Low Carbon Transition Rating

EU Taxonomy Research

FAQ For Companies

Introduction

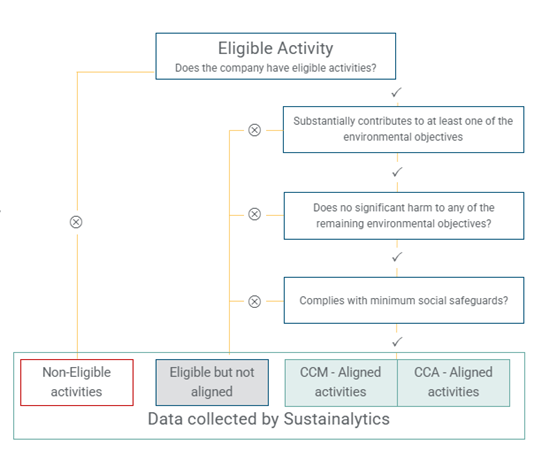

The EU Taxonomy of sustainable activities is a classification framework to determine whether an economic activity is environmentally sustainable. It was developed to help the European Union (EU) scale up sustainable investment, by creating security for investors, protecting private investors from greenwashing, helping companies become more climate-friendly and mitigating market fragmentation. The taxonomy applies three main criteria to screen activities and determine if each is environmentally sustainable and therefore aligned with the EU Taxonomy:

- Substantial contribution to at least one of six environmental objectives as defined by the EU.

- Do no significant harm to other objectives.

- Minimum safeguards.

From January 2023, the EU has required large non-financial entities that are subject to the Non-Financial Reporting Directive (NFRD) to disclose within their annual report their share of involvement in EU Taxonomy-aligned economic activities through revenues, capital expenditure and operating expenditure. Financial entities are required to begin reporting their Taxonomy alignment from January 2024.

Quick Links to official EU Website

Morningstar Sustainalytics’ (“Sustainalytics”) EU Taxonomy research consists of the relevant data we have collected from issuers’ disclosure as well as estimations for non-reporters based on a robust methodology, which is in line with the EU’s Taxonomy criteria.

- Sustainability and impact reporting. The EU Taxonomy is the world’s most advanced framework for assessing company activities for their environmental sustainability using rigorously defined and comprehensive science-backed criteria and thresholds. Sustainalytics’ EU Taxonomy Solution enables investors to credibly quantify and report on the real-world contributions of their investments through this framework.

- Ex ante research and stock selection. The research can be used as an input to stock selection, particularly for those funds looking to achieve impact on environmental objectives or attain environmental characteristics.

- Product Creation. Investor clients can leverage the vetted EU Taxonomy framework and Sustainalytics’ cutting-edge alignment research to build credible green products and portfolios.

- Regulatory reporting. Investor clients who assess Sustainalytics’ research and methodology as suitable may choose to leverage our EU Taxonomy Solution to meet regulatory reporting requirements under the EU Action Plan or other regulations.

- Ex post monitoring and stewardship. Investor clients can use Sustainalytics’ solution to engage their holding companies to improve their alignment with the EU Taxonomy. This may be in the form of encouraging a shift toward activities that are recognized as environmentally sustainable through the lens of the EU Taxonomy. Moreover, Sustainalytics’ Taxonomy Solution provides clients with an independent view on whether company activities are complying with the “Minimum Safeguards” and “Do No Significant Harm” criteria. Clients can engage those companies that are breaching these screens or are close to breaching them (identified through warning flags), to help improve their position. This could be achieved in conjunction with Sustainalytics’ Global Standards Engagement service which engages those companies that are breaching some of the fundamental checks undertaken as part of the EU Taxonomy Solution.

As of November 2023, we cover around 9,000 companies. For around 10% of these researched entities, we leverage reported data collected from company disclosures. For the remaining 90%, the research is based on our estimations.

If you would like a copy of the Sustainalytics EU Taxonomy research on your company, please contact [email protected]. (The research is not available on the Issuer Gateway portal).

Methodology

We provide the date of data aggregation, which informs our investor clients when the research was last updated for a given company. We also provide fiscal year information for our company assessments.

Sustainalytics has been archiving historical data for our EU Taxonomy Solution since July 2021.

Sustainalytics employs end-to-end quality control measures for the EU Taxonomy Solution starting with pre-publishing and post-publishing checks of the research, multiple automated validations throughout the dataflow, and quality checks before data are released to investor clients.

Analysts follow When it comes to reported Taxonomy data we collect from companies, we have a comprehensive EU Taxonomy data guidance that our analysts follow when retrieving this data from company reports. This guidance is based on our expertise in EU Taxonomy regulatory reporting requirements. By following this guidance, our analysts make sure to collect only EU Taxonomy data that is reported in line with EU requirements and reporting templates.

Research Process

We have a monthly research update cycle, which means that each month some companies will get their research updated. In our data collection, we prioritize capturing reported Taxonomy data as soon as it becomes available. By the end of 2025, we aim to capture FY 2024 data for all companies in our universe.

Sustainalytics analysts consult companies’ annual reports, sustainability reports and other publicly available statements to collect reported eligibility and alignment data at the activity and overall level.

Sustainalytics does not audit companies’ EU Taxonomy disclosures. Reported data always prevails in our assessments, providing companies report in line with the EU Taxonomy.

To ensure we do not overlook reported involvements, Sustainalytics conducts tailored Boolean searches to retrieve relevant sources from the web. We also carry out regular expression searches for text mining.

Sustainalytics uses these processes to find textual disclosure related to EU taxonomy reporting on sources retrieved by a dedicated crawler. The searches are designed to screen all companies for reported EU taxonomy data with a high recall, thus minimizing the number of missed involvements. Once corporate reporters are identified, analysts collect reported eligibility and alignment at the activity level based on revenue, capital expenditure and operating expenditure.

For companies within our coverage universe that do not provide Taxonomy disclosures, Sustainalytics provides estimated eligibility and alignment figures based on sophisticated estimation models.

The chart below illustrates EU taxonomy data collection by Sustainalytics.

Sustainalytics does not inform companies about the collection or publication of our EU Taxonomy research. We also do not audit company disclosures. However, if we find inconsistencies in company disclosures, we reach out to companies by email to request a clarification.

Please email your comments to [email protected].

If Sustainalytics reaches out to companies requesting clarification or comments on our assessment of their EU Taxonomy disclosures, we will provide the specific details of the inconsistencies that we have found. We request that companies provide feedback specifically on those inconsistencies or any other feedback they want to provide on how we captured their EU Taxonomy disclosures.

In line with all Sustainalytics research, we can only accept the following types of documents for review:

• Public: Published on the website or as part of a filing available to the public at large.

• Public – Accessible Upon Request: Not published on the website, but the company will share the information upon request and without restriction.

• Internal: Information not published on the website and which the company may not share. Although this information is not material - i.e., may not affect the price of the securities/ financial instrument - it may, if widely disclosed, commercially affect the issuer.

• Confidential: Proprietary information, including details relating to business activities and operations, technical information, and trade secrets, that is confidential to its owner at the time of disclosure and should be understood by a reasonable person to be of a proprietary or confidential nature.

• Material Non-Public Information: This information refers to any information that may have a positive or negative impact on the market price of the company’s securities and could be reasonably expected to be considered relevant by reasonable investors in their investment decision-making.