Norms-based investment strategies represent an enormous market opportunity for investors with $4,7 trillion in assets, according to the GSIA. This strategy is likely to benefit from regulatory tailwinds driven by initiatives such as the EU’s Sustainable Finance Action Plan, which incorporates normative criteria in its requirements.

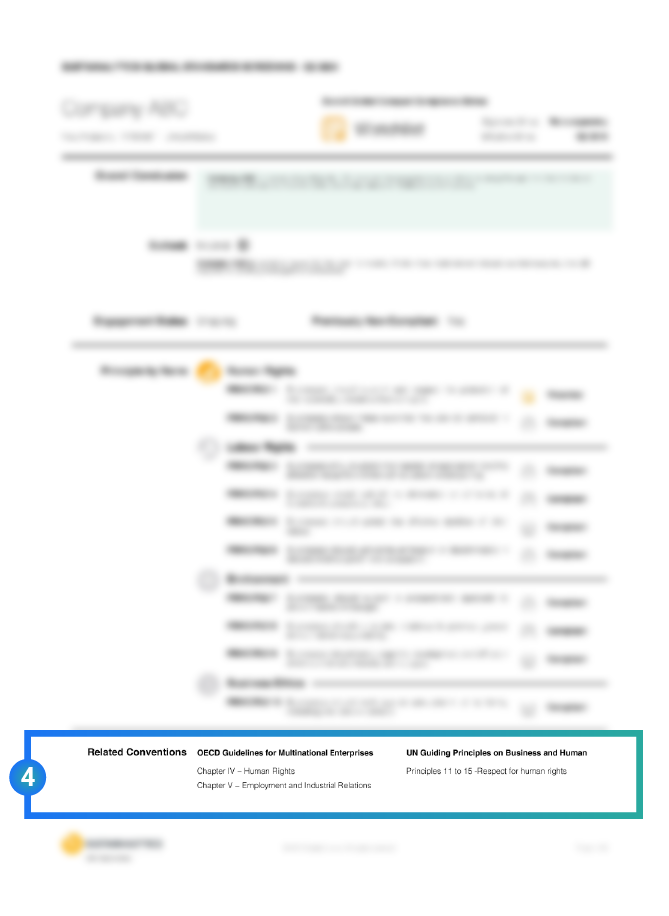

Sustainalytics’ Global Standards Screening assesses companies’ impact on stakeholders and the extent to which a company causes, contributes or is linked to violations of international norms and standards. Our research provides assessments covering the UN’s Global Compact Principles, International Labour Organization’s (ILO) Conventions, OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights (UNGPs). Beyond the market opportunity and compliance requirements, investors can leverage this strategy to proactively manage reputational risks.

Global Standards Engagement provides an active ownership overlay for clients who wish to align their stewardship activities to global standards.

Latest Insights

ESMA Fund Naming Guidelines: Early Insights Into Rebranding Activity and Portfolio Impact

The EU Omnibus: What the Proposals Mean for Sustainability Reporting Among Companies and Investors

Global Standards Screening Introduction

Daily Screening

700,000+

News items

60,000

NGO and media sources

25,000+

Companies

Key Benefits

Improve Reputational Risk Management

Enhance your portfolio’s long-term performance by proactively identifying and managing business conduct related risks.

Ensure your Portfolio Complies with International Norms and Standards

Identify companies that violate the Global Compact’s internationally recognized principles for business conduct and align your portfolio holdings to these standards.

Respond to Responsible Investment Mandates

Expand your product suite to cover the fourth-largest responsible investment strategy and respond to relevant client mandates.

Gain an In-depth Understanding of Incidents

Access qualitative analyses of incidents that consider the company’s accountability, the severity of its impact and the quality of management’s response.

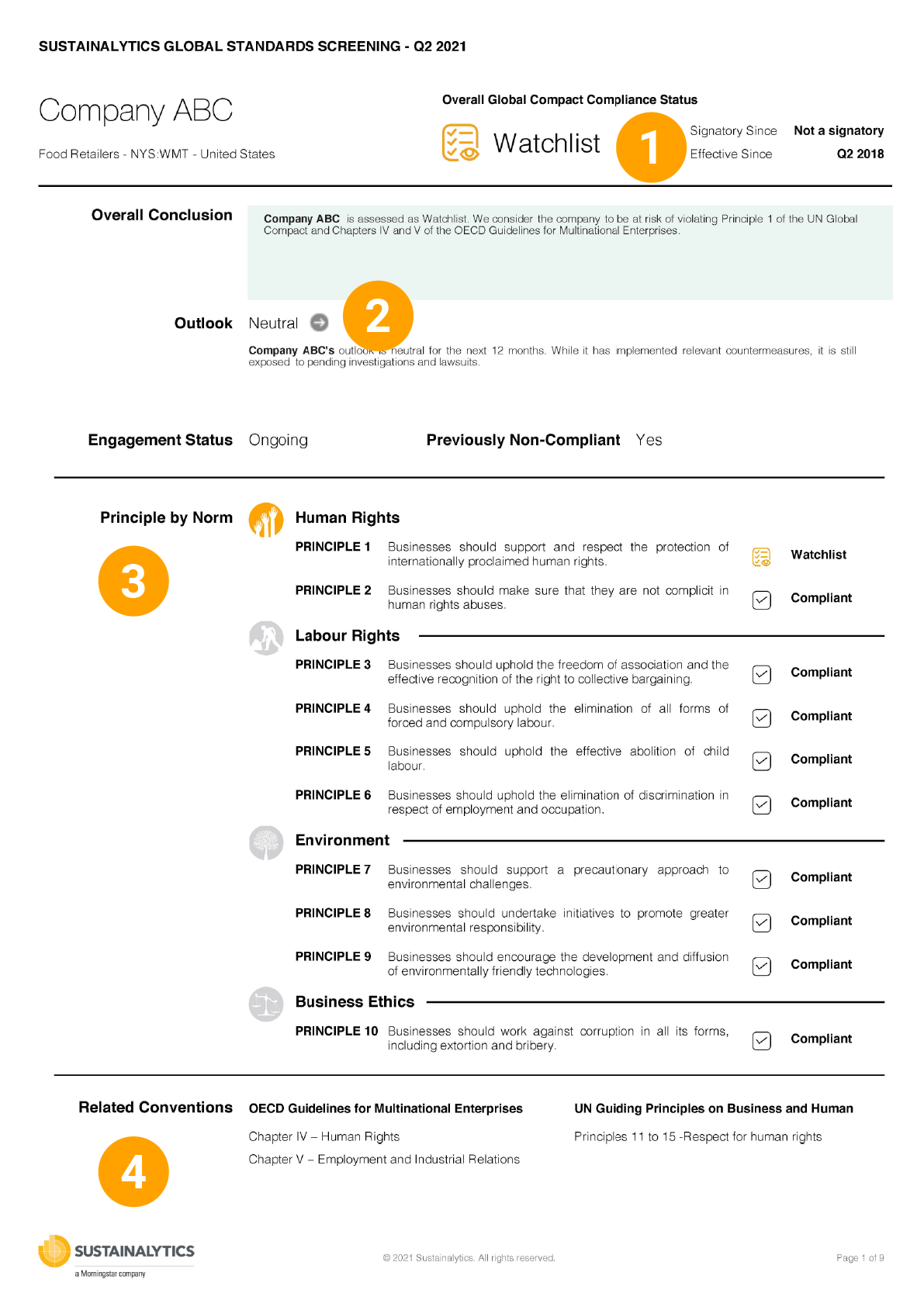

Report Insights

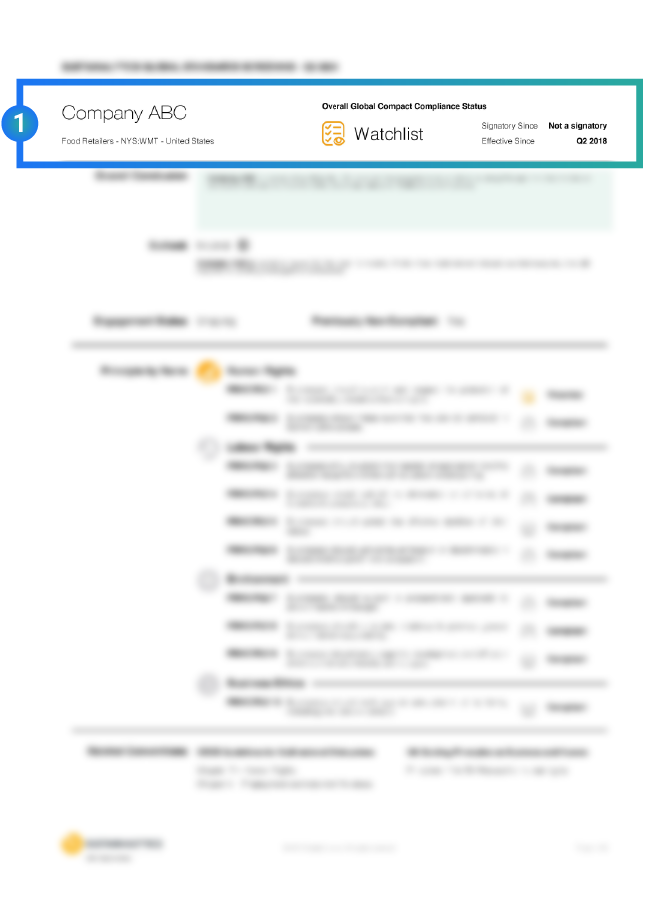

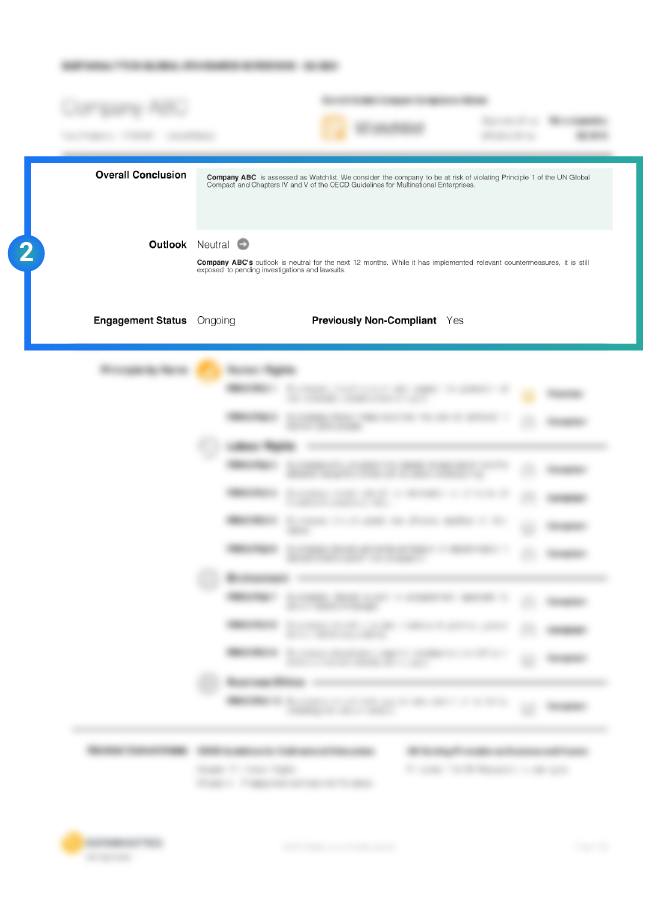

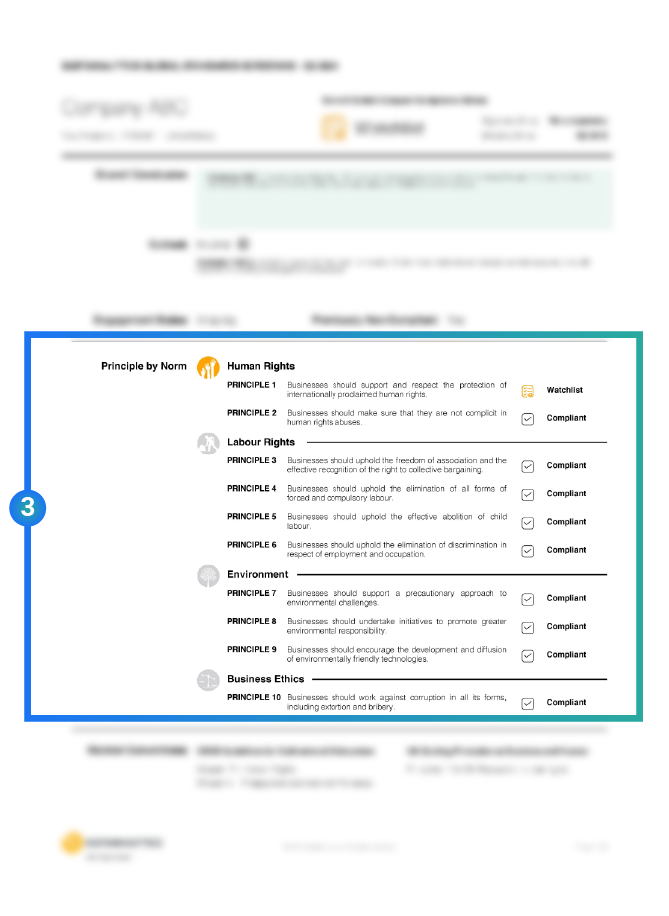

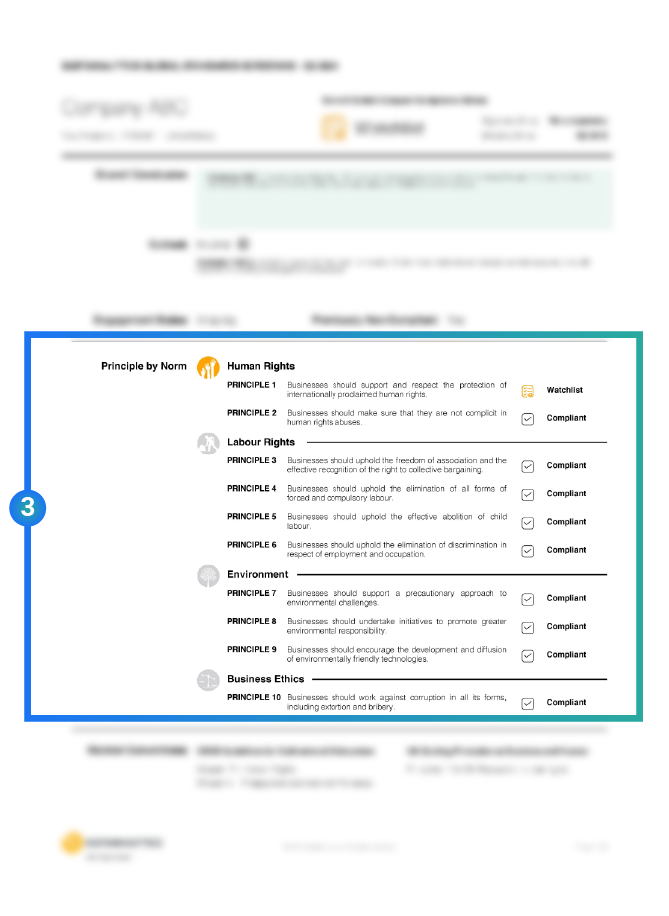

Company is classified as Compliant, Watchlist, or Non-compliant.

A Positive, Negative or Neutral outlook is provided based on our assessment of whether we expect an improvement or a deterioration in the assessment status.

Detailed information about the Principle(s) violated, or at risk of being violated.

Company is analyzed and assessed according to the following framework: Severity of impact, company responsibility, and company management.

How it Works

1. We screen 700,000+ news items from 60,000 media and NGO sources daily to identify relevant news.

2. News items are assessed and classified by a dedicated incidents team.

3. Incidents are then analyzed on case and company-level and an assessment is made against the relevant Global Compact principle(s) with a forward-looking outlook.

4. An oversight committee consisting of senior representatives from Research, Product Management, Engagement Services and Quality Control reviews and approves all assessments.

5. Only after company contact regarding an allegation and an oversight committee’s evaluation a company is classified as Watchlist or Non-compliant.

6. Clients can access company profiles via the online platform in addition to receiving a quarterly update report.

Assessment Example

Example of Non-compliant assessment: Company ABC, a pharmaceutical company

Assessment:

In violation of UN Global Compact Principle 1 (Businesses should support and respect the protection of internationally proclaimed human rights)

Framework:

- Severity of Impact: Company ABC’s pricing model in the US has had a significant negative impact on patients through increased insurance premiums or reduced insurance coverage, depriving patients of much-needed treatments in the absence of viable alternatives

- Company Responsibility: The US authorities criticized company ABC’s business model as it was largely focused on making strategic acquisitions to establish price hikes for medication. This practice is exceptional compared to all its industry peers

- Company Management: Company ABC’s former CEO admitted that the company had been too aggressive in raising the prices of some of its drugs. On the other hand, the US authorities have accused the company of withholding documents requested, related to its pricing. This lack of transparency does not give us confidence in its ability to manage the risks associated with this issue

About Global Compact

The UN Global Compact is the world’s largest principles-based voluntary initiative consisting of over 16,000 companies from 166 countries. UN Global Compact signatories commit to universally-accepted principles on human rights, labor, environmental protection and anti-corruption.

Principle 1

Businesses should support and respect the protection of internationally proclaimed human rights; and

Principle 2

Make sure that they are not complicit in human rights abuses.

Principle 3

Businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining;

Principle 4

The elimination of all forms of forced and compulsory labour;

Principle 5

The effective abolition of child labour; and

Principle 6

The elimination of discrimination in respect of employment and occupation.

Principle 7

Businesses should support a precautionary approach to environmental challenges;

Principle 8

Undertake initiatives to promote greater environmental responsibility; and

Principle 9

Encourage the development and diffusion of environmentally friendly technologies.

Principle 10

Businesses should work against corruption in all its forms, including extortion and bribery.

Demonstrate your Commitment as a Responsible Owner

Subscribe to Sustainalytics’ Global Standards Engagement to pool resources and let us engage with companies on behalf of you and other investors. Support company engagement with independent, 3rd party normative assessments of business conduct incidents.

Delivery Options

Global Access

Access our research through our user-friendly investor interface with easy to use screening and reporting tools. You can also access onscreen & PDF reports

Data Services Regular data feed (SFTP/FTP) or API

Access our research through an internal or a third-party system of your choice: Bloomberg, Factset and Markit

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Global Standards Engagement

Engage with companies that breach international norms and standards as identified by our Global Standards Screening research.

Learn More

Controversial Product Involvement

Screen for companies involved in specific product areas, such as tobacco and military contracting.

Defense Research

Create a robust defense policy with our Controversial Weapons Radar and Arms Trade Research.

Learn MoreMorningstar® Global Market SustainabilitySM Index Family

Best-in-class equity index that features reduced ESG risk profile with low to moderate tracking error.

Morningstar® Minority Empowerment IndexSM

Companies that are committed to racial and ethnic diversity as demonstrated by relevant programs and policies related to diversity, community development etc.

Related Insights and Resources

ESMA Fund Naming Guidelines: Early Insights Into Rebranding Activity and Portfolio Impact

This article looks at how the universe of open-end and exchange-traded funds in scope of the ESMA fund naming guidelines has changed since their introduction in May 2024, through analysis of rebranding activity and assessed the impact of the requirements.

The EU Omnibus: What the Proposals Mean for Sustainability Reporting Among Companies and Investors

On February 26, 2025, the EU Commission published the omnibus packages on sustainability and investment simplification. This article examines the EU Omnibus and its impact on the CSRD, the CSDDD, and the EU Taxonomy Regulation.