Sustainalytics Insight: What is Biodiversity Loss & Why Does it Matter for Investors?

Global investors should take a closer look at biodiversity loss and the potential risk it poses to their portfolio. Investing in companies facing high levels of biodiversity risk could have a material effect on long-term portfolio performance, according to new research from Morningstar Sustainalytics.

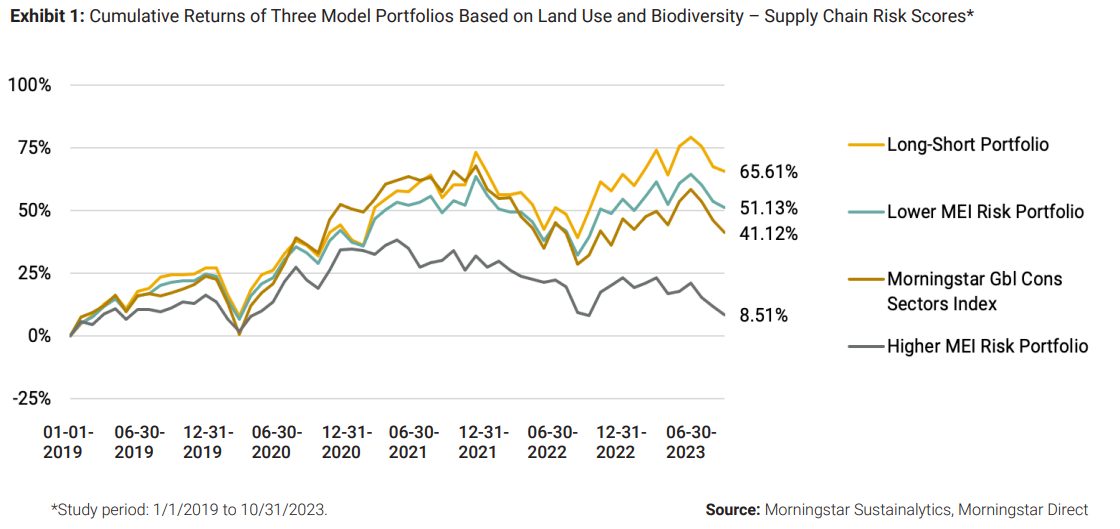

The new study, by Morningstar Sustainalytics ESG Research Associate Director Martin Vezer, PhD, found that a model portfolio investing in Consumer Goods stocks with lower MEI (Material ESG Issue) risk scores delivered a cumulative total return of 51.1% over the past five years as compared to an 8.5% return for a similar yet higher MEI risk portfolio.

Martin Vezer, ESG Research Associate Director, Morningstar Sustainalytics, said:

“Investors have grown increasingly interested in addressing portfolio risks linked to biodiversity loss, which can stem from holding stocks in companies involved in land use changes. Such activities have led to operational and supply chain disruptions, reputational damage and systemic risks. According to our research, Automobiles, Food Retailers, Textile & Apparel and Household Products companies have a relatively high proportion of companies involved in controversies associated with biodiversity loss through their supply chains. Deforestation – a major driver of biodiversity loss – is associated with a swath of environmental and social problems such as climate change, landgrabs, violence, corruption and other criminal activities. Our research can help investors better understand how these factors may affect global equity portfolios.”

To speak in more detail with Martin, reach out to Tim Benedict at [email protected] or (203) 339-1912.

Media Contacts