Growing environmental and safety concerns regarding household and personal care goods have boosted the demand for more sustainable solutions, with an increasing consumer preference for natural products containing responsibly sourced ingredients and eco-friendly packaging. In 2022, these manufacturers may avail of several innovative technologies to mitigate consumers’ and broader stakeholders’ concerns about what goes into their products and to better position themselves against associated ESG risks.

Managing ESG Risk in Supply Chain

Companies in the Household and Personal Products (HPP) industry rely on commodities such as palm oil and mica as key product ingredients. Commodity procurement in general and palm oil production, in particular, are frequently linked to a wide range of issues, such as labor abuses, including child labor and inadequate working conditions, land disputes, deforestation, and environmental damage on plantations. Based on our research, most firms in the industry currently lag behind best market practices for supply chain management, both in environmental and social areas, which Sustainalytics’ ESG Risk Ratings captures under the corresponding Material ESG Issues (MEIs), Land Use and Biodiversity – Supply Chain and Human Rights – Supply Chain, respectively.

The social dimension of supply chains is assessed through a company’s policy on human rights, the strength of its social supply standards and management system, and relevant external supplier certifications. Exhibit A shows HPP constituents are particularly laggard on the latter – only in one case more than half of a company’s main suppliers have received external certification, whereas suppliers of 39 companies – nearly 90% of the industry - have received no certification at all. Similarly, over 60% of HPP have weak or nonexistent systems to prevent labor rights violations within their supplier operations. These management gaps are further amplified by recurring allegations of violations of workers’ rights and other social controversies within the supply chain. For example, in September 2020, an AP investigation revealed forced labor, harassment and a harsh working environment, with no access to medical care or clean water and sanitation, across multiple palm oil producers in Indonesia and Malaysia, including FGV Holdings, a supplier of several HPP companies such as Reckitt and Procter & Gamble (P&G) that has since been banned by US authorities.1

Exhibit A

Source: Sustainalytics

Industry Focus on Deforestation

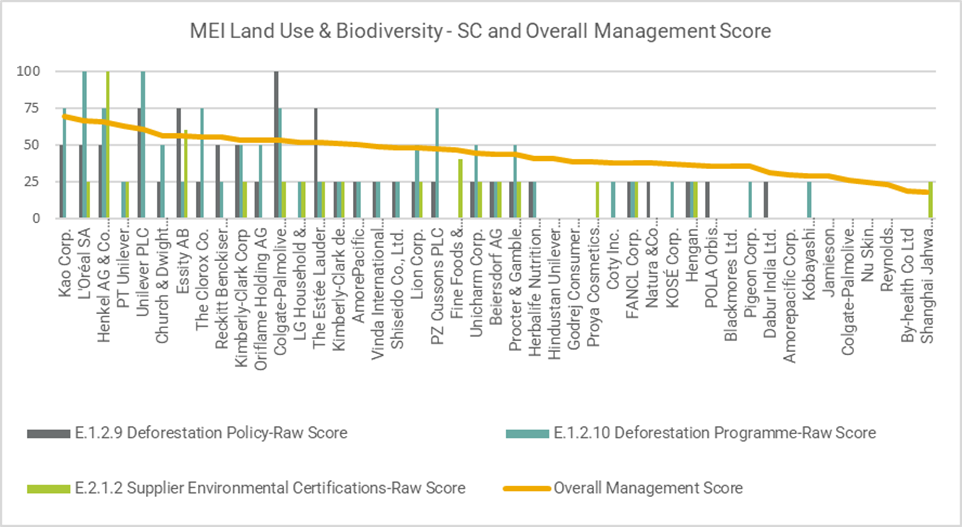

Our research suggests that the HPP industry, as a whole, has substantial gaps in terms of deforestation efforts, with less than a third of the companies having adequate, strong or very strong related policies and programs, as shown in Exhibit B. In addition, environmental supplier certifications are also not common – suppliers of 60% of HPP companies have received none.

The issue is gaining traction with investors, with P&G among those recently coming under fire. Since 2017, NGOs such as Greenpeace, Chain Reaction Research (CRR) and Rainforest Action Network (RAN) have accused the company and its suppliers of continuous involvement in land clearing activities in Malaysia, Indonesia, Papua New Guinea, Canada, and Northern Europe. According to CRR, P&G’s exposure to reputational risks due to the continued presence of deforestation and peatland clearing in its supply chain is valued at USD 41 billion, whereas market access risks are estimated at a further USD 24 billion.2 Concerns reached a breaking point at the company’s 2020 AGM when Green Century’s proposal over P&G's impact on forests received majority support, making it the first-ever forest-related shareholder proposal to pass.3

The resolution, which called on P&G to accurately report and increase its efforts to eradicate deforestation and deterioration of undamaged forests from its supply chain, led to the firm’s 2021 Forestry Practices Report. Among others, it accelerated commitments to achieve RSPO and FSC certifications and provide greater transparency on forest data, signaling positive changes. Nonetheless, investors have expressed concerns over the slow pace of developments with respect to reducing its reliance on intact forests or include best practice measures such as deforestation due diligence and risk assessments, regular audits, and traceability systems.4 Lastly, we note that clear upstream accountability for all commodity suppliers at the management level could also mitigate some concerns.

Exhibit B

Source: Sustainalytics

Altogether, these management gaps indicate ample room for improvement, which can be addressed using blockchain technology—a tool that can safely and securely capture records of transactions with the use of encryption which allows for complete transparency. As it can be used to verify the origin of commodities, their authenticity, and sustainability, compliance with regulations every step of the way, from its source to the end-user, this solution can help create a full value chain view with upstream visibility.

Why Supply Chain ESG Risk Matters to Investors

With growing scrutiny from stakeholders—international regulators and regional governments, NGOs, the general public, investors, and financial institutions—companies accused of human rights violations and environmental damage in their supply chains face substantial risks. This includes reputational damage, which may lead to consumer boycotts, compliance and operational risks stemming from tightening regulations. Together, these issues also pose significant financial risks to the industry. Businesses that understand their impact can act now to improve resource procurement, empower communities in which they operate and better manage their material sustainability risks and opportunities.

To learn more about Sustainalytics' research and insights into the risks associated with the supply management of commodities and the opportunities that blockchain solutions offer to mitigate such concerns, download our report, titled An ESG Lens on Blockchain and Public Equities.

Sources:

[1] Associated Press (24.09.2020), “Palm Oil Labor Abuses Linked to World's Top Brands, Banks,” (accessed 01.03.2022) at: https://apnews.com/article/virus-outbreak-only-on-ap-indonesia-financial-markets-malaysia-7b634596270cc6aa7578a062a30423bb

[2] Chain Reaction Research (15.11.2019), “Procter & Gamble’s Deforestation Exposure May Affect Reputation,” (accessed 01.03.2022) at: https://chainreactionresearch.com/report/procter-gamble-deforestation-exposure-may-affect-reputation/

[3] Green Century Funds (17.09.2020), “Green Century Presses Procter & Gamble* To End Deforestation and Forest Degradation in Its Supply Chain,” (accessed 01.03.2022) at: https://www.greencentury.com/green-century-presses-procter-gamble-to-end-deforestation-and-forest-degradation-in-its-supply-chain/

[4] Green Century Funds (22.07.2021), “Prompted by a Green Century Proposal, Procter & Gamble* Improves No-Deforestation Commitments but Fails to Address Intact Forest Degradation in Climate-Critical Canadian Boreal Forest,” (accessed 01.03.2022) at: https://www.greencentury.com/prompted-by-a-green-century-proposal-procter-gamble-makes-progress-on-forest-policies/