Comprehension of how sustainable investments are defined under the EU’s Sustainable Finance Disclosure Regulation (SFDR) is crucial for investors as they apply these ambitious regulations as part of the EU Action Plan for Sustainable Finance. The requirements to disclose and observe quantitative alignment with this definition (stemming from SFDR and MiFID) and soon potentially ESMA’s guidelines on the use of sustainability related terms in fund names are meant to protect investors from greenwashing and allow them to benchmark products.

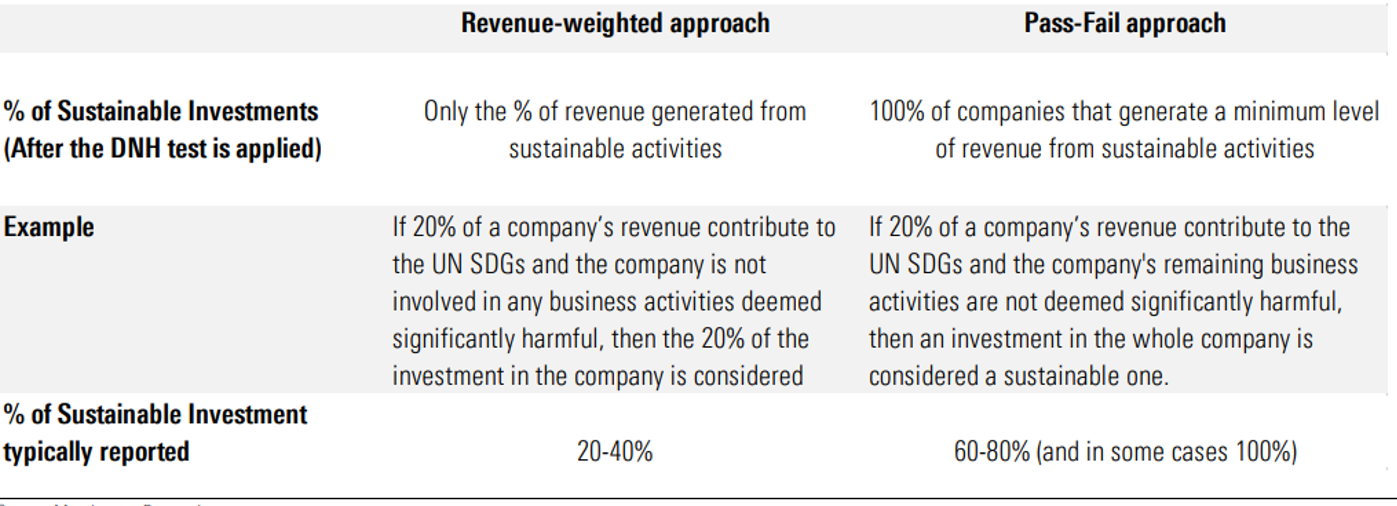

The absence of clear parameters to support the regulatory definition of sustainable investments has pushed market participants to make judgment calls leading to diverging investor approaches. (Figure 1 shows an example of different interpretations.) This will likely expose investors to perceptions of greenwashing as they attempt to disclose sustainability activities that are ill defined.

Figure 1: Two different approaches for sustainable investments,

leading to substantially different outcomes on company and fund level

Source: Morningstar

The Impacts of Reclassifying Sustainable Investments

As per a recent Morningstar SFDR report, a “great reclassification” began in the second half of 2022. The report shows that in terms of assets under management, 40% of Article 9 category funds (“dark green” products under SFDR) have been downgraded to Article 8 (“light green”) over the previous few months and suggests that more downgrades are expected.1 Fund managers that previously labeled their funds as Article 9 realized that the requirement of investing 100% in sustainable investments (with the exception of cash and assets used for hedging) was unattainable for their fund, leading them to make changes until further clarity on the definition is given.

Many passive funds that underwent reclassification are ones that track the EU's climate benchmarks: Climate Transition and Paris-Aligned benchmarks. Despite having obvious climate-related sustainability objectives, it is currently unclear if these benchmarks automatically classify as Article 9. This confusion is mainly related to companies in transition that may still have significant exposure to climate risk factors like fossil fuels, and as such, may not qualify as a sustainable investment.

If the SFDR were regarded as the disclosure regime that it was intended to be, these reclassifications would not be an issue for end investors as there would only be changes to what the product must disclose. However, with Article 9 products being perceived as having been labelled as sustainable, investors looking for the most credible sustainability credentials may find that previously labelled Article 9 products have now been reclassified as Article 8.. If the reclassification is due to the fund lacking sustainability credentials, then the change will ultimately benefit investors as it removes the risk of greenwashing. However, if a downgrade is caused by a lack of clarity on how sustainable investment is defined, this will create confusion and frustration across the value chain.

Reclassification Would Lead to Industry-wide Sustainable Product Rebranding

Morningstar’s report interestingly notes that only 27% of Article 8 funds with sustainable in their names would meet the requirements in the ESMA’s recent proposal on fund names using ESG or sustainability-related terms. In comparison, 92% of Article 9 funds would meet the requirement. If the proposed guidelines are implemented, the great reclassification would be followed by a great rebranding towards the end of 2023, as product names could be seen as misleading in relation to the definition of sustainable investments.

Absence of a specific definition for sustainable investments leaves room for innovation

With the strong and growing interest in sustainable investments, fund managers want to differentiate their products based on sustainability credentials. While the EU Taxonomy is meant to provide the key performance indicators (KPIs) to promote a product’s greenness, it is hampered by the lack of reported data on Taxonomy-aligned activities and the restrictions around using estimates in EU Taxonomy disclosures. Reported Taxonomy alignment figures by funds are low or zero percent and as such, may not be much of a distinguishing factor for some time to come. In contrast, absence of a granular definition for sustainable investments allows more room for interpretation and innovation and therefore for more opportunities for investors to report higher numbers on their sustainable investments. The inadequate comparability resulting from different approaches could enable greenwashing concerns to resurface.

Media Misinterpretations May Add to Confusion in Understanding Companies in Transition

The Morningstar report is one of many reports pointing out that Article 9 funds still hold significant investments in industries that are not traditionally viewed as sustainable. In late 2022, Follow the Money (FTM) and Investico published a report showing that funds classified as sustainable (Article 9) are invested in fossil fuel and aviation. Although the FTM report sparked controversy and outrage, the SFDR is unclear on how companies in transition (e.g., those that still derive revenues from oil and gas but are investing in renewables) fit into the Article 8/9/sustainable investments landscape. Investing in transitioning companies can have positive societal impacts and is necessary to transition our economy. In terms of the definition of sustainable investment, it will ultimately depend on how one defines ‘significant harm’ and how thresholds are set.

Download our latest ebook

Sustainable Investments Are Central to the EU Regulatory Universe

As defined in the SFDR article 2(17), the term' sustainable investments' has left room for interpretation, leading to market implications.

SFDR article 2(17):

"a sustainable investment means an investment in an economic activity that contributes to an environmental objective or an investment in an economic activity that contributes to a social objective, provided that such investments Do Not Significantly Harm any of those objectives and that the investee companies follow good governance practices, in particular with respect to sound management structures, employee relations, remuneration of staff and tax compliance."

The term itself is central across different EU Action Plan legislations. It is featured in the SFDR requirements, sustainability-related requirements under MiFID II, and a recent ESMA draft proposal on funds’ names using ESG or sustainability-related terms:

- SFDR reporting requirements: since 1 January 2023, Article 8 and Article 9 products as per SFDR delegated regulation must disclose their intended minimum proportion of sustainable investments in pre-contractual documents and periodic reporting.

- SFDR classification: since 10 March 2021, financial products classifying themselves as Article 9, must contain 100% sustainable investments (excluding liquidity and hedging instruments). As mentioned earlier on in this article, this requirement has caused substantial changes in classifications as well as interpretation issues that the media caught on to.

- MiFID II and IDD: since 2 August 2022, the amended MiFID II rules require financial advisors to consider clients’ sustainability preferences when conducting suitability assessments, which includes asking for preferences for sustainable investments. If a client expresses a preference for a minimum proportion of sustainable investments, advisors must accommodate. As such, they should be comparing percentages of sustainable investments across different funds and financial products. Similar requirements are in place for insurers and intermediaries as per the amended Insurance Distribution Directive.

- ESMA fund name rules: in November 2022, ESMA published a proposal for guidelines around the use of terms such as ESG, green, sustainable, responsible, and so on, in fund names. Funds that want to use the word sustainable (or similar) in their names, must have at least 50% in sustainable investments. While currently in the proposal stages and subject to consultation, we expect a version of this set of rules to take effect over the coming year.

Perhaps regulators deliberately chose to let fund managers interpret the definition for themselves and explain their approach to their investors. However, the quantitative linkages above, between Article 9 fund requirements, potential fund name rules, as well as the MiFID requirements, make a lack of a universally agreed upon definition problematic.

Investors Fear Market Perceptions of Greenwashing

The European Supervisory Authorities have identified the need for further clarity on this topic. They publicly questioned the European Commission (EC) in late 2022, amongst others, on whether asset managers should consider a revenue-weighted approach or a pass or fail approach when assessing equity/debt holdings.

A revenue-weighted approach would make it difficult for Article 9 funds to meet their 100% sustainable investment criteria and will most likely force the EC to opt for the pass-or-fail approach. However, it is difficult to determine a company threshold that would be relevant across industries and is perceived as sufficiently high by retail investors.

In the absence of clarification, it would be reasonable to require fund managers to disclose in pre-contractual materials how sustainability is defined for their product. This would enable investors to be better equipped to compare products.

Accusations of (unintentional) greenwashing is a troubling risk for investors. In response to this market tension, it is crucial for regulators to take a sensible, transparent, and data driven approach in defining Article 9 products and sustainable investments.

In her opening remarks at the ECON-ENVI joint committee meeting in December 2022, Commissioner Mairead McGuiness said “My services are working on a comprehensive assessment of the implementation of SFDR.” Her remarks make clear that the EC is aware that despite progress, the dust has not yet settled on sustainable finance regulations.

Get in touch with our team to discuss your sustainable investment strategy as it relates to the EU Action Plan.

References:

1. Morningstar Quarterly Report, “SFDR Article 8 and Article 9 Funds: Q4 2022 in Review,” https://www.morningstar.com/en-uk/lp/sfdr-article8-article9

2. Sustainalytics research shows that just under 600 companies out of 10.000 researched have some kind of Taxonomy reporting, in many cases with gaps or slight misalignments with regulatory requirements.

3. The proposed rules also include a minimum requirement of 80% of a fund’s holdings meeting the ESG characteristics of the fund to use ESG or related terms. And all funds with ESG-related terms to comply with minimum safeguards consisting of exclusion criteria applicable to Paris-aligned Benchmarks in the Benchmarks Regulation Delegated Regulation.