You’ve likely made commitments around your sustainable investment activities – either as part of your firm’s investment mandate, to comply with evolving regulatory requirements, or to meet client expectations. Regulators are increasingly scrutinizing so-called sustainable investment products and requiring fund and asset managers to back up their claims. In the instances where your sustainable investments don’t meet expectations, you may be accused of greenwashing – making false or misleading statements about the underlying sustainability profile of an entity, financial product or financial service.1 This could erode investor trust and expose you to regulatory action, penalties, or fines.

So, what can you do to better align your portfolio with your stated sustainability goals and comply with reporting standards and regulations? Consider a double materiality approach when building your portfolios and investment products. Assessing both 1) the ESG risks that are material to enterprise value and 2) the degree to which an enterprise’s activities and products affect the environment and society could be an effective strategy to support your responsible investment policy. And it demonstrates to clients your genuine commitment to sustainable investing.

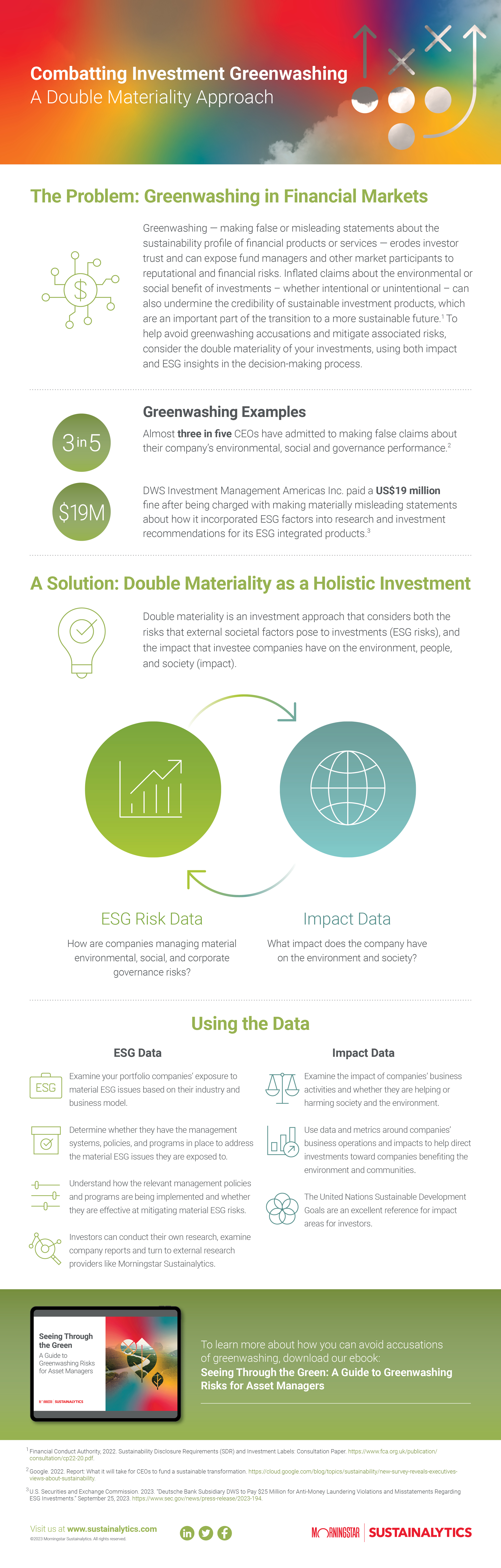

View the infographic below to learn how using the double materiality approach can help you mitigate greenwashing risks in your investments.

Access the PDF by clicking the image below or downloading it here.

References

- European Securities and Markets Authority, 2022. ESAs Call for Evidence on Greenwashing. https://www.esma.europa.eu/press-news/consultations/esas-call-evidence-greenwashing.