Customer Story

How a High Street U.K. Bank Reflected Its Values and Ethics Through ESG Ratings and Reporting

By receiving an ESG Risk Ratings License from Sustainalytics, The Co-operative Bank could better communicate how its ESG Risk Rating reflected its values, policies, and programs around environmental, social, and corporate governance (ESG) issues.

In This Customer Story:

Industry

Banks

Region

EMEA (U.K.)

“The in-depth ESG review provided by Sustainalytics helped us identify our strengths and weaknesses. It also informed our go-forward ESG strategy to be as sustainable and socially conscious as possible.”

Maria Cearns

Managing Director of Customer and People, The Co-operative Bank

The Opportunity

Translating The Co-operative Bank’s values, ethics, and overall approach into a broadly adopted ESG risk assessment framework.

The Solution

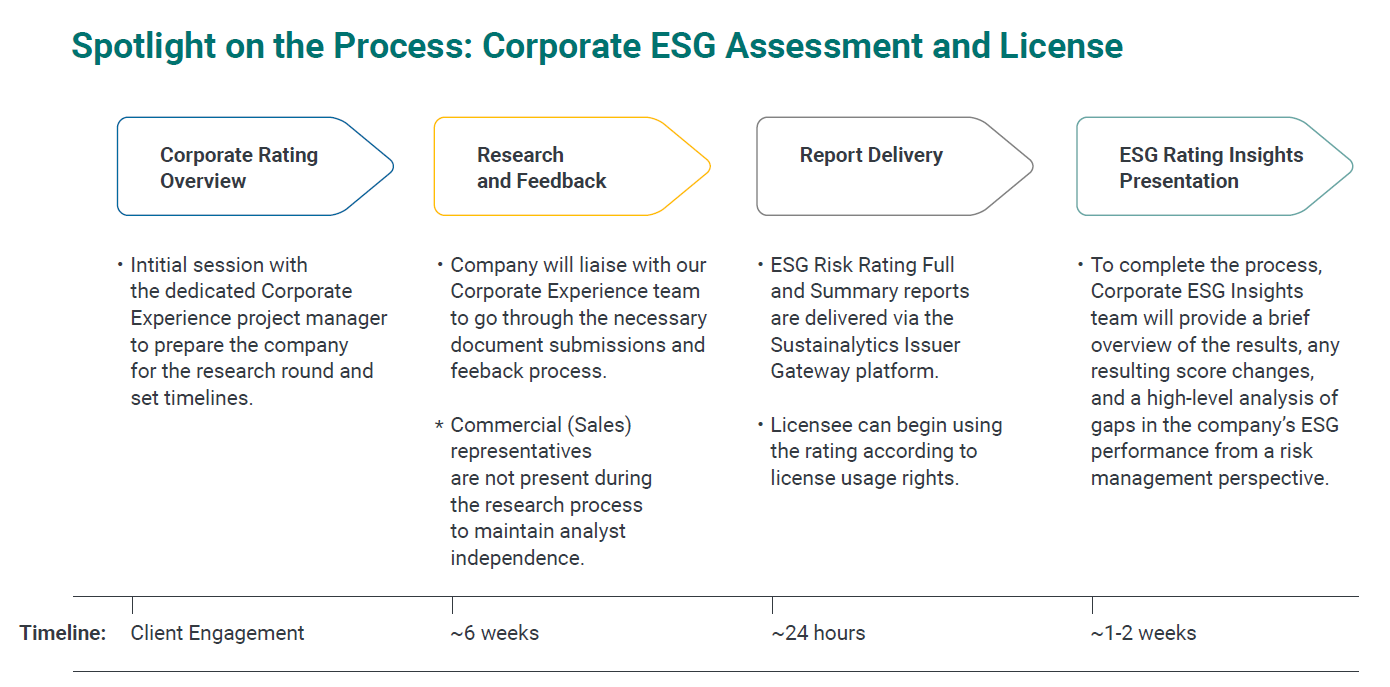

Sustainalytics’ ESG Risk Ratings License process enabled The Co-operative Bank to fully convey its relevant ESG-related company policies, programs, and procedures.

The Results

By engaging with Sustainalytics and providing more thorough data, The Co-operative Bank gained a better understanding of how corporate ESG risk is assessed, while improving the quality and detail of its ESG reporting and disclosures.

About The Co-operative Bank

The Co-operative Bank is a mid-sized bank based in the U.K., offering services for retail customers and small and medium sized businesses, charities, co-operatives, and social enterprises.

In 1992, the bank introduced a customer-led Ethical Policy that set out the way it does business. Believing that doing good and doing good business should go hand in hand, The Co-operative Bank’s unique customer-led Ethical Policy put customers’ values at the heart of what it does.

The Opportunity

Translating Co-operative Values and Ethics Into Conventional ESG Assessment Frameworks

The Co-operative Bank was born out of the co-operative movement over 150 years ago,1 and these values still guide the way the bank does business today. As the prevalence of ESG ratings and performance assessments of financial institutions increased, the bank grew concerned that the values and ethics shaping its business approach did not correspond with broadly adopted ESG assessment frameworks. This discrepancy resulted in The Co-operative Bank receiving ESG ratings it felt were not reflective of its market leading approach to ethics and sustainability.

To address this, The Co-operative Bank sought out the opportunity to engage with ESG ratings providers as part of the evaluation process. The intention was to provide additional information about its ESG-related policies and programs, creating a more accurate review of The Co-operative Bank’s ESG risk management. Its search for a comprehensive assessment of its ESG credentials led The Co-operative Bank to secure a Corporate ESG Risk Ratings License from Sustainalytics.

The Solution

Setting the Record Straight Through an ESG Risk Rating

The Co-operative Bank’s decision to engage with Sustainalytics on its ESG Risk Rating and obtain a license was influenced by a few factors. The bank was informed by some of its stakeholders that several of its peers had been rated by Sustainalytics. The Cooperative Bank also received feedback from several of its close investment bank relationships, recommending that it approach Sustainalytics regarding its ESG score.

Seeing the growing focus on ESG performance within its industry, The Co-operative Bank was also interested in understanding its own scores. “We wanted to be able to engage fully with an ESG ratings provider to better translate our values and ethics into an ESG framework,” said Maria Cearns, Managing Director of Customer and People at the Co-operative Bank. “Our goal was an assessment more reflective of the bank’s ESG risk profile.” By engaging with Sustainalytics, The Co-operative Bank was able to ensure its relevant policies and programs were provided for consideration as part of the assessment process.

The Benefits of the ESG Risk Rating License

The ESG Risk Ratings License afforded several benefits to The Co-operative Bank. With the license, the bank was able to set the initial research date to correspond with its external communications and reporting. It also received an overview of year-over-year score changes as well as notifications of any events or controversies that may have impacted its ESG Risk Ratings score. Additionally, the bank received the full version of its ESG Risk Ratings report, which helped it understand the areas where it was performing well and where it was lacking, as well as the summary version of its ESG Risk Ratings report for easy sharing with stakeholders.

“Sustainalytics’ openness and clarity around its timelines and research approach allowed The Co-operative Bank to manage expectations internally and ensure the review was completed efficiently.”

Maria Cearns

Managing Director of Customer and People, The Co-operative Bank

The Results

An ESG Assessment Reflective of Corporate Values and ESG Risk Management

Disclosing relevant information to Sustainalytics through the ESG assessment process helped The Co-operative Bank convey all aspects of its approach to ESG, demonstrating the bank’s values, ethics and actions. The subsequent ESG Risk Rating of 9.22 allowed The Co-operative Bank to share its ESG score more broadly to external stakeholders and the public.

The ESG Risk Ratings License3 allowed The Co-operative Bank to devise a fully integrated internal and external communications campaign to showcase its ESG leadership. The campaign incorporated public relations, national press advertising, social media posts, website updates, and communications to all key stakeholders (e.g., colleagues, customers, suppliers, and corporate partners). In addition to its overall ESG score, the license allowed the bank to share details on its performance on material ESG issues, as well as its summary ESG Risk Ratings report.

Building on the insights gained through its ESG assessment from Sustainalytics, The Co-operative Bank continues with its ESG practices and disclosing its progress with the aim of maintaining a low ESG risk profile.

References

1. “The co-operative movement is a social and economic movement which emerged in Europe as a reaction to early 19th-century industrialization. Co-operative organizations, enterprises owned by and operated for the benefit of their members, follow a set of principles best defined in 1844 by co-operators in Rochdale, England. The most important of these principles were that members in a co-operative each had one vote regardless of the investments made; anyone could join; surpluses or profits were distributed to members according to their levels of participation; and co-operatives would undertake educational activities for their members.” Macpherson, I. (2015). “Co-operative Movement,” The Canadian Encyclopedia, accessed 0.10.2021 at https://www.thecanadianencyclopedia.ca/en/article/co-operative-movement.

2. Sustainalytics’ ESG Risk Ratings measure a company’s exposure to industry-specific material ESG risks and how well it is managing those risks. The ESG Risk Rating is a company’s total unmanaged ESG risk score, thus the lower the score, the lower the company’s total unmanaged ESG risk. Learn more at https://www.sustainalytics.com/corporate-solutions/esg-risk-ratings.

3. Companies can obtain an ESG Risk Ratings License for three main use cases: Marketing and Investor Relations, Sustainability-Linked Loans, and Remuneration Programs.

Other Customer Stories

How a Leading Infrastructure and Facilities Conglomerate Successfully Linked its Sustainability Ambitions to its Financing

In pursuing a sustainability-linked loan (SLL) and obtaining a second-party opinion on the KPIs tied to it, Downer secured credibility for its sustainability commitments, while also achieving its financing objectives.

Do you have questions?

Set your business on the right ESG path by contacting our team of experts today.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.