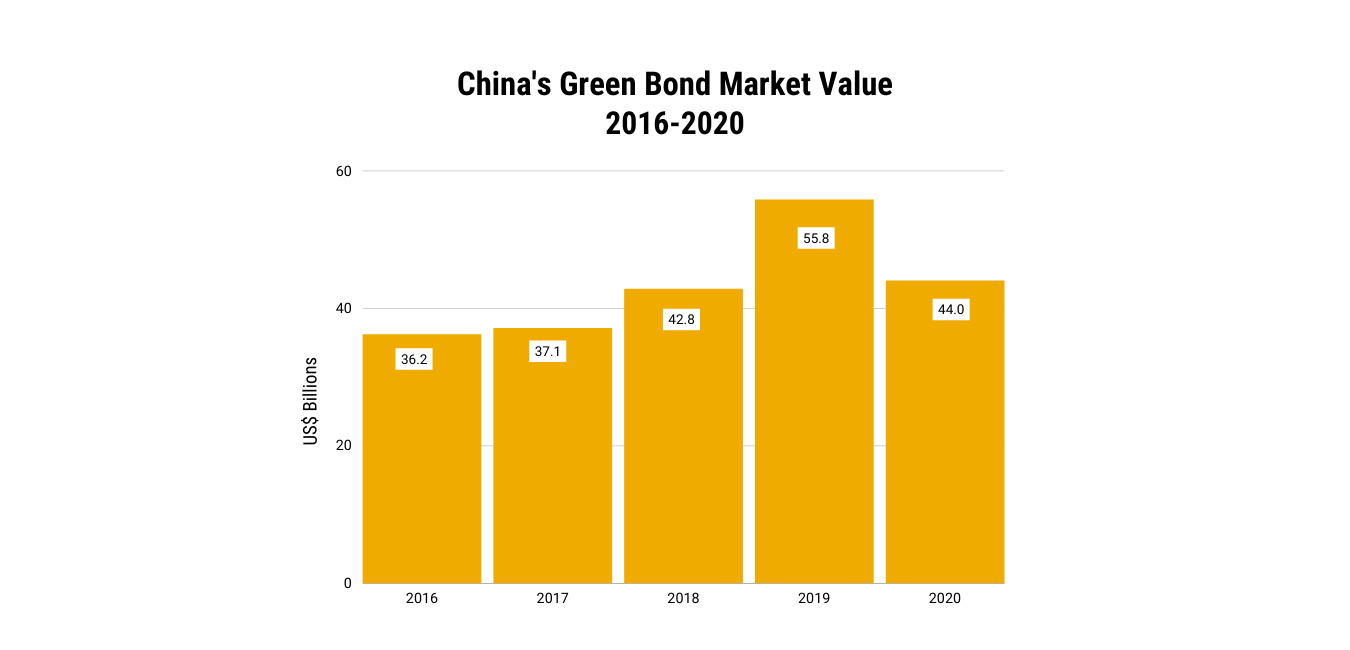

China’s green bond market is relatively young, but has grown into one of the world’s largest.[i] According to the Climate Bonds Initiative (CBI), China was the second-largest country for green bond issuances in 2020, with a total value of US$44 billion in domestic and overseas markets. [ii] In this article, we review developments in China’s green bond market, analyze its characteristics, and provide our thoughts on anticipated developments for the upcoming year.

The Recent Development of China’s Green Bond Market

The first Chinese green bond was issued by the Agricultural Bank of China in the London market in late 2015.[iii] By the end of 2016, Chinese green bond issuances grew to US$36.2 billion, accounting for 39% of global green bond issuances. In 2020, due to the impact of COVID-19, the total value of green bond from Chinese issuers was US$44 billion, a 21% decrease compared to 2019.[iv] Despite the decline, China was still the second-largest green bond market in the world in terms of cumulative issuance.[v] As China’s green bond market rebounded, a total of US$37.6 billion in green bonds were issued in the domestic and overseas markets in the first half 2021, already accounting for approximately 85% of the total annual volume of 2020.[vi]

Source: CBI, China Green Bond Market Report 2020,

https://www.climatebonds.net/files/reports/cbi_china_sotm_2021_06c_final_0.pdf

Source: CBI, China Green Bond Market Report 2020,

https://www.climatebonds.net/files/reports/cbi_china_sotm_2021_06c_final_0.pdf

Key Characteristics of China’s Green Bond Market

A Government Led Approach

China’s green bond market development was primarily driven by a top-down policy endorsement from the central government. The market grew quickly, following the publication of regulations and guidelines from the People’s Bank of China (PBoC) and the National Development and Reform Commission (NDRC).[vii] [viii] The China Securities Regulatory Commission (CSRC) subsequently published guidance for the issuance and trading of green bonds on the exchange market, providing a “green channel” for accepting and reviewing green corporate bonds. [ix] It is widely recognized that China’s top-level policy design, guidance, incentives, and efficient implementation are supporting the rapid growth of the country’s green bond market.[x] This approach helped to build a basic green finance framework effectively and leverage financial instruments to facilitate the transformation to a greener economy.[xi]

China’s Taxonomy: Consolidation and Updated Standards

While a green bond is a commonly recognized sustainable finance instrument in China, the country lacked consistent and unified definitions and classifications of green industries for a long time.[xii] In April 2021, the PBoC, NDRC, and CSRC jointly published the Green Bonds Endorsed Project Catalogue, 2021 Edition (commonly referred to as the “Catalogue”).[xiii] Compared to its 2015 edition, the Catalogue reclassifies green projects in line with NDRC’s Green Industry Guiding Catalogue. More importantly, it removes some carbon-intensive activities related to clean coal, coal-fired power, coal mining and washing, and oil and gas exploration equipment.[xiv] The Catalogue also provides more detailed and stringent qualitative and quantitative criteria for green activities. The Catalogue represents China’s effort to consolidate its taxonomies for green bonds and increase the alignment with international standards such as the CBI’s criteria.

Allocation of Proceeds: Divergence from International Guidance

Along with its taxonomy, China has also developed its own standards for allocating and reporting on the use of green bond proceeds. Per the country’s current regulations, issuers can use 30% to 50% of the proceeds raised from green bonds for general corporate purposes. For example, NDRC allows issuers to use no more than 50% of proceeds to repay bank loans and supplement working capital. In comparison, according to guidelines for the Shanghai Stock Exchange and Shenzhen Stock Exchange, issuers on these exchanges can use a maximum of 30% of proceeds from their green bond issuances for general corporate purposes.[xv] This contrasts with international guidance, such as the Green Bond Principles, which state that proceeds should be used exclusively to finance or refinance green projects. According to the CBI, China’s divergent approach to how proceeds can be allocated has become the primary reason for the misalignment between green bonds from Chinese issuers and green bonds from issuers in other countries.[xvi] This difference could weaken the intended green impact of Chinese green bonds as well as their appeal to investors.

Outlook: Growth, Innovation, and Solidifying Its Place in the Green Bond Market

China’s green bond market has excellent growth potential, as labeled green bonds represented less than 1% of China’s overall bond market in 2020, and nearly 80% of the outstanding onshore green bonds will reach maturity by 2026.[xvii] Moreover, the governor of PBoC expects the private sector to contribute 85% to 90% of the capital investment needed to achieve China’s carbon neutrality target by 2060.[xviii]

In addition, a variety of green and thematic bonds are expected to emerge in China’s green bond market. In 2021, the National Association of Financial Market Institutional Investors (NAFMII) introduced carbon-neutral bonds, sustainability-linked bonds, and initiated pilot programs for social responsibility bonds and sustainable development bonds in the interbank market. Carbon-neutral bonds, blue bonds, and rural revitalization bonds were also introduced to the Chinese exchange market in 2021.

Closer alignment between China’s green bond standards and international standards is also expected. The PBoC and the European Commission jointly launched the Common Ground Taxonomy (CGT) in November 2021.[xix] The taxonomy identifies the similarities and differences between green activities recognized in the EU and China and is expected to enhance the comparability and consistency of sustainable finance classification standards. [xx] China is also seeking to strengthen and unify its requirements on the disclosure of green bond information and has participated in an ongoing pilot project to enhance financial institutions’ climate and environmental information disclosure. [xxi] [xxii] This greater alignment will likely help attract more overseas investors to the Chinese green bond market and facilitate more cross-border transactions.[xxiii]

Strong government support and a country-specific taxonomy with a more flexible approach to how green bond proceeds can be used, has contributed to the fast-paced growth of China’s green bond market. However, to meet the country’s carbon neutrality goals requires input from the private sector and the continued development and funding of green assets. The Common Ground Taxonomy and other efforts to align China’s green bond market with international standards should attract more foreign investment and boost onshore green investment, solidifying China’s place as a major player in the global green bond market.

Sources:

[i] Lin, L. and Hong, Y. (2021), “Developing a Green Bonds Market: The Case of China”, NUS Centre for Banking & Finance Law Working Paper 21/01, accessed (07.01.22) at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3880280

[ii] CBI (2021), “China Green Bond Market Report 2020”, CBI, accessed (07.01.22 ) at: https://www.climatebonds.net/files/reports/cbi_china_sotm_2021_06c_final_0.pdf

[iii] CBI (2017) “China Green Bond Market 2016”, CBI, accessed (07.01.22) at: https://www.climatebonds.net/files/reports/sotm-2016-a4-en.pdf

[iv] CBI, “China Green Bond Market Report 2020”.

[v] Ibid.

[vi] Ibid.

[vii] See regulations and guidelines:

PBoC (2015), “关于在银行间债券市场发行绿色金融债券有关事宜公告”, PBoC, accessed (05.01.22) at: https://www.chinabond.com.cn/cb/cn/sczy/flfg/jgbmgf/fxywl/jrzq/20210224/157149606.shtml

NDRC (2015), “绿色债券发行指引”, NDRC, accessed (05.01.22) at: https://www.ndrc.gov.cn/xxgk/zcfb/tz/201601/t20160108_963561.html?code=&state=123

[viii] CBI (2017) “China Green Bond Market 2016”, CBI, accessed (07.01.22) at: https://www.climatebonds.net/files/reports/sotm-2016-a4-en.pdf

[ix] CSRC (2018), “关于支持绿色债券发展的指导意见”, CSRC, accessed (05.01.22), at: https://www.ndrc.gov.cn/xwdt/ztzl/gbmjcbzc/zjh/201807/t20180704_1209239.html?code=&state=123

[x] Lin, L. and Hong, Y. (2021), “Developing a Green Bonds Market: The Case of China”.

[xi] Ibid.

[xii] The PBoC issued the Green Bond Endorsed Project Catalogue (绿色债券支持项目目录) in 2015 that provides a three-level classification and defining criteria of green projects. NDRC’s Guidelines for the Issuance of Green Bonds (绿色债券发行指引), however, identifies 12 categories of green projects without defining the criteria in detail. The Green Industry Guiding Catalogue issued by NDRC and other six ministries in 2019 classifies green industries into six categories with differences from the Green Bond Endorsed Project Catalogue.

[xiii] PBoC et al. (2021), “绿色债券支持项目目录(2021年版)”, PBoC et al., accessed (03.01.22) at http://www.gov.cn/zhengce/zhengceku/2021-04/22/content_5601284.htm

[xiv] Gao, B. (2020), “China’s New Green Bond Catalogue Could be Greener”, China Dialogue, access (10.01.22) at: https://chinadialogue.net/en/business/chinas-new-green-bond-catalogue-could-be-greener/

[xv] Shenzhen Stock Exchange (2021), “深圳证券交易所公司债券创新品种业务指引第 1 号——绿色公司债券(2021年修订)”, Shenzhen Stock Exchange, accessed (03.01.22) at: http://docs.static.szse.cn/www/disclosure/notice/W020210713654171773449.pdf;Shanghai Stock Exchange (2021), “上海证券交易所公司债券发行上市审核规则适用指引第2号——特定品种公司债券(2021年修订)”, Shanghai Stock Exchange, accessed (03.01.22) at: http://www.sse.com.cn/lawandrules/sselawsrules/bond/review/c/c_20210713_5520720.shtml

[xvi] CBI (2021), “China Green Bond Market Report 2020”.

[xvii] Ibid.

[xviii] CBI (2021), “China Green Securitisation Report: State of the Market 2020”, CBI, accessed (05.01.22) at: https://www.climatebonds.net/files/reports/cbi_cn_2020_sotm_04h_1.pdf

[xix] International Platform on Sustainable Finance (2021), “Common Ground Taxonomy – Climate Change Mitigation”, IPSF Taxonomy Working Group, accessed (10.01.22) at: https://ec.europa.eu/info/sites/default/files/business_economy_euro/banking_and_finance/documents/211104-ipsf-common-ground-taxonomy-instruction-report-2021_en.pdf

[xx] Fintech Global (2021), “EU and China Publish Sustainable Finance Common Taxonomy”, Fintech Global, accessed (10.01.22) at: https://member.fintech.global/2021/11/08/eu-and-china-publish-sustainable-finance-common-taxonomy-in-regtech/

[xxi] PBoC (2021), “Governor Yi Gang attended the PBC-IMF High-Level Seminar on Green Finance and Climate Policy and delivered Opening Remarks”, Hong Kong Green Finance Association, accessed (10.01.22) at: https://www.hkgreenfinance.org/governor-yi-gang-attended-the-pbc-imf-high-level-seminar-on-green-finance-and-climate-policy-and-delivered-opening-remarks/

[xxii] Lin L. and Hong Y. (2021), “Developing a Green Bonds Market: The Case of China”.

[xxiii] Gao, B. (2020), “China’s New Green Bond Catalogue Could be Greener”.

Recent Content

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

Today’s Sustainable Bond Market: Boosting Confidence in Sustainable Bond Issuances

In this article, we examine the kinds of sustainable bonds offered in the market, some of the key regulations being developed in different markets and the current initiatives to improve the quality and credibility of issuances.

Webinar Recap: How Integrating ESG Can Drive Opportunity for Private Companies

Recently, Morningstar Sustainalytics hosted a webinar – ESG in the Lifecycle of a Private Company: How Stakeholder Demands Drive Sustainability in Private Markets – to address some of the questions private companies might have surrounding ESG and how it could impact their business.