As environmental, social, and governance risks are becoming a strategic issue for corporations, CSR and sustainability teams are taking on greater responsibility for ESG activities. As a result, corporate sustainability professionals need to understand how ESG is evolving, how peers are facing ESG risks, and how to approach ESG reporting and ratings.

The Morningstar Sustainalytics Corporate ESG Survey Report highlights the challenges CSR and sustainability professionals are facing, how peers are meeting the challenges, where companies are focusing their ESG efforts, and how companies are using ESG ratings or scores.

Read the report to learn:

- The ESG challenges companies face around the world and the resources CSR and sustainability professionals are using to meet them.

- The key steps to ESG maturity, including assessing strategic ESG risks, setting goals and KPIs to address the risk, and implementing a formal ESG strategy.

- Where companies are focusing their ESG investments, including the priority issues that are of emerging and ongoing concern.

- How companies are using their ESG ratings or scores to help address their own challenges and inform their ESG programs.

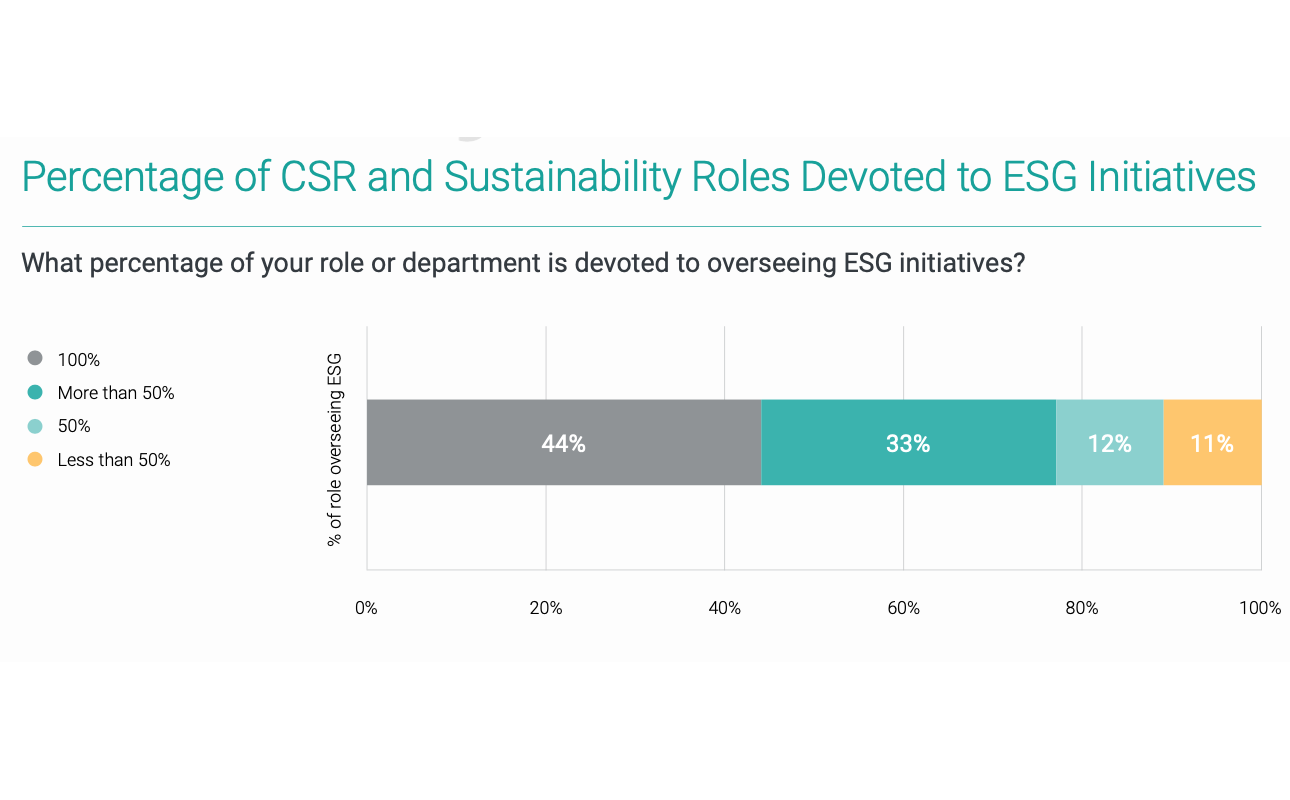

Are CSR and sustainability teams becoming ESG teams?

How many firms have identified strategic ESG risks?

Key Findings

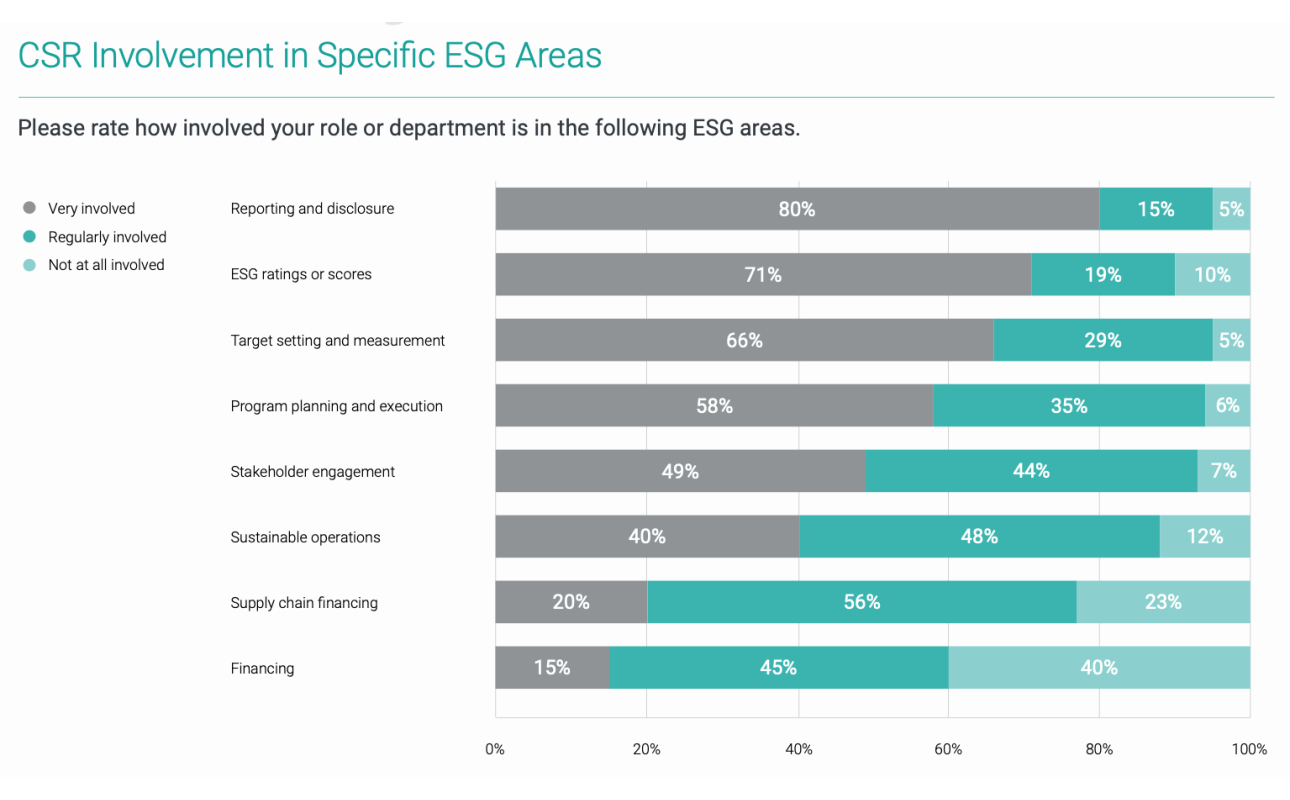

- 77% of CSR and sustainability professionals say they are involved in the majority of corporate ESG-related tasks, including reporting and disclosure, target setting and measurement, program planning, and ESG ratings.

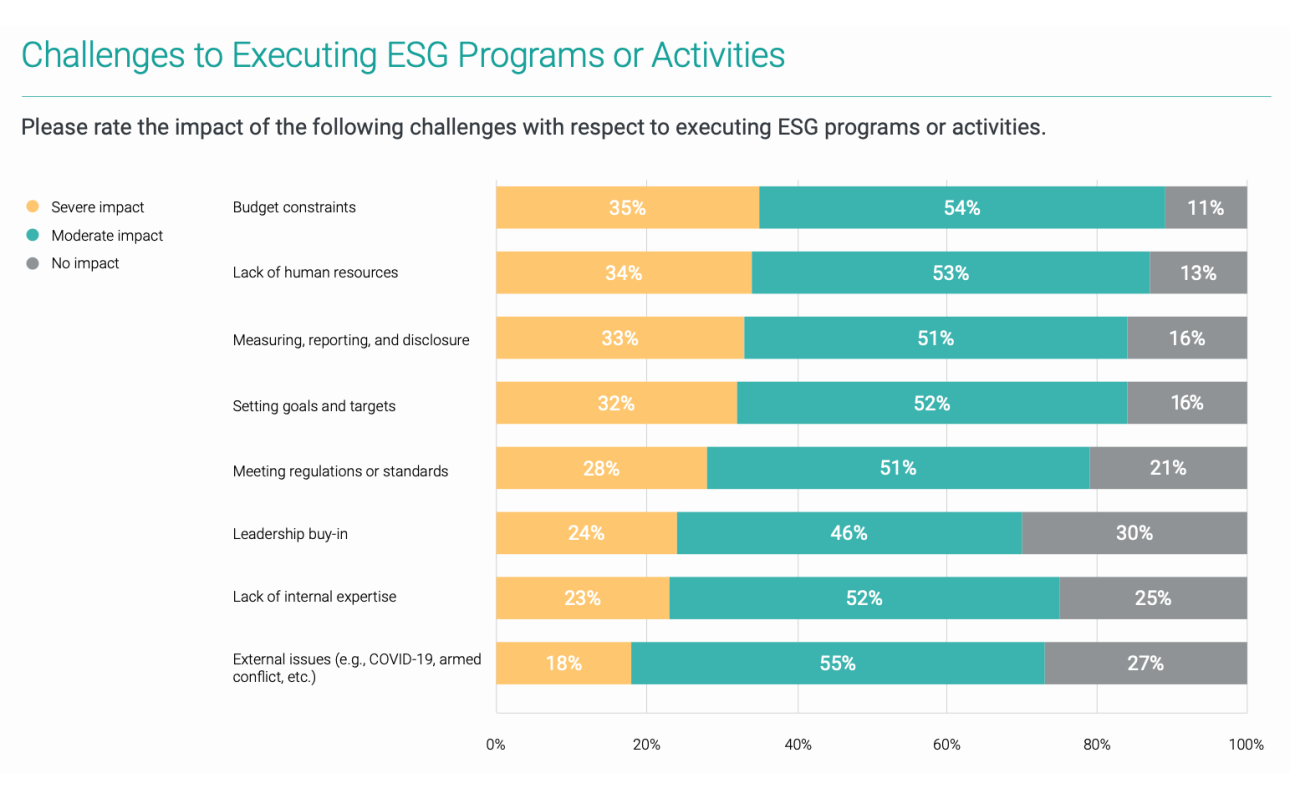

- Budget constraints (35%), lack of human resources (34%), and the measurement, reporting and disclosure of outcomes (33%) are the top challenges for respondents.

- Environmental issues are more than twice as important (53%) to respondents than social (22%) or corporate governance (25%) risks. Emissions are the top priority issue for respondents in the coming year.

Related Insights

Infographic | What's Driving Corporate ESG? CSR and Sustainability Professionals Have Their Say

Discover what CSR and sustainability professionals say are the top motivations and influences driving their firms’ corporate ESG programs in our infographic, featuring data from the Morningstar Sustainalytics Corporate ESG Survey Report 2022: CSR and Sustainability in Transition.

Asia-Pacific Supplement to the Morningstar Sustainalytics Corporate ESG Survey Report 2022

In this Asia-Pacific supplement to the Morningstar Sustainalytics Corporate ESG Survey Report 2022, we share additional findings showing how CSR and sustainability teams in the APAC region are managing ESG programs and compare their responses to the world.

Europe, Middle East, and Africa Supplement to the Morningstar Sustainalytics Corporate ESG Survey Report 2022

In this Europe, Middle East, and Africa supplement to the Morningstar Sustainalytics Corporate ESG Survey Report 2022, we share additional findings showing how CSR and sustainability teams in the EMEA region are managing ESG programs and compare their responses to the world.

Americas Supplement to the Morningstar Sustainalytics Corporate ESG Survey Report 2022

In this Americas supplement to the Morningstar Sustainalytics Corporate ESG Survey Report 2022, we share additional findings showing how CSR and sustainability teams in the Americas are managing ESG programs and compare their responses to the world.

What CSR and Sustainability Professionals Think: 7 Key Insights From Our Corporate ESG Survey

Earlier this year, we surveyed over 500 professionals working in CSR and sustainability to understand how their roles are evolving, what’s motivating their companies to address ESG risks, the key ESG challenges they’re facing, what resources peers are using to meet their challenges, and much more.