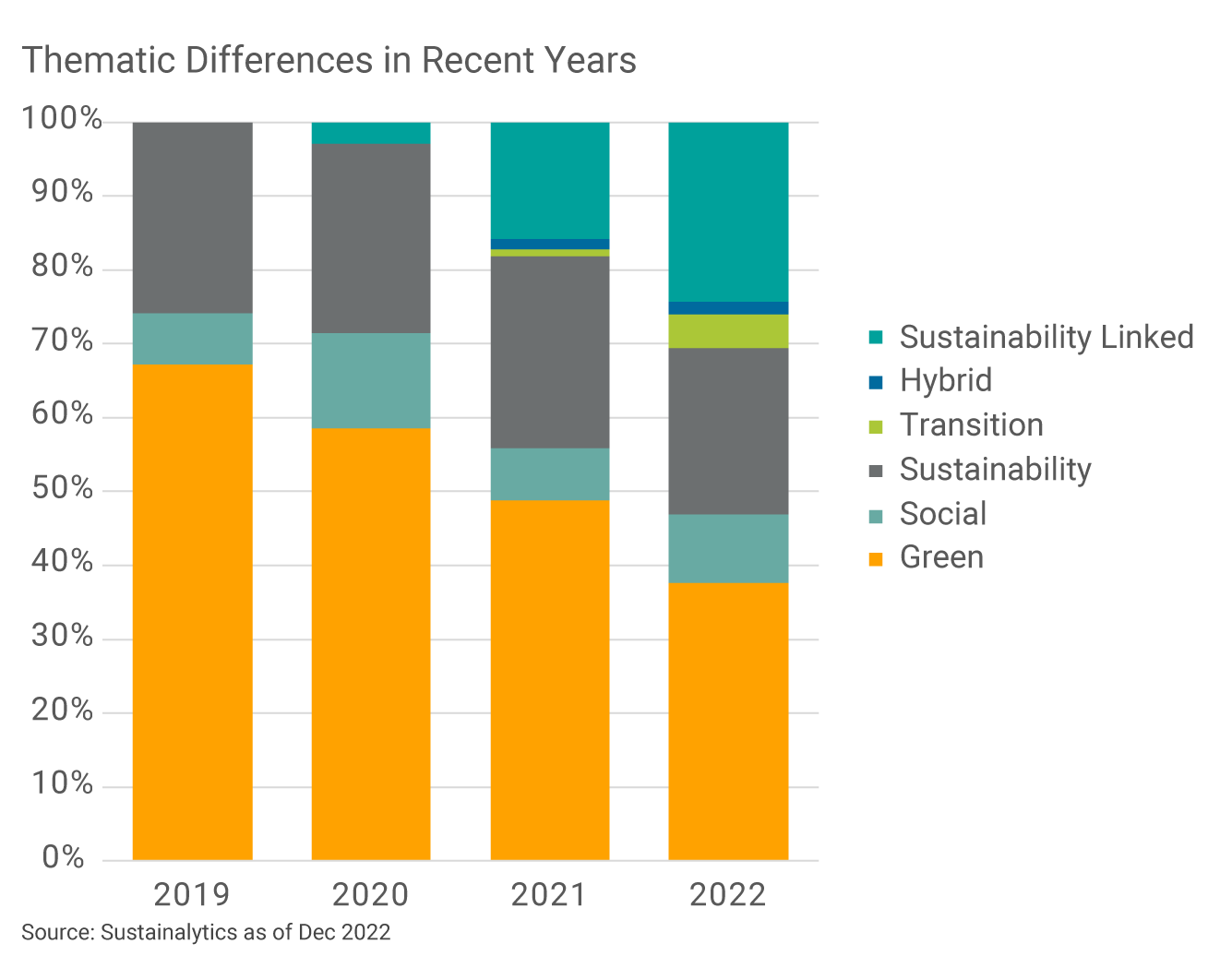

While green bonds continue to lead in terms of total number and volume of deals, we’ve observed a proportional decrease relative to other financial instruments. Notably, the share of Sustainalytics SPOs dedicated to green bonds dropped from 49% to 38% of our total opinions delivered from 2021 to 2022. A correlation can be drawn between this drop and a decrease in bond issuances seen in the market last year. Market experts forecast that 2023 should see a rebound in sustainable bond issuances, but they are still expecting a tough macroeconomic backdrop to start the year. That being said, in the wake of COP26, we’ve observed increased financing related to net-zero commitments from sovereign and corporate issuers.

Recent example: Government of Canada Green Bond Framework Second-Party Opinion

Social bonds dip, yet will be spurred on by new social challenges

After peaking at the height of COVID in late 2020, targeting the direct and indirect impacts of the pandemic, social bonds have since decreased as a percentage of our total SPOs. Looking forward, we expect social bonds to reclaim their important niche in the market based on their demonstrated ability to respond to timely social developments in a flexible manner. With the somewhat grey area surrounding which activities and target groups qualify for social bonds, regional variation will remain key to the growth of these instruments.

Recent examples: Marui Group, and NMB Bank

Flexibility of sustainability bonds appeal to issuers with broader mandates

Sustainability bonds, which include a minimum of one green and one social use of proceeds category, have steadily accounted for a quarter of our opinions to date. The flexibility to broadly allocate proceeds across a wide array of use of proceed categories particularly appeals to financial institutions and sovereign issuers with broader mandates and impacts

Recent examples: Scotiabank, Export-Import Bank of India, and NN Group.

KPI-linked instruments take center stage

Sustainability-linked bonds (SLBs) represented the fastest growing market segment from 2020 to 2021, marked by their flexibility to finance general corporate purposes. In 2022, sustainability-linked issuances did not grow quite as expected which can be partially thanks to the difficult fixed income market we experienced last year. It could also be explained by how increasingly selective most investors have become regarding the strength of key performance indicators (KPIs) and ambitiousness of sustainable performance targets (SPTs). Linked instruments still have a place and role to play in the sustainable bond market. Importance of quality / ambition will play a big role going forward for all GSSSS labeled bonds.

Examples: Telus, Koninklijke Ahold Delhaize and Government of Chile.

Transition finance is gaining traction

Bonds labelled as ‘transition’ have not yet gained the level of momentum anticipated when they first entered the market in late 2020. We attribute this in part to the flexibility of SLBs, as well as the lack of a common definition for transition finance. However, there has been considerable interest in transition bonds from hard-to-abate industries such as aviation and shipping. Transition assessment has also become an important overlay to SLBs by issuers from heavier industries.

Recent examples: Seaspan and Japan Airlines.

Harmonized sustainable finance frameworks on the rise

As our SPOs evolved into a modular format the last two years, we began opining on harmonized sustainable finance frameworks targeting both use of proceeds and linked issuances. We are enthusiastic about this hybrid model, as it allows issuers to finance impactful green and social projects, while also committing to overall improvements in corporate-level sustainability.

Recent examples: Johnson Controls and Vodafone.

What's Next

Sustainalytics’ experience as the leading global provider of SPOs has prepared us well for the expanded volume and increased complexity of projects. Concurrently, our robust innovation agenda has expanded into new territory such as impact reporting, where we see an opportunity to address key gaps in the market.

In this context, we will continue to support forerunning issuers and underwriters to bring credible and impactful sustainable finance instruments to market, embraced by investors worldwide. With world-renowned leadership in SPOs, we are uniquely positioned to meet the demands of this ever-changing market.

SPOs by the Numbers

Thematic bonds (green, social, transition, etc.) continue to grow, owing to their ability to pin-point specific sustainability goals and raise capital for new and existing projects that contribute to meeting ESG targets. Green bond issuances have dominated the sustainable finance space as the world moves towards carbon neutrality. However, interest in more flexible bond issuances via KPI-linked instruments (sustainability-linked bonds and loans) is contributing to a more diverse bond market.

SPO Market Growth Overview

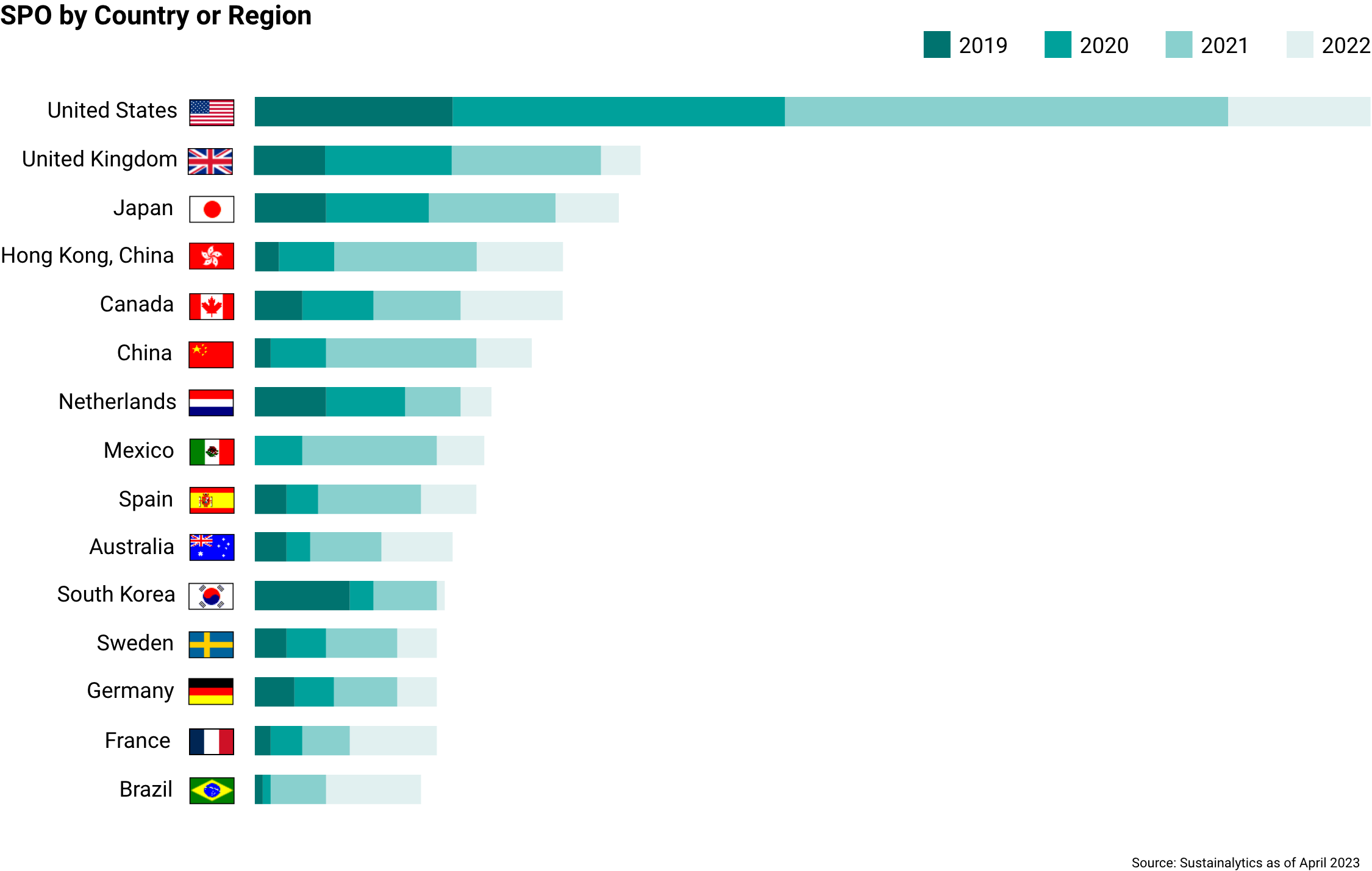

In 2022, the largest issuing countries in the green bond market were the United States, Germany, France, Netherlands, and China. Sustainalytics has seen continual growth in the U.S., Japan, and the Netherlands, followed by the U.K., Canada, Germany, and France.

Regional Breakdown

Americas

Over the last few years, it has become common to hear that the Americas are two or three years behind Europe with regards to ESG and sustainability-themed financing. However, over...

Asia Pacific (APAC)

The APAC region is a dynamic part of the world, where each territory represents different opportunities and stages of sustainability, economic development and ESG journey...

Europe, Middle East and Africa (EMEA)

The green, social, sustainability and sustainability-linked (GSSS) bond market continues to grow steadily in the EMEA region despite...

Recent Awards Won

Related Products

Second-Party Opinions

Get a second-party opinion on your ESG bond framework from the world's largest provider.

Published Projects

Explore our work with issuers, from leading multinational corporations to financial institutions, non-profits, and governments.

Sustainability Linked Bonds

Further develop the key role that debt markets can play in funding and encouraging companies that contribute to sustainability