As our global community continues to endure an altered way of life amidst the on-going COVID-19 outbreak, it is only natural to ask what each of our lives, professional and otherwise, will look like on the other side. Once children and teachers go back to school and workers return to their offices, will our society have done everything it could have to mitigate the social and economic impacts of this crisis and will we have built in resiliency against future system shocks?

For those of us working in sustainable finance, from our team here at Sustainalytics, to debt capital market analysts at global banks, and to corporate treasurers and thought leaders, one area of focus has been on the potential of social bonds to help us collectively mitigate this crisis and adapt to future crises.

To-date, social bonds have been issued at a much lower rate than green bonds. For example, based on our analysis (part 2 of our Sustainable Finance Guide) in 2019, social bonds had a total issuance of USD $13 billion, compared to USD $257 billion in issuances for green bonds. Even when sustainability bonds, which include a mix of social and green use of proceeds, are included, these bonds only account for an additional USD $40 billion in issuances in 2019.

For the following reasons, we believe that social bonds[1], and sustainability bonds, have the potential of being a critical tool for reducing the short and long-term impacts of the COVID-19 pandemic:

- Social bonds are inclusive. While they are expected to specifically target vulnerable and marginalized groups, they can provide general public benefit and, in this way, they build social resilience;

- Social bonds are responsive. They can be designed to be nimble and pivot to raising capital for critical areas of need;

- Sustainability bonds are flexible and multifaceted. Capital markets have become accustomed to thematic social bonds. Social bonds labelled as ‘COVID-19 response’ and/or ‘COVID-19 recovery’ bonds would, therefore, be understood by the market and can even be aligned with another thematic issuance area – the Sustainable Development Goals, which are one of the most widely adopted trackers of combined social, economic and environmental wellbeing that we have.

Social bonds are inclusive

The Social Bonds Principles, 2018 confirm that projects funded by social bonds should “directly aim to address or mitigate a specific social issue and/or seek to achieve positive social outcomes especially, but not exclusively for a target population(s).” In response to the COVID-19 outbreak, the International Capital Markets Association (ICMA) published supplemental guidance acknowledging that “social bonds, while seeking to achieve positive social outcomes for target populations, may also serve to address the needs of the general population.”

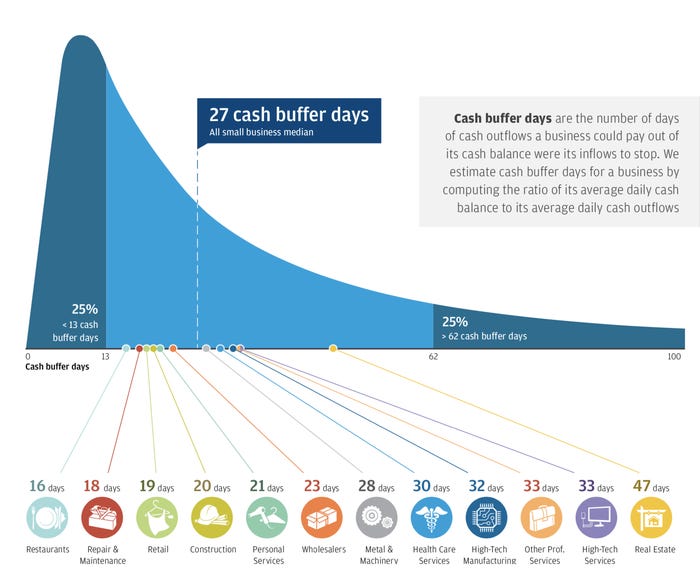

One of the most striking impacts revealed by the COVID-19 outbreak is just how vulnerable large segments of our society are. For example, a recent analysis of 597,000 American small businesses found that only half of the companies held cash reserves large enough to support 27 continuous business days with no revenue. Businesses that were stable just one month ago are now on the brink of bankruptcy, meaning the companies themselves, as well as their owners, employees and suppliers, may all soon fit the definition of “vulnerable populations” by virtue of their unemployment status.

Source: JP Morgan Chase Institute. Republished in Business Insider

Social bonds have the potential to be used to fight the coronavirus not only by financing acute needs such as emergency medical equipment, but also by supporting resiliency functions in various forms, such as by financing R&D that could lead to a vaccine for COVID-19. They can also address the ripple effect that COVID-19 is having on other industries and communities at large, such as providing longer-term economic support that may make the difference between businesses declaring bankruptcy or being able to stay afloat over the coming weeks and months. By helping to prevent business insolvency and even higher unemployment rates, social bonds will provide particularly enduring social and economic value.

Social bonds issued in the past weeks, including from the International Finance Corporation, the Nordic Investment Bank and the African Development Bank, all include use of proceeds design to support both individuals directly impacted by the virus, as well as individuals, charities and companies who are serving those directed impacted. In this way they are supporting both vulnerable populations and the general public and serving a duel mitigation and adaptation function.

Social bonds are responsive to short and longer-term needs

These past few weeks have also shown social bonds to be incredibly responsive to capital needs that are changing on almost a weekly basis. While the concept of ‘catastrophe bonds’ and ‘pandemic bonds’ is not new (issuances of ‘catastrophe bonds’ date back to 1997), the speed at which supra-governmental and central banks have issued social bonds in response to COVID-19 is proof of their timeliness potential.

Social bonds, drafted with the right frameworks in mind, can also pivot as urgent financing needs change. For example, whereas financing healthcare needs in a specific city or country may currently be focused on procuring medical equipment, projects can be added as needed to support R&D on a vaccine or for long-term for those living with permanent health conditions.

Sustainaltyics has already started to receive inquiries from a variety of potential social bond issuers for second-party opinion services. The prospective issuers, some of whom we were not in discussions with prior to the COVID-19 outbreak, as well as the variety of potential issuers – including sovereign entities, municipalities, development banks, and corporates, attest to the fact that social bonds are a timely tool to attempt to flatten the curve of the Coronavirus.

Sustainability bonds are flexible and multifaceted

As discussed above, the COVID-19 outbreak has already inflicted significant social and economic damage. International research shows that viruses like the coronavirus are expected to occur more frequently in a warmer global climate.

Source: World Economic Forum, Global Risks Report 2020

This will create increasing need for expenditures on activities that support both social and environmental improvement. Two related ways of achieving this are through the issuance of sustainability bonds, explained above as bonds which include at least one green use of proceeds and at least one social use of proceeds, and/or thematic bonds such as SDG bonds.

As much as green bond issuances grew from 2018 to 2019, sustainability bonds grew proportionally even more – more than doubling from USD $18 billion in 2018 to USD $40 billion in 2019. Both COVID-19 and climate change-related natural disasters have provided harsh reminders that, in our interconnected world, environment, social, and economic progress go hand in hand in hand. Sustainability bonds are a multifaceted tool to finance both social and environmental resilience.

The past few years have seen the emergence of several types of thematic bonds, many of which align use of proceeds to the achievement of one or more of the U.N. Sustainable Development Goals (SDGs). To-date, several SDG-aligned sustainability bonds have been issued and reviewed by Sustainalytics , attesting to whether the use of proceeds will help achieve one or more SDGs. As the COVID-19 outbreak hopefully moves from disaster relief to longer-term resilience, COVID recovery bonds can sit alongside other thematic issuances such as SDG, gender and water bonds, for example.

One Step at a Time

The COVID-19 crisis is changing on a daily basis. As the number of infected persons rise, governments, NGOs and the business community are trying to figure out, in real-time, the best ways to help people weather the storm. Social and sustainability bonds, due to their ability to provide flexible and immediate financing for critical care and economic stimulus, while also being multifaceted enough to address the longer-term resilience of our economic and social systems, are a vital tool to overcome these times.

[1] In this blog we use the term “social bonds” but acknowledge that “sustainability bonds”, which include at least one social use of proceeds and at least one green use of proceeds, are equally fit for purpose.

Recent Content

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

Today’s Sustainable Bond Market: Boosting Confidence in Sustainable Bond Issuances

In this article, we examine the kinds of sustainable bonds offered in the market, some of the key regulations being developed in different markets and the current initiatives to improve the quality and credibility of issuances.

Webinar Recap: How Integrating ESG Can Drive Opportunity for Private Companies

Recently, Morningstar Sustainalytics hosted a webinar – ESG in the Lifecycle of a Private Company: How Stakeholder Demands Drive Sustainability in Private Markets – to address some of the questions private companies might have surrounding ESG and how it could impact their business.