Planes grounded, borders closed and passengers staying at home: the past months haven’t been easy for the airline industry. COVID-19 has led to the deepest crisis ever in the history of the sector.[i] Airlines are in dire need of cash to recover, while at the same time the industry is also expected to adapt and prepare itself for the more critical crisis ahead that is climate change. Despite the slowdown of air travel, long term prospects of mitigating carbon footprint of the industry are not clear. Carbon commitments supported by comprehensive programs are in place, nonetheless, our research suggests that existing measures may not be sufficient to curve down emissions and mitigate climate change.

Pre-COVID Airlines Industry

Air traffic has increased sharply year after year, both in number of passengers transported and in distance travelled as demonstrates the following data for 2019:

- Over 4.5 billion air passengers, representing over 12 million per day, averaging a yearly growth of 6.8% for the past 5 years, doubling every 10 years;[ii]

- Close to 69 million flights, representing about 189,000 flights per day, a 10% increase compared to 2018;[iii]

- Civil aviation emits globally 1.1 billion tons of CO2 per year or 2.6% of the 37 gigatons of fossil CO2 released annually.

According to Andrew Murphy, aviation manager at Transport & Environment, “euro for euro, hour for hour, flying is the quickest and cheapest way to warm the planet.”[iv]

Airlines’ Financials Plummet

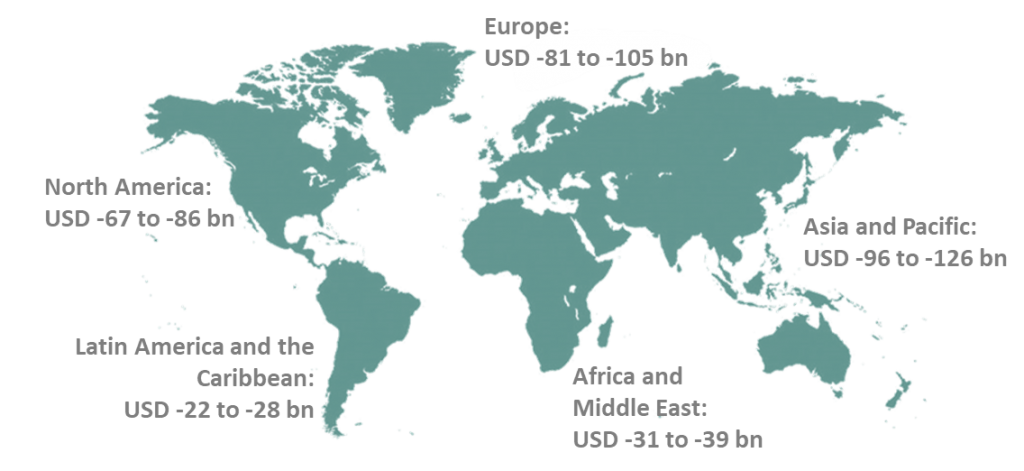

With the total global seat capacity 50 to 60% lower compared to the same period of 2019, recent months have been difficult on airlines’ revenues. [v] Coupled with a 90% fleet being grounded and travel demand narrowing zero, the airline industry is under extreme financial pressure. As shown in Exhibit 1, Asia and Pacific lost the most from international and domestic civil aviation with an estimated revenue loss ranging between USD 96 to 126bn. [vi]

Exhibit 1: IMPACT ON REVENUE (USD) FROM CIVIL AVIATION BY REGION FOR 2020

Source: International Civil Aviation Organization

It is difficult to predict when this decline will reverse and how long it will take for the industry to recover. Yet, according to Brian Pearce, chief economist for the International Air Transport Association (IATA), air travel could come back to 2019 level in 2023.[vii]

Bailouts, a Missed Opportunity to Invest for the Future

The financial struggle of the industry and the required state support is a rare opportunity for governments to invest in cleaner solutions and dictate environmental conditions such as taxing fossil fuels and requiring the use of greener energy sources. Yet, in March, the US Senate approved a USD 58bn bill for US airlines without any environmental conditions in return.[viii] On the other side of the Atlantic, European airlines are seeking an unprecedented EUR 30bn bailouts.[ix] About half has already been granted while the other half is under discussion, none of which include binding environmental agreements.[x] Some companies, such as Air France-KLM, have committed to reducing their greenhouse gas (GHG) emissions, but non-binding promises have been made for years and seldom limit air pollution. Bailouts have their limits and it is becoming clear that Green Deal proposals are weakening as states fail to seize this opportunity to align with the Paris agreement.

How are Airlines Managing Carbon-Own Operations Risks?

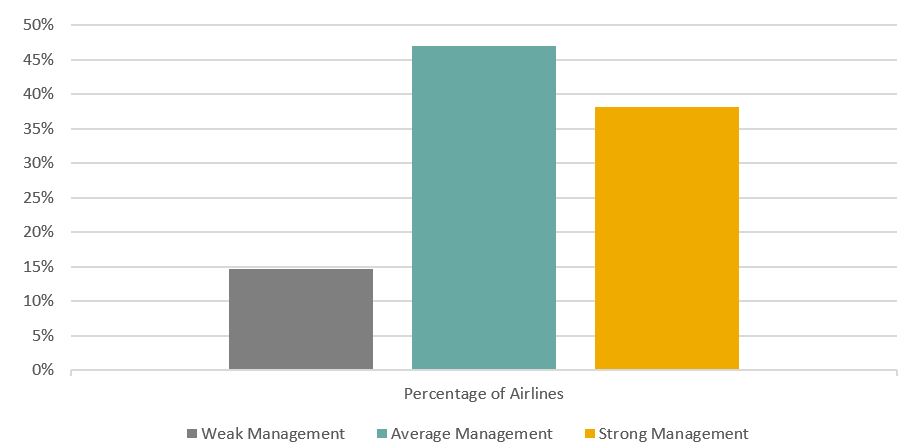

Exhibit 2: AIRLINES CARBON - OWN OPERATIONS MANAGEMENT SCORE DISTRIBUTION (%)

Source: Sustainalytics

Airlines are well aware of their carbon footprint, which is why 75% of the companies in our comprehensive universe disclose average to strong management scores for carbon emissions within their own operations as illustrated in exhibit 2. Airlines generally have comprehensive GHG reduction programs and measures in place to improve the environmental performance of their logistics and their fleet management. Yet, we note a low preparation to transition risks related to climate change with few airlines demonstrating GHG risk management programs. Another area of concern is the lack of transparency as only 55% of airlines covered publicly report on their GHG emissions, half of which provide details on scope 1, 2 and 3 GHG emissions.

Can the aviation industry really go carbon neutral?

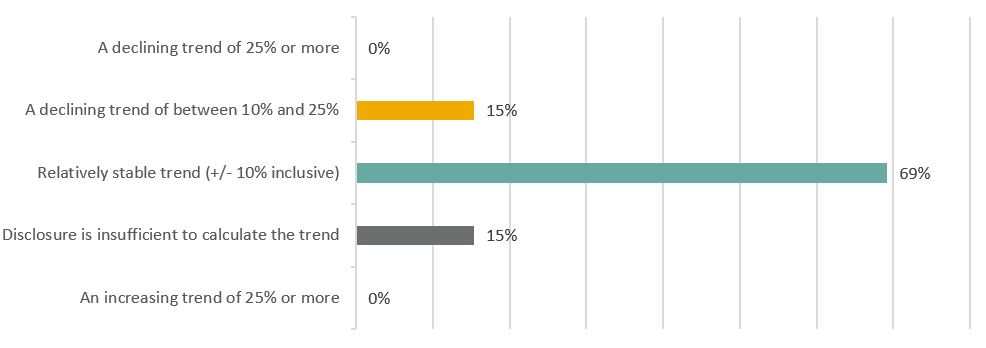

Already in 2009, IATA had aimed to make all industry growth carbon-neutral by 2020.[xi] In recent years major airlines including Delta Air Lines, Lufthansa, Air France-KLM and United Continental have announced ambitious carbon offset plans for international GHG emission growth.[xii] However, this can only be a transition solution since it is incompatible with long-term decarbonization. Our analysis of the carbon intensity trend over the last 3 years for airlines disclosing strong carbon management scores suggests that current measures are not sufficient to curve down emissions. As indicated by exhibit 3, based on our research, only 15% of strong management programs have succeeded in reducing carbon intensity trend by more than 10% while the vast majority only maintained a stable trend despite robust measures in place.

Exhibit 3: CARBON INTENSITY TREND OVER THE LAST 3 YEARS: DISTRIBUTION FOR AIRLINES WITH STRONG CARBON - OWN OPERATIONS MANAGEMENT SCORE

Source: Sustainalytics

There are multiple available solutions from more efficient aircrafts such as Boeing’s 787 or Airbus’s A350 to synthetic and sustainable jet fuel. However, a 2019 study by the International Council on Clean Transportation showed that airlines’ CO2 emissions have increased up to 70% faster than expected.[xiii] During that same period, global aviation traffic grew six times faster than fuel efficiency improved. [xiv] Technological improvements take time to deploy, and with air travel becoming more affordable the increased traffic erodes the few technological advances made over the same period. Given the difficulty to clear pathways for rapid technical progress, the gradual reduction in traffic can also be one of the main levers for reducing the carbon emissions generated by the aviation industry. As former EU climate chief Miguel Arias Cañete warned, the end of the pandemic could not just bring airline carbon emissions to their pre-COVID-19 levels but to exceeding levels if nothing is done.[xv]

The historical fall of fossil fuel prices may also impede the necessary actions to clean the aviation industry and encourage a return to a ‘business as usual’ that is undeniably damaging our planet.[xvi] Let us not forget that after the pandemic is contained, we will still need to address climate change. Another crisis for which we are yet to be prepared. From a risk mitigation perspective, addressing carbon risks in the industry is an ever-growing material issue for the Airlines industry, now more than ever.

Sources:

[i] https://unstats.un.org/unsd/ccsa/documents/covid19-report-ccsa.pdf

[ii] https://www.statista.com/topics/1707/air-transportation/; https://www.statista.com/statistics/193533/growth-of-global-air-traffic-passenger-demand/

[iii] https://www.flightradar24.com/blog/flightradar24s-2019-by-the-numbers/

[iv] https://www.motherjones.com/kevin-drum/2019/08/should-we-all-be-ashamed-for-using-airplanes/

[v] https://www.iata.org/en/iata-repository/publications/economic-reports/airlines-financial-monitor—april-2020/

[vi] https://www.icao.int/sustainability/Documents/COVID-19/ICAO_Coronavirus_Econ_Impact.pdf

[vii] https://www.iata.org/en/iata-repository/publications/economic-reports/covid-19-outlook-for-air-travel-in-the-next-5-years/

[viii] https://www.forbes.com/sites/jeremybogaisky/2020/03/25/us-airlines-on-track-to-get-what-they-wanted-in-senate-bailout-bill-without-environmental-restrictions/

[ix] https://www.transportenvironment.org/sites/te/files/Airline-bailout-tracker_8_May_2020.pdf[x] https://www.transportenvironment.org/press/airline-bailouts-set-double-%E2%82%AC26bn-countries-fail-impose-binding-green-conditions

[xi] https://www.iata.org/en/policy/environment/climate-change/

[xii] https://www.icao.int/environmental-protection/CORSIA/Pages/default.aspx; https://www.bloomberg.com/news/articles/2020-03-16/airline-carbon-offset-plan-moves-forward-as-the-industry-suffers

[xiii] https://www.theguardian.com/business/2019/sep/19/airlines-co2-emissions-rising-up-to-70-faster-than-predicted

[xiv] https://twitter.com/rutherdan/status/1205305500260171777/photo/1

[xv] https://www.theguardian.com/environment/2020/apr/01/financial-help-for-airlines-should-come-with-strict-climate-conditions

[xvi] https://time.com/5824809/negative-oil-price-climate-change/