Over the last decade, portfolio managers worldwide have been increasingly convinced that incorporating environmental, social, and governance (ESG) criteria into investment decisions could provide better risk-adjusted returns. As a result, responsible investing, has moved from a niche activity to the mainstream. As more capital shifts to ESG products, there have been discussions regarding the risk of an ESG bubble as stocks with good ESG scores have enjoyed price appreciation and sometimes go beyond fundamentals[i].

In our recently published Portfolio Research paper “ESG in the COVID-19 recovery”, we developed a unique ESG at a Reasonable Price (ESGarp) model to identify the price attractiveness of various global markets in terms of their ESG scores and P/E ratios. One of the key findings of that paper was that “Chinese equities are distinguished by a relatively unattractive combination of high ESG risk levels and high P/E ratios.”

In this article, we dive deeper into the Chinese market to discuss the main reasons for China’s lower ESGarp scores and identify various related investment risks and opportunities.

High ESG risk level contributes to lower ESGarp scores

With a similar philosophy of a GARP-style investment strategy, the ESGarp score based on ESG risk score and P/E ratio, is a single score assigned for every company/sector/country. This approach is intended to pinpoint markets where investors have the greatest probability of finding stocks with attractive ESG scores that also trade at a reasonable P/E ratio relative to global peers. The scores range from a maximum high of 100 to a minimum low of -100.

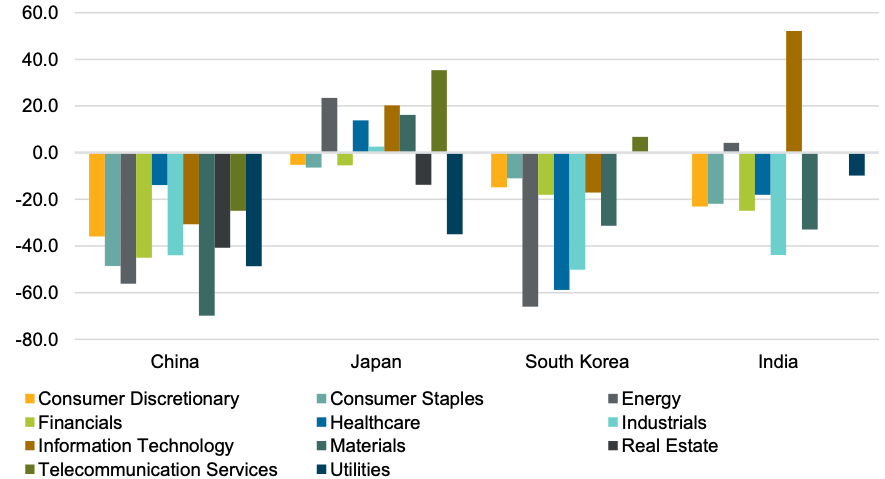

Our findings show that while Asian markets generally do not earn high ESGarp scores compared to most developed markets, Chinese equities feature negative scores across all sectors. Notably, China’s Materials and Energy sectors score worst at less than -50, while its Healthcare sector features a relatively better ESGarp score of -14.

Exhibit 1: ESGarp Scores of Major Asian Markets by Sector

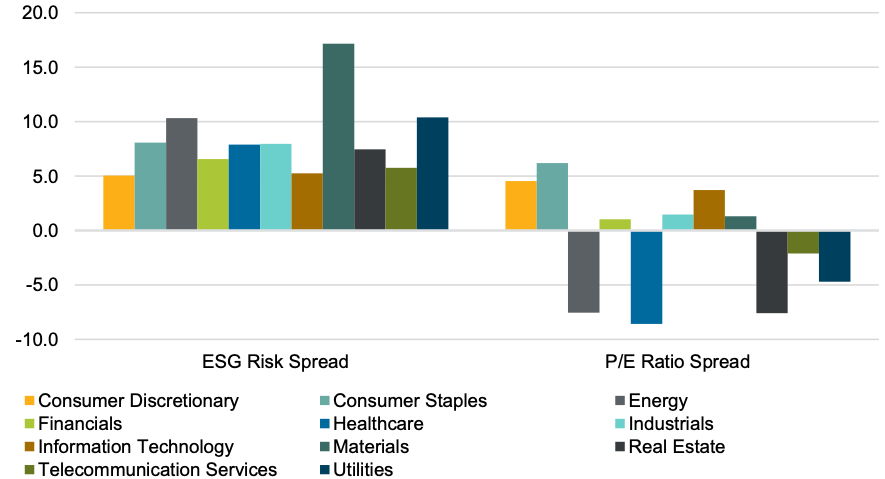

Exhibit 2 breaks down the Chinese equities’ scores further. The ESG Risk Spread measures the difference between the average ESG Risk Rating scores of each sector and their global peers, while the P/E Ratio Spread measures the corresponding difference for P/E ratios. It can be seen that with the exception of Consumer Discretionary, Consumer Staples and Information Technology, where both high ESG risk and high P/E ratios contribute to a negative ESGarp score, the ESGarp scores of most sectors are primarily dragged down by their high ESG risk level. With some sectors, such as Energy, Healthcare and Real Estate, even a P/E ratio significantly lower than the global average cannot offset the impact of their high ESG risk level. If we look at the Chinese market holistically, the high ESG risk is the dominant reason for China’s poor ESGarp score.

Exhibit 2: Breakdown of ESGarp Scores by Sector

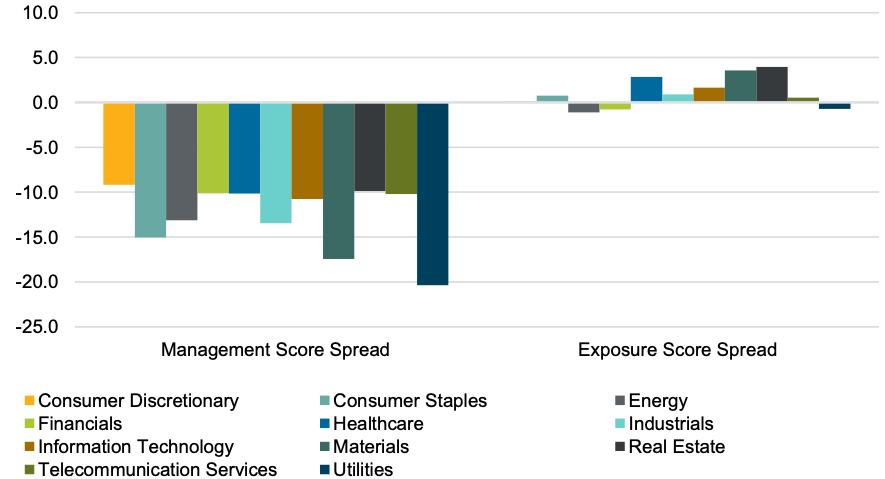

Sustainalytics’ ESG Risk Rating emphasises materiality, requiring the assessment of two dimensions: ESG risk exposure and ESG risk management. Exposure reflects the extent to which a company is exposed to material ESG risks. Whereas the management component incorporates company commitments and/or actions that demonstrate how the company approaches and handles ESG issues.

In Exhibit 3, the Management Score Spread and Exposure Score Spread measure sectors’ deviation from their global peer averages, respectively. Here we can see that the higher ESG risk level of Chinese equities is mainly due to their weaker management scores.

Exhibit 3: Weaker Management Scores Contribute to Higher ESG Risk Levels

In our view, the ESG management gap is driven by two main factors: relatively inadequate disclosure and a lack of focus on the management of material ESG issues.

Chinese company disclosure on ESG issues remains relatively limited compared to industry peers. According to the report ESG Integration in China in 2019 by the CFA Institute, of more than 3,000 Chinese listed companies, less than half disclose ESG factors[ii]. Despite both being members of the Sustainable Stock Exchange Initiative, China’s two stock exchanges, Shanghai Stock Exchange and Shenzhen Stock Exchange, rank 41 and 44 respectively of 47 stock exchanges worldwide, in the sustainability disclosure performance ranking 2019 by Corporate Knights[iii].

Additionally, most Chinese companies still seem more focused on philanthropic activities and put relatively less effort into managing the material ESG risks and opportunities of their operations, products, and business models. While philanthropic activities are undoubtedly positive, material ESG issues are more relevant to a company’s long-term sustainable development strategy. For example, few Chinese companies discuss the impact of their operations on local communities, or the measures taken to mitigate the risks their products and services may pose to customers. Lack of information on the management of some of the most material ESG risks and opportunities drags down the average overall ESG performance of Chinese companies in our rating process.

Are Chinese companies with lower ESG risk levels trading at a premium?

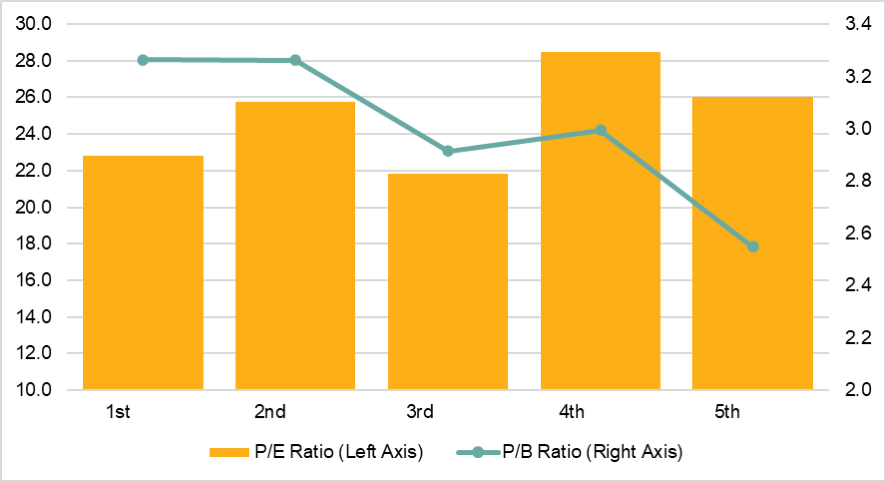

As Exhibit 4 shows, when comparing the valuation metrics of different ESG Risk Rating quintiles (from low risk to high risk) within the Chinese market, we see mixed results. Chinese companies with lower ESG risk levels are only trading at a minor premium in terms of P/B ratio, with no evident premium in terms of P/E ratio. Companies in the 4th and 5th quintiles (the highest ESG risk groups) are even trading at a P/E premium.

Exhibit 4: Average P/E and P/B ratio by ESG Risk Rating quintiles

Unlike in most developed markets, where institutional investors are the dominant force, in the China equity market, retail investors hold more than half of the free-float shares and represent up to 90% of the market transaction value[iv]. Chinese retail investors have long favoured small-cap stocks, which in general have a lower ESG performance compared to large-cap peers, due to weaker management systems and inadequate disclosure practices. Chinese investors’ systematic bias towards small-cap stocks might partly contribute to the mixed result, as small-cap Chinese equities are enjoying a relatively high P/E ratio in China.

Looking forward

With increasing awareness of ESG in China and the opening up of China’s capital market to international investors, we expect Chinese companies to experience increased pressure to improve their ESG risk management in the coming years. Mandatory reporting requirements, government intervention, increasing management awareness of ESG, and shifting consumer behaviour will be strong drivers for change. For example, The Guidelines for Establishing the Green Financial System[v], published in 2016 by the People’s Bank of China, together with several ministries and commissions, established a timeline according to which all listed companies must disclose environmental information by 2020. An enhancement in ESG management might improve China’s ESGarp score in the future.

Additionally, global ESG drivers from outside of China could also push Chinese companies to improve the management of their material ESG risks. For example, the adoption of the EU Taxonomy may result in downstream impacts from those European companies looking to improve their supply chain. We expect this will result in an increase in ESG requirements for Chinese companies to meet the needs of their clientele. Similar impacts can also be anticipated from the UK Stewardship Code[vi] or the Australian Modern Slavery Act[vii].

Finally, driven by Chinese regulation and financial market reform, institutional investors in China are increasingly embracing the concept of responsible investing. Over the past two years, the number of PRI signatories in China has increased from seven to 37, with most of these new signatories being asset managers and services providers[viii]. As more and more investors favour companies with lower ESG risk, we may see ESG leaders trade at a more obvious premium, which provides a potential opportunity to boost portfolio return.

Sources:

[i] Temple-Wes, P. (21.02.20), “‘Monstrous’ run for responsible stocks stokes fears of a bubble”, Financial Times, accessed (30.09.20) at https://www.ft.com/content/73765d6c-5402-11ea-90ad-25e377c0ee1f

[ii] CFA Institute (2019), “ESG Integration in China: Guidance and Case Studies”, CFA Institute, accessed (30.09.20) at https://www.cfainstitute.org/-/media/documents/survey/esg-integration-china.ashx

[iii] Corporate Knights (2019), “2019 World Stock Exchanges”, Corporate Knights, accessed (30.09.20) at https://www.corporateknights.com/reports/2019-world-stock-exchanges/

[iv] Dong, DX. (31.07.19), “A-share institutional ownership rises, trading still dominated by retail investors”, Takungpao, accessed (30.09.20) at http://www.takungpao.com/finance/236134/2019/0731/328423.html

[v] The People’s Bank of China (01.09.16), “The People’s Bank of China and six other agencies jointly issue’Guidelines for Establishing the Green Financial System’”, The People’s Bank of China, accessed (30.09.20) at http://www.pbc.gov.cn/english/130721/3131759/index.html

[vi] Financial Reporting Council (2020), “UK Stewardship Code”, Financial Reporting Council, accessed (30.09.20) at https://www.frc.org.uk/investors/uk-stewardship-code

[vii] Australian Government (2018), “Modern Slavery Act 2018”, Federal Register of Legislation, accessed (30.09.20) at https://www.legislation.gov.au/Details/C2018A00153

[viii] Pirovska, M. (18.03.2020), “ESG and alpha: the mainstream argument for ESG integration in China”, PRI, accessed (30.09.20) at https://www.unpri.org/pri-blogs/esg-and-alpha-the-mainstream-argument-for-esg-integration-in-china/5591.article#:~:text=Over%20the%20past%20two%20years,the%20efficacy%20of%20ESG%20investment

Recent Content

Six Best Practices Followed by Industries Leading the Low Carbon Transition

In this article, we take a closer look at the leading industries under the Morningstar Sustainalytics Low Carbon Transition Rating (LCTR) and examine the best practices that have allowed them to emerge as leaders in managing their climate risk.

Navigating the EU Regulation on Deforestation-Free Products: 5 Key EUDR Questions Answered About Company Readiness and Investor Risk

The EUDR comes into effect in December 2024, marking an important step in tackling deforestation. In this article, we answer five key questions who the EUDR applies to, how companies are meeting the requirements, and the risks non-compliance poses to both companies and investors

Child Labor in Cocoa Supply Chains: Unveiling the Layers of Human Rights Challenges

Child labor remains a persistent issue in the cocoa supply chain. So can major food brands do to stop it? Discover the steps companies can take to address the issue and ways investors can engage with companies to mitigate it.

-5-key-questions-answered-about-company-readiness-and-investor-risk.tmb-thumbnl_rc.jpg?Culture=en&sfvrsn=ee2857a6_2)