A growing number of stakeholders is putting pressure on companies to increase transparency and accountability around environmental, social, and governance (ESG) issues. To make progress on these non-financial strategic issues, many companies are looking to a tried-and-tested tool for addressing financial issues: tying executive compensation to performance metrics.

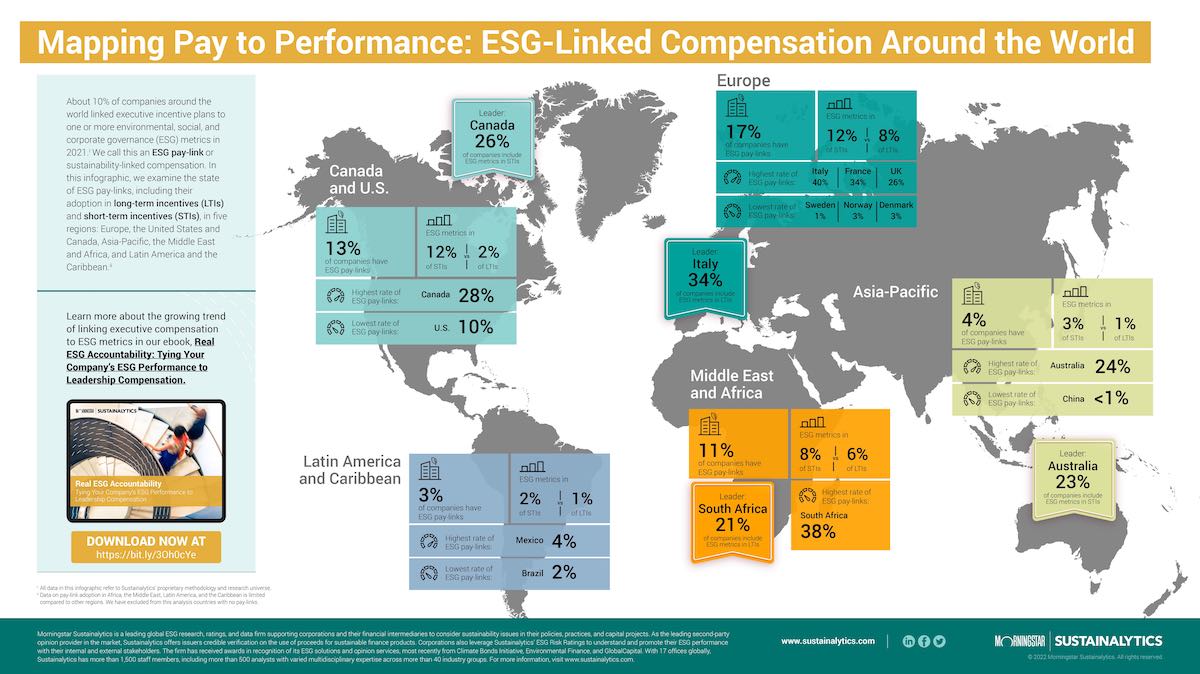

About 10% of companies around the world linked executive incentive plans to one or more ESG metrics in 2021. We call this an ESG pay-link or sustainability-linked compensation. In this infographic, we examine the state of ESG pay-links, including their adoption in long-term incentives and short-term incentives, in five regions: Europe, the United States and Canada, Asia-Pacific, the Middle East and Africa, and Latin America and the Caribbean.

Access a PDF version of the infographic by clicking on the image below or downloading it here.

For more insights on the state of ESG pay-links, why companies are introducing ESG-linked compensation, and how to get started, download our ebook, ESG Accountability: Tying ESG Performance to Executive Compensation.

Recent Content

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

Today’s Sustainable Bond Market: Boosting Confidence in Sustainable Bond Issuances

In this article, we examine the kinds of sustainable bonds offered in the market, some of the key regulations being developed in different markets and the current initiatives to improve the quality and credibility of issuances.

Webinar Recap: How Integrating ESG Can Drive Opportunity for Private Companies

Recently, Morningstar Sustainalytics hosted a webinar – ESG in the Lifecycle of a Private Company: How Stakeholder Demands Drive Sustainability in Private Markets – to address some of the questions private companies might have surrounding ESG and how it could impact their business.