Sustainalytics Insight: Uncovering climate-related investment opportunities in emerging markets.

Emerging markets may contain climate-related investment opportunities for investors seeking to invest in companies pursuing reduced emissions in the real economy, provided they have a helpful framework to find the hidden opportunities, according to new research from Morningstar Sustainalytics.

In the new paper – Opportunities to Finance Reduced Emissions in Emerging Markets – Morningstar Sustainalytics’ Director of climate thought leadership, Azadeh Sabour, and Senior Analyst Mauricio Coronado, unpack emerging market investment dynamics. The paper provides a clearly defined framework for portfolio strategies exploring decarbonization in carbon-intensive sectors within emerging markets, using best-in-class selection, engagement, and direct financing across public and private markets. For illustrative purposes, the paper analyzes the Morningstar Emerging Markets Low Carbon Transition Leaders IndexTM (EM LCTL).

The Index, designed to help investors identify companies leading their sector peers in their commitment to managing climate transition, draws on the Morningstar Sustainalytics Low Carbon Transition Ratings to help inform its methodology. EM LCTL identifies “climate leaders” in emerging markets based largely on four key characteristics; strategic ambition to address climate change-related risks and opportunities, actions the company is taking to pursue its low carbon transition strategy, metrics it is using to monitor success on the journey and ongoing governance of its strategy.

The index has returned 4.8% in 2025 (as of April 29) and 11.9% for 1 year as compared to a 2.9% and 7% rise in 2025 and for 1 year, respectively, for its parent index the Morningstar Emerging Markets Target Market Exposure IndexTM. More importantly, the EM LCTL Index provides roughly 13% more exposure to strong performers in terms of low carbon transition readiness compared to its parent index – a material difference.

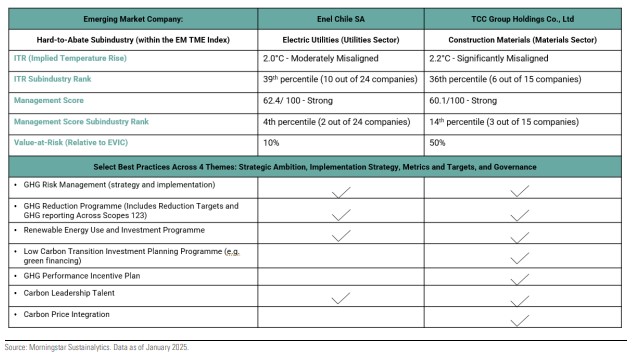

Two of the “emerging market climate leaders” listed in the index are featured in the report: electric utility Enel Chile SA (ENIC) and construction material company TCC Group Holdings Co., Ltd. (1101.TW).

Azadeh Sabour, Director of Climate Thought Leadership, Morningstar Sustainalytics

“Investors focused on mitigating long-term systemic climate risks while pursuing related investment opportunities are increasingly adopting low-carbon transition strategies to finance decarbonization in the real economy, reflecting a shift away from simply decarbonizing portfolios. Financing decarbonization efforts in emerging markets is a meaningful way to achieve real economic impact. Companies operating in emerging markets are in many instances much earlier on their low carbon transition journey than their developed market counterparts. Yet, on closer inspection, curious investors can find strong investment potential in companies that are outpacing their peers in the development, implementation and ongoing management of decarbonization-related strategies. Uncovering these hidden gems can benefit the portfolio strategies of institutional investors.”

To speak in more detail with Azadeh or Mauricio, reach out to Tim Benedict at [email protected] or (203) 339-1912.

Media Contacts