In our paper, Combining ESG Risk and Economic Moat,[i] we examined the effect of combining the two metrics, showcasing the benefits of higher returns and lower downside risk. More specifically, investing in companies with negligible/low ESG risk and wide economic moats was advantageous for creating alpha over the past four years. However, we found indications from a handful of companies that an even more effective strategy might exist. Using the simulated ESG Risk Ratings to research an extended timeframe, we analyze companies with strengthening economic moats and ESG Risk Ratings score momentum.

Economic Moat Upgrades Work Great as Return Enhancers

Let us assume we had a crystal ball at the start of 2015, gifting us the power to predict the directional improvement of ESG Risk Ratings and an economic moat between 2015 to the end of 2020.

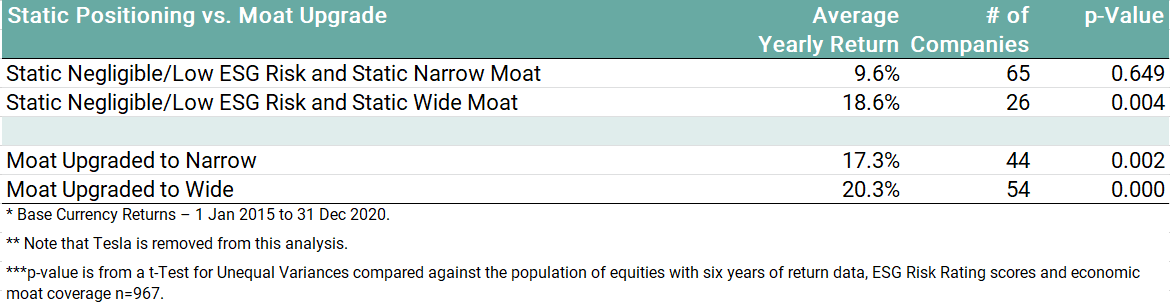

Exhibit 1: Static ESG Risk Rating and Moat vs. Moat Upgrade Strategy

Source: Sustainalytics

Source: Sustainalytics

As seen in Exhibit 1 above, identifying those companies that will experience a moat status upgrade during this timeframe would have been a beneficial investment strategy, regardless of whether it is narrow to wide moat (20.3%) or a no moat to narrow moat (17.3%). Interestingly, investing in those that stay static for negligible/low ESG risk and narrow moats does not produce statistically significant returns (9.6%) when compared to the average returns of all companies in the sample population, creating the presumption that a company with a narrow moat needs to sustain an upward trajectory to create any meaningful difference in returns.

Economic Moat Upgrades and Positive ESG Improvement Appears to Further Increase Returns

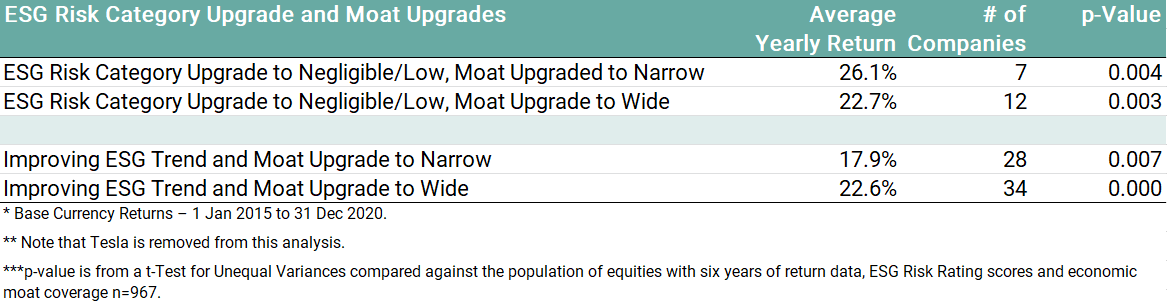

Exhibit 2: Utilizing Different ESG Momentum and Moat Upgrade Strategies

Source: Sustainalytics

Source: Sustainalytics

This combination would generate even better results than any combination from exhibit 1. Unfortunately, the list of companies with a dual ESG category and moat upgrade would have narrowed down the potential list to too few names. By tweaking the approach

to look at companies with an improving ESG Risk Rating trendline (by evaluating year to year trailing three period regressions) might be slightly more realistic while still boasting good returns.

Invest in Those Companies Making Their Way to the Winners Circle

Based on our empirical findings, investing in companies with continually improving sustainable competitive advantages and decreasing ESG risk leads to a maximized potential for return enhancement. However, companies keeping their wide moats with low ESG risk is another rewarding pursuit.

Exhibit 3: Model Pathway's for Enhancing Return

* Base Currency Average Annual Total Returns – 1 Jan 2015 to 31 Dec 2020

This sounds easy in hindsight, but it is, of course, incredibly difficult to make respective forward-looking calls. Nevertheless, we can use some clues from ESG subindustry ranks, management score changes, and the Morningstar moat trend metric, to identify companies on this potential trajectory.

Looking Back at the Paper's Thirteen Standout Companies

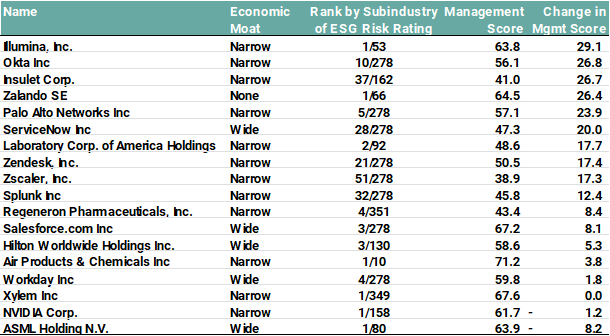

Exhibit 4: Positive ESG Risk Rating, Wide Moat, Low ESG Risk Thirteen

It stood out to us that some of these companies had been excellent long-term investments over the previous decade. Several companies demonstrated exemplified leadership in their subindustry group; others showcased noticeable improvements in management score since January 2019.

Positive Moat Trend Companies

Turning back to the momentum approach, we then apply the shared characteristics of those companies in the winner’s circle, to those companies with a ‘positive’ moat trend as a tactic to identify signals that these are companies which belong to the strengthening economic moats and improving ESG Risk Ratings group. These three ESG metrics being strength in overall management score, significant positive management score improvements since the ESG Risk Rating launch (using January 2019 as the marker date), and ESG Risk Rating subindustry leadership.

Exhibit 5: Positive Moat Trend Companies with Strong ESG Leadership

Future Research

Source:

[i] “Combining ESG Risk and Economic Moat” https://connect.sustainalytics.com/combining-esg-risk-and-economic-moat