Customer Story

How a Business Service Management Platform for Cloud and IT Evolved Its ESG at Strategic Scale

BMC Software needed a holistic view of its environmental, social, and governance (ESG) efforts in order to measure its impact, understand how it could scale ESG programs, and communicate successes to stakeholders. Sustainalytics’ ESG Risk Rating and Performance Analytics process provided the key metrics and indicators BMC sought, plus crucial insights into the competitive landscape, industry best practices, and opportunities to improve efficiency and grow internal talent capacity.

In This Customer Story:

Industry

Software

Region

Global

“The ESG Performance Analytics process confirmed the areas where we believed we were doing well and helped us quickly identify areas where we could continue to improve our internal processes and policies. It has allowed us to rapidly mature our practices and make them repeatable throughout our global organization.”

John King

VP of Assurance, Risk, and Ethics, BMC

The Challenge

BMC needed to clearly understand the impact of its global ESG efforts in order to meet its expanded, purpose-driven corporate vision.

The Solution

Sustainalytics’ ESG Performance Analytics provided a granular analysis of BMC’s ESG Risk Rating against five selected peers, which showcased the company’s strengths and opportunities to refine.

The Results

BMC evolved its ESG strategy based on data-driven best practices for the software industry, scaled existing ESG programs globally, and was able to assure investors, employees, customers, partners, and prospects that the company was living up to its values.

About BMC

BMC works with 86% of the Forbes Global 50, as well as customers and partners around the world to create their future. With a history of innovation, industry-leading automation, operations, and service management solutions, combined with unmatched flexibility, BMC helps organizations free up time and space to become an autonomous digital enterprise that conquers the opportunities ahead.

BMC believes that the autonomous digital enterprise includes everyone and has a responsibility to help reshape the business landscape through equitable and inclusive social practices, environmental stewardship, and doing things the right way.

The Challenge

Evaluate ESG Efforts, Scale Sustainability Programs, and Demonstrate Performance to Stakeholders

BMC was engaged with ESG factors through several paths including corporate social responsibility programs and maintaining its ISO 14001 environmental management system certification. For BMC, this work was essential to demonstrating to its investors, employees, customers, partners, and prospects the company’s commitment to good corporate citizenship. However, without a holistic view, the company didn’t know how impactful its efforts were and couldn’t scale its programs or prove that commitment.

BMC was also facing increasing requests from stakeholders to provide details on its sustainability practices. At the same time, the company had entered a period of significant change, with a new executive vision and products. Recognizing that corporate social responsibility is the business imperative of our time, BMC needed to formally assess its ESG practices on a global level to inform its strategic roadmap. The time was right to start the ESG journey.

“We were doing incredible work on ESG issues across 38 countries and 6,400 people, but needed to understand industry best practices on how to measure, structure, and communicate our programs in a streamlined, globally acceptable way.”

Wendy Rentschler

Head of Global Corporate Social Responsibility, BMC

The Solution

ESG Risk Rating and Performance Analytics from Sustainalytics

BMC placed great value on understanding its ESG performance and scaling its ESG programs in order to eliminate constraints to growth. Executives and senior leadership recognized that engaging in a formal ESG assessment process would help BMC meet its goals, but it had to be done right. The company needed to affirm to stakeholders that it was embodying its values in practice. As a result, BMC sought help from a trusted global leader in ESG and contacted Sustainalytics to learn about ESG Risk Ratings and Performance Analytics.

Overview of the Components Assessed in the ESG Performance Analytics Process

Understanding ESG Performance

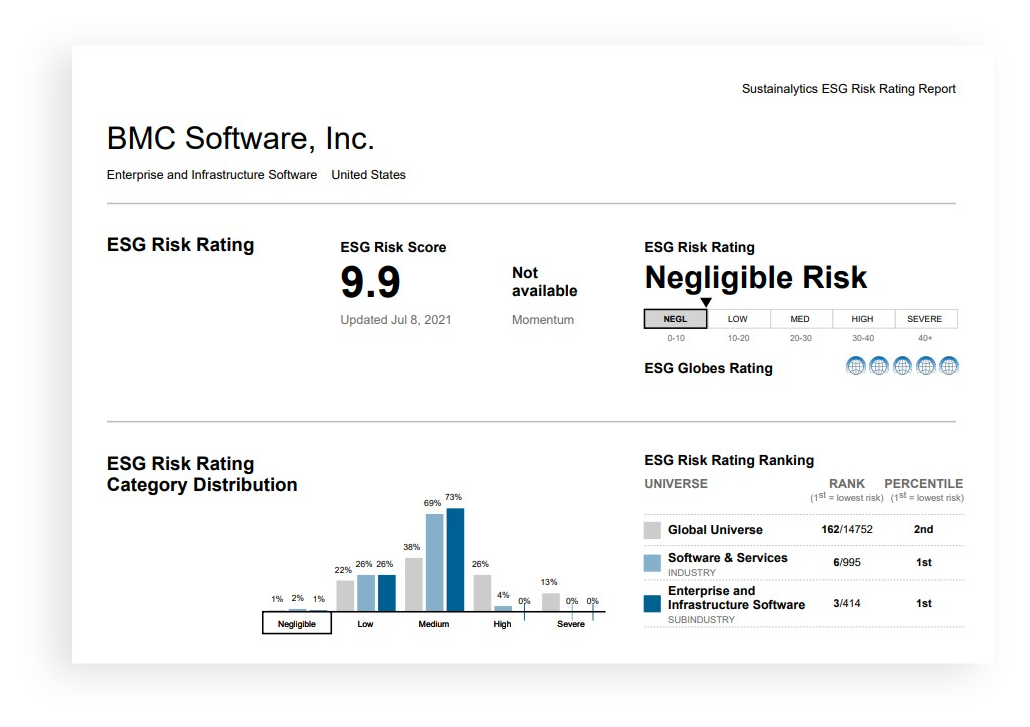

Sustainalytics’ ESG Performance Analytics is based on an in-depth analysis of a company's ESG Risk Rating performance compared against five selected peers. For BMC, the result was clear insight into the impact of the work the company was already doing and opportunities to scale ESG efforts globally. The report also provided a management indicator gap analysis, leading practice examples, and a documented record of BMC’s commitment and efforts to share with stakeholders.

Sample Image of BMC's ESG Risk Ratings Report Provided by Sustainalytics

The Results

A Transformation in Understanding, Engagement, Efficiency, and Communication

Despite all of BMC’s previous work on environmental, social, and governance issues, the company came away transformed from the ESG Performance Analytics process. The final report provided BMC with crucial insight into the organization’s ESG performance. The competitive landscape analysis shed light on industry best practices and key areas to focus on and invest in. BMC gained a deeper understanding of its ESG journey, discovering opportunities to scale programs, increase efficiency, communicate progress, engage executives and employees, and grow internal talent capacity.

In short, the Performance Analytics process helped BMC evolve its ESG program to allow the company to scale ESG practices globally and strongly demonstrate to employees, customers, and owners that the company is exceeding ESG benchmarks and living up to its beliefs.

BMC's ESG Journey

- 2020

- Local ESG efforts

- Out-of-date ESG rating

- Growth bottleneck from disclosure demands

- January 2021

- New corporate social responsibility vision and mission

- April 2021

- Contacted Sustainalytics

- June 2021

- ESG Risk Rating score

- July 2021

- ESG Performance Analytics review

- August 2021 to today

Formalized ESG program leads to:

- Joining SBTi and public CDP disclosures

- Credible disclosure for customers, partners, investors

- Internal ESG policy, program and disclosure enhancements

- Implementation of elevated inclusive human capital strategy

- Focus on sustainable IT internally and through product lines

“I have worked on many external engagements in my career and can say that this will be the one I compare all the rest to moving forward. The Performance Analytics portion, where Sustainalytics provided us with a comparison of our current practice against best practices and then showed real world examples of what best-in-class looks like in the software industry was extremely beneficial.”

Wendy Rentschler

Head of Global Corporate Social Responsibility, BMC

Other Customer Stories

How a Leading Infrastructure and Facilities Conglomerate Successfully Linked its Sustainability Ambitions to its Financing

In pursuing a sustainability-linked loan (SLL) and obtaining a second-party opinion on the KPIs tied to it, Downer secured credibility for its sustainability commitments, while also achieving its financing objectives.

How a Credit Union Analyzed Its ESG Gaps and Set Its Sights on Leading in ESG

The insights and data gathered from Sustainalytics’ ESG Performance Analytics reinforced First West Credit Union’s values-based approach to business and spurred the company to strive for additional positive impacts within its operations, for its members, and for its community teams.

Do you have questions?

Set your business on the right ESG path by contacting our team of experts today.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.