Low Carbon Transition Rating

Low Carbon Transition Ratings

FAQ For Companies

August 2025

This page provides answers to general questions and issues concerning the Low Carbon Transition Rating research methodology and scoring model, and Sustainalytics' research process.

If you have further questions, need clarification on these details or have any technical issues, please contact us at: [email protected] or use the Chat Box function within the Issuer Gateway portal.

General Overview

Morningstar Sustainalytics’ Low Carbon Transition Rating assesses how well a company is preparing for a future low carbon economy. The rating measures how each company is aligned with their net-zero emissions budget.

The Low Carbon Transition Rating expresses this alignment in the following ways:

1. Implied Temperature Rise

The global temperature rise by 2050 if the global economy had the same trajectory.

2. Alignment Category

3. Absolute amount of misaligned emissions.

Sustainalytics is responding to our clients within the institutional investment community – the largest global asset owners and asset managers – who have expressed a strong interest in a rating that focuses on how well companies are preparing for the risks and opportunities associated with a low-carbon economy.

The Low Carbon Transition Rating assesses companies against the UN Principles for Responsible Investments (PRI’s) Inevitable Policy Response scenario, focusing on limiting global warming to 1.5°C. The rating will assess each company’s cumulative progress against this scenario by the year 2050. They will include a series of supporting annual metrics from the present to 2050.

• Issuer Gateway Portal: Companies can access their Low Carbon Transition Rating via Sustainalytics' Issuer Gateway (SIG) portal. (One SIG account per team member).

• Global Access portal: The Low Carbon Transition Ratings are posted on Global Access, Sustainalytics’ portal for investor clients. Investors can also access these ratings from Morningstar’s Data Services and API. (The Data Services delivery includes human-readable standard Excel files as well as machine-readable text files). Sustainalytics’ institutional investor clients receive standard reports on a monthly basis, including any product updates that have occurred in the past month. (Access through Morningstar and third-party delivery systems will be available in the future).

• Sustainalytics’ corporate website: Sustainalytics will in future share a summary of companies’ Low Carbon Transition Rating on the corporate website. It does not include access to a full report.

No, these are two independent ratings. However, both rating products share some management indicators.

The following is a list of indicators used both for the Low Carbon Transition Rating and the ESG Risk Rating:

| E.1.9 | Carbon Intensity | |

| E.3.1.17 | Carbon Intensity of Generation | |

| E.1.10 | Carbon Intensity Trend | |

| E.1.16 | Clinker Ratio | |

| G.1.3.7 | Corporate Finance - ESG Integration | |

| E.3.1.10 | Credit & Loan Standards | |

| S.3.1.11 | Customer Eco-Efficiency Programmes | |

| E.3.1.6 | Eco-Design | |

| E.3.1.20 | Fleet Age | |

| E.3.1.3 | Fleet Emissions | |

| E.3.1.4 | Fleet Emissions Trend | |

| E.1.7.0 | GHG Reduction Programme | |

| E.1.6.1 | GHG Risk Management | |

| G.1.3.4 | Green Building Memberships | |

| E.3.1.13 | Green Buildings Investments | |

| E.1.7.1 | Green Logistics Programmes | |

| E.2.1.6 | Outsourced Green Logistics Programs | |

| E.2.1 | Green Procurement Policy | |

| E.3.1.7 | Product Stewardship Programmes | |

| E.3.1.12 | Real Estate LCA | |

| E.1.8 | Renewable Energy Programmes | |

| E.1.11 | Renewable Energy Use | |

| E.3.1.11 | Responsible Asset Management | |

| G.1.3.2 | Responsible Investment Policy | |

| G.1.3.6 | Responsible Investment Programme | |

| E.1.6 | Scope of GHG Reporting | |

| E.3.1.14 | Share of Green Buildings | |

| E.3.1.5 | Sustainable Mobility Products | |

| E.3.1.1 | Sustainable Products & Services | |

| E.3.1.18 | Transmission Loss Rate |

Data points and indicators begin in 2020. The ratings will accrue historical data on a go-forward basis. However, Sustainalytics recommends that each company archive their annual Low Carbon Transition Rating Reports for their own reference.

Methodology

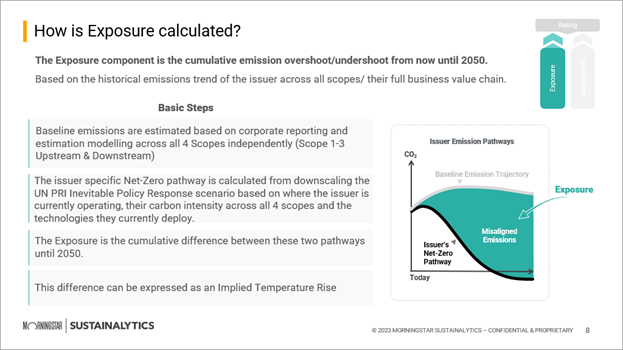

The model combines Sustainalytics' assessment of a company’s exposure to risks associated with the transition to a low-carbon economy and our assessment of how well a company is managing those risks.

- Exposure is assessed by comparing a company’s projected level of Greenhouse Gas (GHG) emissions to a company-specific budget for achieving net-zero emissions.

- Exposure calculation results are presented in metric tons CO2e.

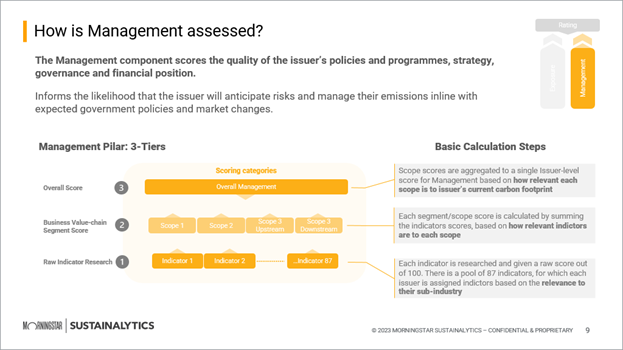

- Management is assessed by evaluating a company’s investment plans and management preparedness for implementing a low carbon transition.

- Investments are assessed by considering how those plans will result in an overshoot or undershoot of the company-specific GHG emissions budget for achieving net-zero emissions.

- Management preparedness is assessed by evaluating company policies, programmes, and performance across six areas:

1. Governance and strategy

2. Financial readiness

3. Company-own operations management

4. Products and services management

5. Supply chain management

6. Carbon financing

No, the ratings are company-specific and consider the unique characteristics of each company’s business model. However, in many cases, companies within the same industry will have the same management indicators and a similar emissions budget.

The use of forward-looking signals helps us to determine the expected changes in emissions, aiding in an understanding of momentum and alignment. By integrating forward-looking signals into the Low Carbon Transition Rating assessment, we can include a real-world evaluation of the climate pathways adopted by companies.

The Investment Alignment management indicator measures the degree to which a company is expected to manage its emissions through its investment in technology. This indicator score informs the company’s overall management score and the expected emissions projection, which in turn determines the overall implied temperature rating.

Morningstar Sustainalytics applies the Investment Alignment indicator to each Carbon Emissions Scope – based on capacity- or production-related investment data – that either contributes to GHG emissions or results in GHG emissions reductions.

To determine a company’s post-investment GHG emissions, we consider forward-looking, year-on-year investment data, applied to each company’s assets, which we split into technology and location.

In addition to capturing the degree to which emissions are expected to be managed through the company’s investment in technology, the Investment Alignment indicator captures the corresponding impact this has on the company’s emissions. For example, if an Electric Utility is making investments in renewable energy while decommissioning its coal-fired power plants, this could lead to an effective reduction of its emissions, and thus reflect positively on the company’s ability to manage its emissions. However, if an auto manufacturer invests in generating solar power for its factories, that investment alone will have no bearing on the GHG emissions that result from the use of its cars. Thus, the company is making an investment in managing its Scope 1 emissions but its Scope 3 – Downstream emissions are not expected to be impacted.

The change in emissions that is expected from the investment is translated into an Investment Alignment management indicator score. Technology investments are based on capacity- or production-related changes that either contribute to GHG emissions or result in GHG emissions reductions.

In cases where a company’s investment plans are not known or not yet covered by Morningstar Sustainalytics research, the Investment Alignment indicator is scored according to a proxy. The proxy assumes that the company’s emissions will change according to the change in emissions expected in the broader economy, as prescribed by the IEA Stated Policies Scenario (STEPS). Notably, our Baseline GHG Emissions Projection also incorporates STEPS by considering the change in economic activity that is expected. The Investment Alignment indicator differs from this approach by not only considering the change in economic activity but also the change in emissions intensity per unit of economic activity.

Currently, the proxy is calculated for the overall economy which expects a reduction in emissions equating to approximately 34% for the period from 2021 to 2050. According to Morningstar Sustainalytics’ indicator scoring methodology, this results in a management indicator score of 67.4 for companies where the investment plans are unknown.

A company’s net-zero budget is calculated as follows:

• Sustainalytics assigns a subindustry classification to the company.

• The UN PRI’s Inevitable Policy Response (IPR) unit has calculated the projected annual carbon baseline emissions for every subindustry, and the carbon budget for each subindustry.

• Sustainalytics has calculated the percentage of the baseline total for each company within the subindustry.

• A company’s net-zero budget is the same percentage of the net-zero budget for the subindustry.

• These annual figures are totalled over every year through 2050.

Sustainalytics uses estimates because there is a lack of consistent reporting of Scope 3 data by companies. Very few companies report Scope 3 emissions and even fewer meet the rigorous greenhouse gas accounting standards created by the Greenhouse Gas Protocol. Sustainalytics is reviewing how best to incorporate Scope 3 company reporting that meets GHG Protocol standards.

Sustainalytics assigns each company to a subindustry. A company’s subindustry rank is defined by a company’s Low Carbon Transition Rating score. If a company is ranked #1, then its score is the lowest (the best) score in its subindustry.

A company’s subindustry percentile rank indicates the percentage of companies within the subindustry that have lower scores. For example, if a company has a percentile rank score of 36, then 36% of the subindustry has a lower score than that company.

Subindustry rank and percentile rank can be found in both the “Alignment Overview” section of the Low Carbon Transition Rating on the Issuer Gateway and in the Peer Analysis section on Page 3 of the PDF version of the rating.

Science-based targets, whether set by the Science Based Targets initiative (SBTi) or by other organizations, are assessed as part of the E.4.1.1. GHG Emissions Targets Management Indicator. This management indicator assesses the level of ambition of a company's emission reduction target.

The SBTi is a partnership between CDP, the United Nations Global Compact, World Resources Institute (WRI) and the World Wide Fund for Nature (WWF). According to the SBTi, science-based targets provide a clearly-defined pathway for companies to reduce GHG emissions, helping prevent the worst impacts of climate change and future-proof business growth.

Targets are considered ‘science-based’ if they are in line with what the latest climate science deemed necessary to meet the goals of the Paris Agreement – limiting global warming to well-below 2°C above pre-industrial levels and pursuing efforts to limit warming to 1.5°C. SBTi provides information on the process of setting targets here.

The baseline GHG Emissions projection represents the emissions a company is expected to have if it takes no action to manage its emissions. Sustainalytics uses a company’s reported emissions for 2021 to estimate cumulative emissions through 2050. The current year’s baseline GHG emissions is projected into the future by assuming that the company continues to have the same market share—production increases or decreases at the same rate as the market—and that it has the same carbon intensity for each unit of production as it does now. Expected changes in business activity are based on the International Energy Agency’s (IEA) Stated Policies Scenario.

Sustainalytics calculates the baseline GHG emissions for each year until 2050. The Cumulative Baseline GHG Emissions Projection adds all baseline emissions from the current year to 2050.

In 2019, the United Nations PRI commissioned an analysis of inevitable policy responses by governments around the world to meet the 1.5 degrees Paris ambition. It has since updated these forecast policy scenarios:

IPR 2021 Top-Ten Policy Forecasts

Carbon pricing

1. Carbon Border Adjustments Mechanisms (CBAMs) for carbon will become increasingly a policy option. This could lead the United States to announce a national carbon pricing system by 2025 and signal a strong carbon price path to reach a backstop of $65 by 2030.

2. The European Union’s evolving commitments will deliver substantial carbon prices. By 2030, we expect EU policy to backstop an EU ETS carbon price of $75/tCO2 to ensure long-term action toward decarbonization in heavy emitting sectors.

Coal

3. In India, rapidly evolving Indian policy and prospects for market reforms and pricing has already ended further investment in new coal.

4. China will end construction of new coal fired power production after 2025, driven by new policies to facilitate its 2060 net zero target and ongoing market liberalization.

5. The United States will end all coal-fired power generation by 2030, through a combination of emission performance standards and carbon pricing at the Federal and State levels, combined with market forces.

Clean power

6. The United States will implement a binding and credible 100% clean power standard for 2040, ending unabated fossil electricity generation.

Zero Emission Vehicles

7. China, France, Germany, Italy, and Korea will end the sale of fossil fuel cars and vans in 2035. Jointly these large markets will accelerate the auto industry transition to electric drive and precipitate further policy action internationally.

8. All major industrial economies including the US, Germany, Japan, and China will require all new industrial plants, led by steel and cement, to be low carbon by 2040, through a combination of emissions performance standards and carbon pricing.

Agriculture

9. The US, Canada, Australia, and other major agricultural producers will have comprehensive mitigation policy in place by 2025 to reduce emissions from production of crops and livestock pricing.

Land use

10. Major tropical forest countries will end deforestation by 2030, with domestic policy responding to international climate finance and corporate supply chain pressures.

Research Process

The display of the year FY2021 within the LCTR report is a reference to the year from which we are measuring a company’s GHG emissions performance against our reference and budget scenarios. It does not represent the latest year for the calculation of the company’s management score.

The management score is based on the latest reports available at the time of the last full research/ data collection for a company. For most companies, this data is now based on the reports they released in 2023 and many LCTR ratings are based on reports published in 2024.

Sustainalytics includes companies within our Standard Ratings Universe, which comprises more than 5,000 primarily public large- and mid-cap companies. We will continue to expand this coverage to small-cap companies over time.

The Research team assesses each company's transition preparedness through quantitative metrics and qualitative management indicators. Sustainalytics collates this information using a mix of primary sources (in 2022, we opted for a company questionnaire) and secondary sources (company reports and filings). The latter involves the use of web-scraping algorithms (the process of extracting data from multiple websites) to capture information from company reports and filings on companies’ transition-related activities.

• We use Sustainalytics Carbon Emissions data for the emissions input. These inputs include, but are not limited to, the disclosed Scope 1-3 emissions, and modelled Scope 1-3 where disclosures are not available.

• There are 87 indicators and 19 metrics assessing management preparedness that are researched by Sustainalytics or gathered directly from companies.

• Of the 87 indicators, Sustainalytics created 39 new indicators specifically for the Low Carbon Transition Rating.

• Eight indicators were translated from financial betas to integrate the financial assessment into the management assessment.

• On average, 21 indicators are researched per subindustry. Overall, over 200,000 new data points will be generated for the Low Carbon Transition Ratings.

• Regional forward-looking carbon budget/scenarios are gathered from leading scenario data providers, specifically the UN PRI. Specific examples of data inputs include:

- Average total emissions three-year average for each company

- Annual company budget for each scope (2020-2050)

- Company operational location

- Projected emissions (2020-2050)

- Fair share contributory emissions for each company

Where company-reported information is not available, Sustainalytics uses estimations for the assessment. However, company-reported information is preferred. When Sustainalytics shares details with our investor clients via the Global Access portal, we will specify whether details for each company’s management indicators are estimated or reported.

Forward-looking emissions are estimated based on current disclosed emission, management preparedness, and short-term investment plans.

• We use Sustainalytics Carbon Emissions data for the emissions input. These inputs include, but are not limited to, the disclosed Scope 1-3 emissions, and modelled Scope 1-3 where disclosures are not available.

• There are 87 indicators and 19 metrics assessing management preparedness that are researched by Sustainalytics or gathered directly from companies.

• Of the 87 indicators, Sustainalytics created 39 new indicators specifically for the Low Carbon Transition Rating.

• Eight indicators were translated from financial betas to integrate the financial assessment into the management assessment.

• On average, 21 indicators are researched per subindustry. Overall, over 200,000 new data points will be generated for the Low Carbon Transition Ratings.

• Regional forward-looking carbon budget/scenarios are gathered from leading scenario data providers, specifically the UN PRI. Specific examples of data inputs include:

- Average total emissions three-year average for each company

- Annual company budget for each scope (2020-2050)

- Company operational location

- Projected emissions (2020-2050)

- Fair share contributory emissions for each company

The Low Carbon Transition Ratings have an annual research cycle where all data points are researched and re-calculated based on the most recent corporate reporting. Sustainalytics rebalances the product universe on a quarterly basis and includes any new, relevant data that may have been added to the Ratings universes, in addition to any issuer additions, deletions, or corporate actions.

Sustainalytics does not consult external websites, such as the CDP website, to access your submissions to other organizations.

- See a summary of document types here.

- As of July 1, 2025, Sustainalytics no longer accepts any internal or private documents or information as we prepare our research assessments of each company. Sustainalytics will use only public documents as part of our assessment.

Sustainalytics provides the following guidance:

Public Documents:

- Sustainalytics may reference information from a company’s documents (only public documents accepted) within research products for investor clients, following the standard citation rules.

- We may include excerpts within external-facing documents, provided that appropriate citation is in place.

IMPORTANT: As of July 1, 2025, Sustainalytics no longer accepts any internal or private documents or information as we prepare our research assessment of each company. Sustainalytics will use only public documents as part of our assessments.