Chemical companies face growing pressure from investors to accelerate phasing out some of the most hazardous chemicals from their product portfolios. In December 2022, 47 of the world’s leading institutional investors, including Aviva, Axa and Robeco, representing US$8 trillion in assets under management,1 presented a letter to over 50 global chemical companies. These investors requested increased transparency around the chemicals these companies produce, specifically hazardous chemicals such as per- and polyfluoroalkyl substances (PFAS).

From this letter, the Investor Initiative on Hazardous Chemicals (IIHC) was formed in February 2023. It includes over 50 institutional investors with more than US$11 trillion in assets under management.2 The initiative formalizes and reinforces the aims detailed in the letter, namely to:

- Increase transparency, by disclosing hazardous chemicals in their product portfolios.

- Publish time-bound plans to phase out persistent chemicals, such as PFAS.

Read on to learn more about the regulations and financial risks facing companies that manufacture and use PFAS and other hazardous chemicals, and why investors are calling for more transparency.

What are PFAS?

PFAS are a group of particularly prominent hazardous synthetic chemicals consisting of about 10,000 substances.3 They are used in many consumer products and commercial applications, from firefighting foams to cosmetics, due to their non-stick, stain-repellent, and waterproof characteristics.

PFAS are highly persistent and accumulate in humans, animals and the environment. Exposure in humans occurs through ingestion of contaminated food and drinking water and can be harmful to human health. These chemicals have been linked to several health issues, including infertility, impaired immune function, and various cancers.

PFAS can be divided into short-chain and long-chain compounds, based on the carbon chain length. Due to their toxic properties, long-chain PFAS came under additional regulation while short-chain compounds were increasingly used as alternatives – under the assumption that they posed a lower risk of bioaccumulation. However, short-chain PFAS have other properties of concern, such as higher volatility and water solubility, which causes them to accumulate in surface, ground and drinking water.4 These chemicals were quickly being created, manufactured and sold, and regulation was unable to keep pace.

Hazardous Chemicals Represent a Significant Risk to Investors

Chemical companies could face lengthy and costly litigation as well as heightened regulatory and reputational risk associated with their production and use of PFAS and other hazardous substances. In 2021, Chemours, DuPont and Corteva agreed to pay a combined US$4 billion to settle claims related to pollution caused by their past production and use of hazardous PFAS chemicals.5 The June 2023 settlement from 3M for US$10.3 billion further highlights the significant financial risk. The lack of transparency into the product portfolio of companies in the chemical sector amplifies the risk for investors.

Current PFAS-Focused Regulation

Regulation up until recently has typically focused on individual substances and closely related derivatives. Given the magnitude of PFAS substances currently available, regulating them individually is becoming unfeasible due to the time commitment and cost. The development of existing and new regulations will likely impact the companies that use PFAS, both operationally and financially.

Multilateral Regulations

The Stockholm Convention:6 Since 2009, perfluorooctane sulfonic acid and its derivatives (PFOS) have been included in the Stockholm Convention on Persistent Organic Pollutants (POPs). The Stockholm Convention is a global treaty with the overarching aim of eliminating the production and the use of POPs. As of 2019 the Stockholm Convention also regulates perfluorooctanoic acid (PFOA) and derivatives.

European Regulations

European Union Persistent Organic Pollutants Regulation:7 The manufacturing or use of PFOA is banned in the EU and the use of PFOS is heavily restricted and only allowed for a few applications in the EU.

REACH:8 The EU’s regulation on the registration, evaluation, authorization and restriction of chemicals (REACH) is a law to protect people and the environment from the potential risks posed by chemicals. Several PFAS are included in the candidate list of substances of very high concern, such as PFOA, perfluorinated carboxylic acids and perfluorohexanesulfonic acid, and others. A chemical included in the candidate list is likely to be restricted or allowed only for specific purposes, with the aim that producers gradually replace them with safer alternatives.

Upcoming PFAS-Focused Regulations

Europe

In January 2023, The Netherlands, Germany, Denmark, Sweden, and Norway jointly submitted a restriction proposal to the European Chemicals Agency9 to limit the import, use and manufacture of all PFAS in all EU member states. This proposal aims to restrict or ban the whole family of chemicals rather than individually regulating them, which would take considerable time. A six-month consultation period started in March 2023.

United States

In October 2021, the U.S. Environmental Protection Agency (EPA) announced the PFAS Strategic Roadmap aimed at increasing its understanding of the chemicals, restricting their use, and remediating historically polluted sites. In August 2022, the EPA proposed PFOA and PFOS be classified as hazardous substances under the Comprehensive Environmental Response, Compensation, and Liability Act,10 which would hold those responsible for the remediation costs of previously polluted sites. A ruling is expected in August 2023.

How Are PFAS Producers Managing Risk?

Upcoming regulations represent a significant risk to companies currently or historically involved in using or manufacturing PFAS. Additionally, companies that produce or use PFAS in their products have faced and continue to face lawsuits related to water and environmental pollution surrounding their manufacturing sites. In the U.S., this has evolved into lawsuits from individuals claiming personal injury, and lawsuits from water utilities and state governments claiming water contamination.

One of the environmental indicators assessed in Sustainalytics’ ESG Risk Ratings measures the strength of a company’s hazardous substance management program. It assesses whether companies have procedures in place to identify and review the use of substances of concern in their products. It also assesses whether they have targets to reduce their use or have phase-out plans in place.

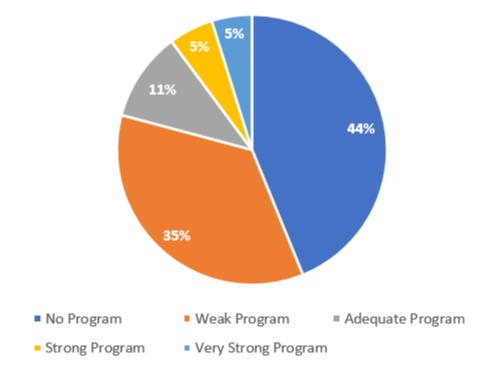

The chemical industry performs poorly. Only 10% of companies in our chemicals universe have strong or very strong management of this issue (Figure 1). This indicates that most chemical companies are taking little or no action to phase out hazardous chemicals, despite the regulatory risk.

Figure 1. Strength of Hazardous Substance Management Program

Source: Morningstar Sustainalytics. For informational purposes only.

Regulators and Investors Seek Greater Hazardous Chemical Management

Regulation targeting substances of high concern continues to evolve and become more robust. Regulators are increasingly scrutinizing whether chemicals that are deemed hazardous to health and the environment are necessary. Investors are also demanding greater transparency around product portfolios of the companies in which they invest, as they aim to mitigate risk and meet their own regulatory requirements. This is demonstrated by the dialogue created between some of the largest institutional investors and largest global chemical companies facilitated by the IIHC. The risks are substantial, and increasing, and chemical companies must be prepared for this scrutiny and stakeholder questions as stricter regulations loom on the horizon.

References

- Perkins, T. 2023. “Investors Pressure Top Firms to Halt Production of Toxic ‘Forever Chemicals.’” The Guardian. January 6, 2023. https://www.theguardian.com/environment/2023/jan/06/pfas-toxic-forever-chemicals-manufacturers.

- ChemSec. “Investor Initiative on Hazardous Chemicals (IIHC).” n.d. https://chemsec.org/knowledge/iihc/#:~:text=The%20initiative%20aims%20to%20reduce,threats%20to%20license%20to%20operate.

- European Chemicals Agency. 2023. “ECHA Publishes PFAS Restriction Proposal.” February 1,2023. Press Release. https://echa.europa.eu/-/echa-publishes-pfas-restriction-proposal.

- European Environment Agency. 2023. “Emerging chemical risks in Europe — ‘PFAS’.” December 12, 2019. Briefing. https://www.eea.europa.eu/publications/emerging-chemical-risks-in-europe.

- Friedman, L., Giang, V. 2023. “3M Reaches $10.3 Billion Settlement in ‘Forever Chemicals’ Suits.” The New York Times. June 22, 2023. https://www.nytimes.com/2023/06/22/business/3m-settlement-forever-chemicals-lawsuit.html.

- Stockholm Convention website. https://www.pops.int/.

- European Chemicals Agency. “Understanding POPs.” https://echa.europa.eu/understanding-pops.

- European Commission. “REACH Regulation.” https://environment.ec.europa.eu/topics/chemicals/reach-regulation_en.

- European Chemicals Agency. 2023. “ECHA Publishes PFAS Restriction Proposal.” February 1,2023. Press Release. https://echa.europa.eu/-/echa-publishes-pfas-restriction-proposal.

- U.S. EPA. “Proposed Designation of Perfluorooctanoic Acid (PFOA) and Perfluorooctanesulfonic Acid (PFOS) as CERCLA Hazardous Substances.” n.d. https://www.epa.gov/superfund/proposed-designation-perfluorooctanoic-acid-pfoa-and-perfluorooctanesulfonic-acid-pfos.