In one of the starkest contrasts of our world, two billion people go without enough food every day, while another two billion are overweight or obese.[i] Meanwhile, the Food and Agriculture Organisation (FAO) estimates that one-third of global food production is wasted each year.

In addition, for the first time since being published, the 2020 World Economic Forum Risk Report included food, water, and biodiversity crises among the most perilous risks over the next ten years.[ii] This indicates that risks and opportunities related to food go beyond ethical considerations and extend to use of resources and climate change impacts, brand and reputation, operational efficiencies, regulation, and value creation.

This makes food waste a very costly practice for both companies, society, and investors. To talk volumes, one in ten kilos of produced food ends up in trash bins, whereas two in three kilos are lost along supply chains.[iii] Food waste seems to be so ingrained in production and consumption patterns that it may be almost considered a by-product of our habits. In the context of humanitarian concerns about poverty and hunger, addressing the issue of food waste can form the basis of a responsible investment strategy for asset managers pursuing an impact investing agenda aligned with the UN Sustainable Development Goals (SDGs). Food security is also an important issue for mainstream, fiduciary investors to address because it can affect macroeconomic and geopolitical stability.

On the other side of the spectrum are consumers and their behaviour and attitude towards food. Statistically speaking, they are responsible for approximately 30% of global food waste.[iv] There is, however, a silver lining as their environmental consciousness is increasing. In a recent survey by Dutch bank ING, 38% of respondents stated that they actively stopped buying food or drink products after discovering that a company was not environmentally responsible.[v]

The last piece of the puzzle is regulators. Table 1 summarises some of the flagship initiatives taken by governments. Companies that take proactive steps to adapt and comply with regulation (even if not legally binding) can benefit from first-mover advantages. For example, they can get ahead of industry norms, front-run potential more stringent regulation in the future, and boost their green image, which might improve brand recognition, customer loyalty and sales. Partnerships to support government efforts can have similar positive reputation effects for both companies and investors.

Table 1: Selected legislative initiatives to reduce food waste

Source: Sustainalytics

What our research says

Sustainalytics’ ESG Risk Ratings captures how food companies address the issue of waste and consumption at large through two MEIs: E&S Impact of Products and Services and Emissions, Effluent and Waste., There are clear, though perhaps subtle, material business opportunities from curbing food losses from more efficient inventory management to lower waste disposal fees and higher revenues. Our research currently does not track dedicated food waste metrics, however for our paper 10 for 2021: Investing in the Circular Food Economy, we created a composite indicator to measure company performance, based on four distinctive indicators which are part of the underlying management assessment of the two MEIs: E.1.1 Environmental Policy, E.1.2 Environmental Management System, E.1.2.6.1 Solid Waste Management, and E.3.1.1 Sustainable Products & Services.

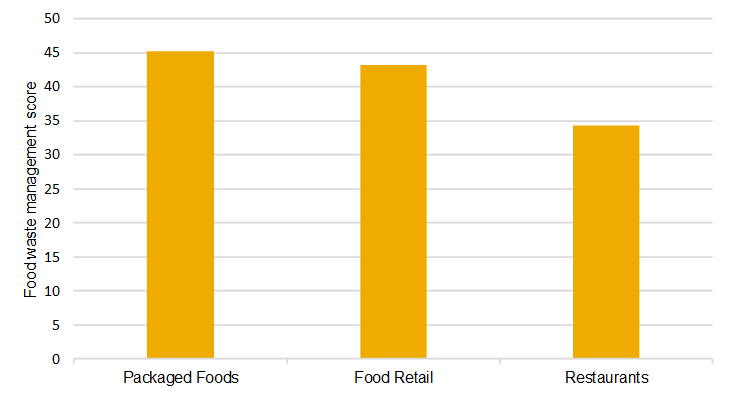

Figure 1 shows the average score for companies on food waste management performance across three subindustries: Packaged Foods, Food Retailers and Restaurants. Packaged Foods companies demonstrate the highest preparedness, with an average score of 45, closely followed by Food Retail (43), while Restaurants lag at 34. This differential is primarily due to the B2B model of Packaged Foods companies which allows for closer oversight of waste management. Food Retailers are pivotal in driving food waste reductions, as they find themselves in a sweet spot to influence behaviours of different actors, from farmers to consumers.[vi] However, for supermarkets closing the loop requires more efforts in terms of projecting the amount of goods that will be sold before expiry, and accounting for changing consumer preferences. Even more challenges exist for Restaurants, which cannot control consumers’ habits. Leading companies are nonetheless taking steps to increase circularity and minimize food waste.

Figure 1 Average composite score for selected subindustries

Source: Sustainalytics

Source: Sustainalytics

The circular way forward

Indications that a food crisis is imminent are clear. Fundamental changes in the global food system are required to address these challenges. This decade is a watershed moment for urgent efforts to close the loop, and companies and investors can play a pivotal role. Despite being closely connected to issues such as climate change and basic human rights, food waste has attracted comparatively less attention from companies, investors, and other stakeholders.

Without profound changes to current patterns, wasted food is estimated to reach USD 1.5 trillion by 2030, so businesses and investors have tremendous untapped opportunities to capture the value currently lost. Research suggests that every dollar invested in optimizing food value chains can return 14 dollars.

Leading companies in the food, packaging and waste management industries are responding to pressures from consumers, regulators and stakeholders while taking advantage of competitive and business opportunities. As investors become more aware and concerned about ESG risks, including the humanitarian and environmental impacts of food and packaging waste, companies that offer innovative solutions to tackle problems may represent compelling investors.

To learn more about leveraging Sustainalytics' insights to develop well-diversified circular food economy-focused funds, download the 10 for 2021 report, this year's winner of Environmental Finance's Award for impact research.

Sources: