Customer Story

How a Critical Minerals Company Forged Ahead With Its ESG Risk Rating

With aspirations to include environmental, social, and corporate governance (ESG) principles as a fundamental part of its business model, FYI Resources Ltd. embarked on a journey to understand how it could better manage these risks and opportunities. The critical minerals producer engaged Morningstar Sustainalytics to obtain an ESG Risk Rating License that would support its mission – to become a key contributor to a sustainable world through responsible innovation, environmental impact reduction, and community outreach.

In This Customer Story:

Industry

Diversified Metals

Region

APAC (Australia)

“After conducting our own review of ESG risk rating providers, we concluded that Morningstar Sustainalytics provided best-in-class research, service, and products in the ESG market.”

Roland Hill

Managing Director, FYI Resources Ltd.

The Opportunity

FYI Resources aimed to adopt sustainable business practices by improving its ESG performance and reporting practices, while communicating its progress to all its key stakeholders.

The Solution

After receiving several recommendations, FYI Resources obtained an ESG Risk Ratings License from Sustainalytics to support their progress and access best-in-class ESG research and services.

The Results

The support and structure provided by Sustainalytics during the ESG Risk Rating process enabled FYI Resources to better plan and execute its activities, while further understanding its opportunities for improvement.

About FYI Resources Ltd.

FYI Resources Ltd. is a publicly traded, Australia-based resources company that focuses on exploration and development of critical and strategic mineral projects. As a core activity, FYI Resources is developing high-purity alumina (HPA) through an innovative and efficient process. HPA is a critical material for many high-tech products and is expected to advance the electrification of other industries, contributing to the low carbon transition of the global economy.

The Opportunity

When Integrating ESG Makes Good Business Sense

In recent years, the benefits of strong ESG performance became clear to FYI Resources. The company’s leadership could see that climate action and sustainability were driving global change and they wanted to be part of the transition. The adoption of ESG by shareholders, regulators, and industry peers further convinced FYI Resources to pursue ESG leadership within the diversified metals industry.

With its core focus on producing HPA – a product that is crucial to sustainable industries like electric vehicle production, increasing the power yield, functionality, and overall safety of battery cells – incorporating ESG into the company’s business model just made sense.

With that in mind, the mineral development company crafted a new ESG mission statement, committing to become a key contributor to a sustainable world, by innovating responsibly, giving back to the community, and reducing its environmental impact for future generations.

The company also recognized that an emphasis on ESG could enhance its efforts in marketing, investor relations, capital raising activities, and the attraction and retention of top talents. However, the company quickly realized it required better measures to quantify and report on its ESG efforts, and a more structured approach to achieve its desired ESG objectives. In short, it was missing an essential piece of the puzzle.

The Solution

Accessing Tools to Support ESG Integration

In its search to find an ESG rating provider that could help measure and communicate its ESG performance, FYI Resources received several recommendations from business associates to consider Sustainalytics products and services. Following a thorough review process, the company’s leadership was encouraged by Sustainalytics’ reputation and that of its parent company, Morningstar. In engaging and consulting with Sustainalytics, FYI Resources saw that their needs would best be met by obtaining an ESG Risk Rating License.

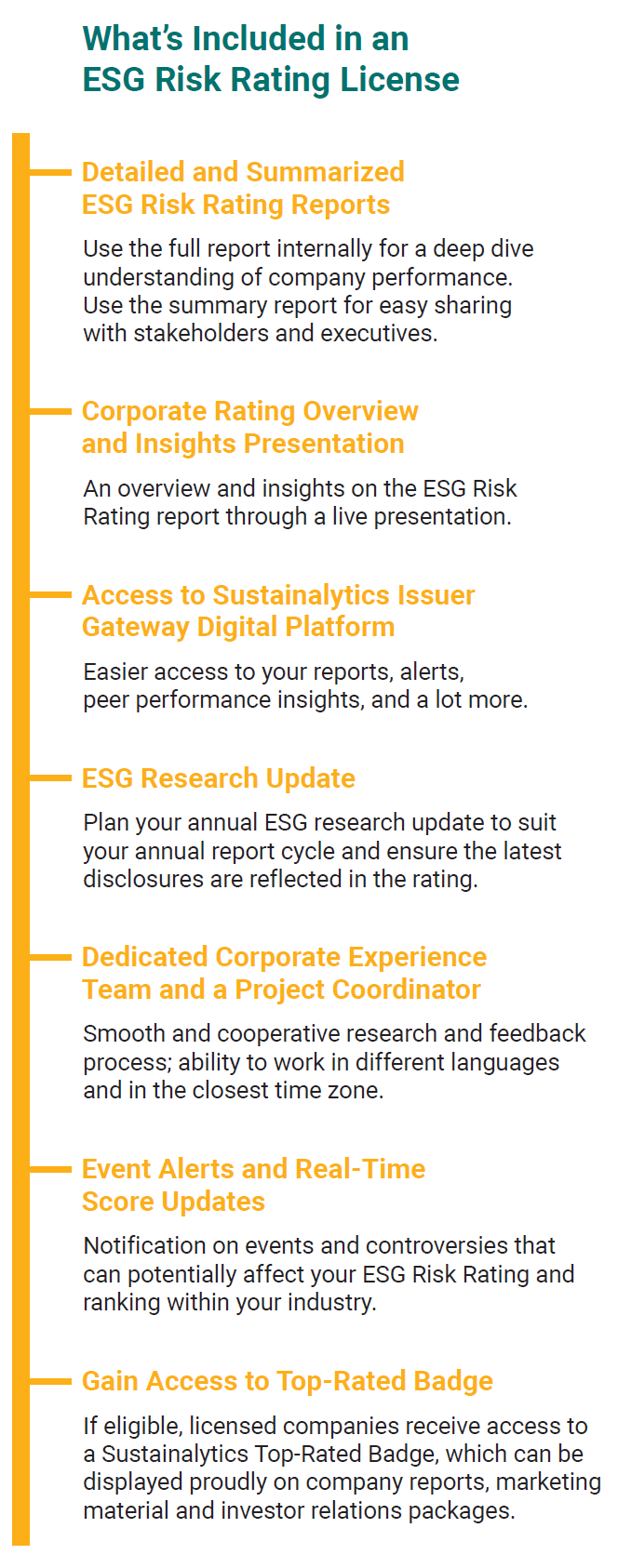

The ESG Risk Rating License is an agreement that enables businesses to use Sustainalytics’ Risk Rating for a variety of internal and external corporate purposes, including marketing, reporting, and communications. With the Sustainalytics ESG Risk Rating License, FYI Resources was provided a full risk rating report. The report provided an in-depth analysis of the company’s ESG Risk Rating, including a detailed record of risk exposure, material ESG issues (MEIs), as well as managed and unmanaged risk.

FYI Resources could clearly see where it was performing well and where it could improve, while leveraging a benchmark for setting performance targets and objectives for the future. In acquiring the license, FYI Resources also received access to a dedicated team of Sustainalytics service professionals. This team reviewed the ESG Risk Rating with FYI Resources and provided the support the company needed to understand and interpret its ESG data.

“We believe that Sustainalytics will continue to be an integral partner in our journey to achieve our ESG goals.”

Roland Hill

Managing Director, FYI Resources Ltd.

The Results

Benefiting from the Details: Achievements and Opportunities

FYI Resources found that Sustainalytics’ ESG Risk Rating review process offered valuable insights into what material ESG issues the company should prioritize, and areas with the most impact on the company’s ESG performance. This information can now be used to focus FYI Resources’ efforts and improve its rating, while also informing decision-making, strategy, and resource allocation throughout the organization. The support provided by Sustainalytics also helped guide the company’s planning and reporting processes, while the information provided in the risk rating served to elevate and promote its ESG activities.

The company’s ESG Risk Rating report found that since it was still in the pilot phase of its joint venture with Alcoa (a world leader in aluminum production), their exposure to issues like occupational health and safety, effluents and waste, and emissions would appear lower than industry peers. However, FYI Resource’s technology was found to produce alumina using 40% less energy, emitting half the amount of GHG emissions than traditional methods.

The report also noted that in the future, FYI Resources will be required to source raw materials through mining development and operations and could be subject to added scrutiny. Nevertheless, since the company has already integrated ESG considerations into its business model, this is a good indication that its dedication to reducing environmental harm and its impact on the community will continue.

Other Customer Stories

How a Leading Infrastructure and Facilities Conglomerate Successfully Linked its Sustainability Ambitions to its Financing

In pursuing a sustainability-linked loan (SLL) and obtaining a second-party opinion on the KPIs tied to it, Downer secured credibility for its sustainability commitments, while also achieving its financing objectives.

How a Credit Union Analyzed Its ESG Gaps and Set Its Sights on Leading in ESG

The insights and data gathered from Sustainalytics’ ESG Performance Analytics reinforced First West Credit Union’s values-based approach to business and spurred the company to strive for additional positive impacts within its operations, for its members, and for its community teams.

Do you have questions?

Set your business on the right ESG path by contacting our team of experts today.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.