Introduction

Sustainable finance has steadily gained traction in recent years, underpinning significant product and regulatory developments by the public and private sectors to galvanize sustainable economic growth. Broadly defined as “the provision of finance to investments taking into account environmental, social and governance considerations”,i sustainable finance is the maturation of a market that has been growing and innovating for several decades – responsible investing. Surpassing USD 30 trillion in assets under management in 2018,ii responsible investing spans a diverse range of approaches across regions and asset classes. Over the past decade, investor uptake has become widespread and mainstream with an emphasis on risk mitigation. There has also been a notable shift from siloed centers of ESG expertise to enterprise-wide integration across asset management and financial institutions.

A parallel trend among investors in recent years includes products and strategies explicitly oriented towards impact and sustainability solutions, fueled in part by the launch of the Sustainable Development Goals (SDGs) and the COP 21 Paris Agreement. With increased urgency around climate change, water and resource shortages and social inequality, there is growing recognition of the key role financial institutions must play in reallocating capital towards sustainability solutions, climate change mitigation and adaptation. The Organization for Economic Co-operation and Development (OECD) estimates that USD 6.9 trillion per year is required over the next decade to meet climate and development objectives.iii

Note: Asset values are expressed in billions of US dollars. All 2016 assets are converted to US dollars at the exchange rates as of year-end 2015. All 2018 assets are converted to US dollars at the exchange rates at the time of reporting.

Source: Global Sustainable Investment Alliance, “2018 Global Sustainable Investment Review,”

http://www.gsi-alliance.org/wp-content/uploads/2019/06/GSIR_Review2018F.pdf

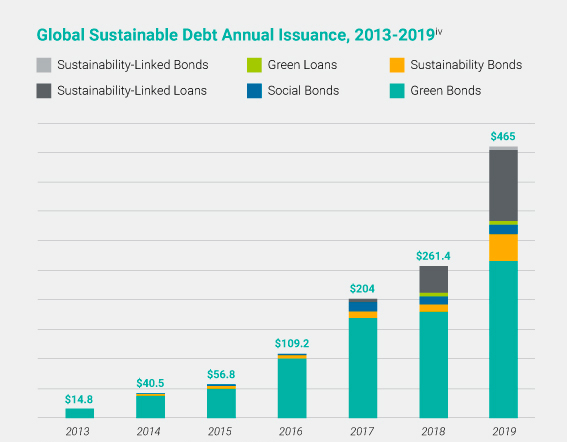

Note: Debt values are expressed in billions of US dollars.

Source: BloombergNEF, “Sustainable Debt Sees Record Issuance at $465Bn in 2019, Up 78% From 2018,” January 8, 2020, https://about.bnef.com/blog/sustainable-debt-sees-record-issuance-at-465bnin-2019-up-78-from-2018/

Financing Change: Allocating Capital to Sustainability Initiatives

In this context, forward-looking companies are addressing sustainability within their operations by bridging the gap between sustainability and finance. Companies are leveraging innovative financial instruments, such as green bonds, green loans and sustainability-linked loans, to fund sustainable projects. Green bonds enable capital-raising and investment for new and existing projects with environmental benefits; social bonds raise funds for projects with positive social outcomes; whereas sustainability bonds include a combined focus on social and environmental projects. Green loans enable financial institutions to directly fund environmentally beneficial assets, while sustainability-linked loans (also known as ESG-linked loans) are general purpose loans linking interest rates to improvements in sustainability performance.

Leading financial institutions are playing a critical role in driving product innovation and capital allocation to sustainability initiatives. As key intermediaries channeling investment towards sustainable projects, debt capital markets and sustainable finance teams are supporting their clients (corporate, sovereign and municipal issuers) in developing sustainable bond1 frameworks and promoting them to investors. While there is no conclusive evidence of preferential pricing for these types of bonds, they tend to be heavily oversubscribed while attracting new investors.v

Initially, the sustainable debt market focused on addressing environmental impacts through green bonds. Aligned with the Green Bond Principles, vi the most widely applied green use of proceeds categories include renewable energy, green buildings and transportation. As the market has evolved, the scope and complexity of sustainable bond frameworks has matured with new industries entering the market. The introduction of the Social Bond Principles and Sustainability Bond Guidelines in 2018 provided credibility to use of proceeds not explicitly defined as green. The sophistication of green bond underwriters, coupled with the expertise of second-party opinion providers like Sustainalytics, has supported market expansion into new thematic areas aligned with the SDGs, including gender, supply chain and SME financing.

Currently, some market participants are advocating for the addition of “transition bonds” to the green bond space, arguing that the transition to a sustainable, low-carbon economy will require that “brown” activities, such as steel, mining and cement production, take incremental steps toward sustainability and decarbonization, and that this too requires financing.vii

In the interim, sustainability-linked general-purpose loans and revolving credit facilities are providing more flexibility to borrowers in terms of allocating funds. While still linking capital to sustainability criteria, these instruments appeal to a wide range of sectors including browner industries. To broadly incentivize sustainability performance among their clients, forward-looking lenders are tying discounts or premiums of loan interest rates to their borrowers’ ESG ratings or other sustainability metrics. ESG Ratings from external research providers like Sustainalytics have underpinned many of the prominent ESG-linked loans to date due to their investor uptake and credibility.

Sustainability Linked Loan Principles – Core Components

The SLLP set out a framework, enabling all market participants to clearly understand the characteristics of a sustainability linked loan, based around the following four core components:

Relationship to Borrower’s Overall Corporate Social Responsibility (CSR) Strategy

Borrower should clearly communicate to its lenders its sustainability objectives and how they align with its proposed sustainability performance targets (SPTs).

Target Setting – Measuring the Sustainability of the Borrower

Appropriate SPTs should be negotiated and set between the borrower and lender(s). The SPTs should be tied to a sustainability improvement.

Reporting

Transparency is important in this market and borrowers should provide information on their SPTs to institutions participating in the loan at least once per year.

Review

This may involve audit/assurance statement or borrower can seek an external review of its performance against its SPTs.

Source: Loan Market Association, “Sustainability Linked Loan Principles”, March 2019, https://www.lsta.org/content/sustainability-linked-loan-principles-sllp/

Issued under various labels including, Sustainability Linked Loans, ESG Linked Loans and Positive Incentive Loans, the market grew to USD 122 billion in 2019viii since the first such loan was issued in April 2017. Spearheaded by syndicates representing some of the largest and most sustainable European banks, these loans have gained greatest traction in Europe and Asia-Pacific.

"The first Sustainability Linked Loan was led by ING and Dutch health technology company, Philips. In April 2017, a consortium of 16 banks led by ING agreed on a USD1.2 billion syndicated loan. The revolving credit facility’s (RCF) interest rates were tied to Sustainalytics’ ESG Rating. As per the loan terms, if Philips’ ESG Rating improves annually then its interest rates go down or vice versa. Since the pricing was dependent on the company’s overall ESG performance as opposed to a defined use of proceeds, Philips had maximum flexibility in utilizing the funds. Both ING and Philips benefitted from visibility for their sustainability leadership."

Contributing to the credibility of these loan instruments, in March 2019 three global loan trade bodies, Europe’s Loan Market Association (LMA), the US Loan Syndications and Trading Association, and Asia Pacific Loan Market Association (APLMA), launched a set of voluntary global guidelines called the Sustainability Linked Loan Principles. These principles provide a high-level framework focused on improving transparency and disclosure related to criteria for loans linked to sustainability performance.ix

Sustainable Finance as Part of the International Agenda

A wave of regional regulatory developments aims to support the shift in capital allocation to innovative environmental and social solutions which accelerate a transition to a low carbon economy. The European Commission stands out for its ambitious action plan on sustainable finance, adopted in 2018 as “a comprehensive strategy to further connect finance with sustainability”.x

Key elements of the plan include developing a detailed taxonomy of sustainable activities, European Union (EU) labels for green financial products, ESG reporting requirements for companies and requirements for sustainability benchmarks. The EU Taxonomy,xi once implemented, will define business activities across a range of sectors that make a “substantial contribution” to at least one of the EU’s sustainability objectives (to date the focus has been on climate change mitigation and adaptation) while also meeting a set of “do no significant harm” requirements and minimal social safeguards.

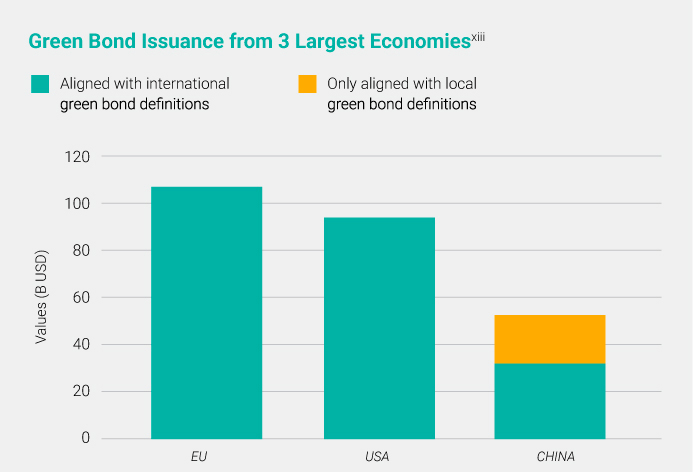

Issuance of sustainability bonds and loans have soared in Europe, accounting for over 40% of green bonds issued globally in 2019.xii Including the market for social, sustainable or SDG bonds, this number would be even higher. Among the largest global economies, Europe outpaced both the US and China in green bond issuance with more than USD 100 billion in bonds.

Following Europe’s leadership in sustainable finance, other regions are taking similar steps. Twenty-eight major cities including, London, New York, Toronto and most recently Tokyo, have joined the United Nations Environment Programme’s International Network of Financial Centres for Sustainability (FC4S). These cities have pledged to embed sustainable innovation within their financial institutions, among other sectors. Governmental initiatives, including regional green bond guidelines and subsidies in countries such as Japan and Singapore, are also being launched to incentivize green bond issuances.

2019 At a Glance

The top 5 cumulative green bond issuers for 2019 were Fannie Mae (USD22.8bn), KFW (USD9.02bn), Dutch State Treasury Agency (USD6.66bn), Republic of France (USD6.57bn) and Industrial & Commerce Bank of China (ICBC) (USD5.85bn).

Source: Climate Bonds Initiative, “Record 2019 GB Issuances $255bn! EU largest market: US, China, France lead top 20 national rankings: Sovereign GBs & Certified Bonds gain momentum,” https://www.climatebonds.net/2020/01/record-2019-gb-issuance-255bn-eu-largest-market-us-china-france-leadtop-20-national

In this context, leading corporate issuers are leveraging sustainability bonds and sustainability-linked loans tied to ESG ratings to expand their investor base, lower their cost of capital and secure preferential pricing from financial institutions. In doing so, they are investing in key areas of sustainability impact, while demonstrating their leadership. Financial intermediaries, including corporate lending and debt capital market desks, are playing a prominent role in advancing company uptake of such opportunities. Linking capital raising activities to sustainability initiatives requires meaningful collaboration across sustainability and finance departments, which have historically operated quite autonomously. Executive management and companies’ boards of directors also play a key role in setting the sustainability “tone from the top”. This speaks to the heart of sustainable finance – combining financial and sustainability objectives in innovative ways to galvanize sustainable economic growth.

References

i Sustainable Finance definition: https://ec.europa.eu/info/businesseconomy-euro/banking-and-finance/sustainable-finance_en

ii Global Sustainable Investment Alliance, 2018 Global Sustainable Investment Review, http://www.gsi-alliance.org/wp-content/uploads/2019/03/GSIR_Review2018.3.28.pdf

iii OECD, Financing Climate Futures: Rethinking Infrastructure, http://www. oecd.org/environment/cc/climate-futures/

iv Veronika Henze, BloombergNEF, “Sustainable Debt Sees Record Issuance At $465Bn in 2019, Up 78% From 2018”, January 2020, https://about.bnef.com/blog/sustainable-debt-sees-record-issuance-at-465bn-in-2019-up-78-from-2018/

v Climate Bonds Initiative, Green Bond Pricing in the Primary Market: Jan – June 2019, https://www.climatebonds.net/files/reports/cbi_gb_pricing_h1_2019_final.pdf

vi A voluntary set of process guidelines that clarify the approach for issuance of a Green Bond. International Capital Markets Association Green Bond Principles: https://www.icmagroup.org/green-social-and-sustainabilitybonds/green-bond-principles-gbp/

vii See, for example, AXA IM’s call for the addition of “transition bonds” to the green bond market: https://realassets.axa-im.com/content/-/asset_publisher/x7LvZDsY05WX/content/axa-investment-managers-calls-fornew-transition-bonds-to-help-companies-go-green/23818

viii Veronika Henze, BloombergNEF, “Sustainable Debt Sees Record Issuance At $465Bn in 2019, Up 78% From 2018”, January 2020, https://about.bnef.com/blog/sustainable-debt-sees-record-issuance-at-465bn-in-2019-up-78-from-2018/

ix Loan Market Association, Sustainability Linked Loan Principles, https://www.lsta.org/content/sustainability-linked-loan-principles-sllp/

x European Commission, Commission Action Plan On Sustainable Finance, https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance_en#action-plan

xi European Commission, EU Taxonomy For Sustainable Activities, June 18, 2019, https://ec.europa.eu/info/publications/sustainable-finance-tegtaxonomy_en

xii Leena Fatin, “Record 2019 GB Issuances $255bn! EU largest market: US, China, France lead top 20 national rankings: Sovereign GBs & Certified Bonds gain momentum,” Climate Bonds Initiative, January 16, 2020, https://www.climatebonds.net/2020/01/record-2019-gb-issuance-255bneu-largest-market-us-china-france-lead-top-20-national

About Sustainalytics’ Sustainable Finance Solutions

Sustainalytics is a leading global provider of environmental, social, governance (ESG) research, ratings and analytics. For over 25 years, Sustainalytics has been at the forefront of developing innovative solutions to meet the evolving needs of investors. Today, we support hundreds of the world’s leading pension funds and investment managers who incorporate ESG and corporate governance insights into their investment processes.

Sustainalytics’ Sustainable Finance Solutions support the growing demand for green and sustainability themed finance instruments in debt capital markets. The firm’s Sustainable Finance team work with issuers and underwriters to provide second-party opinions on bond frameworks aligned with leading global Principles and Guidelines. Sustainalytics also offers corporations the option to license its ESG Risk Ratings, which can be used for sustainability-linked loans and for other capital raising activities.