Leading organizations are looking beyond the impact they create from an economical point of view to emphasize the social causes their business affects. As a result, sustainable finance projects with positive social outcomes have experienced rapid growth amongst the bond investor community as well as an overall increase in interest from issuers.

Social bonds can be used to finance both public and private demand to create positive social outcomes in communities.

Learn more about Sustainalytics’ social bond second-party opinion service.

Find out how the path of green finance has evolved, as well as our view on where the sustainable finance bond market is headed.

Latest Insights

ESG in Conversation: The AI Revolution Comes to ESG

Reducing Emissions Through Sustainable Finance: A Guide for Companies in Carbon Intensive Industries

ESG in Conversation: Asset Owners Share Their Views on the Changing Investment Landscape

Overview of Our Social Bond Service

An SPO from Sustainalytics on your social bond framework will give investors and the market the assurance that your bond is credible by assessing your social bond framework to ensure eligible projects are aligned to the Social Bond Principals (SBP). Common categories of eligible social bond projects that we assess include but are not limited to providing and promoting:

Basic infrastructure such as clean drinking water, sanitation and energy.

Access to essential services such as healthcare and education.

Access to affordable housing.

Job creation and employment generation.

Availability and Food Security.

Socio-economic advancement and empowerment.

Contact our expert team to discuss how our leading second-party opinion service can help your social bond issuance.

Key Benefits

Enhance Awareness of Social Issues

Issuers can highlight their work in addressing social goals to investors and other stakeholders.

Meet Growing Investor Demand

As the importance for addressing social issues grows, an increasing number of investors are investing in social conscious companies

Gain Investor Confidence

An SPO from a trusted ESG ratings provider, like Sustainalytics, provides additional assurance on the credibility of the issuer and the issuance.

Diversify Issuer Investor Base

The demand for social bonds has significantly increased and these types of bonds tend to be oversubscribed.

Meet Market Expectations

An SPO assesses the alignment of the bond’s framework with recognized International Capital Market Association’s (ICMA) Principles.

Assess the Use of Proceeds

An SPO assesses the impact of projects to be financed with the social bond’s proceeds.

Use of Proceeds Assessment Service

At Sustainalytics we also offer a Use of Proceeds (UoP) Assessment. The assessment is an evaluation of the eligibility criteria for categories of sustainable projects that issuers intend to finance through sustainable finance instruments, such as green, social, sustainability and transition bonds or loans.

Non-public Assessment

The final report is a non-public assessment that can be used by the issuer teams for internal purposes only eg. to inform the framework development process.

Sustainalytics’ Methodology

The final report will be an assessment in line with Sustainalytics’ Use of Proceeds Financing methodology, informed by relevant ICMA principles.

Option to Extend

Issuers can extend the engagements to a full Second-Party Opinion within 12 months.

No SPO Commitment Required

Issuer can sign up for UoP assessment without committing to the full SPO.

Contract Value

The UoP Assessment is priced at a discount versus an SPO and the contract value of the UoP assessment will be available as credit if the engagement is extended to a full SPO.

Expedited Assessment

The UoP assessment has a quick turnaround time of 2 to 3 weeks.

Enhance Your Bond Framework

Annual Review

Issuers are continuously under pressure by investors and the market to ensure their bond framework is aligned well past the issuance process. With our Annual Review service, we work with issuers post issuance to ensure that the projects financed and the reporting are aligned with the intended use of proceeds and commitments set out in the bond framework.

Projects are aligned to the eligibility criterial in your framework.

You are reporting on impact metrics as outlined in your framework.

Allocation processes and reporting are as outlined in the bond framework.

Climate Bond Verification

Leading companies are examining their climate-related business risks as well as their role in climate change mitigation. Climate bonds are used to finance projects that address climate change and are aligned with achieving the goals of the Paris Agreement. As a Climate Bonds Standard Board approved external reviewer, Sustainalytics has completed more climate bond verifications than any other external reviewer in the market for 2020

Pre-issuance verification:

Verify that projects and assets are eligible under relevant sector eligibility criteria and that internal processes and controls exist to manage bond proceeds

Post-issuance verification:

Through our assessment, provides issuers with a report stating whether the bond meets the Climate Bonds Standard’s post-issuance requirements

Ongoing verification:

Issuers must annually report on their bond to comply with the Climate Bonds Standard’s post-issuance requirements to maintain a bond’s certification.

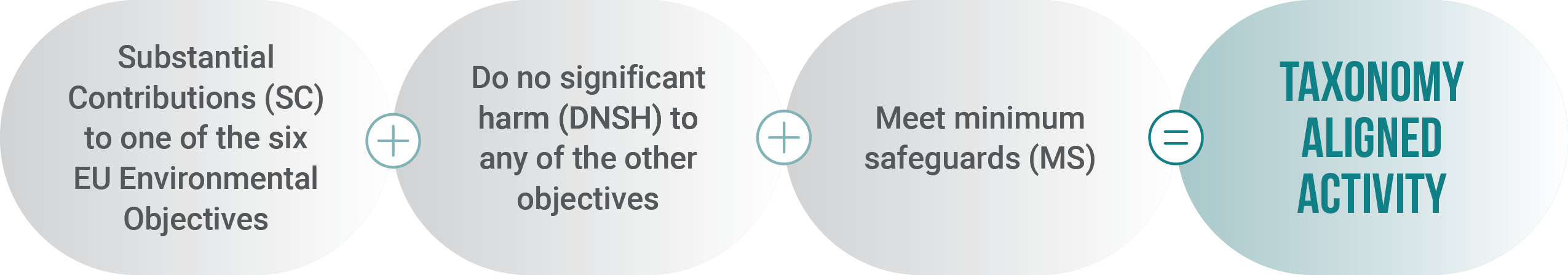

EU Taxonomy

Sustainalytics offers issuers the ability to include in its second-party Opinion an additional assessment that aligns the issuer’s bond or loan framework with the EU Taxonomy. Adding the EU Taxonomy to a second-party opinion

assures the market and investors that the bond or loan framework is aligned to the EU’s six environmental objectives, giving confidence and reputability during issuance.

Sustainalytics’ assessment considers the following general requirements for a bond framework’s alignment with the EU taxonomy:

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Related Insights and Resources

Reducing Emissions Through Sustainable Finance: A Guide for Companies in Carbon Intensive Industries

This corporate guide discusses the difficulties in measuring, reporting, and reducing GHG emissions in hard-to-abate sectors and provides key takeaways so that companies can take advantage of the opportunities sustainable finance offers.

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

Today’s Sustainable Bond Market: Boosting Confidence in Sustainable Bond Issuances

In this article, we examine the kinds of sustainable bonds offered in the market, some of the key regulations being developed in different markets and the current initiatives to improve the quality and credibility of issuances.

Related Products

Second-Party Opinions

Get a second-party opinion on your ESG bond framework from the world's largest provider.

Green & Sustainability Bonds

Instill investor confidence in green- and sustainability-focused bonds with an SPO.

Sustainability Linked Bonds

Tie loans to ESG risk ratings or KPIs to incentivize borrowers to improve sustainability targets.