Companies operating in the Beer, Wine and Spirits subindustry have suffered from knock-on effects of COVID-19 lockdown measures, as governments across the globe have moved to close hotels, bars and restaurants, and ban large events and gatherings, such as festivals and sports events. Given that these venues are an important source of revenue for alcohol companies, investors within this space may benefit from a closer look at how firms have adapted to the rapidly changing market conditions.

In this post, we highlight contributions of this subindustry to mitigating some of the social impacts of COVID-19 and assess five major brands on their broader approach to managing environmental, social and governance (ESG) risks, particularly those related to human capital and brand image.

Washing hands and keeping friends

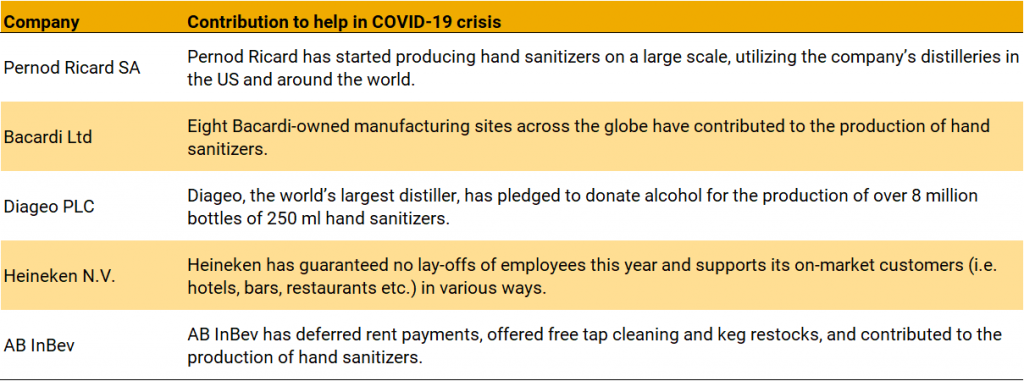

While the pandemic clearly poses a challenge for the on-premise alcohol market, it has also spurred Beer, Wine and Spirits producers to spring into action to address shifting market conditions. Their collective contributions include the production of hand sanitizers, guaranteeing no lay-offs resulting from the COVID-19 backlash, and assisting hotels, bars and restaurants with their lease obligations and other costs. For investors, such efforts may indicate how these companies manage risks in terms of human capital and social license to operate. Exhibit 1 highlights the contributions of Pernod Ricard SA, Bacardi Ltd, Diageo PLC, Heineken NV, and AB InBev.

Exhibit 1: Beer, Wine and Spirits companies that are contributing solutions to the social impacts of COVID-19

Source: Sustainalytics[i]

Human Capital

Human Capital is a Material ESG Issue (MEI) for these companies because it relates to their ability to attract, develop and retain the necessary know-how, including the in-house mixing skills to switch to the production of hand sanitizers. It also relates to how companies manage positive relations with employees.

More broadly, Human Capital is an important MEI for alcohol companies to manage so as to attract and retain skilled employees to produce high-quality products and to address concerns of employees who are often organized in labour unions. Poor management of human capital can lead to conflicts with unions, strikes, protests, lawsuits filed by workers, or regulatory penalties. As the COVID-19 crisis and associated lockdowns have hit the alcohol industry, companies may seek cost-cutting measures going forward, including potential lay-offs.

Environmental & Social (E&S) Impact of Products and Services

By contributing to the production of hand sanitizers and supporting employees and distributors during the COVID-19 crisis, companies may improve how the public perceives them. More generally, how the companies in our sample address concerns about their societal impact is reflected in part in the MEI E&S Impact of Products and Services. This MEI is an important source of risk for the industry, in part because of the potential for tightening regulations related to the negative health effects of the overconsumption of alcohol, which regulators might seek to mitigate if alcohol companies fail to address this issue adequately without intervention.

By taking steps to combat the COVID-crisis, companies in this subindustry may present themselves as responsible actors. Beyond the COVID-crisis, other ways in which companies in this industry can achieve a responsible image include formulating comprehensive policies on responsible marketing, addressing health issues related to alcohol consumption, and participating in industry-wide initiatives, such as information campaigns.

MEI Analysis

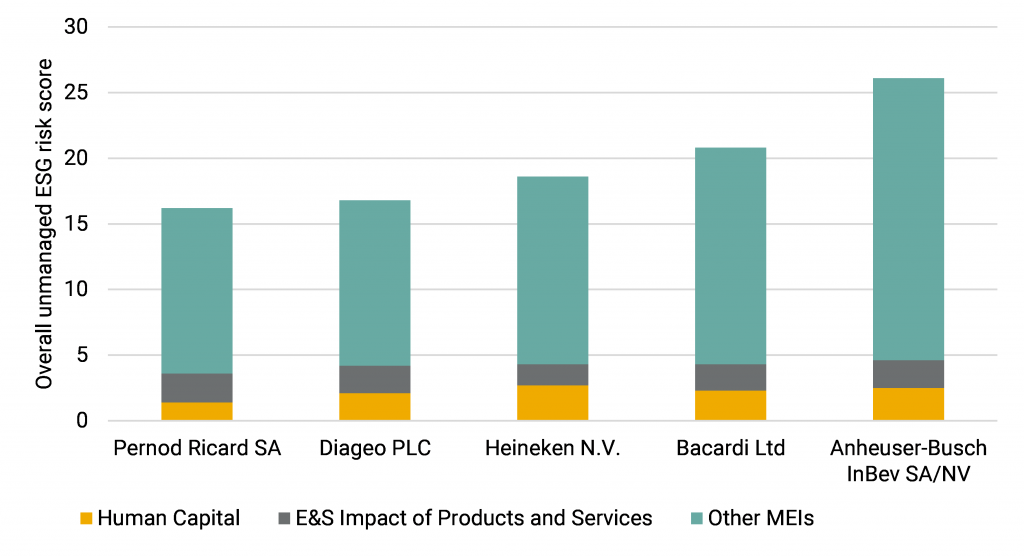

Exhibit 2 shows the contributions of Human Capital, and E&S Impact of Products and Services to the overall ESG Risk Ratings of alcohol companies. The overall unmanaged risk scores of these firms range from 16 (low ESG risk) to 26 (medium ESG risk). The combined contribution of Human Capital and E&S Impact of Products and Services to the overall unmanaged risk is limited to between 17% and 25%, in large part due to their relatively strong management of these issues.

Exhibit 2: Contribution of Human Capital and E&S Impact of Products and Services to the ESG Risk Ratings, five alcohol companies

Source: Sustainalytics

On average, these five companies outperform their peers on both MEIs, due largely to their strong management of associated risks. They have a mean management score of 76.6 (another component of its ESG Risk Rating) on E&S Impact of Products and Services, compared to a subindustry average of 49.7. For Human Capital, the sample mean management score is 43.3, compared to a subindustry average of 32.4.

Heineken scores particularly high on its management of the E&S Impact MEI (83.9); the firm’s contributions in combating some effects of the COVID-19 crisis reflects their strong focus on brand awareness. Likewise, Pernod Ricard’s relative strength in managing Human Capital MEI (55.5) may have been a factor in the company’s ability to switch to the production of hand sanitizers, building on in-house expertise.

The next round

Overall, the contributions of the companies featured in this post to help in the COVID-19 crisis may reflect some underlying strengths in their management of human capital and focus on brand awareness. Strengthening these efforts may also support these firms during the COVID-19 recovery. Beyond assessing company efforts to address social risks related to the pandemic, investors can evaluate how companies manage other long-term risks related to human capital and product impacts, which range from retaining skilled employees to mitigating the societal impacts of alcohol overconsumption.

Sources:

[i] https://www.bloomberg.com/news/articles/2020-03-24/companies-revamp-to-make-hand-sanitizer-and-coronavirus-products; https://www.bacardilimited.com/bacardi-helps-produce-hand-sanitizers-with-change-in-production/; https://www.diageo.com/en/news-and-media/press-releases/diageo-pledges-more-than-eight-million-bottles-of-sanitiser-for-frontline-healthcare-workers/; https://dutchcreativeindustry.com/news/heineken-announces-measures-to-tackle-corona-virus-crisis.html ; https://ab-inbev.eu/news/ab-inbev-records-half-a-million-prepaid-pints/