Customer Story

How a Telecommunications and Software Company Laid the Foundation for Its ESG Performance

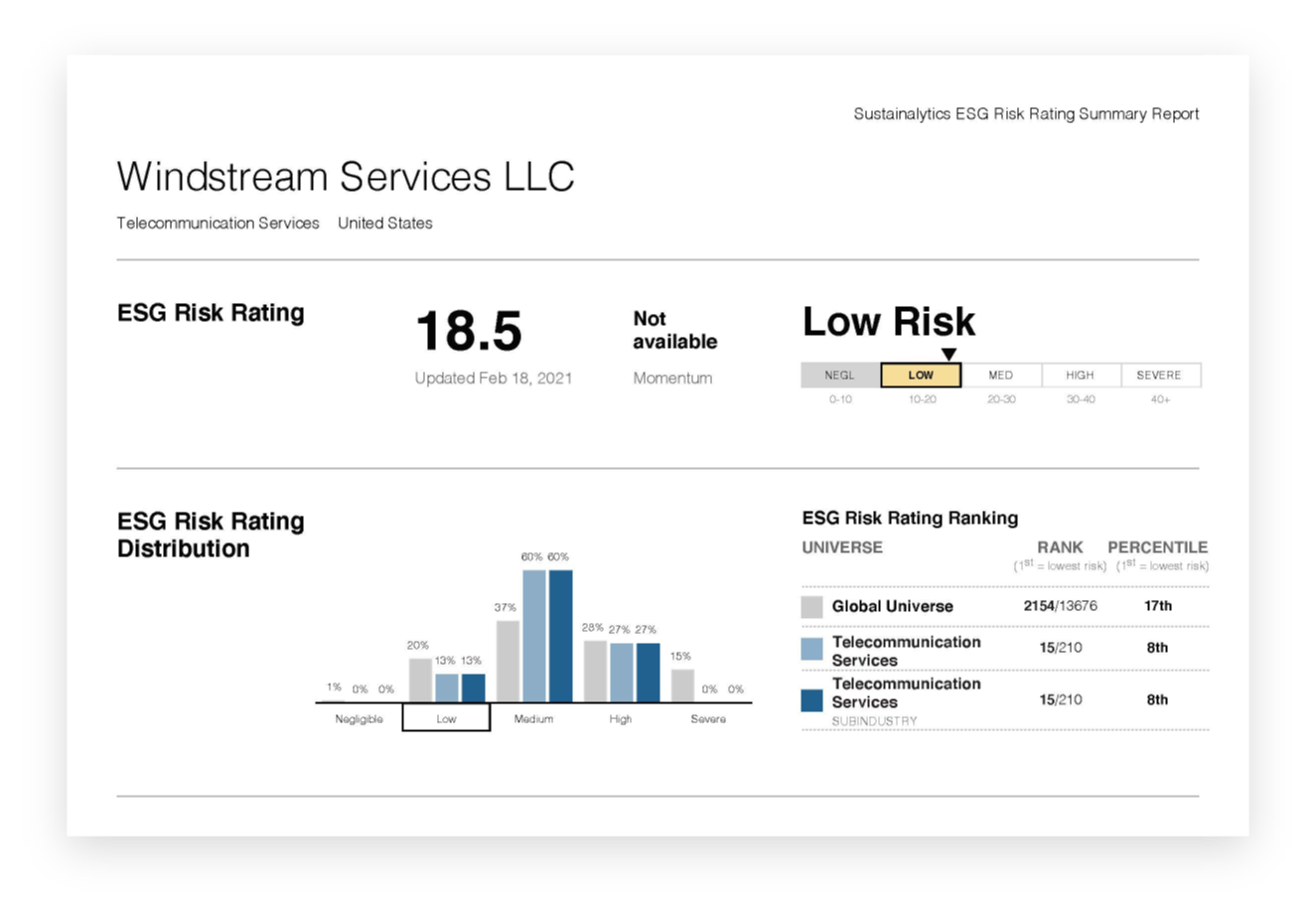

By understanding its ESG position among industry peers, Windstream set a benchmark for improving its ESG targets and communicating sustainability accomplishments to key stakeholders.

In This Customer Story:

Industry

Telecommunications

Region

North America

“Sustainalytics’ ESG Risk Rating allowed us to determine our performance baseline, and helped us identify and close the gaps in our policies and programs.”

Mark Reed

Chief Procurement Officer and ESG Operational Committee Member, Windstream

The Challenge

Generating transparency around the company’s environmental and social impacts for investors, employees and customers.

The Solution

An ESG Risk Rating helped Windstream identify gaps and set a baseline for improving ESG performance. An ESG Performance Analytics reports effectively identify Windstream’s sustainability performance against its peers.

The Results

Windstream brought its ESG reporting and disclosures in line with best practices by publishing a robust, GRI-aligned annual ESG report, making public CDP disclosures, and applying to the UN Global Compact.

About Windstream

Windstream Holdings is a privately held communications and software company. Windstream offers managed communications services, including SD-WAN and UCaaS, and high-capacity bandwidth and transport services to businesses across the U.S. The company also provides premium broadband, entertainment, and security services through an enhanced fiber network and 5G fixed wireless service to consumers and small and midsize businesses primarily in rural areas in 18 states.

The Challenge

Develop a Company ESG Performance Baseline

Windstream established a board-level committee in 2020 focused on environmental, social and governance (ESG) factors that could make the company stronger over time. Although the company had been focused on mitigating environmental impacts and using resources more efficiently, there was not a full appreciation or understanding of the importance of disclosure and publicly reporting on all ESG matters. Efforts centered more on execution of its strategies and less on effectively telling its ESG story.

As its ESG journey continued, Windstream came to realize that transparency around its environmental and social impacts was valued not only by investors, but also by its employees and customers. To help assess its ESG position and performance relative to its industry and peers, and to better communicate this to stakeholders, Windstream contacted Sustainalytics to learn how it could obtain an ESG Risk Rating.

The Solution

Understanding ESG Risk for the Company Among Industry Peers

An ESG Risk Rating to Identify Gaps and Set a Baseline for Improving ESG Performance

Sustainalytics’ ESG Risk Ratings service allows companies to assess their ESG performance. The process provides insights into ESG issues that are considered material for the company and how well the company is managing those risks.

Windstream’s ESG assessment was calculated according to the ESG Risk Ratings methodology which uses publicly available quantitative and qualitative data as well as information provided by the company (i.e., documentation on ESG policies and programs, data on emissions, resource use, etc.). As per the ESG evaluation process applied to all companies in Sustainalytics’ Comprehensive ESG Research universe,i Windstream’s information was assessed by a sector analyst and the company had an opportunity to offer feedback on the assessment and provide any missing information for consideration.

ESG Performance Analytics Positioning Windstream Against Competitors

Windstream was committed to fully understanding its ESG strengths and weakness and was able to deepen its knowledge with Sustainalytics’ ESG Performance Analytics. ESG Performance Analytics provided a granular analysis of Windstream’s ESG Risk Rating performance, showcasing its strengths and weaknesses, and presenting in-depth analysis against five selected peers. With the support of Sustainalytics’ designated Performance Analytics team, Windstream identified five telecom companies for comparison, including U.S. competitors and global companies considered ESG leaders in the industry.

The final report and presentation included score and material ESG issue comparisons at the industry and peer levels, management indicator gap analysis, information on expected industry practice, and leading practice examples.

The Results

Roadmap to ESG Success

For Windstream, the process was an eye-opener both in understanding the company’s starting point and what it needed to do to improve its ESG performance. With the ESG Risk Rating and ESG Performance Analytics report, the company learned that it compared quite well against its U.S. peers, but also saw that even industry leaders in the U.S. are operating below global best practice.

The process also helped Windstream realize that ESG disclosure does not need to be daunting or overwhelming. Sustainalytics provided real-world best-practice examples and introduced Windstream to several international reporting frameworks recognized by investors and regulators globally. In a few short months, Windstream went from no ESG rating and minimal disclosure, to publishing a robust GRI-aligned annual ESG report, publishing public CDP disclosures and applying to the UN Global Compact.

By understanding its current ESG position and learning from its peers, Windstream created a roadmap for continued improvements towards ESG targets and communicating those accomplishments to key stakeholders.

"This isn’t just about Windstream, this is about saying: ‘Look, effective ESG reporting can be done,’ and by the way it can be done by companies like us who are new to the world of ESG disclosures in a very short amount of time."

Mark Reed

Chief Procurement Officer and ESG Operational Committee Member, Windstream

Other Customer Stories

How a Business Service Management Platform for Cloud and IT Evolved Its ESG at Strategic Scale

BMC Software gained the holistic view of its environmental, social, and governance efforts the company needed to measure its impact, understand how it could scale ESG programs, and communicate successes to stakeholders.

How a Leading Infrastructure and Facilities Conglomerate Successfully Linked its Sustainability Ambitions to its Financing

In pursuing a sustainability-linked loan (SLL) and obtaining a second-party opinion on the KPIs tied to it, Downer secured credibility for its sustainability commitments, while also achieving its financing objectives.

How a Credit Union Analyzed Its ESG Gaps and Set Its Sights on Leading in ESG

The insights and data gathered from Sustainalytics’ ESG Performance Analytics reinforced First West Credit Union’s values-based approach to business and spurred the company to strive for additional positive impacts within its operations, for its members, and for its community teams.

Do you have questions?

Set your business on the right ESG path by contacting our team of experts today.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.