Investors are shifting focus from reducing emissions to allocating capital toward companies well positioned for the low-carbon transition. This requires research and structured evaluation across key indicators, assessing not only stated commitments but also measurable actions.

As demand for transition-focused investments increases, the right tools can support portfolio preparedness for the complexities of the evolving market.

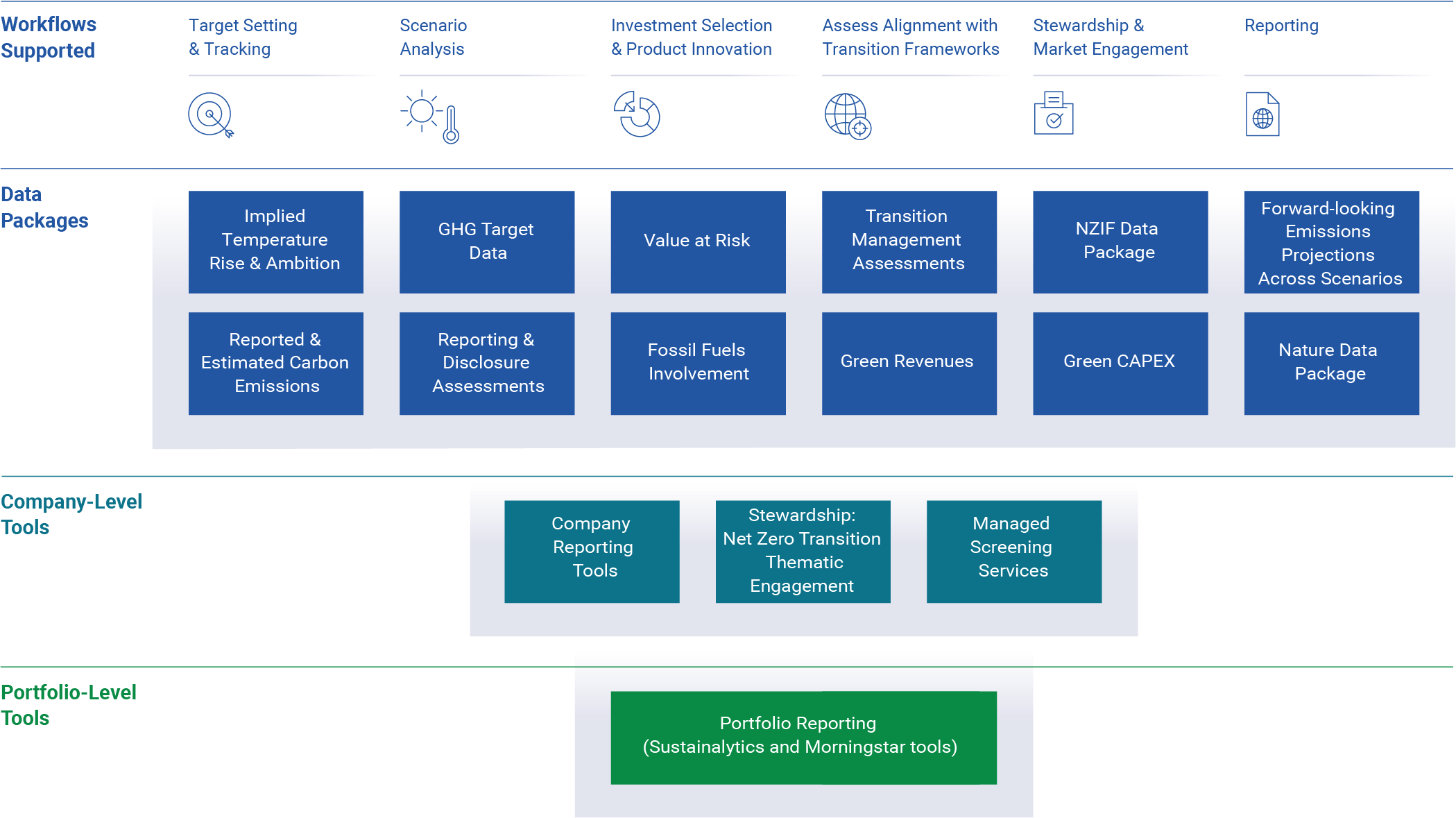

The Climate Transition Toolkit is designed to support every stage of your climate integration journey. Our top line signals are useful starting points for strategy building and portfolio screening, while the deeper insights allow you to customize your own modeling approach and help empower you to allocate capital to companies which align with your investment objectives and risk tolerance.

Comparison of Action with Ambition

Assess how well climate ambition matches action with low carbon alignment metrics that put a lens on both company targets and performance, so you can analyze which holdings are best positioned to meet decarbonization goals, engage misaligned companies with standardized metrics and justify necessary investments in high emitting industries.

Breadth, Depth, and Flexibility

Leverage key top line signals like Implied Temperature Rise, Value-at-risk and TCFD Disclosure sufficiency score, as well as granular metrics on green revenues, green CAPEX, fossil fuel involvement, carbon emissions scope 3 categories, management performance indicators, and underlying company-level low carbon transition data to help surface differentiated performance signals and convert them into investment decisions.

Insight into Climate Action

The Transition Management score, combined with deep insights into 85+ management indicators, enables you to benchmark low carbon preparedness, spotlight high-impact decarbonization efforts, and embed these signals into strategies that can assist with driving transition-aligned outcomes.

Curated NZIF Alignment Data

Spend less time grappling with fragmented and inconsistent data, and more time integrating transition signals across your investment process. Investors receive structured, relevant data curated specifically for all seven criteria of the framework, including Capital Allocation Alignment, across 10,000 issuers.

Tailored Stewardship Experience

Morningstar Sustainalytics' Net Zero Transition Stewardship Programme supports investors as they address a company's approach to low carbon alignment by assisting with climate change governance, emissions reductions, improved financial disclosures and strategic planning.

Custom Reporting Tools

Create reports that reflect your clients' unique priorities. Our reporting tools in Morningstar Direct allow you to customize outputs using comprehensive transition data, helping investors demonstrate alignment with preferences, meet key regulatory disclosure requirements, and differentiate strategies in a crowded market.

Learn about how the key metrics and tools available in the Climate Transition Toolkit support each step of your climate integration journey.

Define credible decarbonization objectives, track portfolio emissions, and measure progress against targets, align with target-setting frameworks like SBTi FINZ, and track alignment against multiple transition scenarios.

Our data and tools help manage this workflow, including:

- Implied Temperature Rise

- Transition Management Score

- Annual and Cumulative Emissions Projections

- Carbon Emissions Data

To learn more about the features our tools provide, explore these products:

Low Carbon Transition Ratings >

Carbon Emissions Data >

Get support in developing a clearer view on portfolio resilience using downscaled emissions budgets and time-series data across orderly, disorderly, and hot-house scenarios to assess transition risk exposure and inform portfolio stress testing.

Our data and tools help manage this workflow, including:

- Value-at-Risk

- Annual and Cumulative Emissions Projections

- Carbon Emissions Data

To learn more about the features our tools provide, explore these products:

Low Carbon Transition Ratings >

Carbon Emissions Data >

Identify and select companies with robust climate transition strategies through deep, comparable insights into management practices, policies, and performance. Our data enables full customization through over 2,000 individual data points allowing investors to screen, compare, and construct portfolios aligned with strong transition risk management and develop unique investment strategies.

Our data and tools help manage this workflow, including:

- Management Indicator Data

- Underlying Company Data

- Implied Temperature Rise

- Value-at-Risk

- Transition Management Score

- Carbon Emissions Data

- Green Revenues

- Green CAPEX

- Fossil Fuel Involvement

- Nature Data Package

- Screening Service

To learn more about the features our tools provide, explore these products:

Low Carbon Transition Ratings >

Carbon Emissions Data >

Impact Metrics >

EU Taxonomy Solution >

Nature Data >

Product Involvement >

Screening Services >

Assess and disclose portfolio alignment against climate integration frameworks, like the IIGCC's Net Zero Investment Framework (NZIF) 2.0 through curated, standardized data, covering all seven NZIF criteria.

Our data and tools help manage this workflow, including:

- NZIF Data Solution

- Implied Temperature Rise (eligible methodology for FINZ standard by SBTi)

To learn more about the features our tools provide, explore these products:

Low Carbon Transition Ratings >

NZIF Data Solution >

Support effective stewardship by integrating company-level transition data and performance indicators to guide engagement focus. Compare peers across sectors, assess management quality, and track progress using granular indicators to track desired KPIs.

Our data and tools help manage this workflow, including:

- Implied Temperature Rise

- Value-at-Risk

- Management Indicator Data

- TCFD Disclosure Sufficiency Score

- Underlying company data

- Carbon Emissions Data

- Net Zero Transition Stewardship Programme

- Global Access Portal

To learn more about the features our tools provide, explore these products:

Low Carbon Transition Ratings >

Carbon Emissions Data >

Thematic Stewardship Programmes >

We will help you respond to climate disclosure requirements efficiently with a wide range of data coverage and custom reporting capabilities. Evaluate portfolio alignment, track emissions intensity, perform scenario analysis, communicate portfolio performance to clients and surface actionable insights to support transparent, regulatory-ready disclosures.

Our data and tools help manage this workflow, including:

- Implied Temperature Rise

- Transition Management Score

- Carbon Emissions Data

- Value-at-Risk

- TCFD Disclosure Sufficiency Score

- Morningstar Reporting Tools

To learn more about the features our tools provide, explore these products:

Low Carbon Transition Ratings >

Carbon Emissions Data >

Morningstar Climate Risk Analytics >

Learn more about the Transition Toolkit

Get more information about the metrics and tools we offer to help you integrate climate transition risks and opportunities into your workflows.

Investing in Times of Climate Change 2025

This new edition of Investing in Times of Climate Change provides an update on the rapidly evolving global landscape of climate funds, which are subdivided into five categories: low carbon, climate transition, green bond, climate solutions, and clean energy/tech.