Important Announcement

Please note that effective March 31, 2024, the Jantzi Social Index will be migrated to the Morningstar Indexes calculation platform. This change is part of Morningstar's continued consolidation of our index calculations in-house to improve client experience and reduce reliance on external calculations agents. On April 1, this page you are currently on will be removed and visitors will be redirected to the Morningstar Indexes website. For more information read this Jantzi Social Index migration FAQ.

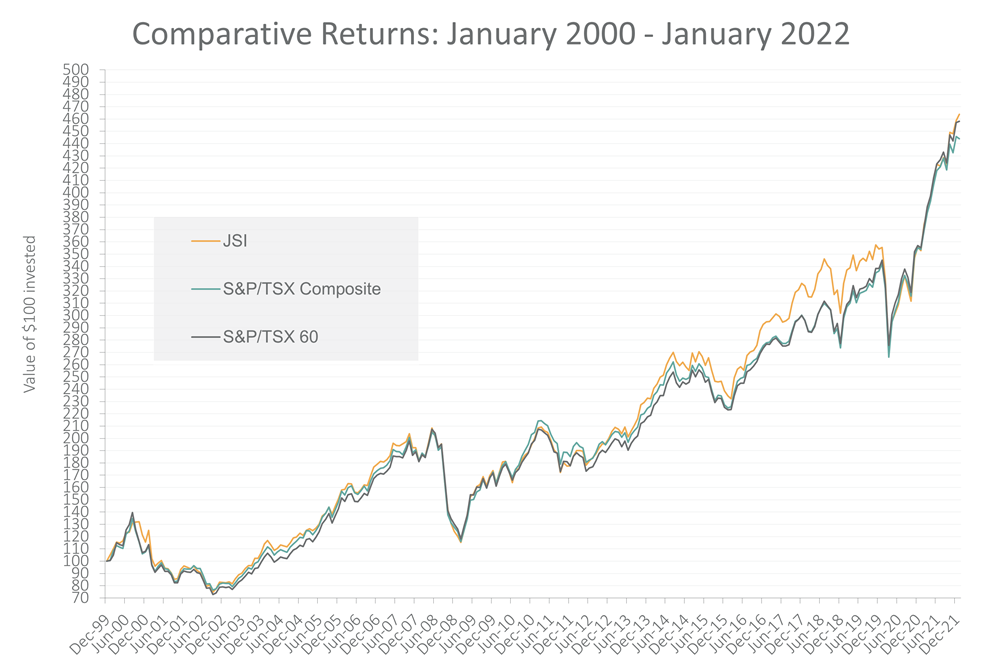

The Jantzi Social Index (JSI) was launched in January 2000 in partnership with Dow Jones Indexes. It is a socially screened, market capitalization-weighted common stock index modeled on the S&P/TSX 60 consisting of 50 Canadian companies that pass broad set of ESG criteria. The JSI has begun to generate the first definitive data on the effects of social screening on financial performance in Canada.

Sustainalytics developed a thorough ratings framework for the JSI that calls for an in-depth examination of a company’s (historical) performance in social areas such as aboriginal relations, community involvement, corporate governance, employee relations, the environment and human rights. The JSI excludes companies that have significant involvement in nuclear power, tobacco and weapons-related contracting. For more information, please see the methodology. Please follow the link to see the list of index constituents.

Performance

Monthly Returns

-

June 21, 2023

Jantzi Social Index May 2023 Total Returns

Morningstar Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) decreased in value by 5.31 percent during the month of May.

-

June 21, 2023

Jantzi Social Index April 2023 Total Returns

Morningstar Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) decreased in value by 4.07 percent during the month of April.

-

June 19, 2023

Jantzi Social Index March 2023 Total Returns

Morningstar Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) decreased in value by 0.43 percent during the month of March.

-

March 14, 2023

Jantzi Social Index February 2023 Total Returns

Morningstar Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) decreased in value by 3.55 percent during the month of February.

-

February 9, 2023

Jantzi Social Index January 2023 Total Returns

Morningstar Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) increased in value by 7.75 percent during the month of January.

-

January 13, 2023

Jantzi Social Index December 2022 Total Returns

Morningstar Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) decreased in value by 4.36 percent during the month of December.

-

December 15, 2022

Jantzi Social Index November 2022 Total Returns

Morningstar Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) increased in value by 5.76 percent during the month of November.

-

November 11, 2022

Jantzi Social Index October 2022 Total Returns

Morningstar Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) increased in value by 8.65 percent during the month of October.

-

October 17, 2022

Jantzi Social Index September 2022 Total Returns

Morningstar Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) decreased in value by 3.65 percent during the month of September.

-

September 15, 2022

Jantzi Social Index August 2022 Total Returns

Morningstar Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) decreased in value by 1.47 percent during the month of August.

-

August 19, 2022

Jantzi Social Index July 2022 Total Returns

Morningstar Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) increased in value by 2.90 percent during the month of July.

-

July 12, 2022

Jantzi Social Index June 2022 Total Returns

Morningstar Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) decreased in value by 9.04 percent during the month of June. During the same period, the S&P/TSX Composite Index decreased by 8.71 percent and the S&P/TSX 60 Index decreased by 8.33 percent.

-

June 16, 2022

Jantzi Social Index May 2022 Total Returns

Morningstar Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) increased in value by 0.31 percent during the month of May.

-

May 8, 2022

Jantzi Social Index April 2022 Total Returns

Morningstar Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) decreased in value by 4.85 percent during the month of April.

-

April 13, 2022

Jantzi Social Index March 2022 Total Returns

Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) increased in value by 3.42 percent during the month of March. During the same period, the S&P/TSX Composite Index increased by 3.96 percent and the S&P/TSX 60 Index increased by 3.80 percent.

-

March 8, 2022

Jantzi Social Index February 2022 Total Returns

Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) decreased in value by 0.34 percent during the month of February. During the same period, the S&P/TSX Composite Index increased by 0.28 percent and the S&P/TSX 60 Index decreased by 0.12 percent.

-

March 3, 2022

Jantzi Social Index January 2022 Total Returns

Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) increased in value by 1.15 percent during the month of January. During the same period, the S&P/TSX Composite Index decreased by 0.41 percent and the S&P/TSX 60 Index decreased by 0.20 percent.

-

January 10, 2022

Jantzi Social Index December 2021 Total Returns

Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) increased in value by 2.38 percent during the month of December. During the same period, the S&P/TSX Composite Index increased by 3.06 percent and the S&P/TSX 60 Index increased by 3.43 percent.

-

December 7, 2021

Jantzi Social Index November 2021 Total Returns

Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) decreased in value by 0.28 percent during the month of November. During the same period, the S&P/TSX Composite Index decreased by 1.62 percent and the S&P/TSX 60 Index decreased by 1.13 percent.

-

November 11, 2021

Jantzi Social Index October 2021 Total Returns

Sustainalytics, a leading global provider of ESG and corporate governance research, ratings and analytics, today reported that the Jantzi Social Index® (JSI) increased in value by 6.26 percent during the month of October. During the same period, the S&P/TSX Composite Index increased by 5.02 percent and the S&P/TSX 60 Index increased by 5.38 percent.

Investable Products

In 2001, Meritas Mutual Funds launched the Social Index Fund, an RRSP eligible mutual fund that invests in common shares of companies that comprise the JSI. The fund’s holdings of each company match the sector and industry weights, as well as the relative market capitalizations, of the JSI. Please see Meritas Mutual Funds for more information.

In 2007, iShares launched the first socially responsible Exchange Traded Fund (ETF) in Canada, the iShares Jantzi Social Index Fund (XEN). XEN is designed for socially responsible investors to help attain diversification in their portfolios.