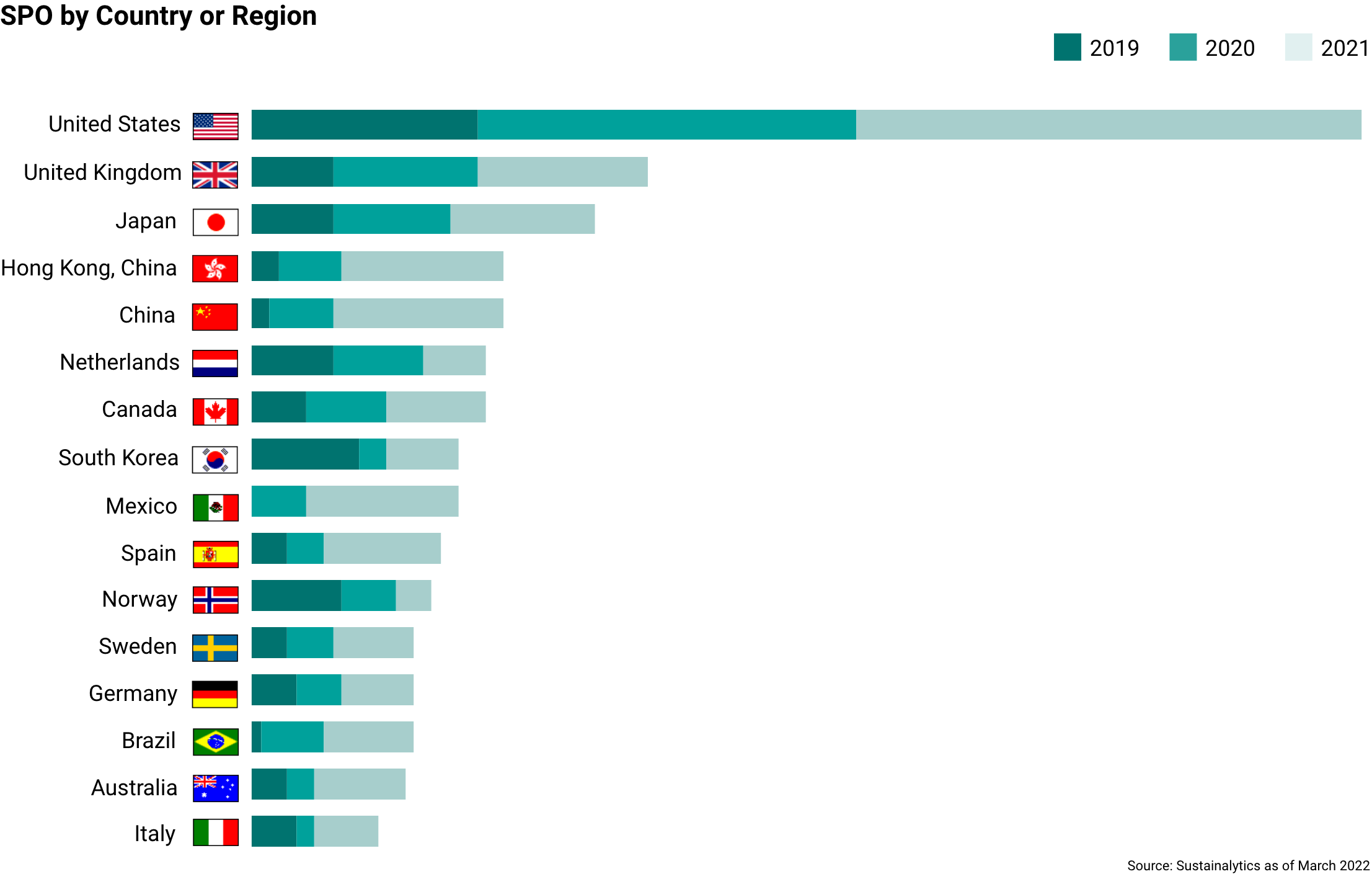

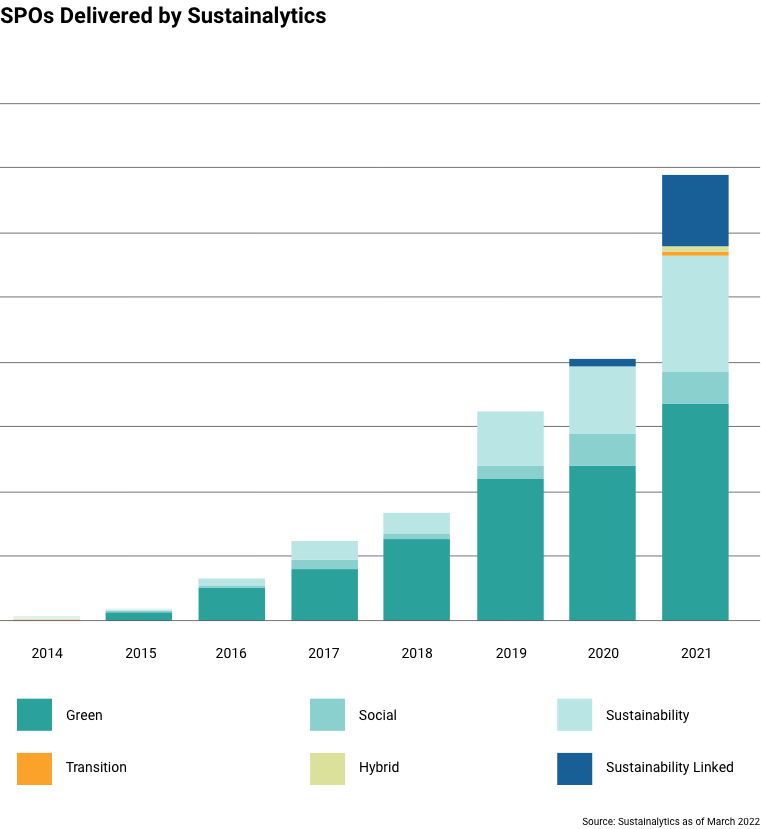

Sustainalytics is the world’s largest provider of second-party opinions (SPOs), having successfully completed over a 1000 projects for green, social, sustainability and KPI-linked bonds and loans for issuers and their underwriters. 1

Sustainalytics’ SPO service has won multiple awards and continues to be an industry leader. Our first SPO published in 2014 was for a sustainability bond framework, followed by our first Green Bond SPO and Social Bond SPO in early 2015.

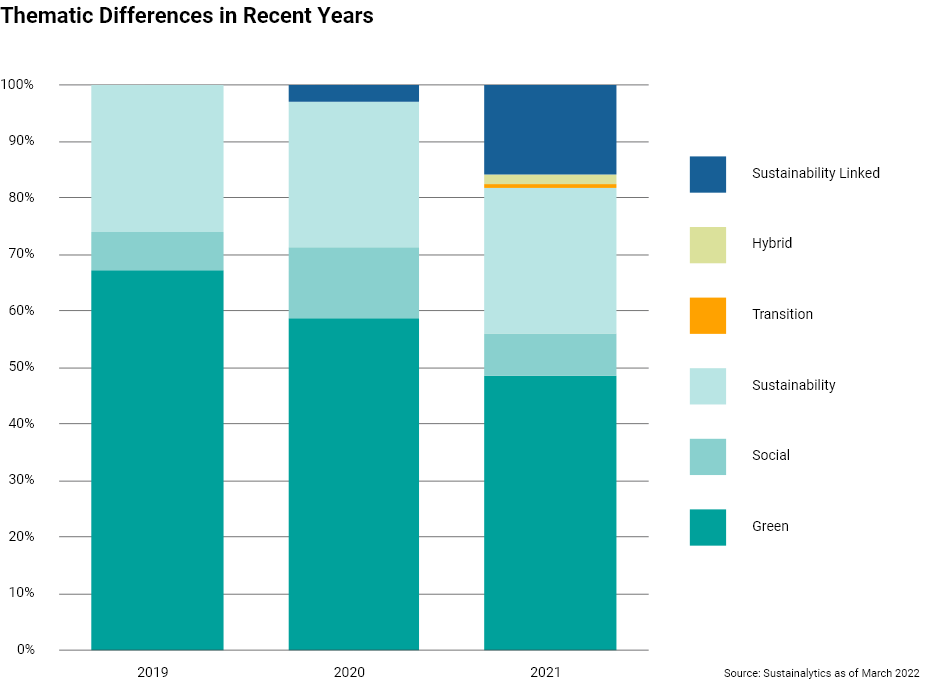

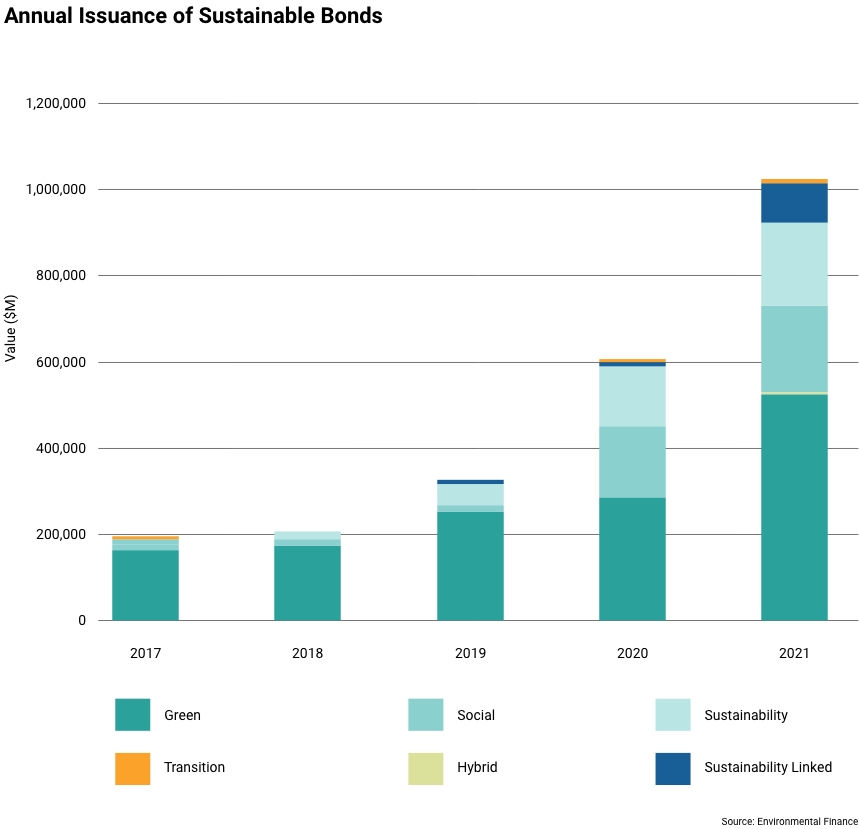

Since then, the sustainable bond market continue to experienced explosive growth. The Green, social, sustainability and sustainability-linked bond market crossed reached the $1.03 Trillion mark in 2021 (over 69% higher than 2020). Expert predict the market to reach $1.5 trillion in 2022. 2 Of which sustainability-linked bond issuance, is forecast to more than double to $200 billion in 2022 according to environmental finance.

Organizations are leveraging sustainable finance instruments to fund related projects, meet their own sustainability targets, and advance their corporate sustainability profiles.

Set your sustainability-linked loan apart with a second-party opinion from Sustainalytics.

A New Milestone: Sustainalytics 1000th Second-Party Opinion

By the Numbers

3 Reasons Why You Need a Sustainalytics SPO for Your sustainability-linked loan

Independent reviews have become market best practice with approximately two-thirds of issuers using SPOs to provide investors with assurance that use of proceeds are credible and impactful3. Knowing that your linked loan framework is aligned to market expectations has become essential. Sustainalytics works with banks and companies to build the Sustainability Linked Loan Program.

Our solutions are aligned to the Sustainability Linked Loan Principles

We work in-close collaboration with the borrower and the client to identify and track the ideal metrics that the Sustainability Linked Loan will be tied to.

At Sustainalytics we also offer a KPI-SPT Assessment. The assessment is an evaluation of the relevance and materiality of an issuer’s Key Performance Indicators (KPIs) and the ambitiousness of the associated Sustainable Performance Targets (SPTs) that can be considered as part of the potential sustainability-linked loan.

Published Projects

Recent examples of sustainable bond reports: Telus, Koninklijke Ahold Delhaize, and Government of Chile..

Explore some of our 1000+ published opinions for bonds issued by leading multinational corporations to financial institutions, non-profits, and governments.

Bridge the Gap Between Corporate Sustainability and Finance

The ever-changing sustainable finance landscape can seem overwhelming for companies and issuers as financial markets increasingly allocate growing amounts of capital to finance climate change mitigation and the transition a low carbon economy. Read insights on recent progress made by organizations bridging the gap between sustainability and finance and gain a better understanding of key sustainable finance concepts.

What’s Next?

The sustainable finance market has demonstrated its resilience and staying power through an unprecedented socio-economic upheaval.

Sustainability-linked bonds (SLBs) represent the fastest growing market segment in the past two years, marked by their flexibility to finance general corporate purposes. In parallel, investors have become more discerning regarding the strength of key performance indicators (KPIs) and ambitiousness of sustainable performance targets (SPTs). Sustainability-linked loans have also experienced a noteworthy uptick driven by the success of SLBs.

Learn more about our Second-Party Opinion Services and contact us to get started.

Join Our Weekly Second-Party Opinion Update

Subscribe to receive weekly updates from Sustainalytics’ recently published opinion projects and services.

.png?sfvrsn=a278e6b2_1)