While traditional sovereign credit assessments focus on macro-economic analysis, they often overlook key ESG factors like political instability, governance, and social policies that can drive economic volatility and impact sovereign bond performance.

By combining national wealth data and over 35 ESG metrics, along with analyst-driven overlays for real-time events, the Country Risk Ratings offer a more comprehensive view of sovereign risk. Aligned with the ESG Risk Ratings, this tool allows seamless comparisons between corporate and sovereign bonds, enhancing portfolio analysis and reporting.

A Three-Capital Framework

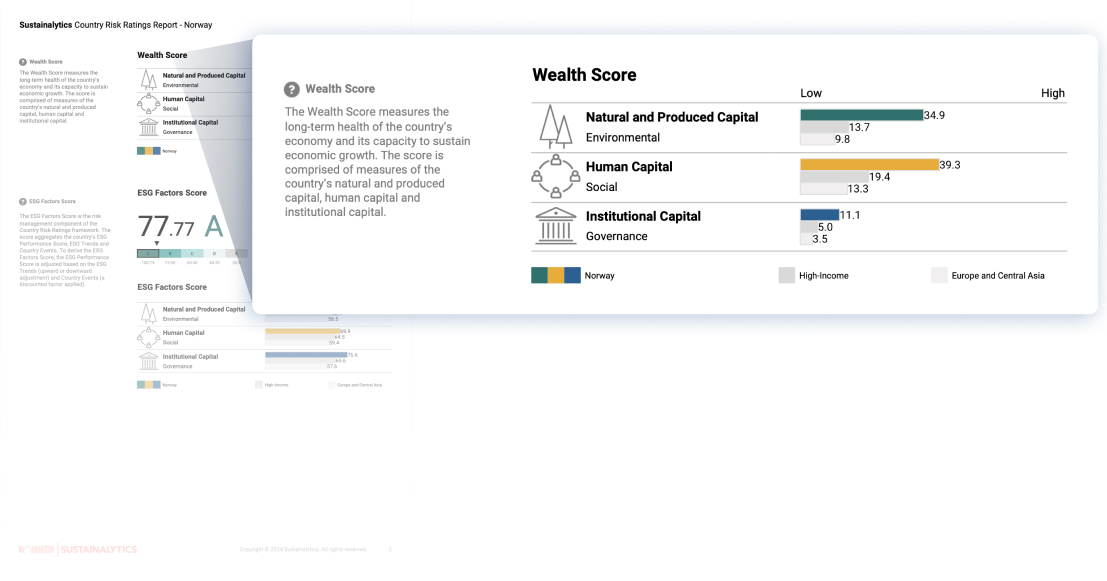

The Country Risk Ratings assess a nation’s ability to manage its wealth sustainably through three main capitals: Natural & Produced Capital, Human Capital, and Institutional Capital. This approach is built on the World Bank’s concept of capitals and incorporates ESG factors to evaluate wealth management. Our three-step framework includes:

We evaluate a country’s wealth by examining its three Capitals:

- Natural & Produced Capital

- Human Capital

- Institutional Capital

We analyze how effectively a country utilizes its capitals, identifying risks using ESG pillars and more than 35 ESG performance metrics and data trends. The focus of the three ESG pillars are:

- Environment Pillar: Energy, climate change readiness, resource use, and governance.

- Social Pillar: Basic needs, health and well-being, equity, and opportunities.

- Governance Pillar: Institutional strength, regulations, rights, and freedoms.

We combine our wealth and ESG assessments to generate ratings and scores at the indicator, capital, and country level. Our quantitative research covers all Country Event severity categories, and our qualitative research focuses on events classified as significant, high and severe.

Modular and Flexible Integration into Investment AnalysisThe modular nature of the ratings provides flexibility, enabling analysis of a sovereign’s ESG profile on its own or combined with wealth risks for a comprehensive view of ESG risk from short-term to long-term perspectives. The product covers 164 countries, offering data points in scores, letter grades, and indicator breakdowns, representing 97% of all issuable sovereign debt. | |

Curated and Granular InsightsOur ratings are highly correlated with industry standards, yet our curated data points focus on the most impactful insights. The scoring framework distinguishes true leaders and laggards, based on demonstrated performance rather than arbitrary metrics. Our approach ensures clear assessment of risk management, offering a balanced view regardless of wealth and income disparities. | |

Full Integration for Comprehensive Portfolio AnalysisDesigned to complement our ESG Risk Ratings, this product facilitates complete portfolio ESG risk exposure analysis. | |

Transparent, Simple, In-House MethodologyBuilt on in-house research and methodology, our ratings provide transparency and consistency. The Country Event Classification system offers a cohesive assessment of risks through a streamlined approach. | |

Qualitative Event Analysis Across All Severity LevelsOur coverage includes over 300 events, with qualitative analysis that overlays ongoing material events, helping to identify the impact of diverse risk factors. | |

Dynamic Ratings Reflecting Real-Time EventsUpdated quarterly, the ratings offer a forward-looking perspective, enabling clients to track evolving risks. Our analysts continuously adjust ratings in response to critical events, keeping you informed on the impact of news and developments. |

Discover more about our Country Risk Ratings

Holistic Macroeconomic Analysis

Combine ESG data with wealth and economic indicators for a well-rounded assessment of a country’s economic health and associated risks.

Proactive Risk Anticipation

Utilize forward-looking Country Risk Ratings to identify and manage emerging risks. Regular updates on country-specific events support proactive decision-making.

Investment Screening

Leverage scores, ESG letter grades, and risk categories to screen portfolios for exposure to high and severe-risk countries.

Enhanced Portfolio Analysis & Reporting

Integrate Sustainalytics’ ESG Risk Ratings for corporate and sovereign bonds to perform comprehensive risk assessments. This unified approach bolsters transparency and strengthens fixed income portfolio management.

ESG Integration in Credit Analysis

Enhance traditional credit assessments by evaluating a country’s wealth and its management through an ESG perspective, uncovering risks often missed by standard credit ratings.

Countries are categorized across five risk levels: Negligible, Low, Medium, High, Severe.

Risk Scores are broken down by different types of capital: Natural and Produced, Human, and Institutional.

See how Country Risk Ratings evolve over time.

See Country Risk Ratings broken down by indicators.

| Country Screening & Sanctions ResearchScreen countries for compliance to international treaties and agreements as well as UN, US and EU sanctions. Learn More ❯ |

| ESG Risk RatingsEmpower your investment decisions with a consistent approach to assess material ESG risks. Learn More ❯ |

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.