Customer Story

How Norway’s Largest Bank is Using its Sustainable Product Framework to Fund a Greener Future

With ambitious sustainability targets to achieve, DNB set out to solidify its existing sustainable product framework, stay current in an ever-evolving sustainable finance market, and identify projects that have material impacts on the environment. DNB initially engaged Sustainalytics’ Finance Insights services to support the creation of the bank’s original framework and Sustainalytics has been instrumental in the framework’s annual review process ever since.

In This Customer Story:

Industry

Banks

Region

EMEA

“Our work with Sustainalytics was successful and the updated sustainable finance framework fully meets our expectations. The Sustainable Finance Insights team provided the competence to ensure leading market practices, plus the flexibility, openness, and willingness to engage that were so important for us. Together, these qualities made the ensuing product that much better.”

Morten Knutzen

Business Developer for Sustainability, DNB

The Challenge

Enhancing DNB’s Sustainable Product Framework to help achieve their goal to finance and facilitate NOK 1,500 billion (US$141.3 billion) of environmental, social and governance (ESG) activities, including innovative, modern technologies, while also harmonizing with the EU Taxonomy.

The Solution

The guidance and support provided through Sustainalytics’ Sustainable Finance Insights service enabled DNB to build upon and improve its sustainable product framework and align itself with industry leading practices.

The Results

DNB is now using its improved sustainable product framework to ensure it is financing the investments and projects that yield real results toward a more sustainable future.

About DNB

DNB is Norway’s largest financial services group and the 10th largest bank in Europe. It serves more than 2.3 million customers, approximately 230,000 of which are corporate clients. With considerable international reach and influence, sustainability is a key pillar of DNB’s corporate philosophy. For several years, DNB’s own operations have boasted net-zero emissions. Now, the financial services leader is pledging that all company activities, including the ones they finance, will contribute to the target of net-zero emissions by 2050.

The Challenge

Lead the Way With an Enhanced Sustainable Product Framework

DNB was eager to play an active role to increase the speed at which Norway and the world transitioned to a sustainable economy. As part of its efforts, the bank embarked upon a new sustainability strategy in 2021, with lofty targets and even more ambitious timelines. The bank was looking to finance and facilitate sustainable investments of NOK 1,500 billion (US$141.3 billion) by 2030.

With these goals on the horizon, DNB needed to update and enhance its existing sustainable product framework. The original framework, instituted in 2019, provided transparency and predictability for DNB’s sustainable financing operations, but revitalizing the framework would ensure that it remained in line with new technologies and upcoming regulations, like the EU Taxonomy.

“It is very important to provide transparency to our customers. By engaging with Sustainalytics, our sustainable finance framework says out loud that these are the projects that we consider green and that this is the criteria. It simplifies matters for everyone involved.”

Magnus Meland Roed

Client Advisor, Real Estate and Construction, DNB

The Solution

A Rock Solid Framework as the Foundation of Sustainable Success

As banks increasingly offer sustainable finance products to corporate and retail clients, they need advanced ESG knowledge and credible frameworks to guide them. With the support of Sustainalytics’ Sustainable Finance Insights specialists, DNB developed their sustainable product framework to simplify the work of classifying sustainable transactions. The framework built out a clear set of guidelines that would allow the bank to easily identify investments that would increase positive impact, or decrease negative impact, on the environment.

Finding the Right ESG Partner

DNB is also committed to keeping their sustainable product framework as relevant and up to date as possible, maintaining an annual review process. Sustainalytics has reviewed the framework every year since its inception to ensure continued alignment with industry best practices. As the market evolves, qualifying activities are added and removed as needed, to keep up with market and regulatory developments.

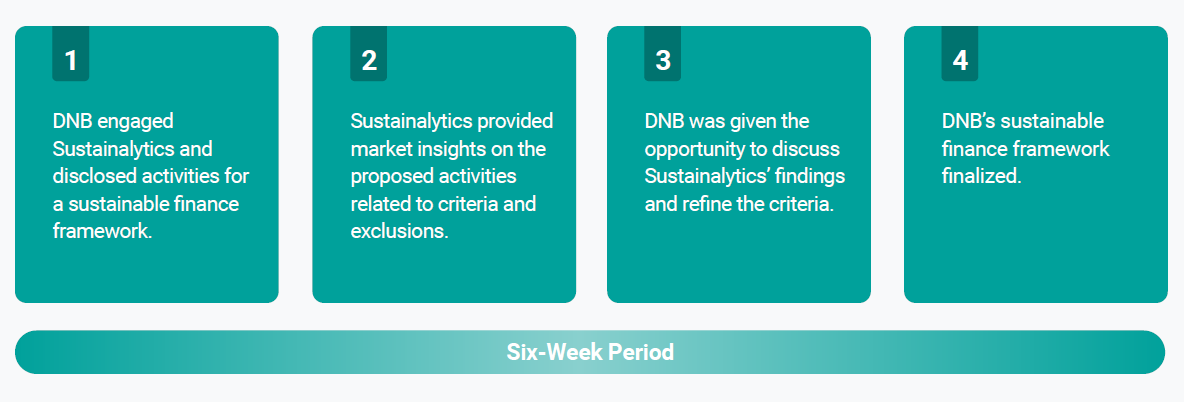

Sustainable Finance Framework Develpment Process

DNB Sustainable Finance Projects

Approximately half of DNB’s green loans to date have been within real estate, consisting mostly of construction loans for certified, energy-efficient buildings. For the remainder of its loans, they help finance a broad spectrum of industries and activities. Here are two examples:

In 2020, DNB helped finance the purchase of five plug-in hybrid ferries for Torghatten AS. The transportation company engaged in multiple projects to contribute to zero or lowemission innovation, including low-emission aircraft, hybrid ferries, and implementation of eco-friendly fuels.

The green loan was certified under DNB’s Sustainable Product Framework and its Clean Transportation category.

In 2021, DNB helped finance a new biochar factory for Oplandske Bioenergi AS. Biochar is a carbon-rich material produced through thermal decomposition of organic matter in an oxygen starved chamber. It is used to improve soil quality for agriculture and can also mitigate climate change by securely storing carbon in the earth, acting as a carbon sink.

The green loan was certified under DNB’s Sustainable Product Framework, and the loan purpose was found to contribute to the reduction of greenhouse gas emissions.

The Results

An Effective Framework to Diversify ESG Investments and Reduce Emissions

Now DNB is financing the investments and projects that make the most progress toward its sustainability goals. Since publishing its enhanced sustainable product framework in January 2022, DNB has experienced growth in projects funded and is now prepared to take the next step into a sustainable future.

DNB expects ESG-related financing to continue growing, and the framework provides a solid foundation to ensure the quality and transparency of the sustainability elements. While primary focus has been on the ‘E’ of ESG, DNB is looking to expand future versions of the framework into the social and governance dimensions as well. Additionally, based on this project and the resulting framework, DNB is considering a similar approach to address transition financing as a way to reduce greenhouse gas (GHG) emissions in hard-to-abate sectors like shipping, oil and gas, and heavy industry. This is central to the bank’s core strategy to reach low-carbon targets set by the Paris Agreement.

“In the end, we came out of the process with a better sustainable finance framework, well-suited to our needs, and aligned with leading market practices.”

Lene Gulbrandsen

Head of Product Financing and Deposits, DNB

Other Customer Stories

How a Leading Infrastructure and Facilities Conglomerate Successfully Linked its Sustainability Ambitions to its Financing

In pursuing a sustainability-linked loan (SLL) and obtaining a second-party opinion on the KPIs tied to it, Downer secured credibility for its sustainability commitments, while also achieving its financing objectives.

Do you have questions?

Set your business on the right ESG path by contacting our team of experts today.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.