Changing expectations and a global push to influence systemic change mean many investors are looking to demonstrate a robust, active and holistic approach to ESG engagement. Through industry initiatives, like the PRI, and new stewardship codes and regulatory frameworks, like the EU’s Action Plan, there is a growing need among investors to demonstrate that they take stewardship responsibilities related to ESG issues seriously.

At Sustainalytics, we work collaboratively with the world’s leading asset owners and asset managers and foster constructive dialogues with our target companies. For nearly 30 years, our programme has helped our clients achieve consistent ESG engagement outcomes and promote and protect long-term shareholder value. All our engagements are informed by Sustainalytics’ company research, helping clients take a coherent approach to ESG across the entire investment value chain.

Sustainalytics’ Stewardship Services

Sustainalytics facilitates a variety of stewardship avenues for our investor clients to help promote and protect long-term shareholder value. We work with the world’s leading asset owners and managers to engage with issuers who have high levels of unmanaged material ESG risk. We influence companies to proactively address systemic ESG risks and identify ESG-related opportunities, and we support investors to align integrated ESG research and engagement dialogue with proxy voting.

Latest Insights

Integrating Nature into Finance: Key Challenges Facing the Financial Sector

Exploring Climate-Related Systemic Risks: Possible Ways Forward for Asset Owners

Morningstar Sustainalytics is proud to be recognized as a signatory to the UK Stewardship Code for the 5th year in a row.

Our Engagement Solutions

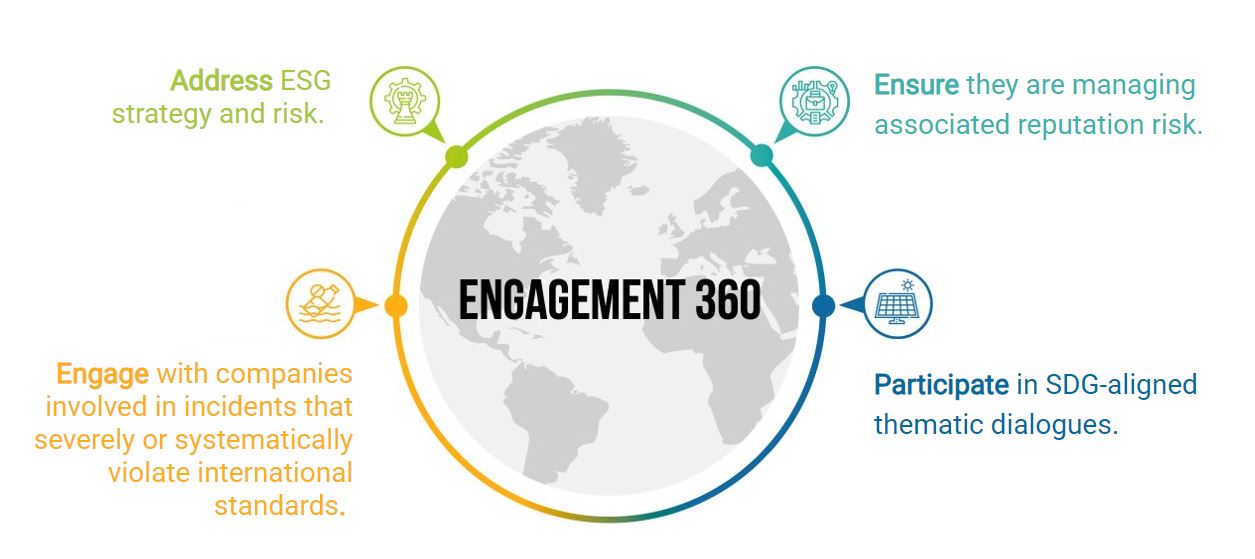

Sustainalytics' Engagement 360 Solution

Engagement 360 is a full-service stewardship solution and our most holistic service offering—it packages together all the engagement services into a comprehensive service bundle. It was designed to satisfy our clients' need for an integrated approach to engagement that combines research overlay, thematic engagements and an ESG lens to proxy voting.

Engagement 360 is our most comprehensive stewardship solution. It is designed to help our clients generate positive and meaningful environmental, social and governance change. Engagement 360 is right for clients looking to take a robust and integrated approach to engagement. It supports investors in understanding companies holistically rather than on independent topics.

Material Risk Engagement

A proactive engagement with companies with the greatest unmanaged financially-material ESG risks.

Norms-based Engagement

Incident-driven engagement that identifies companies not in compliance with accepted international conventions, such as the UN Global Compact, OECD Guidelines and other accepted standards.

Thematic Stewardship Programmes

Proactive engagement services that focus on tackling the most challenging ESG issues, from climate change to child labor.

We believe effective engagement is a constructive process aimed at creating long-term investment value. To achieve this aim, engagement requires:

- Clear engagement objectives that both resolve relevant issues and improve companies’ overall ESG performance

- Constructive relationships built on two-way dialogue

- Clear time frames for engagement results

- Versatility and the use of all available engagement tools, including email communications, calls and meetings with management, conference calls, site visits and proxy voting

- Working on a collaborative basis to leverage the power of ownership influence

Our constantly growing team currently consists of around 50 highly experienced engagement professionals, with extensive market knowledge. Our Engagement Managers are able to leverage Sustainalytics’ in-depth and diverse ESG research, which is supported by more than 800 research analysts and the largest dedicated ESG client servicing team in the industry.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Related Insights and Resources

AI’s Energy Demand Meets US Utility Readiness: A Look at Carbon Intensity and Transition Risk

This article explores how the impacts of powering US data centers for AI are emerging as major challenges. Meeting the electricity needs of AI will increasingly depend on how quickly grid infrastructure, siting processes, and permitting systems can adapt.

Related Solutions

Material Risk Engagement

Engage on the most material ESG risks identified by the ESG Risk Ratings.

Global Standards Engagement

Engage with companies that breach international norms and standards as identified by our Global Standards Screening research.

Thematic Stewardship Programmes

Engage on the most challenging ESG issues, from climate change to human capital.