Principles of Responsible Banking

On September 22, 2019 in New York, representatives from 130 banks joined dignitaries, including the Secretary-General of the United Nations, to launch what has been called “the most significant mechanism ever jointly created by the UN and the global finance industry” to cultivate a sustainable and responsible banking system. The Principles for Responsible Banking (the “Principles”) is an initiative of the United Nations Environment Programme Finance Initiative (“UNEP-FI”) in collaboration with the banking sector. The Principles have the stated goal of ensuring the banking industry is aligned with the UN Sustainable Development Goals (“SDGs”) and the Paris Climate Agreement.

As with many such voluntary, aspirational, and industry-wide programs, there are many encouraging developments contained in the Principles. At the same time, the ability for this initiative to bend decision-making amongst some of the world’s largest banks towards alignment with the SDGs and Paris Climate Agreement will take some time to be revealed. Most exciting to our team at Sustainalytics is that the Principles require banks to take a hard look at their business strategies and their impacts on the environment and society. We believe this undertaking will reveal clear benefits for creating products for customers and investors that offer transparency on a bank’s activities. Coupled with products and services offered by Sustainalytics, the Principles could potentially spur banks to move from reducing the negative impacts of their activities to proactively “doing good” for people and planet. For this reason, Sustainalytics has endorsed the Principles for Responsible Banking and has committed to working closely with banks as they seek to further incorporate sustainability considerations throughout their operations.

Content of the Principles

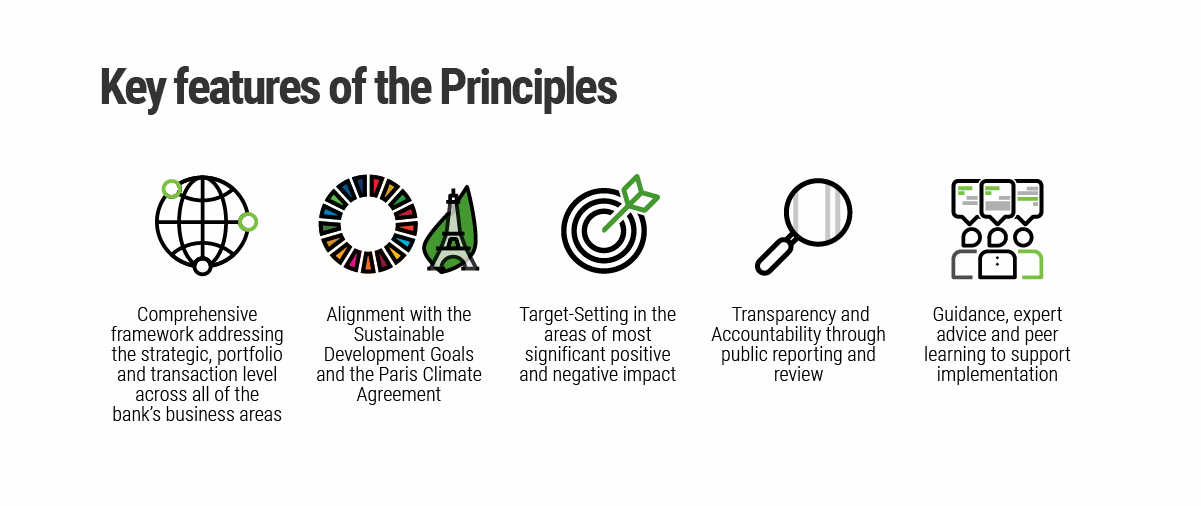

Source: UNEP FI / Principles for Responsible Banking

To join the Principles for Responsible Banking, a bank’s CEO must publicly commit to the ambition of the six principles, which are:

- Alignment

- Impact & Target Setting

- Client & Customers

- Stakeholders

- Governance & Culture

- Transparency & Accountability

The first and second principles are where we believe real impact can be achieved. Principle #1 states that signatory banks will “align [their] business strategy to be consistent with and contribute to individuals’ needs and society’s goals, as expressed in the Sustainable Development Goals, the Paris Climate Agreement and relevant national and regional frameworks.” The guidance document further explains that a bank, including its board and executives, should have a comprehensive understanding of the SDGs and the Paris Climate Agreement and should identify if “any current activities, portfolio focus areas, products or services to clients and customers are inconsistent with the SDGs and the Paris Climate Agreement.” This will likely require banks to proactively seek to increase finance in green and socially responsible sectors and decrease investment in non-aligned sectors, such as fossil fuel activities and forestry or agriculture that is not sustainably managed. A tool launched by the World Resources Institute in 2019 shows that of the world’s 50 largest private sector banks, only four have sustainable finance commitments larger than their fossil fuel finance. Presumably, to align with the Principles for Responsible Banking, not only would every bank have to finance green and socially sustainable projects to a far greater degree than fossil fuels, but they would also need a plan to completely eliminate fossil fuel financing by 2030 at the latest, in line with research from the UN Framework Convention on Climate Change.

Principle #2 states that participating banks will “continuously increase [their] positive impacts while reducing the negative impacts on, and managing the risks to, people and environment resulting from [their] activities, products and services. To this end, [they] will set and publish targets where [they] can have the most significant impacts.” Here again, the potential is significant. Signatory banks must identify, assess and improve the impact on people and the environment resulting from their activities. They must also set a minimum of two targets that address at least two of the identified significant impacts. This requirement will again demand that banks make tough choices and, we believe, will result in changes to how banks operate internally. Specifically, banks will have to closely consider which projects and companies are funded and to what extent, and which projects and companies can no longer be funded as they pose too great a risk to people and/or the natural environment.

Products and Services to put the Principles into Action

The Principles for Responsible Banking require signatory banks to take several steps to ensure their activities support the SDGs and the Paris Climate Agreement. Moreover, the Principles also call for banks to increase their positive impacts on people and planet, while reducing negative impacts and managing remaining risks. Beyond the impact assessments (Principle #2), stakeholder mapping (Principle #4), building of internal expertise (Principle #5) and reporting on progress (Principle #6), banks will need to develop products and services that bring the Principles to life. Leading banks, many with the support of Sustainalytics, are already doing the following:

- Guides for Deposits and Lending – As clients increasingly demand that banks use their deposits for responsible investing, banks are turning to Sustainalytics to support them in defining eligibility criteria for green and social categories under which the bank will accept deposits and make loans. Forthcoming regulation, in the form an EU-wide taxonomy, means that investment decisions will become more robust, but also more complicated to understand and develop.

- Green, Social and Sustainability Bonds and Loan Products – The market for green, social and sustainability bonds and loans has grown significantly in recent years. As the market for these finance instruments blossoms, leading banks will continue to issue such bonds and loans to increase the positive impact they can have in their markets. Sustainalytics is the leading provider of opinions on green, social and sustainability bonds, as well as ESG-linked and sustainability loans.

- Marketing ESG Performance– Banks who implement the Principles for Responsible Banking may see their ESG scores improve, and some may already be leaders in their industry. Communicating this performance, both internally and externally, is becoming a vital tool for banks. Sustainalytics offers financial institutions the chance to license their ESG Risk Rating. The ESG Risk Rating is one of the clearest and most reputable means of communicating a bank’s overall corporate sustainability as it measures both a company’s exposure to ESG risks, as well as its performance in managing those risks.

To provide feedback on this topic or to discuss some of the ways we can help your bank demonstrate a leadership position in sustainable finance, please get in touch!

Recent Content

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

Today’s Sustainable Bond Market: Boosting Confidence in Sustainable Bond Issuances

In this article, we examine the kinds of sustainable bonds offered in the market, some of the key regulations being developed in different markets and the current initiatives to improve the quality and credibility of issuances.

Webinar Recap: How Integrating ESG Can Drive Opportunity for Private Companies

Recently, Morningstar Sustainalytics hosted a webinar – ESG in the Lifecycle of a Private Company: How Stakeholder Demands Drive Sustainability in Private Markets – to address some of the questions private companies might have surrounding ESG and how it could impact their business.