Understanding the depth of exposure and management of material ESG issues within your portfolio is crucial for making informed investment decisions.

Morningstar Sustainalytics' ESG Risk Ratings provides a multi-dimensional assessment of a company's exposure to industry-specific material ESG risks and its management of those risks. Our transparent methodology categorizes risks into five severity levels, offering an absolute measure of risk.

About ESG Risk Ratings

What are the ESG Risk Ratings?

How do the ESG Risk Ratings work?

What are Material ESG Issues?

Morningstar Sustainalytics is a trusted and reliable choice for investors who are looking for a streamlined methodology in assessing financially material ESG issues.

About Our Framework

Key Features

Two-Dimensional Materiality Framework

Extensive Coverage

Three Central Building Blocks

Flexible Accessibility

Five Risk Levels

AI in our information value chain

Absolute Measure of Risk

Looking for underlying ESG data to strengthen your ESG processes?

Use Cases

ESG Risk Ratings meticulously assesses significant Environmental, Social, and Governance (ESG) risks, offering extensive coverage of large and mid-cap companies across equity and fixed income strategies. Morningstar Sustainalytics research serves a wide array of purposes for asset managers, asset owners and banks.

Strategy Definition

- Establish a clear ESG policy for organization-wide integration.

- Gain key insights for manager selection and evaluation.

- Align investments with client values for sustainable portfolios.

- Integrate ESG into decision-making to manage risks effectively.

- Access insights for thought leadership on material ESG issues.

Investment Selection and Construction

- Integrate ESG criteria into asset allocation, considering impact and governance.

- Construct portfolios with strong ESG performers, using ratings or specific ESG issues.

- Incorporate multi-dimensional ESG risk scores into valuation models.

- Maintain sector weights through best-in-class tilting.

- Identify ESG leaders and laggards for engagement prioritization.

- Utilize historical data for back testing support.

Portfolio Monitoring and Reporting

- Utilize ESG Risk Ratings for portfolio-level manager evaluation across asset classes. Morningstar Sustainability ratings support fund comparison.

- Conduct ESG scenario analysis -- identify potential impacts and prepare for future risks and opportunities.

- Analyze sustainability factors' impact on performance and share ESG insights with beneficiaries.

- Customize ESG reporting to meet stakeholders' needs.

- Benchmark and compare ESG performance against industry standards globally.

Active Ownership

- Prioritize engagement based on company ESG performance.

- Engage on specific ESG issues using ESG Risk Ratings.

- Use ESG Risk Ratings for informed proxy voting decisions.

- Set ESG targets by benchmarking against peers.

- Enhance transparency in engagement and voting practices.

Regulatory and After-Sale Reporting

- Ensure alignment with ESG regulatory frameworks.

- Disclose ESG practices using ESG Risk Ratings.

- Provide stakeholders with transparent ESG information.

- Monitor compliance and address gaps over time.

- Leverage our Score Change Log to understand score changes over time.

Report Insights

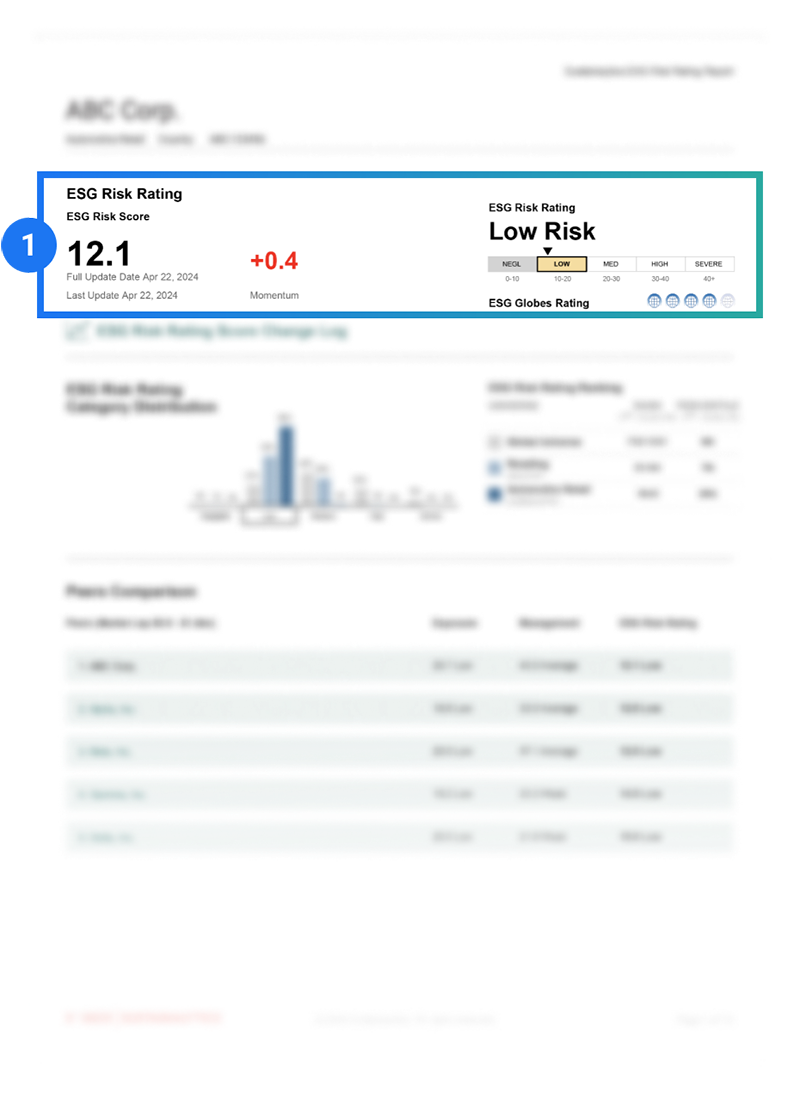

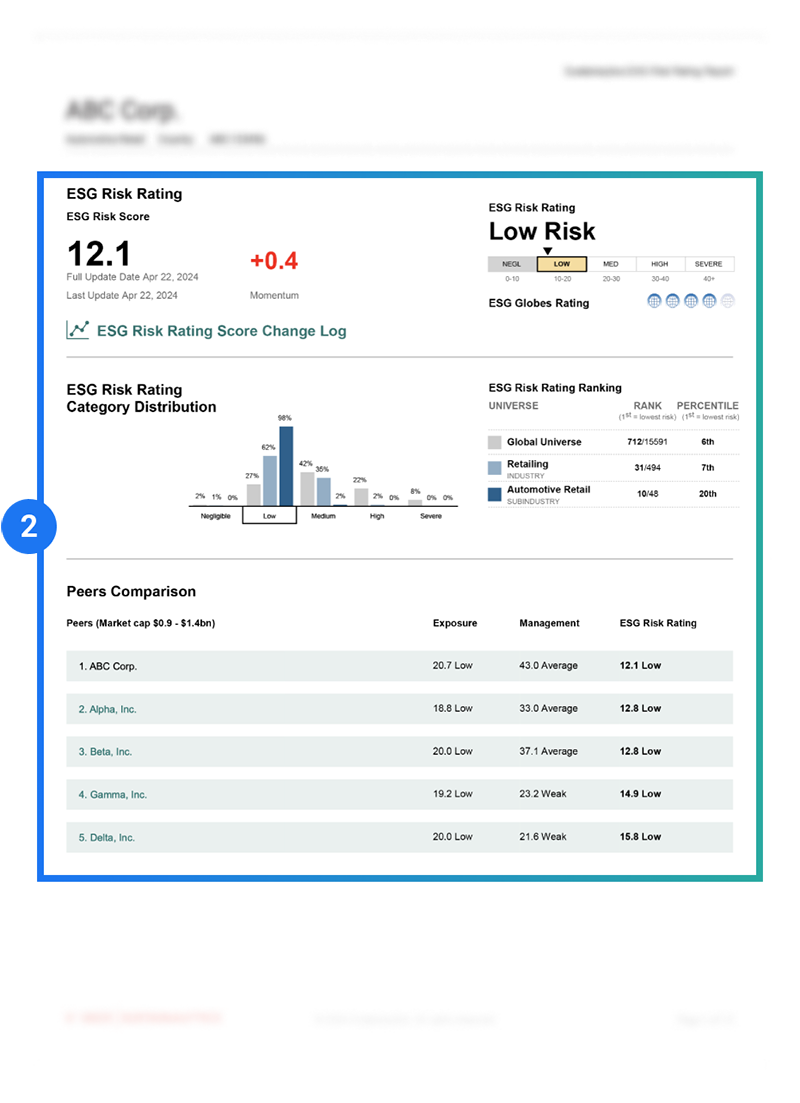

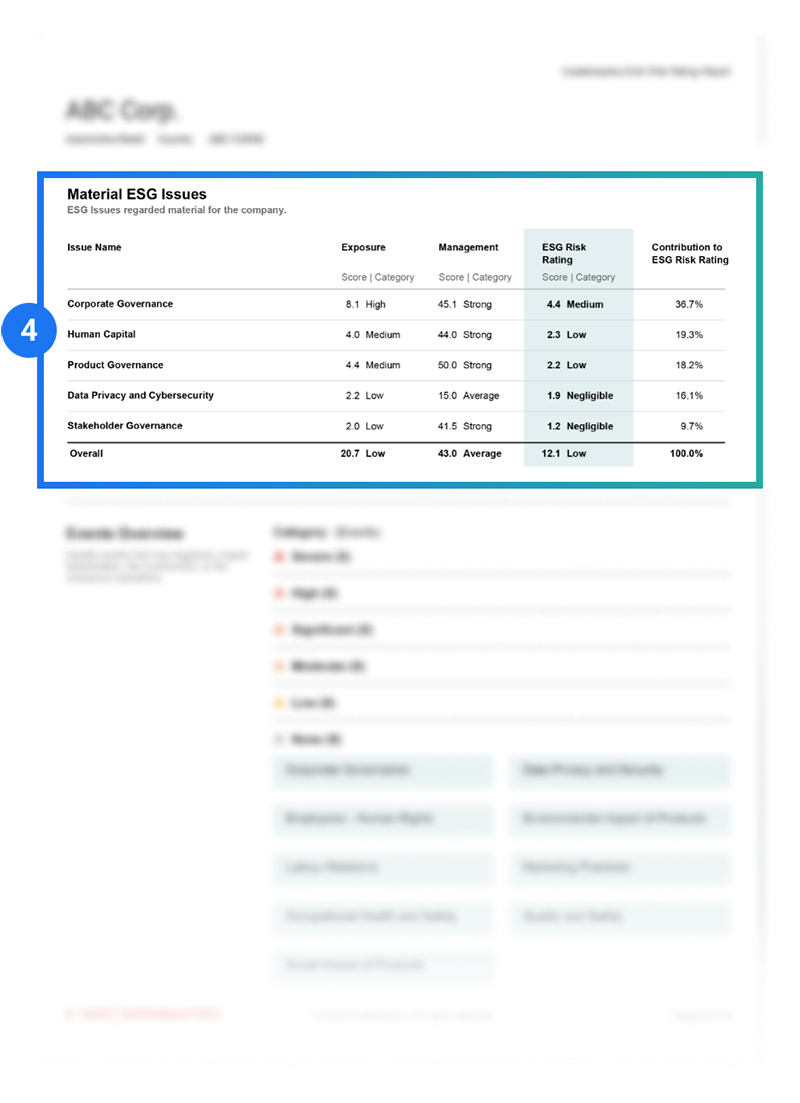

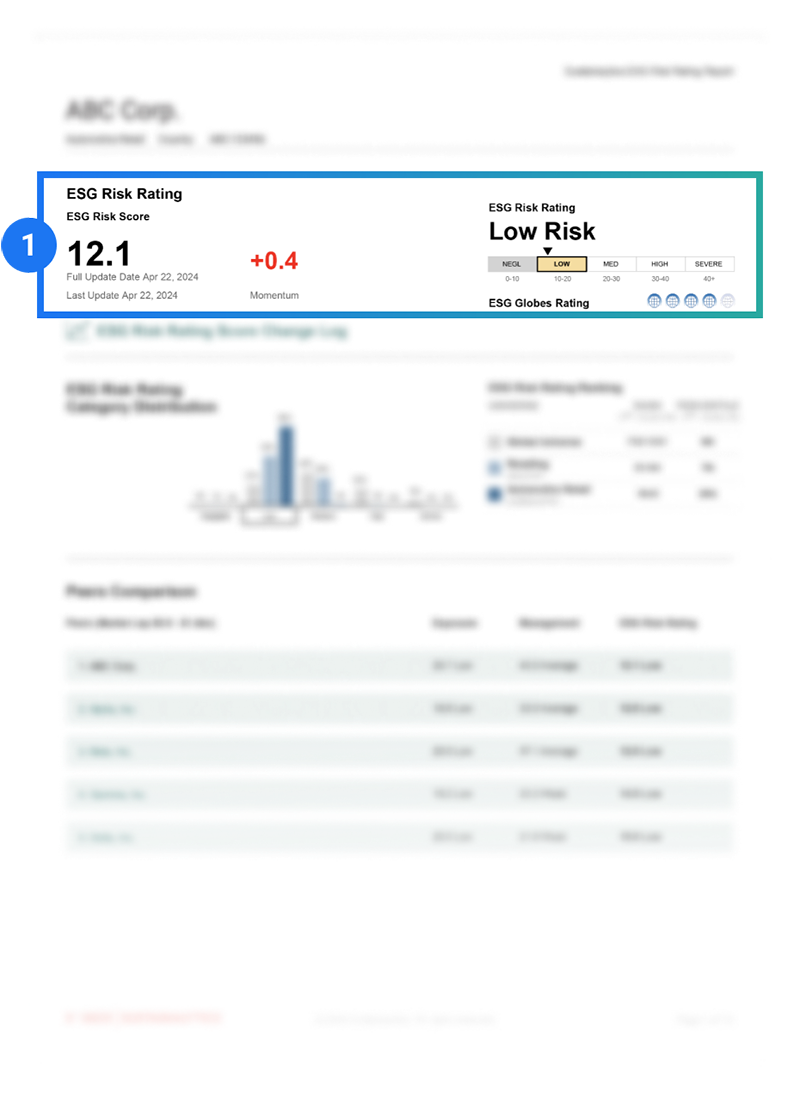

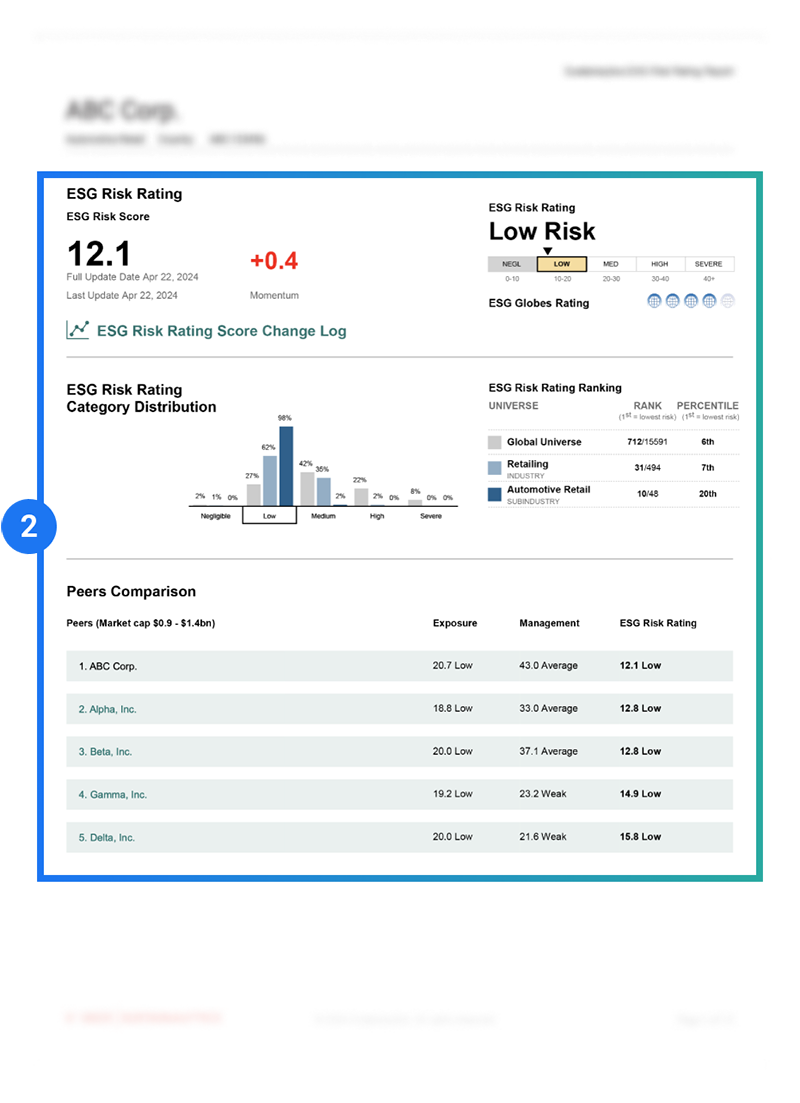

Company ratings are categorized across five risk levels: negligible, low, medium, high, and severe and represented by our ESG Globes icons.

A company’s risk is measured against its industry peers and against the global universe.

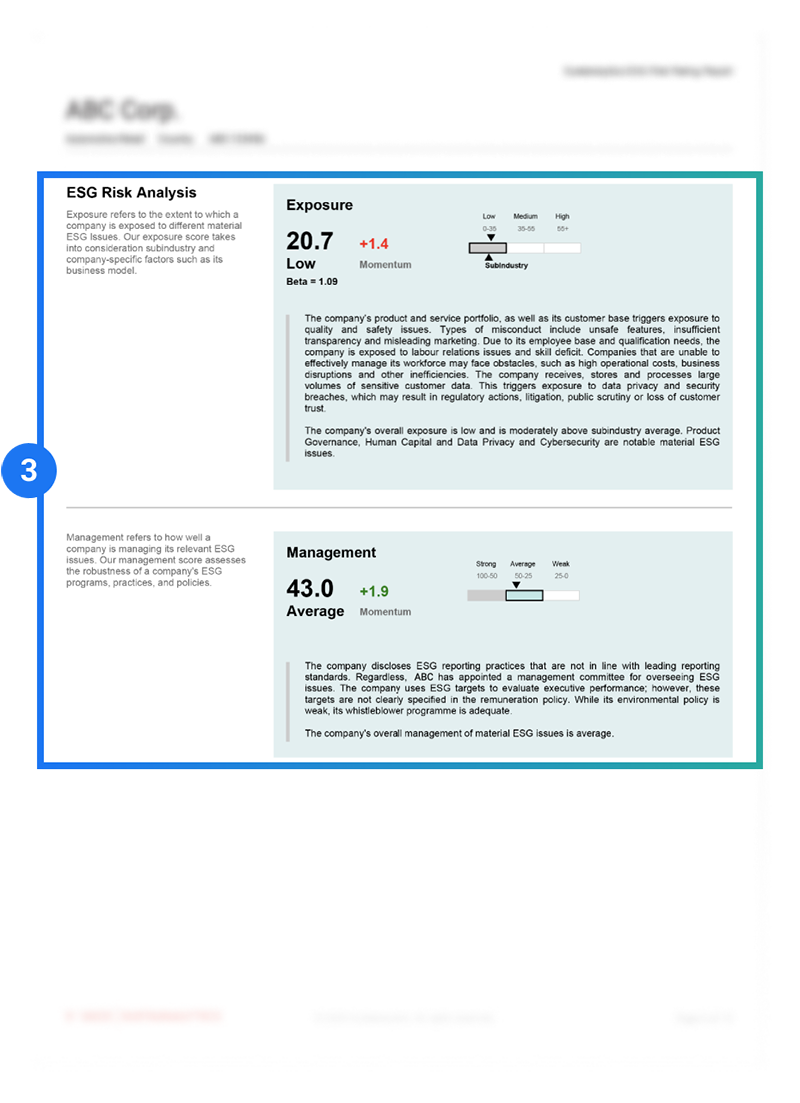

Qualitative analysis, underpinned by analyst insights and quantitative data, describes the reasons why a company is exposed to specific material ESG issues and explains how well a company is managing these issues.

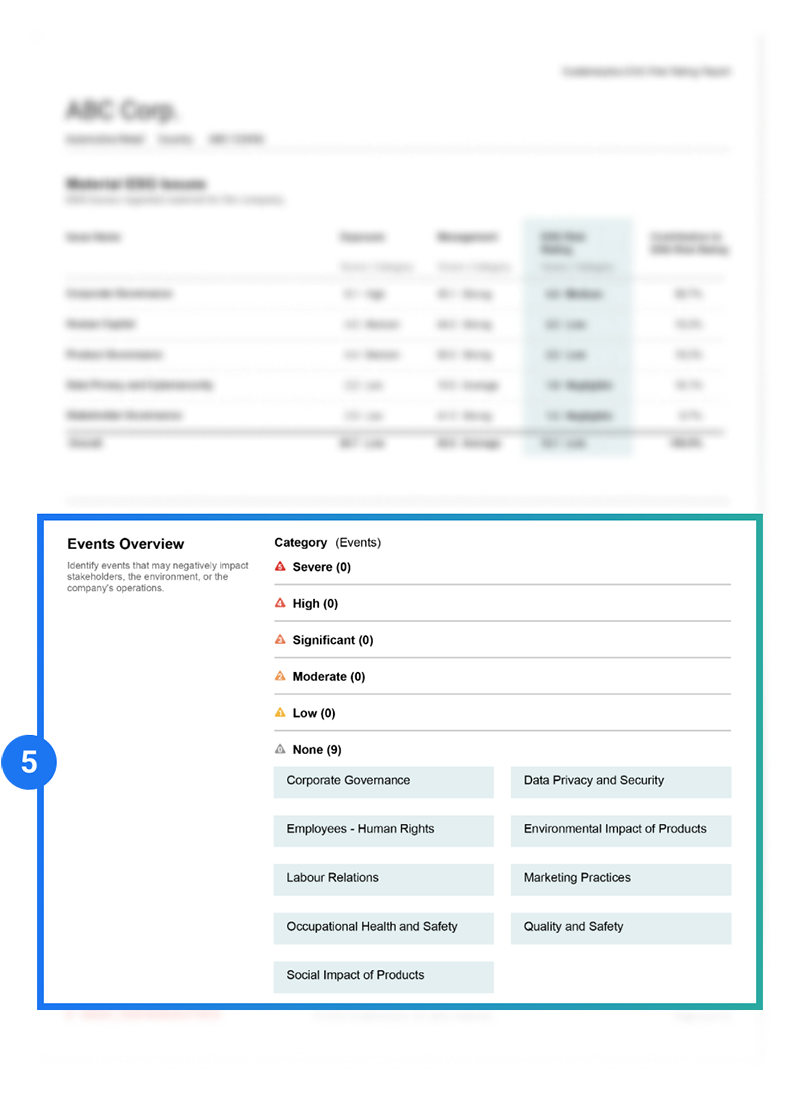

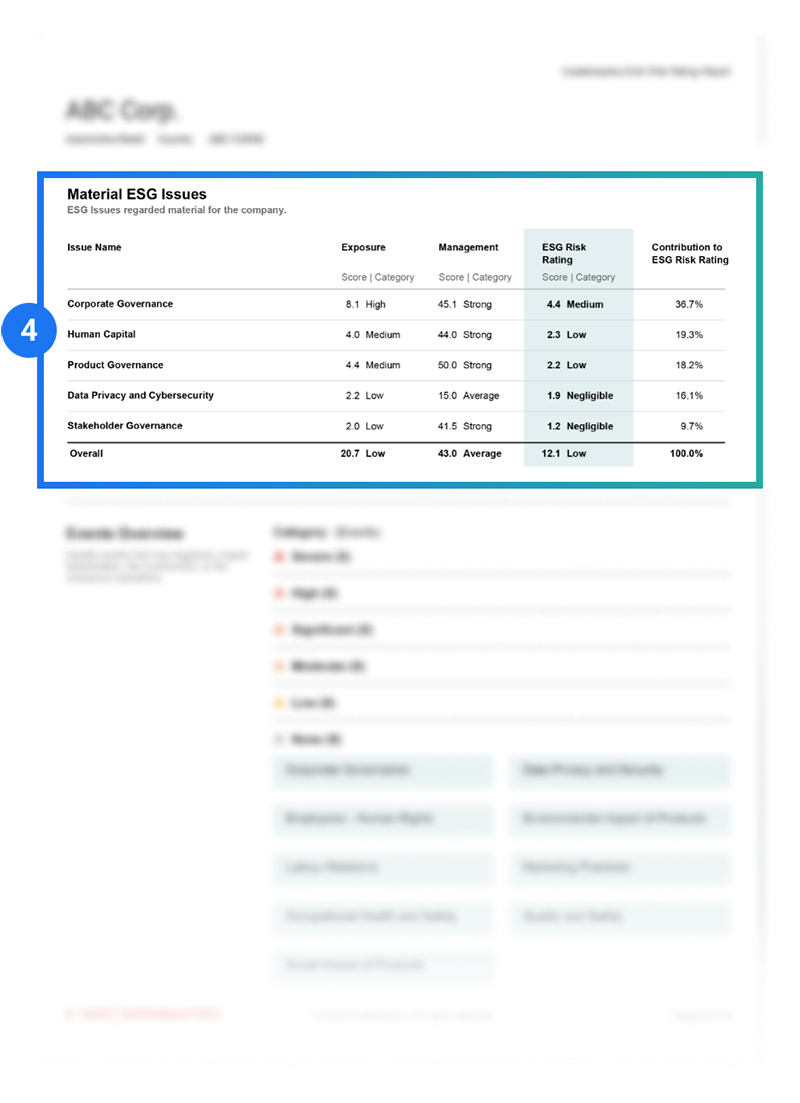

Material ESG Issues (MEIs) are identified and brought into focus.

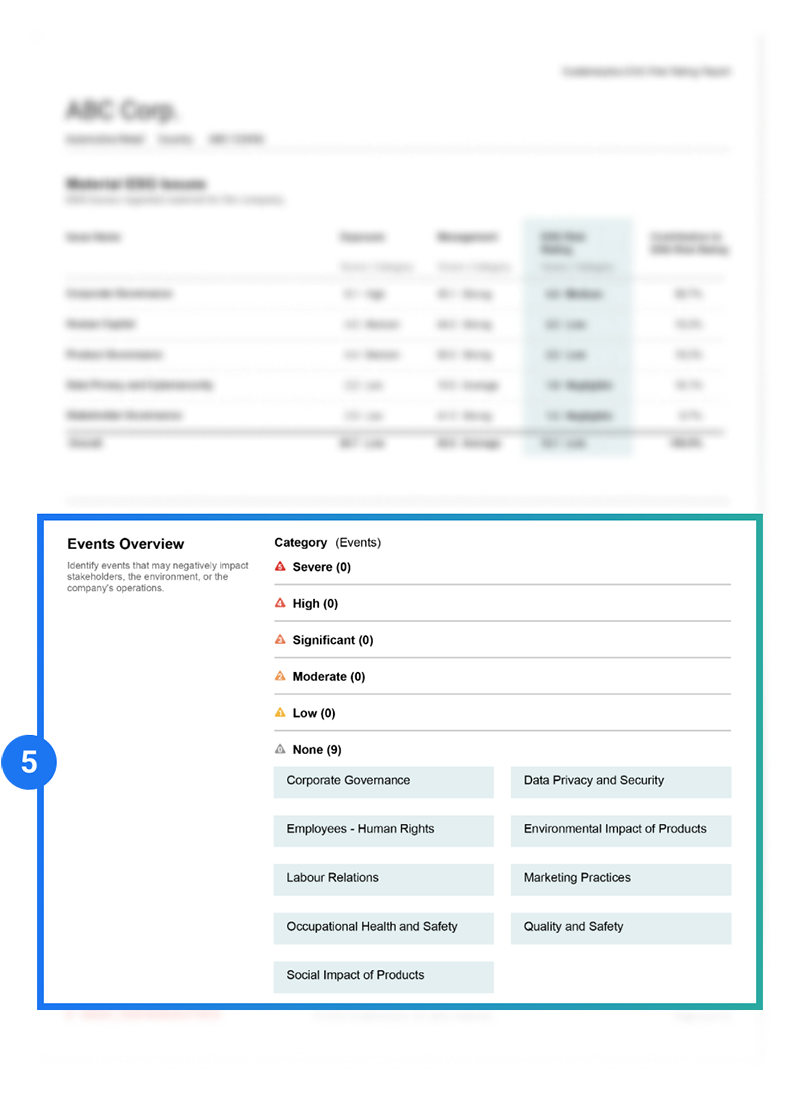

Transparency into company events that may impact a company’s operations, stakeholders or the environment.

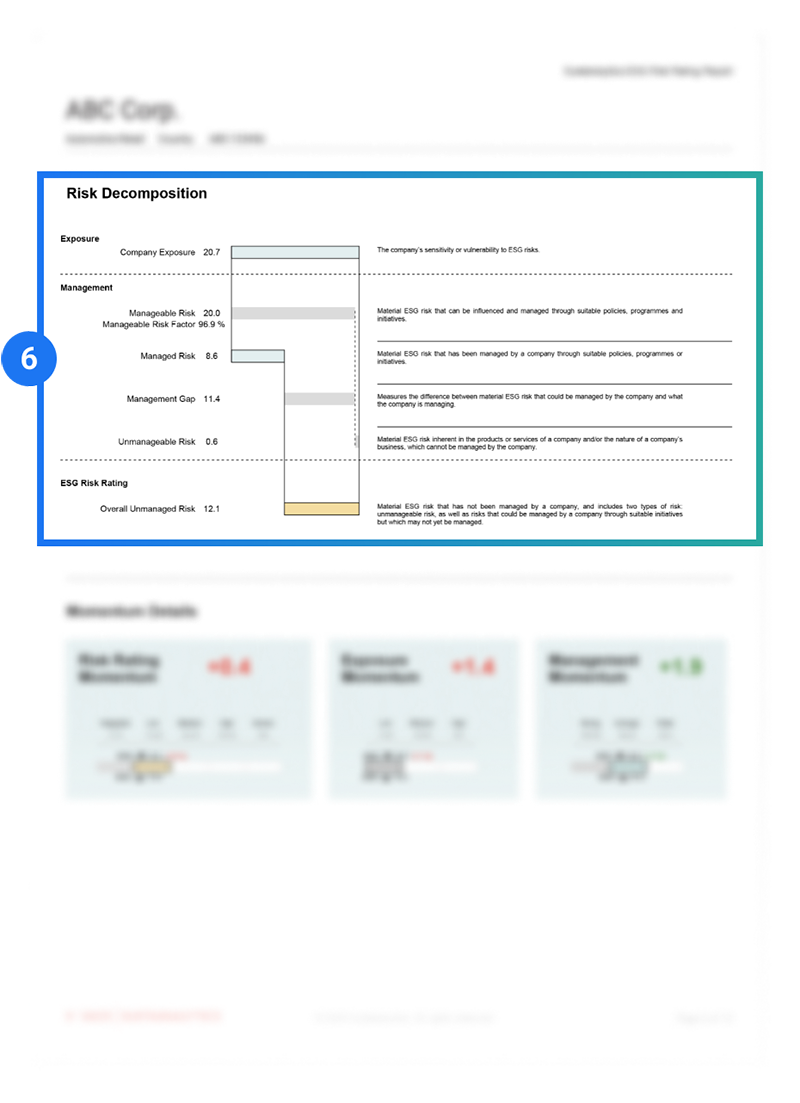

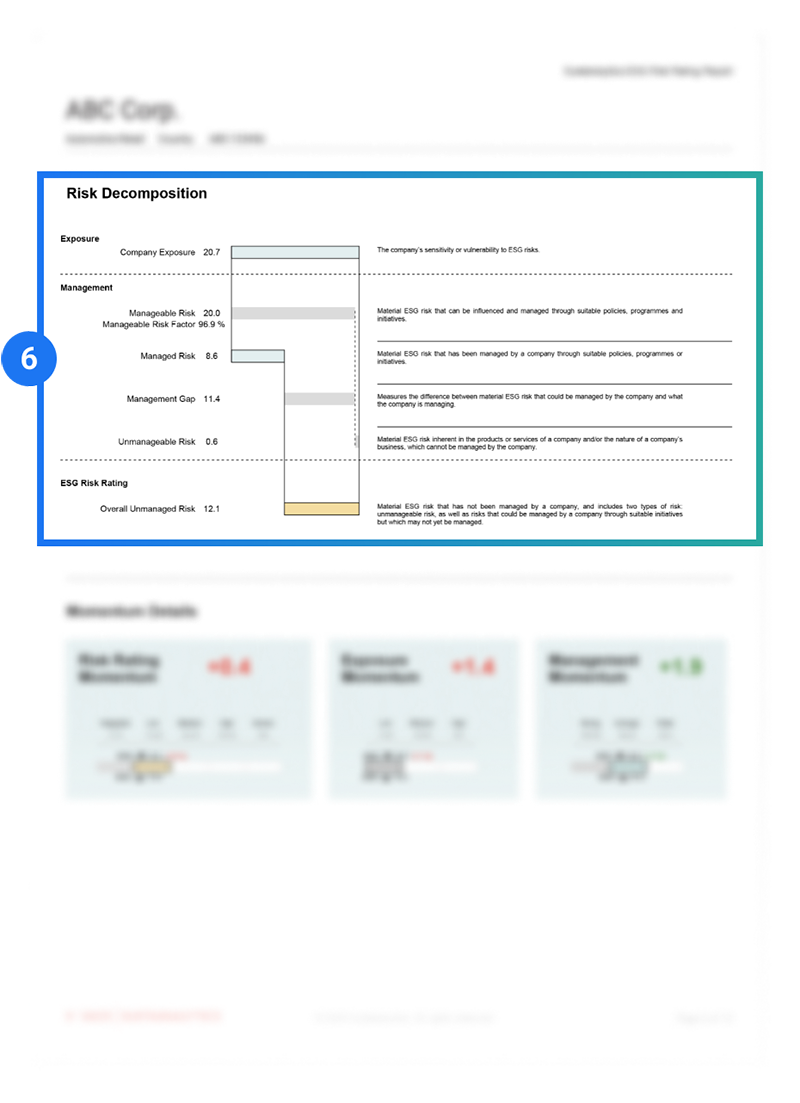

The magnitude to which a company is exposed to ESG risk and how well the company is managing that risk is measured and explained.

Access company ratings and comprehensive ESG Risk Insights

Unlock the potential of ESG investing with our in-depth reports. Gain valuable perspectives on ESG risk distribution across regions, sectors, and company sizes, understand the key factors influencing ESG risk in global markets, and explore the implications for portfolio construction. This series, in partnership with Natixis, provides essential guidance for aligning investment strategies with ESG standards.

Integrate Biodiversity Risks and Opportunities with Nature Data

Use our flagship ESG Risk Ratings to get a wholistic view of how the company is managing Material ESG Issues (MEIs). Use the Nature Data Package to uncover additional nature-related risks, like the involvement in business activities that have a negative impact on nature or face regulatory risks, and the operational metrics related to biodiversity loss drivers. In addition, users can take advantage of:

- Additional management indicators on climate change to better account for the third major biodiversity loss driver

- Opportunities, in the form of business activities that have a positive impact on nature

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.