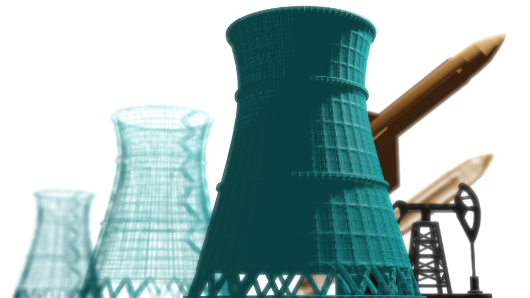

There is a growing demand for portfolios that are better aligned to their beneficiaries’ values and beliefs. A pension fund for nurses may not want exposure to tobacco while a religious foundation might be concerned about the optics of profiting from online betting businesses.

Beyond these value-driven concerns, there is a growing segment of long-term investors that view activities like shale energy production or pesticides as being simply too risky in light of rapidly changing regulations and accompanying lawsuits.

Sustainalytics’ Controversial Product Involvement research enable investors to create investment universes that are aligned to these clients’ mandate and their long-term investment strategy.

Latest Insights

ESMA Fund Naming Guidelines: Early Insights Into Rebranding Activity and Portfolio Impact

The EU Omnibus: What the Proposals Mean for Sustainability Reporting Among Companies and Investors

Key Benefits

Access research on all publicly-listed companies with involvement in the most widely used product areas.

Rely on high quality research curated through systematic and comprehensive data collection methods.

Understand the nature and level of each company’s involvement.

Gain access to our dedicated team of product and topic experts.

Receive up-to-date information on companies’ business activities.

Controversial Product Involvement Report

Our product involvement reports identify the nature and extent of a company’s involvement in a range of product and business activities. Each activity is accompanied with a concise summary of the way the company is involved in the relevant product or activity.

Areas of Involvement

Nuclear Power

Thermal Coal

Oil Sands

Arctic Drilling

Shale Energy

Oil and Gas

Palm Oil

Pesticides

Genetically Modified Plants & Seeds

Tobacco

Alcoholic Beverages

Cannabis

Adult Entertainment

Pork Products

Gambling

Life Ethics*

*Our Life Ethics research includes product involvement screening for abortion, contraceptives and human embryonic stem cell & fetal tissue.

Riot Control

Military Contracting

Small Arms

Controversial Weapons*

*More comprehensive research available through the Controversial Weapons Radar service.

Predatory Lending

Animal Testing

Whale Meat

Fur & Specialty Leather

Private Prisons

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Defense Research

Create a robust defense policy with our Controversial Weapons Radar and Arms Trade Research.

Learn More

Global Standards Engagement

Engage with companies that breach international norms and standards as identified by our Global Standards Screening research.

Learn More

Global Standards Screening

Identify companies in breach of the UN Global Compact to support your norms-based screening strategy.

Learn MoreMorningstar® Sustainability LeadersSM Index Family

Pure exposure to exemplary ESG companies .

Morningstar® Sustainability Dividend Yield FocusSM Index Family

High Income generating equity investments focused on total returns with reduced ESG Risk.

Morningstar® Global Market SustainabilitySM Index Family

Best-in-class equity index that features reduced ESG risk profile with low to moderate tracking error.

Morningstar® Societal Development IndexSM

Developed and emerging market companies that align with one or more of the UN SDGs.

Morningstar® Minority Empowerment IndexSM

Companies that are committed to racial and ethnic diversity as demonstrated by relevant programs and policies related to diversity, community development etc.

Related Insights and Resources

ESMA Fund Naming Guidelines: Early Insights Into Rebranding Activity and Portfolio Impact

This article looks at how the universe of open-end and exchange-traded funds in scope of the ESMA fund naming guidelines has changed since their introduction in May 2024, through analysis of rebranding activity and assessed the impact of the requirements.

The EU Omnibus: What the Proposals Mean for Sustainability Reporting Among Companies and Investors

On February 26, 2025, the EU Commission published the omnibus packages on sustainability and investment simplification. This article examines the EU Omnibus and its impact on the CSRD, the CSDDD, and the EU Taxonomy Regulation.

Regulating 'Forever' Chemicals: Examining Company Readiness and Investor Risk

Chemical companies face growing pressure to phase out some of the most hazardous substances from their product portfolios. Learn how well companies manage related risks and what upcoming regulations could mean for them and their investors.