Introduction

Nature’s alarm bells are ringing at a feverish pitch. Natural capital, such as food production and timber, and the invaluable services nature provides, is in peril due to an unprecedented increase in human-induced biodiversity loss. This growing biodiversity deficit has both direct and indirect impacts on economic prosperity, with over half of the world’s GDP at moderate to severe risk. With biodiversity loss designated as one of the top three risks to business, biodiversity is quickly becoming a key topic in boardrooms around the globe.i

Business as usual won’t protect nature’s greatest assets – instead, a nature-positive approach to doing business is urgently required.ii Biological diversity, or biodiversity, refers to the wide variety of living species on Earth, including animals, plants, bacteria, and fungi. Out of the estimated 8.7 million species in existence, only around 1.2 million species have been identified and described so far. Similar to how diversification of a financial portfolio reduces risks, diversity within nature’s assets increases our planet’s resilience to shocks and reduces risks to ecosystem services. These living organisms provide both resources and essential ecosystem services – the material and non-material benefits people derive from ecosystems. Ecosystems services include provisioning services (e.g., food, wood), regulating services (e.g., crop pollination, water purification, soil erosion prevention) and cultural services (e.g., outdoor recreation, wellbeing, and a sense of place).

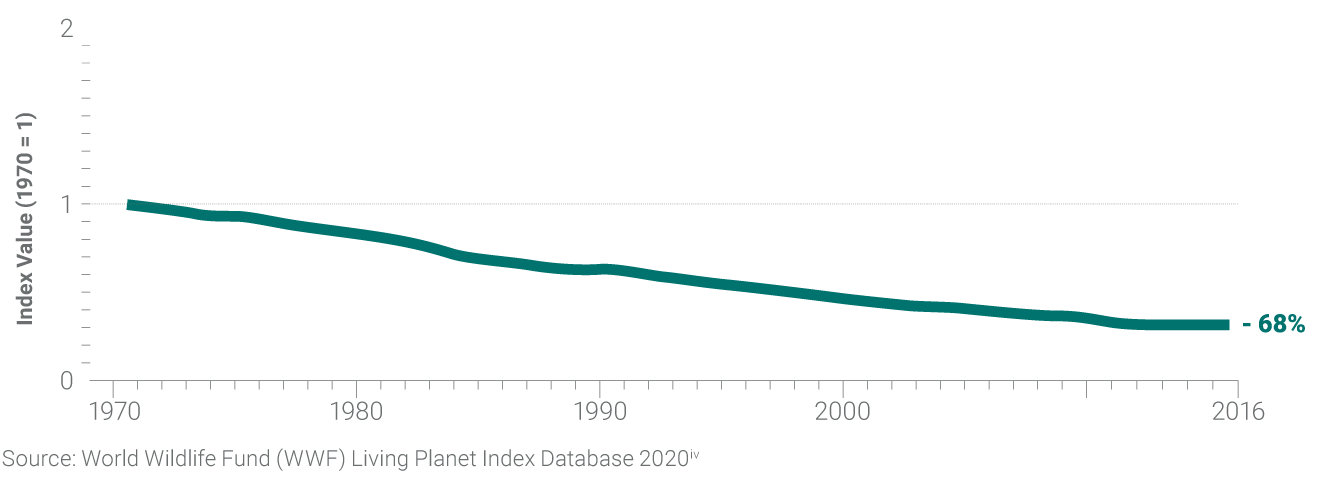

However, these valuable resources and services are in jeopardy. Direct and indirect human pressure on natural environments and ecosystems is rapidly accelerating species loss at a rate at least 100 times higher than the natural extinction rate.iii Studies show that between 200 to 2,000 species go extinct each year, with an average 68% decrease in monitored populations of mammals, birds, reptiles, amphibians, and fish since 1970 (see Figure 1).

Over half of the world’s GDP is at moderate or severe risk due to biodiversity related losses

Figure 1: Decrease in Species Abundance According to the WWF Living Planet Index: 1970 to 2016

This alarming decline has not only environmental impacts, but also far-reaching economic and social impacts. Approximately $44 trillion of economic value generated each year – more than half of global GDP – is moderately to highly dependent on ecosystem services.v vi Within the agricultural sector alone, more than three-quarters of the world’s food crops are threatened due to a decreasing number of pollinators, an estimated potential loss of between $235 billion and $577 billion per year.iv Biodiversity loss is also correlated with an increased likelihood of pandemics, as habitat loss may create the conditions for spillover events, where viruses may jump from animals to humans.viii

In light of these substantial risks, both private and public actors are mobilizing to address biodiversity loss. International organizations are putting pressure on governments and corporations to take significant steps within the next decade to protect biodiversity, such as through the UN’s Sustainable Development Goal 15: Life on Land, or the new Science-Based Targets for Nature initiative. Over 100 nations, including the United States, Brazil and China, pledged to end deforestation at the 2021 UN Climate Change Conference (COP26). And, in 2022, the UN Biodiversity Conference is expected to produce a post-2020 global biodiversity framework to stem biodiversity loss, with far-reaching business implications. Many financial institutions are also taking steps to ensure their lending and investment portfolios do not harm biodiversity, including the over 75 institutions signing the Finance for Biodiversity pledge.

Unless further biodiversity loss is prevented and biodiversity-related impacts becomes better managed, many business activities will soon be unviable. As such, businesses across sectors are seeking to integrate biodiversity considerations into their strategy and operations. But how does that look in practice? This ebook investigates the material impacts of biodiversity loss, explores which sectors are highly affected and offers five steps on how companies can measure and manage biodiversity-related issues.

5 Key Drivers of Biodiversity Loss

- Habitat Loss: Land use changes including deforestation, growing monocultures, or built environments.

- Overexploitation: Harvest of natural resources above natural replenishment rate such as overfishing.

- Invasive Species: Introduction of invasive nonnative species that outcompete local species for natural resources.

- Pollution: Harmful contaminants released into ecosystems, including microplastics in marine habitats and fertilizers from intensive agricultural practices.

- Climate Change: Higher temperatures, rising sea levels, and extreme weather patterns cause direct impacts to ecosystems as well as exacerbate the other four drivers.

Bound to Nature: Sectors Impacted by Biodiversity Issues

In the past 50 years, rapid growth in international trade, demographic shifts, and changing consumption patterns have transformed the global economy. This has come at a cost to nature: unsustainable economic activities have accelerated human-induced biodiversity loss since the 1970s.ix Operations across just four value chains – food, infrastructure, energy, and fashion – are estimated to spur up to 90% of man-made pressure on biodiversity.x In turn, these shortsighted demands on natural resources and ecosystem services trigger significant financial and non-financial risks for companies.

Business’ Impacts on Biodiversity

If left unmanaged, many business activities fuel the drivers of biodiversity loss, including habitat change, overexploitation of natural resources, pollution, climate change, and the spread of invasive species. Clear-cutting forests for food production, for example, demolishes local habitats, while fertilizers and pesticides intended to maximize crop yields can reduce bird, insect, and amphibian populations.xi Unsustainable consumption patterns (e.g., fast fashion and meat-heavy diets), inefficiencies and resource misallocation during production, as well as poor systems of governance, can further compound these business-induced impacts on the state of nature.xii

While the impacts of business on biodiversity vary considerably by sector and location, there are five commonly identified primary biodiversity loss drivers, as shown in Figure 2 below.

Figure 2: Examples of Sector-Specific Pressures on Biodiversity Loss Drivers

| Primary Industries (i.e., agriculture, forestry, mining, etc.) | Secondary Industries (i.e., manufacturing, food processing) | Tertiary Industries (i.e., commercial services, transport, etc.) | |

|---|---|---|---|

| Land Use Changes |

|

|

|

| Overexploitation |

|

|

|

| Climate Change |

|

|

|

| Pollution |

|

|

|

| Invasive Species |

|

|

|

Biodiversity’s Impacts on Business

Given that most businesses rely on ecosystem services to a certain degree, biodiversity loss endangers all sectors of the economy at varying levels. Greater variability of species, genes and ecosystems is also associated with increased productivity, resilience, and consumer preference. For instance, biodiverse soils are generally more productive, and biologically rich environments, such as tropical forests, offer more unique compounds for industrial and pharmaceutical uses.xiii

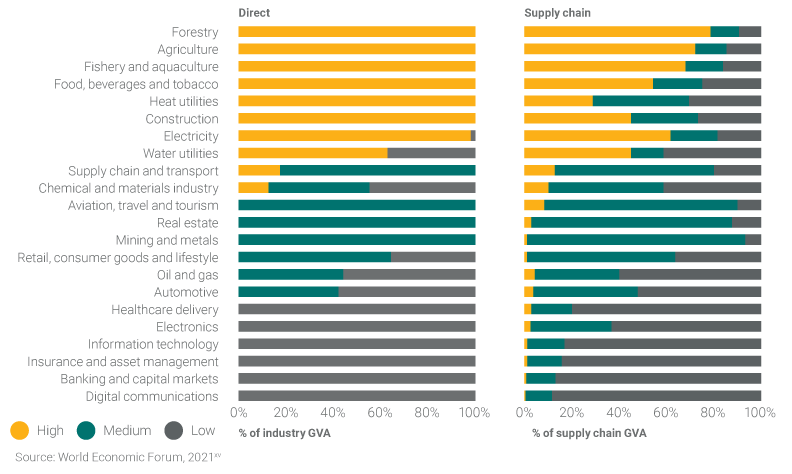

Sectors such as agriculture, forestry and fishing face direct and immediate risks related to biodiversity loss, including reduced crop yields, limited timber availability, and loss of fisheries. However, the indirect impacts of biodiversity loss are far-reaching. Consumer goods, food products, and even health care delivery are indirectly affected through upstream and downstream impacts. Concealed dependencies in these sectors’ supply chains expose businesses to significant financial and non-financial risks. Deforestation, pollinator loss and invasive parasites in Africa, for example, are threatening shea trees, putting at risk a portion of the $380.2 billion-dollar cosmetic industry that uses shea butter in products.xiv Figure 3 captures the proportion of gross value addition across 22 industries that are exposed to biodiversity loss-related risks.

Figure 3: Degree in Which Direct and Supply Chain Gross Value Added (GVA) is Dependent on Nature, by Industry

3 Ways Biodiversity Loss Can Become a Material Issue

The loss of biological diversity can become a material issue for business in the following three ways:

- Dependency on Ecosystem Services: When a company depends directly on nature for operations, supply chain performance, real estate asset values, physical security, and continued development.

- Socio-Economic Consequences: When a company’s negative biodiversity impacts cause social consequences, such as losing customers, legal action, and divestment by investors.

- System Impacts: When biodiversity losses trigger market and societal disruptions where the company operates, increasing both physical and financial risks to the company.

Subindustries’ Dependencies and Impacts on Biodiversity

Ecosystem services are indispensable for many subindustries, particularly in the primary sector described in Figure 3 above. Sustainalytics’ environmental, social and governance (ESG) corporate research universe data reveals subindustries with the highest exposure to biodiversity risks include agriculture, energy and water utilities, and mining.xvi Many of these subindustries face additional challenges with exponential increases in demand due to population growth and consumer trends.

Agriculture and Food Production

With only limited man-made alternatives available, agriculture and food production are dependent on ecosystem services and, therefore, are highly exposed to biodiversity-related risks. Agriculture’s impacts on biodiversity are primarily through habitat changes, as original vegetation is cleared and replaced with crops, as well as pollution from fertilizer and pesticide run-offs.xvii Agricultural companies are seeking to mitigate these impacts using nature-positive techniques. Brazilian sugar producer Native, for instance, developed a new harvesting technique, which leads to biodiversity levels over 20 times higher than in conventional sugar cane farms.

Energy and Water Utilities

At an operational level, many energy producers are dependent on water ecosystem services – from cooling required for solar power plants to hydropower’s reliance on natural watersheds. Infrastructure for energy and water utilities such as pipelines, dams, and operational structures also rely on erosion control, protection against extreme weather events, and other ecosystem services related to the remediation of pollution caused by spills. Energy and water utilities, in turn, can impact a region’s biodiversity due to land use changes, excessive water use, and contaminants. These pressures can cause habitat loss, species disturbances, and population declines among native species.xviii To combat some of these impacts, EDF Renewables France developed localized land management plans to ensure the company’s solar parks have minimal impact on native vegetation.xix

Despite the broad business impacts of biodiversity loss across sectors, only 32% of U.S. companies report on material issues related to biodiversity – even less are taking internal actions to mitigate against biodiversity-related risks.xx In light of the significant financial risks associated with biodiversity loss, investors and government regulators are increasingly calling for companies across sectors to take meaningful steps to protect biodiversity.

Natural Assets: The Strategic Case for Protecting Biodiversity

With the effects of biodiversity loss impacting some sectors already, corporations are waking up to the associated risks and recognizing opportunities presented by preserving biodiversity. In addition to the obvious environmental benefits, there are strong strategic incentives to embrace a nature-positive approach to doing business.

Safeguarding Against Natural Capital Losses

Almost all businesses rely on natural capital and ecosystem services to a certain degree, with dependencies embedded across value chains. Ecosystem services alone – including timber production, crop pollination, water filtration, waste decomposition, and climate regulation – are worth approximately $125 trillion every year.xxi As these services rely on intact and biologically rich natural environments, the loss of biodiversity endangers continued access to natural capital and services. Some sectors are already impacted by biodiversity loss, including crop production shortfalls due to declining pollinator populations and tourism impacts around Australia’s bleached coral reefs. By taking steps to preserve natural ecosystems, businesses are helping safeguard the natural assets they rely upon.

Protecting Access to Finance

Recognizing the risks biodiversity loss presents to their returns, many financial institutions are taking steps to ensure their investment and lending portfolios do not harm natural ecosystems. Over 75 financial institutions representing €12 trillion worth of assets under management have already committed to protect and restore biodiversity through their finance activities and investments under the UN-initiated Finance for Biodiversity pledge. The launch of the Taskforce on Nature-related Financial Disclosures (TNFD) and the continued industry adoption of sustainable finance frameworks such as the Equator Principles have triggered financial services and investors to scrutinize corporate borrowers closely on their biodiversity impacts. Those companies with poor performance or insufficient data on biodiversity risks may be subjected to higher cost of capital. On the other hand, companies with strong corporate biodiversity management practices and projects aimed at fostering biodiversity can access a range of sustainable financing options such as certified climate bonds, green loans, or blue bonds.

Staying Ahead of Regulatory Requirements

As governments respond to biodiversity loss with an expanding number of policy interventions, companies are facing additional disclosure specifications, due diligence requirements, and potentially higher costs of doing business if there are associated biodiversity-related risks.

New reporting requirements introduced under the EU’s Sustainable Finance Disclosure Regulation require financial market participants to disclose investments that may negatively affect biodiversity sensitive areas, and the EU Taxonomy for Sustainable Activities will mandate large companies report on economic activities making a substantial contribution to biodiversity from 2023 onward. Due diligence requirements are also expected to expand, including the EU’s proposed legislation requiring corporations to take steps to prevent deforestation and forest degradation across their supply chains.

Biodiversity-relevant taxes, fees, and charges have also been gradually increasing across 62 countries, while other countries have also enacted moratoriums on harmful activities, such as Indonesia’s 2019 ban on clearing primary forests and peatlands for palm oil plantations and logging.xxii xxiii The Conference of the Parties to the Convention on Biological Diversity, or COP15, is also expected to release a global biodiversity framework in 2022 that is likely to trigger further legislation. By strengthening corporate biodiversity management practices, companies can mitigate reporting burdens, avoid stranded assets, and avert the need for additional compliance activities.

Mitigating Against Reputational Risks

Shifts in consumer sentiment and mounting public demand for action can trigger significant reputational damages for a company if insufficient steps are taken to protect biodiversity. These reputational impacts can erode a company’s customer base, lead to divestments, increase insurance premiums, and reduce the ability to attract top talent.xxiv International organizations and activists can also target poor corporate performers, resulting in decreases in stock prices and boycotts. Greenpeace’s campaign against food producers’ sourcing of palm oil from deforested Indonesian rainforests, for instance, led some companies’ stock prices to fall by 4%.xxv

Strategic Stewardship: How Business Can Address Biodiversity Issues

While corporate biodiversity management practices have matured over the past decade, many companies struggle with how to operationalize their nature-positive ambitions and reduce their exposure to biodiversity-related risks. To provide a jumpstart on the journey to a nature-positive business, here are five practical steps to consider.

Assess Biodiversity Impacts Across the Value Chain

Map out the company’s most material impacts and dependencies on biodiversity, both geographically and across your value chain. This includes identifying activities, locations, and commodities that are most vulnerable to biodiversity loss, from supply chain impacts to potential downstream impacts such as product use and disposal. Many companies also divide their biodiversity impacts on terrestrial, aquatic (i.e., lakes, wetlands, streams), and marine (i.e., oceans and seas) ecosystems. Much of the data required may already be collected as part of the company’s existing sustainability or ESG reporting processes. If not, companies can utilize several well-known tools and methodologies when assessing their biodiversity footprint, including the Global Biodiversity Score or sector-specific tools such as the Agrobiodiversity Index. Dutch ASN Bank, for example, utilizes the Biodiversity Footprint for Financial Institutions when calculating its biodiversity footprint and monitoring its progress.

Key Actions

- Measure impact using industry-accepted biodiversity measurement tools: Draw from the emerging number of measurement tools and methodologies for capturing your biodiversity footprint, including many sector-specific tools. The Cross Sector Biodiversity Initiative’s timeline tool, for instance, illustrates the timeline of biodiversity impacts and considerations, alongside financing and project development time frames for extractive projects.

- Capture supply chain impacts and dependencies: Leverage internal supply chain data and third-party value chain assessments – such as Sustainalytics’ ESG Assessment Platform – to locate potential biodiversity impacts and vulnerabilities.

Set Mitigation Targets

After conducting biodiversity materiality assessments, use the baseline data to prioritize key issues to address, and set targets to monitor biodiversity-related risks and assess company progress. Targets should cover biodiversity-related risks and opportunities to direct operations, supply chain activities, and business continuity (i.e., reducing dependency risks where possible). Align targets with natural limits and societal goals, such as those derived from the SDG 15’s twelve biodiversity-related targets or the Science Based Targets for Nature. Danone, for example, aligns and reports on its biodiversity goals under three of SDG 15: Life on Land targets. When determining the ambitiousness of targets, consider the company’s overall sustainability goals and how you want to be positioned in the market. Integrate tracking and reporting of key biodiversity metrics into existing internal ESG monitoring systems where possible.

Key Actions

- Align target setting with existing frameworks: Use the Science Based Targets for Nature, emerging guidance from the Post-2020 Global Diversity Framework, and other wellknown frameworks to set targets.

- Analyze targets in comparison to peers: Compare goals to industry peers and consider desired market perception of the company when setting ambition level.

Implement a Comprehensive Action Plan

Take meaningful steps to achieve biodiversity targets by detailing a strategy and operations action plan. Address the five driving factors of biodiversity loss – habitat loss, overexploitation, pollution, climate change, and invasive species – throughout the value chain when developing action steps. Schneider Electric identifies potential levers for action across its value chain and uses a mitigation hierarchy in its action steps:

- Avoid impacts whenever possible;

- Minimize unavoidable impacts;

- Restore biodiversity;

- Offset any remaining impacts to reach no net loss or even net gain;

- Compensate when impacts cannot be offset.

Unlike climate change, biodiversity loss can be highly localized, so think about potential actions in company locations to highlight the importance the company places on biodiversity. Similar to climate risks, biodiversity risks are also increasingly on investors’ and regulators’ radar. Therefore, ensure that action is taken to reduce exposure and manage biodiversity-related risks. For many companies, operational improvements can be financed through a growing range of sustainable financial instruments, including sustainability-linked loans and green bonds (see Sustainalytics’ Solutions for Companies for more relevant financial instruments and services).

Key Actions

- Use emerging mitigation frameworks as references: Consult international initiatives’ mitigation action plan guidance such as the Science Based Targets for Nature’s “Avoid, Reduce, Regenerate, Restore, Transform” action framework.

- Leverage sustainable financing to fund internal and external projects aimed at protecting biodiversity: Investigate sustainable financing options such as sustainability-linked loans or green use of proceeds bonds to finance operational improvements or corporate biodiversity-related projects.

- Learn and share industry best practices: Consider becoming a member of industry-led coalitions such as Fashion Pact (fashion and textiles), One Planet Business for Biodiversity (OP2B) (agriculture), or Proteus Partners (cross-sector).

Strengthen Corporate Governance on Biodiversity

Magnify your focus on biodiversity management by establishing a robust governance structure to support the ongoing identification and management of biodiversity-based risks and opportunities. This is of particular importance for sectors with significant reliance on ecosystem services, and therefore need defined processes in place to identify, communicate, and mitigate emerging biodiversity-related risks throughout the business.

To streamline intersectional ESG processes, integrate biodiversity issues into your existing environmental risk management, embed biodiversity issues within corporate social responsibility, enterprise risk management (ERM), or ESG teams, and formalize processes on escalating biodiversity issues to senior management. Explore the evolution of biodiversity-related risks over different time horizons and integrate this information into strategy and operational planning where possible.

Key Actions

- Demonstrate clear commitment from senior management: Nominate senior management and board member(s) to be responsible for biodiversity-based risks and opportunities.

- Incentivize strong managerial focus by tying board and senior management remuneration to ESG performance: Integrate performance on managing ESG issues – such as biodiversity issues or overall ESG rating – into senior management and board members’ rewards packages.

Monitor and Report on Biodiversity Issues

Promote transparency and get ahead of disclosure regulations by publicly reporting on the results of your biodiversity materiality assessment and sharing your mitigation plans. When selecting metrics and scope, consider using new reporting frameworks such as the Taskforce for Nature-Related Financial Disclosures (TFND) or the Climate Disclosure Standards Board’s proposed framework guidance for biodiversity-related disclosures. While some companies, such as Schneider Electric, produce a stand-alone biodiversity report, companies can reduce the reporting burden by integrating biodiversity-related disclosures into existing financial and nonfinancial reporting practices. Audi, for example, integrates biodiversity-related disclosures in its sustainability report.

Key Actions

- Report in alignment with internationally recognized frameworks: Consider reporting according to emerging disclosure frameworks focused on biodiversity, such as the Taskforce on Nature-related Financial Disclosures.

- Track performance against peers: Monitor progress against industry competitors using tools such as Sustainalytics’ Peer Performance Insights and share learnings with industry groups such as Business for Nature.

- Tailor disclosures for key stakeholders: Stay abreast of key stakeholders’ reporting preferences as some – including potential and current investors – may favor certain metrics.

Sustainalytics Solutions for Companies

Sustainalytics offers several solutions for businesses seeking to mitigate against biodiversity loss:

Peer Performance Insights:

Compare company ESG performance – including exposure and management of biodiversity-related risks – against peers to identify gaps and gain insight on industry best practice.

Bond Issuance Support:

Receive support for certified climate bond issuances (Climate Bonds Initiative approved verifier) and second-party opinions to support green, social, blue, and transition bond issuances to finance projects aimed at protecting biodiversity.

Sustainability-Linked Finance Support:

Verify the credibility and ambitiousness of key performance indicators and sustainability performance targets for sustainability-linked loans and bonds.

ESG Assessment Platform:

Investigate potential upstream issues by assessing exposure to biodiversity-related risks within supply chains and suppliers’ management of biodiversity issues.

The Future of Business is Nature-Positive

Momentum is building on stemming biodiversity loss as businesses wake up to the looming financial and environmental impacts. However, biodiversity conservation and sustainable business growth go hand in hand. Preserving biological diversity is not only about protecting nature, but also safeguarding the trillions of dollars’ worth of ecosystem services provided by biodiversity that business relies on. If action is not taken now, the decline of biodiversity could compromise business continuity across most industries. With pressure also mounting from investors, regulators, and customers, businesses that act now can get ahead of likely reporting and regulatory requirements and position themselves as industry leaders and good corporate citizens. Nature is an irreplaceable asset and actions must be taken now to safeguard it.

Additional Resources

- International Union for Conservation of Nature (IUCN): The IUCN’s Business and Biodiversity webpage provides recommended processes, tools, case studies, and reports to help companies adopt practices that conserve nature.

- EU Business @ Biodiversity (B@B): The B@B platform offers a range of resources for businesses to account for their biodiversity impacts, assess their related risks, develop biodiversity management approaches, and facilitate business innovation. This includes case studies, reports, listed funding opportunities, tools, data, and guidance documentation.

- Science Based Targets for Nature: This initiative provides practical guidance for companies to measure biodiversity impacts, and offers a robust framework to set and track biodiversity targets.

- Business For Nature: This global coalition of companies and conservation organizations provides biodiversity management advice to businesses.

- Taskforce for Nature-Related Financial Disclosures: The TFND provides companies with a risk management and disclosure framework to report and act on nature-related risks.

References

i World Economic Forum (2020). “The Global Risks Report 2020,” World Economic Forum, access (19.10.21) at: https://www.weforum.org/reports/the-global-risks-report-2020.

ii Nature-positive refers to activities that not only minimize impact, but also enhance natural capital and ecosystems. At the 2021 G7 Summit, G7 leaders announced that ‘our world must not only become net zero, but also nature positive, for the benefit of both people and the planet’ in the G7 2030 Nature Compact. World Economic Forum (2021). “What is Nature Positive and Why is it the Key to our Future?, ” WEF, accessed (02.11.21) at: https://www.weforum.org/agenda/2021/06/what-is-nature-positive-and-why-is-it-the-key-to-ourfuture/.

iii The natural extinction rate – or the background extinction rate - is the rate of species extinctions that would occur if humans were not present.

iv World Wildlife Fund (WWF) and ZSL (2020). “The Living Planet Index Database, ” WWF and ZSL, accessed (03.11.21) at: https://livingplanetindex.org/

v World Economic Forum (2020). “Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy, ” World Economic Forum, accessed (15.10.21) at: https://www3.weforum.org/docs/WEF_New_Nature_Economy_Report_2020.pdf.

vi All dollar amounts are in USD unless otherwise noted

vii IPBES (2017). “The assessment report on pollinators, pollination and food production, ” IPBES, accessed (20.10.21) at: https://ipbes.net/assessment-reports/pollinators.

viii Borio, L. and Vora, N. (2021). “G20 can prevent future pandemics by stopping destruction of nature, ” World Economic Forum, accessed (12.10.21) at: https://www.weforum.org/agenda/2021/07/g20-prevent-pandemics-stopping-destruction-nature/

ix WWF (2020). “Living Planet Report 2020 – Bending the curve of biodiversity loss, ” WWF and Zoological Society of London, accessed (04.11.21) at: https://f.hubspotusercontent20.net/hubfs/4783129/LPR/PDFs/ENGLISH-SUMMARY.pdf

x Kurth, T. et al. (2021). “The Biodiversity Crisis is a Business Crisis, ” Boston Consulting Group, accessed (03.11.21) at: https://www.bcg.com/publications/2021/biodiversity-loss-business-implications-responses

xi Sud, M. (2020). “Managing the Biodiversity Impacts of Fertilizer and Pesticide Use Overview and insights from trends and policies across selected OECD countries, ” OECD, accessed (01.11.21) at: https://www.oecd.org/officialdocuments/publicdisplaydocumentpdf/?cote=ENV/WKP(2020)2&docLanguage=En

xii IPBES (2019). “Global assessment report on biodiversity and ecosystem services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services, ” IPBES, accessed (01.11.21) at: https://ipbes.net/global-assessment

xiii EU Business @ Biodiversity (2010). “Agriculture Sector and Biodiversity Conservation: Best Practice Benchmarking, ” EU Business and Biodiversity Platform, accessed (04.11.21) at: https://ec.europa.eu/environment/archives/business/assets/pdf/sectors/FINAL_Agriculture.pdf

xiv UK Department for International Development (2016). “Cultivating climate resilience: The shea value chain,” UK Department for International Development, accessed (18.10.21) at: https://www.gov.uk/dfid-research-outputs/cultivating-climate-resilience-the-shea-valuechain

xv World Economic Forum (2020). “Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy, ” World Economic Forum, accessed (15.10.21) at: https://www3.weforum.org/docs/WEF_New_Nature_Economy_Report_2020.pdf

xvi Top ten subindustries (as of 30 September 2021) with the highest exposure score are Agriculture, Water Utilities, Independent Power Production and Traders, Multi-Utilities, Electric Utilities, Renewable Power Production, Gas Utilities, Facilities Maintenance, Aluminum, Diversified Metals Mining

xvii Secretariat of the Convention on Biological Diversity (2014)‚ “How Sectors Can Contribute to Sustainable Use and Conservation of Biodiversity – CBD Technical Series No. 79, ” PBL Netherlands Environmental Assessment Agency, access (05.11.21) at: https://www.cbd.int/doc/publications/cbd-ts-79-en.pdf

xviii UNEP-WCMC (2017). “Mainstreaming of Biodiversity into the Energy and Mining Sectors: An Information Document for the 21st Meeting of the Subsidiary Body on Scientific, Technical and Technological Advice, ” UNEP-WCMC, accessed (04.11.21) at: https://www.cbd.int/doc/c/d9d0/7a53/95df6ca3ac3515b5ad812b04/sbstta-21-inf-09-en.pdf

xix IUCN (2021). “Mitigating biodiversity impacts associated with solar and wind energy development, ” IUCN, accessed (05.11.21) at: https://portals.iucn.org/library/sites/library/files/documents/2021-004-En.pdf

xx Human, T. (2021). “Only a third of large companies disclose strategic biodiversity issues, finds study, ” IR Magazine, accessed (18.10.21) at: https://www.irmagazine.com/esg/only-third-large-companies-disclose-strategic-biodiversity-issues-finds-study

xxi Global Commission on the Economy and Climate (2014). “The New Climate Economy: Better Growth, Better Climate, ” Global Commission on the Economy and Climate, accessed (14.10.21) at: https://newclimateeconomy.report/2014/wp-content/uploads/sites/2/2014/08/NCE-Global-Report_web.pdf

xxii OECD (2021). “Tracking Economic Instruments and Finance for Biodiversity, ” OECD, access (14.10.21) at: https://www.oecd.org/environment/resources/biodiversity/tracking-economic-instruments-and-finance-for-biodiversity-2021.pdf

xxiii L. Tacconi et al. (2019). “Policy forum: Institutional architecture and activities to reduce emissions from forests in Indonesia, ” Forest Policy and Economics, accessed (14.10.21) at: https://www.sciencedirect.com/science/article/pii/S1389934118304647?via%3Dihub

xxiv World Economic Forum (2020). “Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy, ” World Economic Forum, accessed (15.10.21) at: https://www3.weforum.org/docs/WEF_New_Nature_Economy_Report_2020.pdf

xxv G. Rijk et al. (2019). “Deforestation-driven reputation risk could become material for FMCGs, ” Chain Reaction Research, accessed (19.10.21) at: https://chainreactionresearch.com/report/deforestation-driven-reputation-risk-could-become-material-for-fmcgs/

Connect With Our Team of Experts to Learn More About Corporate ESG and Sustainable Finance

Sustainalytics, a Morningstar Company, is a leading global ESG research, ratings, and data firm supporting corporations and their financial intermediaries to consider sustainability issues in their policies, practices, and capital projects. As the leading second-party opinion provider in the market, Sustainalytics offers issuers credible verification on the use of proceeds for sustainable finance products. Corporations also leverage Sustainalytics’ ESG Risk Ratings to understand and promote their ESG performance with their internal and external stakeholders. The firm has received awards in recognition of its ESG solutions and opinion services, most recently from Climate Bonds Initiative, Environmental Finance and GlobalCapital. With 16 offices globally, Sustainalytics has more than 1,600 staff members, including more than 500+ analysts with varied multidisciplinary expertise across more than 40 industry groups. For more information, visit www.sustainalytics.com.