Environmental, social, and governance (ESG) considerations continue to accelerate for financial market participants at every level, from asset managers and pension plan sponsors to wealth advisors and retail investors. Many global investors already incorporate ESG factors into their evaluation of public companies across developed markets. We are now observing increasing interest in applying ESG considerations across a broader set of asset classes and regions.

A growing list of ESG data sources is emerging to support increasing market demand; however, data availability and reliability for certain asset classes remain challenging. In this article, we explore three areas in which investors are seeking more ESG data: fixed income, emerging markets, and private equity.

Fixed-Income Investors Want More Reliable Sustainability Data

Demand from retail investors has been a key driver of the proliferation of sustainable considerations in fixed-income investing. ESG-focused fixed-income investments have seen impressive growth over the past few years. As flows to sustainable equity funds have slowed during 2022, sustainable fixed income funds’ inflows doubled in the third quarter of 2022 relative to the second quarter.1

ESG data availability has historically been a challenge for fixed-income investors. The increasing availability of both qualitative and quantitative ESG data has been an essential enabler for growth in sustainable fixed-income investing. However, investors continue to ask for more comprehensive data to help provide the necessary signals to manage downside risk and track opportunities.

Facilitated by Reuters, a recent survey of 300 U.S. and European investment managers showed an increase in ESG considerations in fixed income. In this poll, more than three-quarters of respondents said they consider ESG factors when making fixed-income investments, up from 42 percent of respondents saying the same in in 2021.2 In Europe alone, by the end of the first quarter of 2022, more than 2,500 billion euros was invested through sustainable investment funds.3 With inflows into sustainable investment funds continuing to rise, Morningstar Sustainalytics is heeding investors’ demands for more and richer data.

Emerging Markets: Investors Are Looking More Closely at China for ESG Opportunities

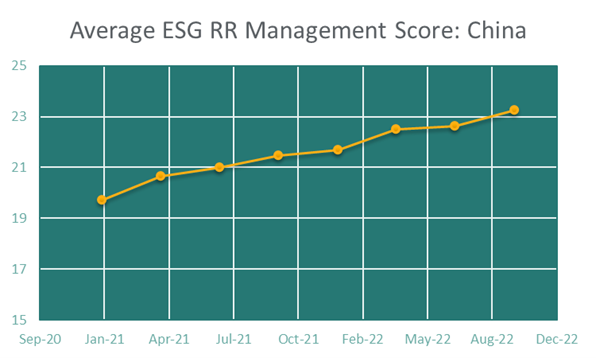

Investors have less data available to assess ESG risk in emerging-market companies, which tend to disclose fewer sustainability details than their developed-market counterparts. China is the most significant contributor in all major emerging market indices,4 so investors are particularly interested in the ESG risk profiles and management of companies in the region. President Xi Jinping’s call for China to become net zero by 2060, alongside a growing appetite for electric vehicles5 and exponential growth in ESG funds driven by retail investors in the country6 appears to signal a broader societal shift toward sustainability. This shift also shows in companies’ management of ESG risk and relevant ESG issues.

Using Morningstar Sustainalytics’ ESG Risk Ratings, some initial signals suggest that Chinese companies are improving their management of ESG risks, as shown below.

Source: Sustainalytics ESG Risk Rating, October 2022

Source: Sustainalytics ESG Risk Rating, October 2022

Investors Seek More ESG Disclosure from Privately Held Companies

Private equity investing accounts for a significant share of assets under management across asset classes (roughly US$6.3 trillion globally). The industry is so large that without the active participation of private equity investors, society cannot tackle environmental and social issues.7 As such, asset owners are looking for private equity investors to integrate ESG considerations into their investment decisions. APG, a prominent Dutch pension investor, is an example to watch as it leads an initiative to report on sustainability matters for its private equity investments like it does for its other investment strategies.8 Furthermore, the World Economic Forum has identified the importance of incorporating ESG in private equities by listing the 'Monday morning priorities' for private equity investors.9 These developments drive investor demand for more ESG data on private companies.

To meet the growing demand for ESG data in the three areas discussed, Morningstar Sustainalytics has significantly expanded its analyst-based ESG Risk Ratings to more than 16,300 companies to support investors across their entire portfolio. This expanded universe offers wider coverage of analyst-based research and ratings and includes more coverage for fixed income issuers, private companies, and Chinese companies listing A and/or B shares. Asset managers, wealth managers and retail managers who incorporate ESG factors to guide their security selection, portfolio construction and reporting can now access a broader set of data across diverse asset classes and geographies.

To learn more about Morningstar Sustainalytics’ ESG Risk Ratings, get in touch with our Client Advisory team.

Sources:

1. Morningstar (2022), “Global Sustainable Fund Flows: Q3 2022 in Review”, Morningstar, accessed (11.09.2022) at Morningstar.com. (Sustainable Equity inflows: Q2, USD 21.3 billion, Q3, USD 10.8 billion. Sustainable Fixed Income inflows: Q2, USD 5.2 billion, Q3, USD 11 billion)

2. Reuters (2022), “Managers use ESG fixed income surges survey finds”; Reuters; accessed (10.10.2022) at www.reuters.com

3. De Standaard (2022), “De groeipijnen van duurzaam beleggen”; De Standaard accessed (10.15.2022) at www.standaard.be

4. As per October 17th; 32.29% in FTSE Emerging All Cap index/ 31.35% in MSCI Emerging Market index/20.12% in FTSE Emerging Markets Broad Bond Index

5. De Standaard (2022), “Peking racet Europa voorbij met elektrische wagens”; De Standaard accessed (10.17.2022) at www.standaard.be

6. Bloomberg (2022), “Xi’s ESG Boom Funnels Billions into Coal, Liquor, Defense Stocks, Bloomberg accessed (10.10.2022) at www.Bloomberg.com

7. Harvard Business Review (2022), “Private Equity Should Take the Lead in Sustainability”, Harvard Business Review accessed (12.10.2022) at HBR.org

8. APG (2021), “APG ondersteunt initiatief om duurzaamheid private equity beter te beoordelen, APG accessed (12-10-2022) at APG.nl

9. World Economic Forum (2022), “Five ‘Monday morning priorities’ for private equity investors looking to progress on sustainability”, WEF accessed (12-10-2022) at weforum.org