Businesses from nearly every industry face risk related to their environmental, social and corporate governance (ESG) practices. And customers, shareholders and regulators are increasingly calling on companies to address their impact on issues like climate change and social inequality in order to mitigate those associated risks. Many businesses and their stakeholders are turning to ESG performance and rating to assess their risk exposure; however, there is some confusion around the metrics used to generate ESG ratings and what these ratings measure. In this article we’ll shed some light on what the top-level corporate ESG rating means, and the metrics used to measure corporate ESG performance.

What Are ESG Risk Ratings Assessing?

ESG Risk Ratings have become a common and effective tool for companies to signal their ESG performance to stakeholders and potential investors. Today, there are several firms that assess corporate ESG performance and provide ratings and scores that are used by stakeholders globally. So, what do ESG ratings really measure?

Most of the world’s commonly used ratings, such as our very own ESG Risk Ratings, are an assessment of the risks key ESG issues pose to a company’s financial performance. Although the methodology for each ratings provider differs, generally the ratings consider a company’s exposure and management of ESG issues material to their business and industry. The ESG issues that are most material to a company and likely to affect its bottom line are closely tied to the industry or subindustry the company operates in, as well as its business model. High exposure to and poor management of material ESG issues will typically result in a higher overall ESG risk assessment and cause investors to take a closer look at a company’s practices.

How is ESG Performance Measured?

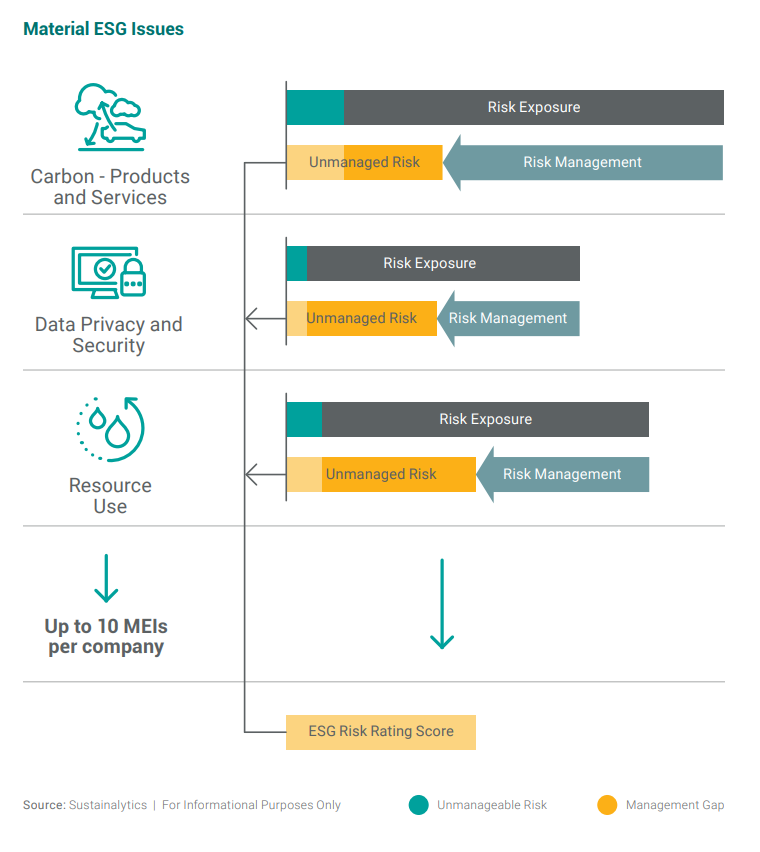

When assessing a company’s ESG performance, ratings providers measure metrics related to the ESG issues that are material to the company. Under our ESG Risk Ratings methodology, the rating is determined based on an assessment of a company’s exposure to and management of its material ESG issues (MEIs). MEIs can be any number of issues, from business ethics to community relations to resource use in the supply chain.

A company’s exposure to risks associated with MEIs will differ depending on the subindustry it operates in. Of the MEIs companies are exposed to, a portion of the related risks can be managed by the company through effective ESG programs and policies, while the other portion would be deemed unmanageable.

The overall ESG Risk Rating is the sum of the amount of unmanaged risk for each MEI the company is exposed to. While the top-level risk ratings can be a useful indicator of company ESG performance, many investors also look at how the company performs on key quantitative and qualitative metrics, as well as the quality of its management of relevant MEIs.

Figure 1. Visual Overview of ESG Risk Ratings Methodology

What are ESG Metrics?

The nature and variability of many ESG metrics is one of the main challenges facing companies today. Unlike financial datasets, ESG metrics can include both quantitative and qualitative data to help investors and other stakeholders understand a company’s actions and intentions.

Quantitative metrics are numbers-based, measurable metrics such as greenhouse gas emissions or water consumption. In our ESG ratings approach, quantitative performance indicators measure the effectiveness of a company’s policies, programs and management systems and are tracked yearly to show trends over time. For example, carbon intensity trend tracks a company’s carbon emissions over time to provide information regarding the effectiveness of its carbon emissions reduction programs.1

Qualitative metrics, such as assessing the strength or effectiveness of a whistleblower policy, are not as easily measured. However, that does not mean they are of less importance. The existence and implementation of these policies and programs is an indication that the company sees the importance of these issues and that it complies with relevant regulations within its industry and/or jurisdiction. Robust policies may also help mitigate business risks and potential negative financial impacts.

Common MEI Indicators for Corporate ESG Performance

In assessing corporate ESG performance, some MEIs are relevant to all companies regardless of their industry. Effective management of these common MEIs such as corporate governance and human capital, can help companies mitigate or even avoid costly and reputation damaging repercussions.

One such MEI is business ethics; the moral principles and values that dictate how a company conducts itself and its transactions. Business ethics issues are material for 40 out of the 42 industry groups in our ratings universe. Poor management of business ethics can severely harm a company’s reputation and lead to serious financial risks. This makes it vital that a company’s strategies and operations comply with relevant laws, regulations, and ethical business principles.

We use several metrics to assess companies’ performance on the MEI of business ethics, such as the existence and strength of whistleblower programs, political involvement policies, and bribery and corruption programs. Some metrics may be more relevant for some industries than others. For instance, among diversified banks, business ethics is a particularly material issue given the industry's history of ethical controversies like market manipulation, money laundering, bribery, corruption and insider trading. Given the subindustry’s high business ethics risk scores and in the face of a strict regulatory environment, stronger measures may be required for diversified banks to continue providing trustworthy and reliable services. Regardless of the industry, company performance on these metrics is a key indicator of the exposure and management of business ethics risks.

| Table 1. Common Business Ethics Indicators | |

|---|---|

| Whistleblower Programs | Programs launched to encourage and enable stakeholders in a company to report on and prevent improper activities. |

| Business Ethics Programs | Policies implemented to ensure that a company and its stakeholders conduct themselves and makes decisions with honesty and integrity. |

| Money Laundering Policies | Policies implemented to ensure that a company and its stakeholders comply with applicable laws and regulations related to the prevention of money laundering. |

| Political Involvement Policies | Policies outlining a company’s stance on issues related to contributions to political campaigns or organizations, gifts to government officials, etc. |

| Compliance Programs | Programs designed to ensure that a company’s employees follow relevant laws, rules, and regulations. |

| Lobbying and Political Expenses | Expenses paid for the purpose of influencing legislation, influencing the electorate, supporting political campaigns, etc. |

Source: Morningstar Sustainalytics. For informational purposes only.

Companies with well-defined ESG programs to manage their most material ESG issues are finding it easier to lower costs, attract new customers and investors, stay ahead of regulatory changes, and create long-term value.

Interested in learning more about the metrics and indicators used to assess ESG performance? Discover how companies with strong management scores are approaching common ESG issues in our ebook, Managing ESG Performance: A Practical Guide on Corporate Governance, Business Ethics and Human Capital.

References

- Morningstar Sustainalytics. 2021. ESG Risk Ratings Methodology, Version 2.1. January 2021. https://connect.sustainalytics.com/srw-esg-risk-ratings-methodology

Recent Content

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

Today’s Sustainable Bond Market: Boosting Confidence in Sustainable Bond Issuances

In this article, we examine the kinds of sustainable bonds offered in the market, some of the key regulations being developed in different markets and the current initiatives to improve the quality and credibility of issuances.

Webinar Recap: How Integrating ESG Can Drive Opportunity for Private Companies

Recently, Morningstar Sustainalytics hosted a webinar – ESG in the Lifecycle of a Private Company: How Stakeholder Demands Drive Sustainability in Private Markets – to address some of the questions private companies might have surrounding ESG and how it could impact their business.