As environmental, social and corporate governance (ESG) issues continue to capture substantial attention from both society and regulators, investors are increasingly integrating ESG considerations into investment and risk processes. Investors need comprehensive and expansive ESG data that covers different markets and asset classes to ensure consistent application of ESG considerations across diversified investments and holistically understand portfolio ESG risk exposure.

Morningstar Sustainalytics has announced an expansion of its ESG Risk Ratings coverage to enable material ESG risk assessment across more asset classes and regions. With a nearly 30 percent increase in comprehensive issuer ratings, the firm’s coverage universe includes more than 16,300 analyst-based ESG Risk Ratings, spanning public equity, fixed-income, and privately held companies. Additionally, the expanded research universe now covers more Chinese companies listed in Shanghai and Shenzhen, which are predominant regional contributors in emerging market indices.

Now, investors can leverage Morningstar Sustainalytics’ expanded ESG Risk Ratings to inform security selection across an even wider array of issuers and gain a more holistic perspective when assessing diversified portfolios.

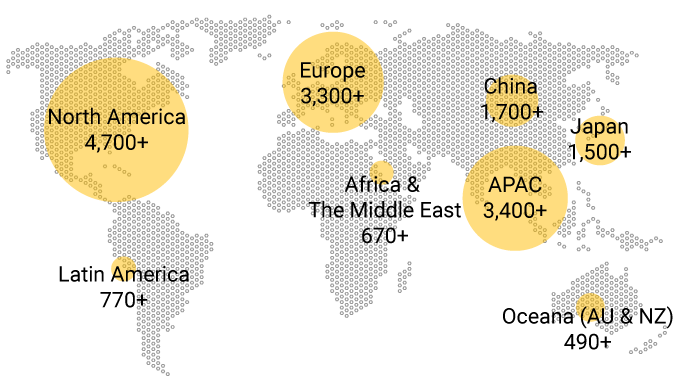

Global Coverage

In response to client demand and shifts in investors geographical focus, the expanded universe has strengthened coverage of more than 6,600 companies in APAC, 4,700 in the US and Canada, 3,300 in Europe, and 1,500 around other regions.

The increased coverage across all regions including Asia/Pacific, Latin America, and Africa/Middle East enables investors to construct a balanced portfolio as well as holistically understand portfolio ESG risk exposure.

16,300+ Companies Covered

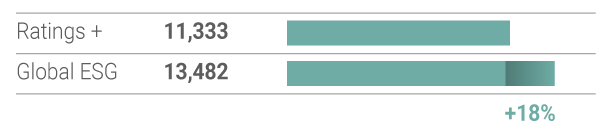

Distribution by Markets

The expanded universe covers 5,400 companies that are based in emerging and frontier markets. This provides asset management firms the ability to diversify their portfolio and flexibility in security selection across different markets.

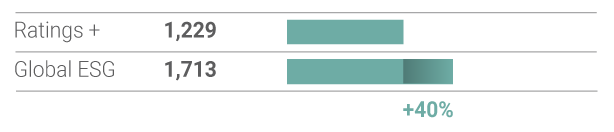

Fixed Income Issuers

Sustainable Fixed Income investing has seen impressive growth over the past few years. In the frame of the universe, fixed income coverage tracks major Fixed Income Indices and allows investors security selection across a wide array of issuers. This enables a more robust ability to identify ESG risk and opportunity while providing a more holistic view in building and reporting upon well-diversified portfolios.

Mainland China

In recent years, China has sought to make it easier for foreign investors to invest in its companies, leading to increased interest in ESG Ratings of Chinese firms. Sustainalytics provides ESG Risk Ratings for more than 1,700 companies that offer A and B shares listed on the Shanghai (SSE) and Shenzhen (SZSE) Stock Exchange to support investors focused on the Chinese securities market.

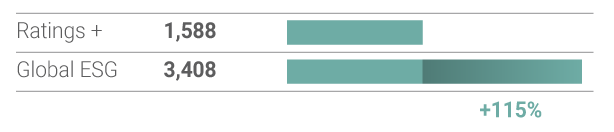

Private Issuers

Investors focusing on private companies are also increasingly looking to integrate ESG considerations into their risk management processes. In response to this demand, the number of private companies covered within new universe was increased by 115% and made up 3,400 companies in total. The largest increase in Private Issuers exists in North America, with a set of nearly 1,300 companies.

The numbers are as of Q3 2022 and are subject to quarterly rebalancing.