Monday’s rout of the global equity market has left investors reeling. Major benchmarks including the S&P 500, FTSE 100 and the DAX were down well over 7%. In Canada, the commodities heavy TSX Composite shed over 10%.

Monday’s sell off was largely driven by two factors: mounting concern about the economic impact of coronavirus, and the steep decline in oil prices following the disintegration of the alliance between OPEC and Russia over the weekend. Oil futures were down a remarkable 20% on Monday, among the largest single day drops in history.

Equity and oil prices are staging a modest comeback as of the time of writing, although index levels are still well down for the year.

While it is impossible to say where markets will go from here, we think there are steps investors can take now to better understand the responsiveness of their portfolio companies to coronavirus-related risks. Namely, we believe ESG data related to supply chain and health and safety management systems will offer particularly salient insights for equity strategists in the coming months.

But before strategizing around coronavirus, we first deliver some quick thoughts on what many analysts believe was the primary driver of the new Black Monday – the sudden collapse in oil prices.

Do not push the panic button on renewable energy

Low oil prices are sometimes thought to be bad for renewable energy companies but we would argue it really depends. We do not believe a period of sustained low oil prices, which is a genuinely possible future scenario, will damage the growth prospects of solar or wind. This is partly because oil and solar/wind compete in different markets: oil is primarily used in transportation, whereas solar and wind are used in electricity generation. Oil accounts for less than 5 percent of global electricity supply.[i]

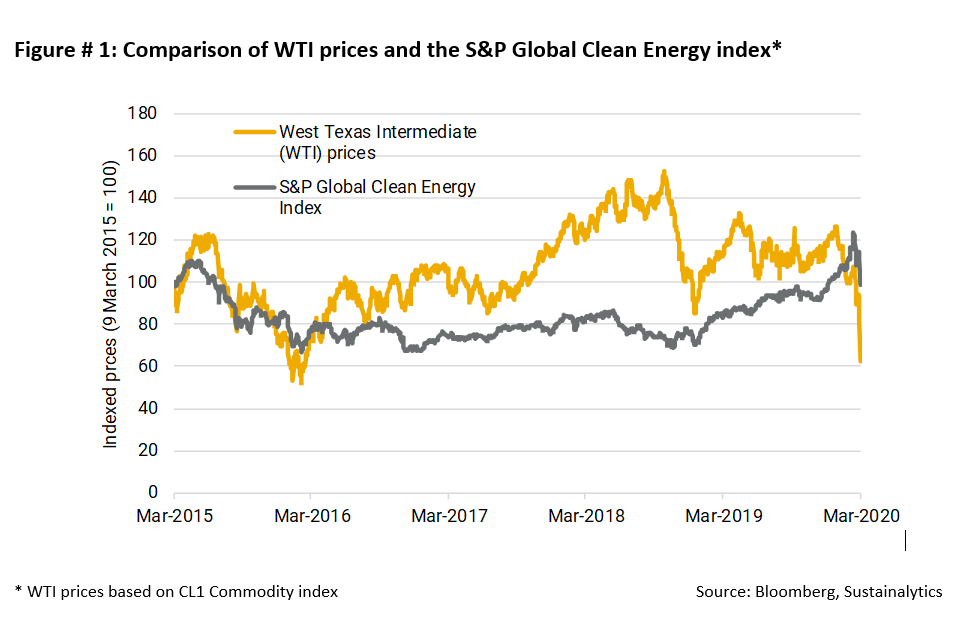

As shown in the chart below, oil prices and the shares of renewable energy firms have been largely unrelated over the past five years, with an r-squared of 0.03. Although both dropped precipitously on Monday, the chart also shows periods where oil prices and the index diverged.

One part of the renewable energy sector that is meaningfully affected by oil prices is biomass-based diesel, and investors can generally expect that a period of low oil prices would curtail demand in this segment.

Solar and wind are sensitive to shifts in gas prices, but oil and gas prices do not always move in the same direction. In fact, gas prices in the US were up almost 3% on Monday.

There is an additional element to consider when contemplating the future of renewable energy in a potential low oil price environment. The sector has come to be supported by a broad range of government policies and incentives, and large volumes of institutional assets. It is also seen as a cornerstone of the international community’s strategy to meet the ambitious climate goals spelled out in the Paris Agreement.

We do not believe that a period of sustained low oil prices would trigger a relaxation in renewable energy support or investor interest, or meaningfully threaten the long-term fundamentals of the sector.

Coronavirus leads management teams to better understand their supply chains

Executive teams closely track their tier 1 suppliers, but many are unaware of the full extent of their global supply chain. Bain & Co recently estimated that up to 60% of executives have no knowledge of the items in their supply chain beyond the tier 1 level.[ii]

With supply chains in China and Italy already disrupted, we believe the coronavirus will lead management teams to better understand the dependencies of their supply chains and generally improve their supply chain management going forward.

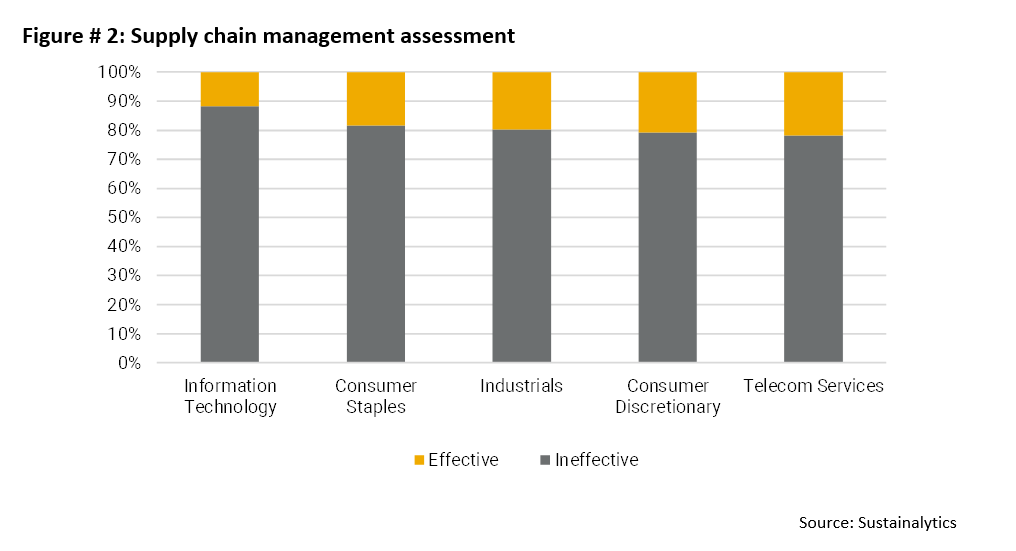

Hallmarks of an effective supply chain management system include board-level responsibility for supply chain management, engagement with suppliers on ESG issues and the use of targets to drive performance, among other factors. As shown in the chart below, which is based on Sustainalytics’ Supply Chain Management indicator, companies have a long way to go in their supply chain management practices.

In the Information Technology sector, which relies heavily on components produced in China, only 12% of companies demonstrate an effective supply chain management system. Top firms include Apple, HP and Intel. Performance is best in the Telcom Services sector, although even here effective strategies are not particularly common. Just under one-quarter (22%) of Telecom Services firms have an effective approach to supply chain management, including Vodafone and Telenor.

We expect executive teams to double down on understanding their supply chains in the months to come, and investors to reprioritize supply chain issues in their engagements.

Companies deploy widespread coronavirus prevention measures

Many companies have acted quickly to contain the transmission of coronavirus, and we expect more robust measures in the weeks ahead.

We have already seen significant announcements, such as forced work-from-home for staff, business travel restrictions and conference cancellations.

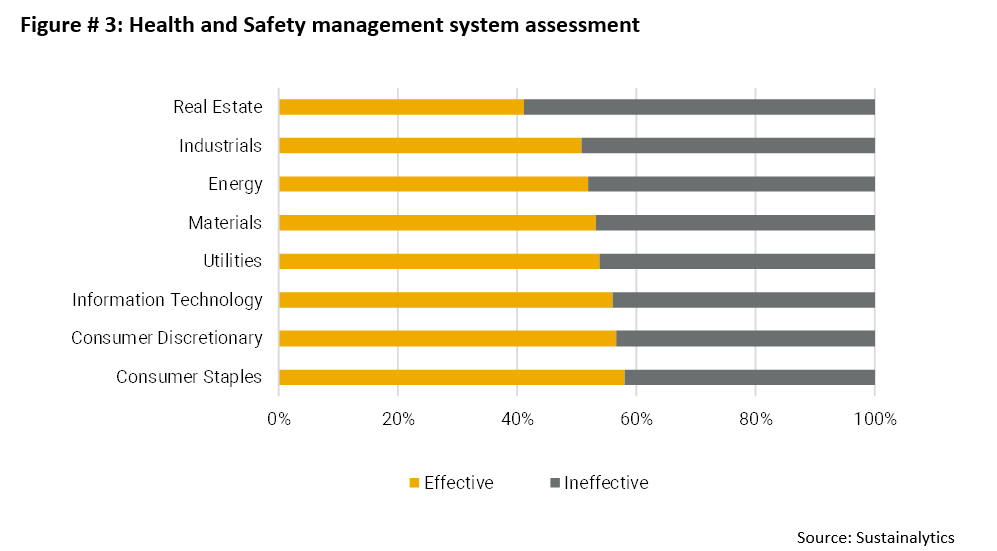

We believe that companies with advanced health and safety management infrastructure, such as emergency preparedness procedures, audits and managerial responsibility for health and safety issues, may be better able to efficiently implement coronavirus risk measures going forward.

These and other characteristics are captured in Sustainalytics’ Health and Safety Management System indicator. As shown below, some sectors are better prepared than others to manage health and safety risk. Over half (58%) of Consumer Staples companies, for instance, have what we consider to be an effective health and safety management system. Top performers include Danone and Pernod Ricard. By contrast, only 41% of Real Estate firms have an effective system in place, including Singapore’s City Developments.

While the existence of an effective health and safety management system does not guarantee the smooth delivery of coronavirus-related programmes, it certainly cannot hurt.

We expect management teams to significantly boost health and safety management budgets as a direct result of coronavirus, and investors to increasingly target health and safety preparedness in their engagements.

To recap, Monday’s collapse in oil prices may or may not last, but we do not believe it will alter the long-term fundamentals of the renewable energy sector. We think mounting concerns over a coronavirus-driven economic slowdown could trigger a wholesale reassessment of risk in 2020. We believe it will be increasingly important for investors to know whether or not their portfolio companies are effectively managing supply chain and health and safety-related risks. The analysis presented in this blogpost is a starting point for investors and executive teams in thinking about these issues.

Sources:

[i] https://www.mckinsey.com/industries/oil-and-gas/our-insights/lower-oil-prices-but-more-renewables-whats-going-on

[ii] https://www.ft.com/content/be05b46a-5fa9-11ea-b0ab-339c2307bcd4

Recent Content

Six Best Practices Followed by Industries Leading the Low Carbon Transition

In this article, we take a closer look at the leading industries under the Morningstar Sustainalytics Low Carbon Transition Rating (LCTR) and examine the best practices that have allowed them to emerge as leaders in managing their climate risk.

Navigating the EU Regulation on Deforestation-Free Products: 5 Key EUDR Questions Answered About Company Readiness and Investor Risk

The EUDR comes into effect in December 2024, marking an important step in tackling deforestation. In this article, we answer five key questions who the EUDR applies to, how companies are meeting the requirements, and the risks non-compliance poses to both companies and investors

-5-key-questions-answered-about-company-readiness-and-investor-risk.tmb-thumbnl_rc.jpg?Culture=en&sfvrsn=ee2857a6_2)