Overview

Are you faced with data gaps when assessing ESG risks across your portfolios? A strong approach to integrating ESG risk requires risk signals across all portfolio holdings, including smaller companies and companies based in emerging market jurisdictions which tend to have limited or no ESG disclosure.

Leveraging the power of machine learning and advanced data analytics, Morningstar Sustainalytics' ESG Risk Smart Score provides broad coverage of ESG risk signals across portfolio holdings. The ESG Risk Smart Score is an estimated score of a company's top level ESG risk with coverage that includes

Analyzing the ESG risks associated with smaller companies can be difficult for investors.

The ESG Risk Smart Score complements Morningstar Sustainalytics’ ESG Risk Ratings by extending ESG Signals across broader market caps and geographies .

Key Features and Benefits

Identify outliers for ESG Risk

Address data gaps for integrating ESG across decisions. Can serve as a severity flag to identify potential exposure to ESG Risk, where additional research may be needed.

Proprietary AI Model

Our proprietary machine-learning model leverages the data of Sustainalytics flagship ESG Risk Rating product, combining it with additional ESG and financial variables to produce an enhanced estimated ESG risk score.

Extensive coverage across several industries and sub-industries

40 industries and over 100 sub-industries are covered with ESG Risk Smart Score.

Quarterly Updates

Stay updated with new data delivered every quarter.

Three Delivery Options

Choose the output that is most suitable for you - through API (JSON format), as a data feed (.txt format) or excel format.

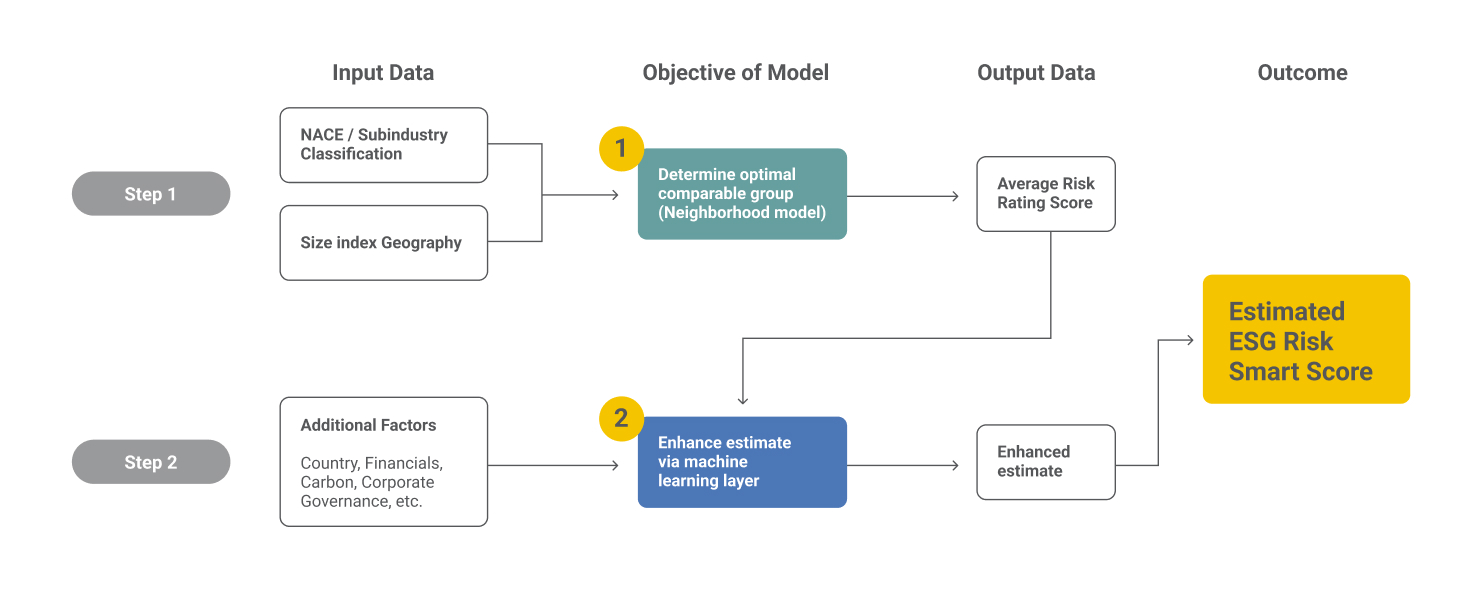

Our Framework: How the ESG Risk Smart Score is Calculated

ESG Risk Smart Score uses a two-step approach which has an average risk category accuracy of above 80%

Step 1:

Step 2:

Use Cases for ESG Risk Smart Score

ESG Risk Smart Score can be used to support clients’ decision making and due diligence processes in the following:

Portfolio

Construction

Portfolio

Management

Security

Selection

Extending ESG signals

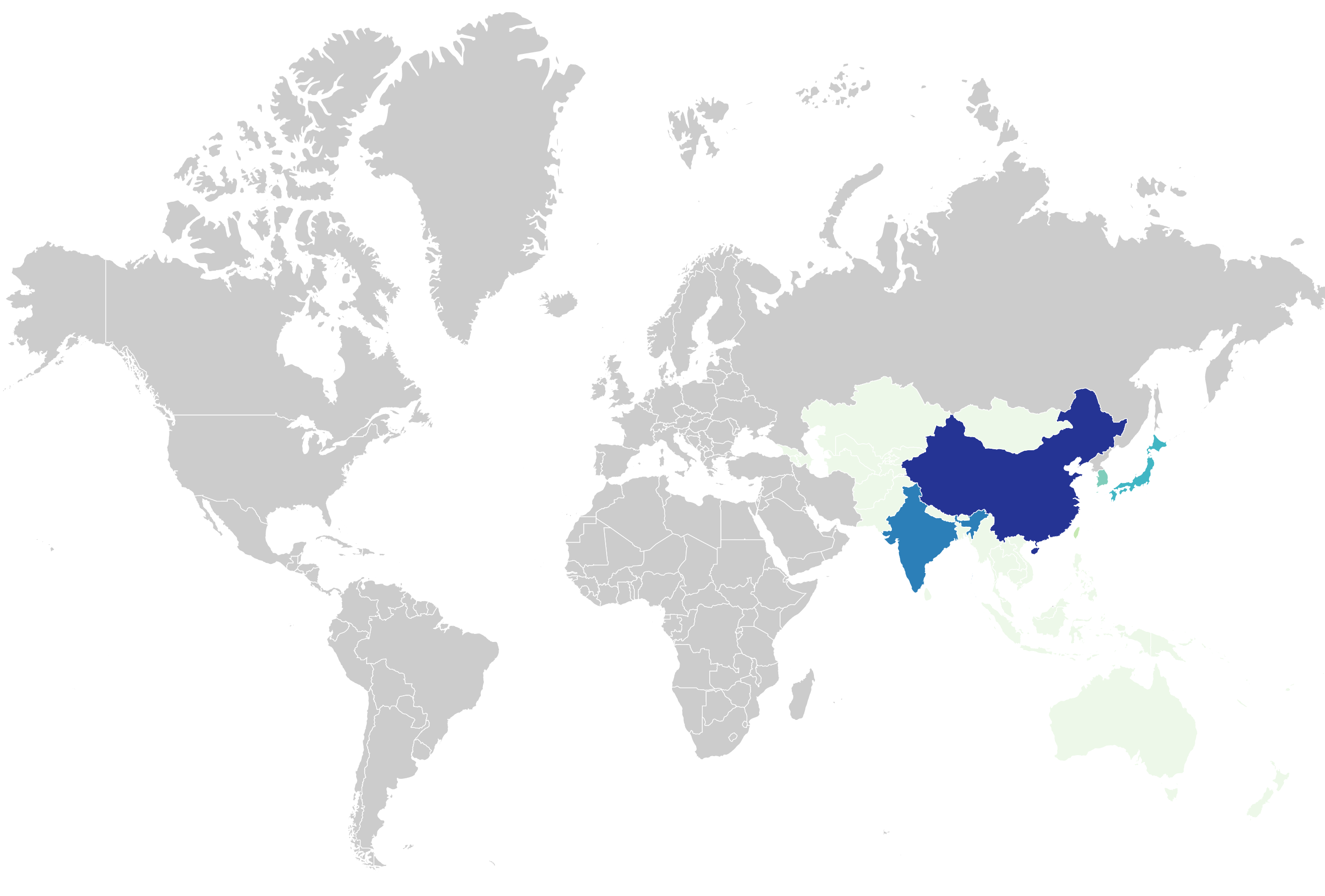

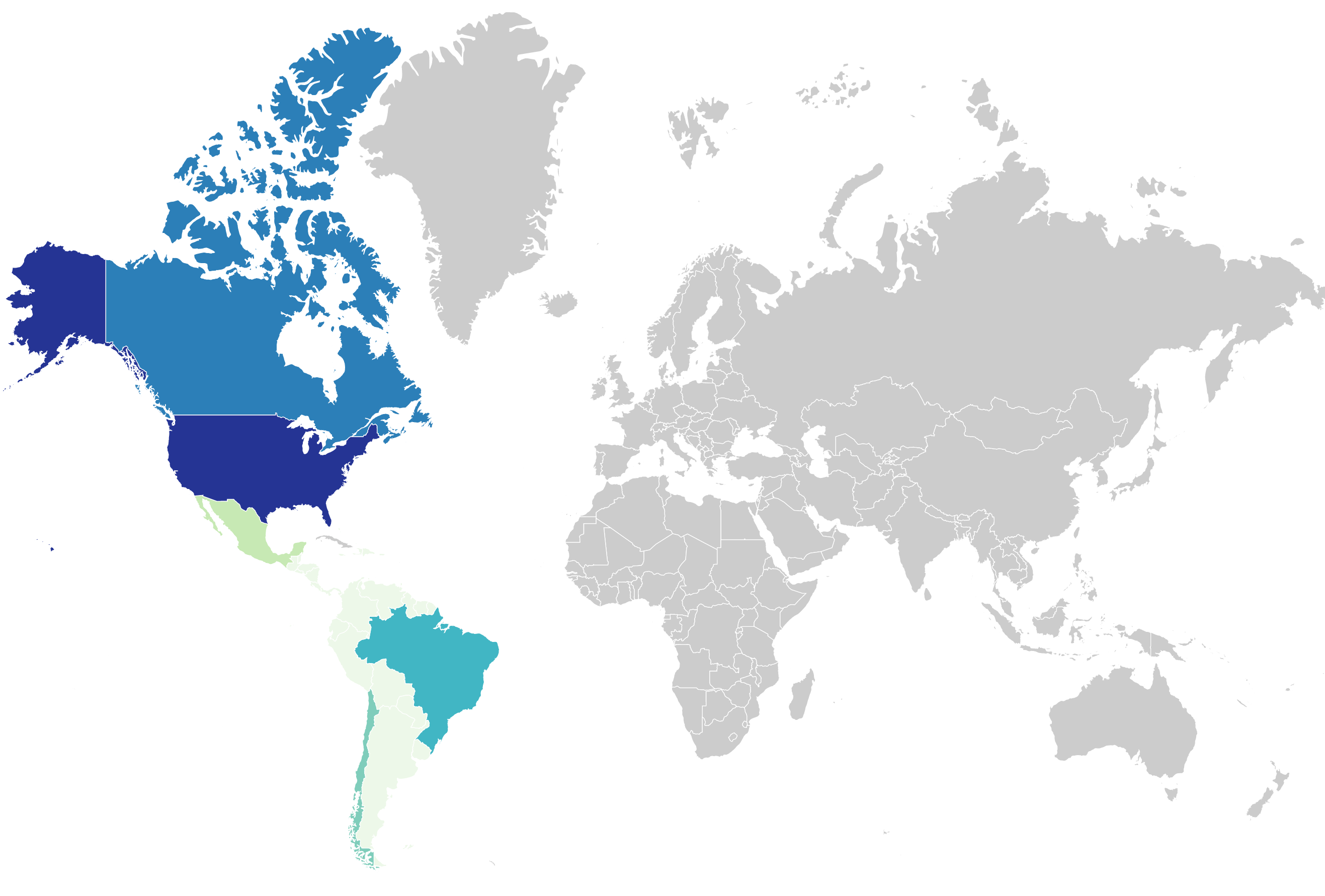

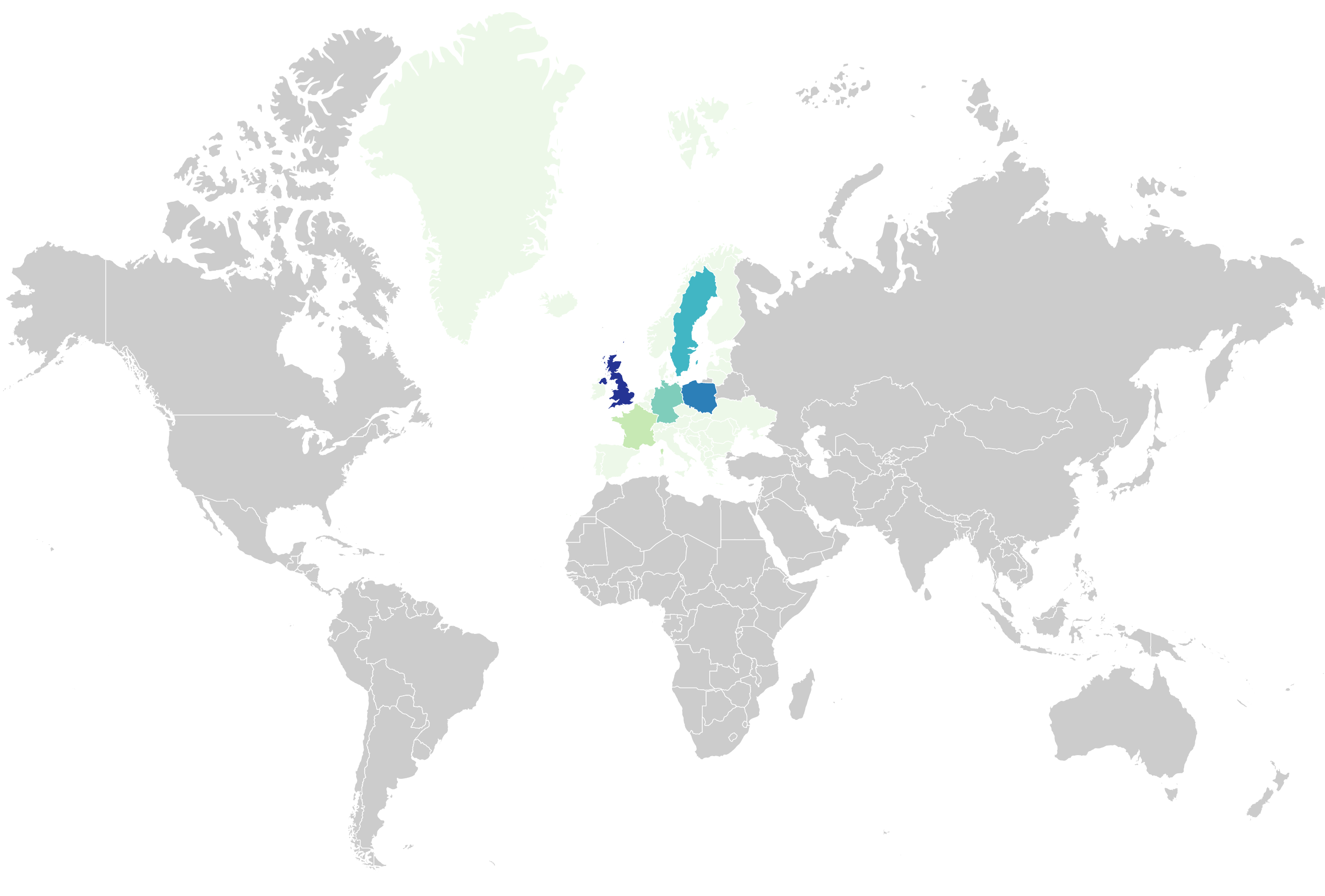

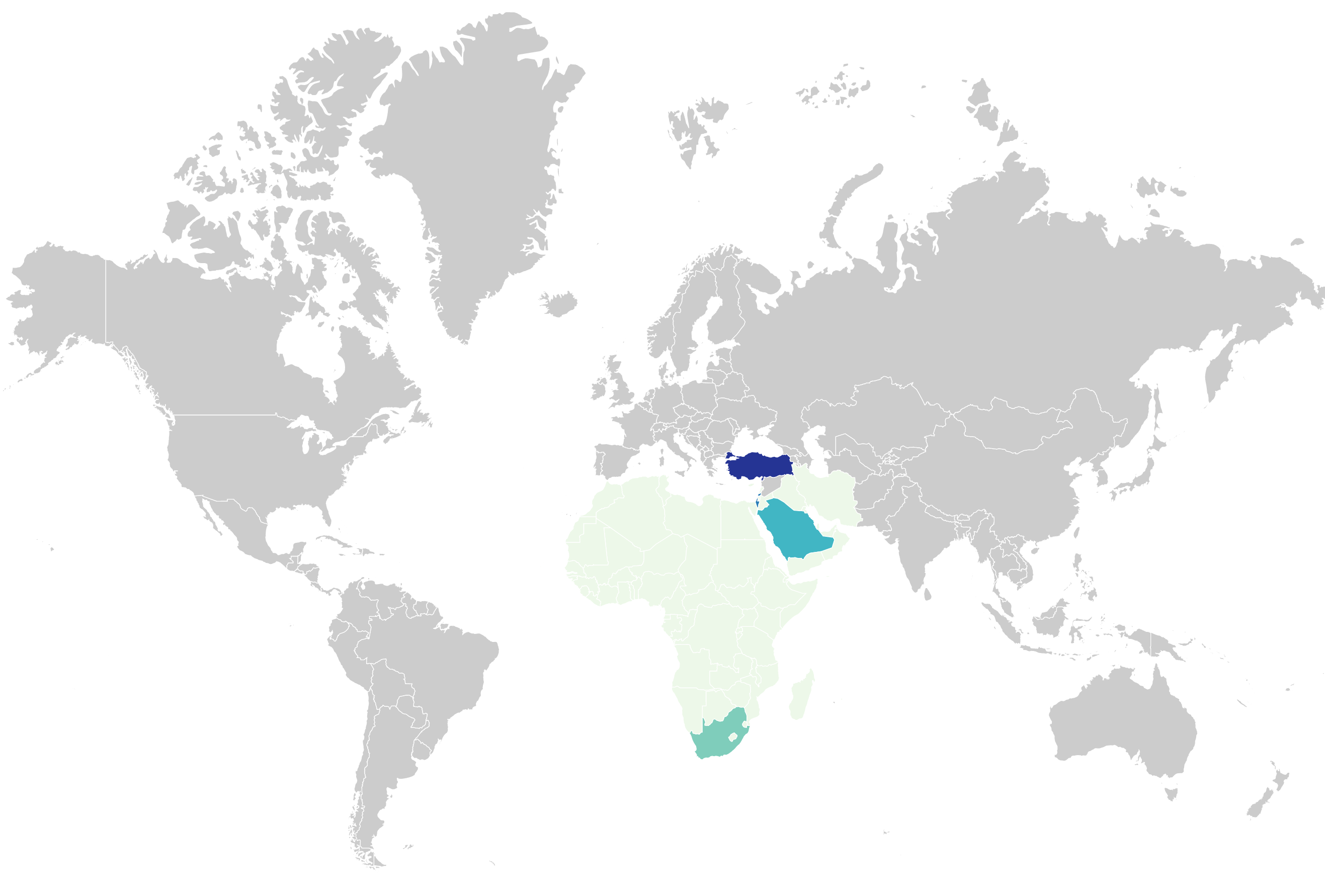

The ESG Risk Smart Score provides ESG signals for over 34,000 companies, primarily small, micro-cap and nano cap companies. Over 70% of those companies are in Asia Pacific, Africa and the Middle East Regions, making it suitable for frontier market portfolios. Through the ESG Risk Ratings and the ESG Risk Smart Score, fund managers can access ESG signals for over 50,000 companies across a range of market caps and geographies

Corporate

Lending

Immediate red flag signal

Asset managers and banks can use ESG Smart Score as a heat map to efficiently highlight companies with more ESG risk where additional research would be prudent.

Regional Coverage

| China | 4500+ |

|---|---|

| India | 4100+ |

| Japan | 2500+ |

| South Korea | 2000+ |

| Taiwan | 1500+ |

| Other | 5500+ |