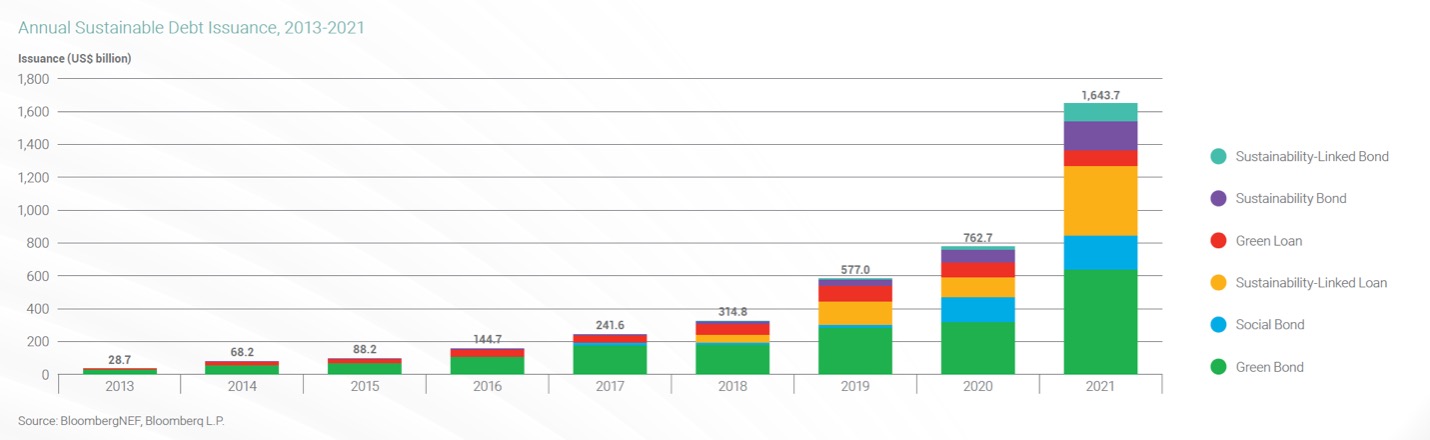

Despite the market volatility due to COVID-19, the sustainable finance market has seen rapid growth in the last two years. Sustainable debt issuance set a record in 2021, surpassing US$1.6 trillion.1 Even in the face of broader market forces, which contributed to a decline in the volume of issuances in the first part of 2022, the total outstanding value of the sustainable finance market continues to rise.2

With the market rapidly expanding, there are also growing expectations for transparency around key performance indicators (KPIs) and associated sustainability performance targets (SPTs) of sustainability-linked finance instruments.

The Growing Importance of KPIs and SPTs

What’s Next in the Evolution of Sustainability-Linked Instruments

- SLBs and SLLs are flexible and can be used for general corporate purposes.

- Sustainability-linked finance instruments offer companies a good avenue to communicate their sustainability commitments to the market.

- Investors are continuing to demand more information on material ESG issues.

References

1 BloombergNEF. 2022. “1H 2022 Sustainable Finance Market Outlook.” January 24, 2022. https://about.bnef.com/blog/1h-2022-sustainable-finance-market-outlook/.

2 Natixis. 2022. “Green Bonds Review 2Q22: The green and sustainable bond market starts to mature.” April 28, 2022. https://home.cib.natixis.com/articles/green-bonds-review-2q22-the-green-sustainable-bond-market-starts-to-mature.

3 TDC Net. 2022. Sustainability-Linked Finance Framework. https://tdcnet.dk/media/yflpkwgr/tdc-net-sustainability-linked-finance-framework.pdf.

4 Nauman, B. 2020. “Green loans catch on in push for companies to clean up.” January 20, 2020. Financial Times. https://www.ft.com/content/d649cf78-35f8-11ea-a6d3-9a26f8c3cba4.

5 Environmental Finance. 2022. “Sustainability-linked Debt – Carbon Emissions KPIs.” July 11, 2022. https://www.environmental-finance.com/content/downloads/sustainability-linked-debt-carbon-emissions-kpis.html.

6 Low base effect is the tendency for a small absolute change from a low initial amount to be translated into a large percentage.

Recent Content

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

Today’s Sustainable Bond Market: Boosting Confidence in Sustainable Bond Issuances

In this article, we examine the kinds of sustainable bonds offered in the market, some of the key regulations being developed in different markets and the current initiatives to improve the quality and credibility of issuances.

Webinar Recap: How Integrating ESG Can Drive Opportunity for Private Companies

Recently, Morningstar Sustainalytics hosted a webinar – ESG in the Lifecycle of a Private Company: How Stakeholder Demands Drive Sustainability in Private Markets – to address some of the questions private companies might have surrounding ESG and how it could impact their business.