Utilities have found themselves in the literal and metaphorical eye of the storm over the last year as hurricanes, floods and wildfires of increasing frequency and strength have wreaked damage on their assets. In late August, Storm Ida made landfall in Louisiana, USA and devastated the power grid lines. Entergy, the utility operating in Louisiana, supplying most of New Orleans, restored 90% of the supply only by mid-September, with 87,000 customers still without power.1

Over the last year, the US saw a series of extreme weather events that impacted utilities considerably. Storm Isaias hit the East Coast, and over 2 million people across New York, New Jersey and Connecticut faced electricity blackouts,2 which the utilities scrambled to get online, indicating the level of unpreparedness for a storm of that scale, despite the increased frequency of hurricanes along the Atlantic coast.3 In the same month, Hurricane Laura made landfall in Louisiana, wreaking significant damage to the transmission network leaving 270,000 customers without power for a week.4 In February 2021, Texas was hit with winter storm Uri, resulting in record low temperatures, snow, and ice. Gas well-heads and pipe networks were not weatherized for the unusually low temperatures and froze and the resulting power blackout affected over 4.7 million people.

Aside from mitigating the immense financial losses, electricity, heat, and water are essential services, and extended blackouts and network disruptions of the scales experienced in 2020 and 2021 are a matter of life and death for residents.

The immediate need for utilities to assess their vulnerabilities in the specific context of climate and weather events is more pronounced with events that would be previously modelled as once-in-a-hundred years now occurring with alarming frequency, often annually. For instance, after Superstorm Sandy’s extensive damage and resulting blackouts in 2012, ConEdison invested USD 1 billion5 to improve its systems’ resiliency to major storms. However, in 2020, Strom Isaias led to widespread blackouts in the state and an investigation by the NY Public Service Commission. In November 2020, it found the utilities’ response inadequate and held them liable.6 ConEdison is facing potential fines of USD 102.3 million, as well as the possibility of having its license to operate revoked.

On the other coast, California has strong regulatory oversight over utilities for wildfire prevention, management, and involvement. Pacific Gas & Electric (PG&E) was found liable for wildfires in 2017 and 2018. The company had to pay USD 25 billion in penalties and compensation for damage which led to its filing for bankruptcy.7 As of 2020, the utility is once again the focus in the investigation of a fire in September 2020.8

Both states have now increased regulatory requirements for utilities. New York and California require utilities to submit updated climate resiliency and wildfire management plans, respectively. PG&E, Southern California Edison and San Diego Gas and Electric submitted wildfire management plans that would cost a total of USD 15 billion over the next two years.9

The cost of climate events is just as high even when regulation is weaker or non-existent. The Texas electricity market, which is deregulated, saw prices spike as gas wells shut down production in the unexpected cold. 2.7 million customers were affected, and the resulting supply constraint led to a massive price surge – around USD 9,000/MWh – which is now being passed down to customers as a surcharge to be paid off over several years.10 Given that the deregulated nature of the market encourages competitive pricing, it does not incentivize expending capital on weatherization. Still, as seen in the Texas storm case, the costs ultimately get passed down to customers. Several utilities filed for bankruptcy.11 Ultimately, the Texas state house passed a USD 25 billion bailout plan,12 which will be passed down to taxpayers and customers.

Similarly, in Louisiana, Hurricanes Laura, Delta, and Zeta in 2020 caused significant damage to transmission networks and resulted in blackouts. Entergy estimated that the total cost of the damage was USD 2.4 billion and had to raise debt for reconstruction.13 It is likely the some of the costs will be passed down to ratepayers eventually.

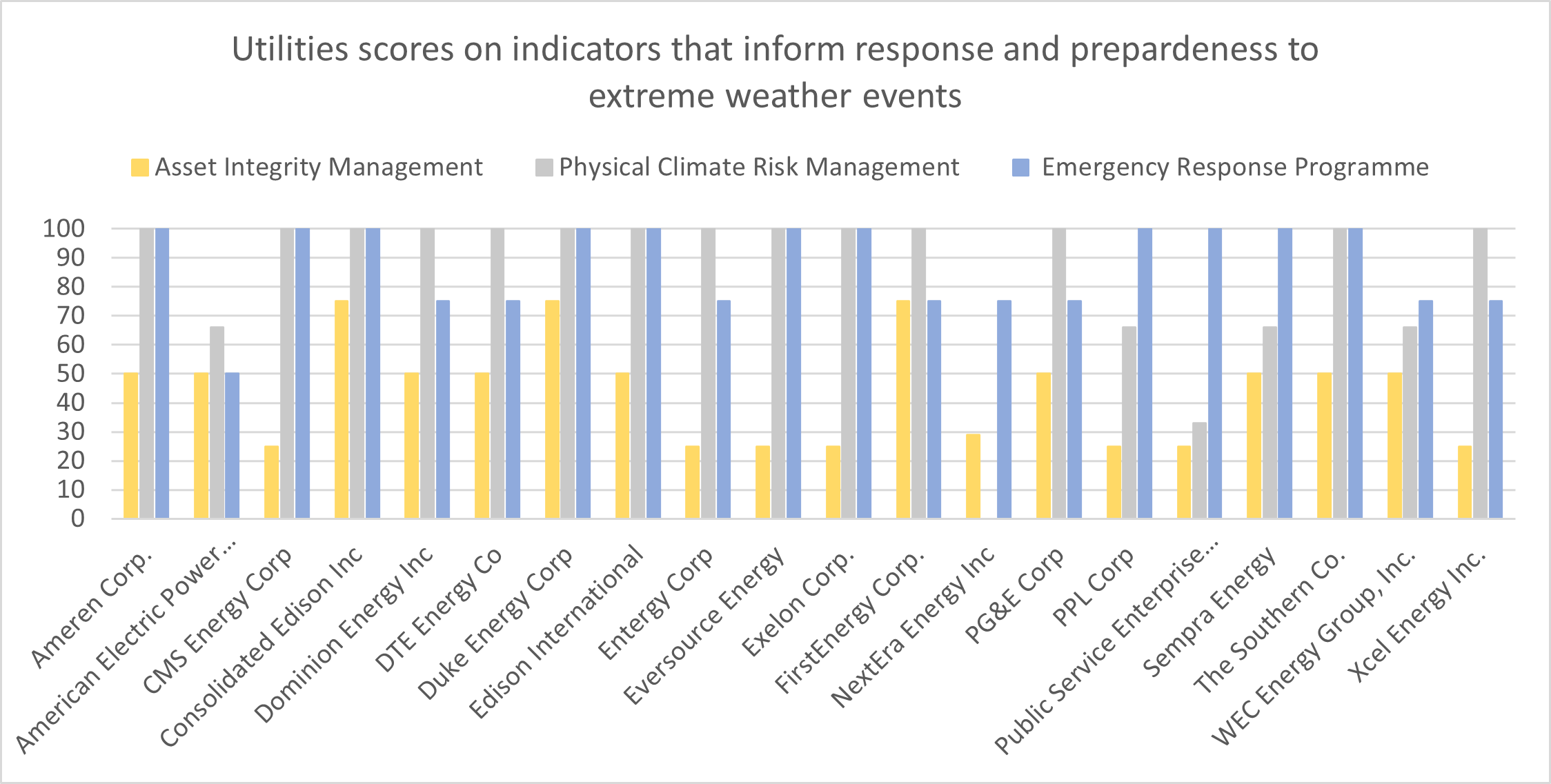

Sustainalytics’ ESG Risk Ratings research specifically addresses utilities’ engagement with this issue. The Physical Climate Risk Management indicator is a metric that looks at the extent to which a utility manages risk assessment of potential climate impacts. This includes identifying and incorporating climate impacts into their enterprise risk assessment, the various strategies and mid- to long-term plan to mitigate the effects of these events on their assets, and the expenditure earmarked for climate impacts. The utility’s preparedness for emergencies – communication protocols, service restoration plans, engagement with local communities and first responders during crises – also indicate its incorporation of extreme weather risk management into their operations.

Additionally, Sustainalytics examines the utility’s existing management plan for risks associated with existing assets, maintenance, long-term management plans, targets and oversight using the Asset Integrity Management indicator.

Sustainalytics’ Risk Rating research indicates that utilities’ engagement with the issue is mixed. Most companies identify and address the physical impacts of climate change. Still, several companies, including American Electric and WEC Energy, do not report detailed plans or initiatives to manage or mitigate the risk. While DTE and Dominion disclose formal asset management plans of their gas pipelines, they do not disclose a similar program for all their other assets, nor is it clear if the programs are regularly audited or externally certified to ISO 55001. Utilities that have a history of repeatedly grappling with extreme weather events, and subsequent regulatory demand for greater disclosure, also have higher levels of reporting on the issue. We observed this trend with ConEdison, PG&E Corp, and Edison International, which have more detailed, extensive risk assessments and management of potential physical impacts of climate change.

Source: Sustainalytics data based on companies’ disclosure in Annual and Sustainability reports

A 2019 report by McKinsey estimated that an average US utility could incur a 23% increase in losses resulting from extreme weather by 2050, compared to the previous 20-year average.14 A survey of utility executives undertaken by Accenture in 2020 showed that 73% of the respondents believed that extreme weather posed a serious challenge to their grid networks, but only 24% believed that their companies were prepared for it.15

Companies that perform well on all three metrics are likely to be better prepared, or at the least, in a position to anticipate the extent to which their assets are exposed to extreme weather events and reckon with the likely impacts – financial, regulatory, and reputational.

Sources:

[2] https://www.theverge.com/21361751/tropical-storm-isaias-power-outages-tristate-utilities-energy-grid

[4] https://www.usatoday.com/story/news/local/louisiana/2020/09/03/hurricane-laura-recovery-damaged-utility-grid-take-weeks-repair/5690935002/

[5] https://www.coned.com/-/media/files/coned/documents/our-energy-future/our-energy-projects/climate-change-resiliency-plan/climate-change-resilience-adaptation-2020.pdf

[6] http://documents.dps.ny.gov/public/MatterManagement/CaseMaster.aspx?MatterCaseNo=20-01633&submit=Search

[7] https://www.utilitydive.com/news/pge-says-it-could-face-significant-liability-due-to-september-zogg-fire/588094/

[8] https://www.pge.com/en/about/newsroom/newsdetails/index.page?title=20210322_pge_responds_to_cal_fires_announcement_about_2020_zogg_fire_in_shasta_county

[9] https://www.bloomberg.com/news/articles/2021-02-06/california-utilities-plan-15-billion-for-fire-safety-work

[10] https://www.dallasnews.com/opinion/commentary/2021/08/01/the-texas-blackouts-were-caused-by-an-epic-government-failure/

[11] https://www.power-technology.com/news/industry-news/texas-snow-storm-bankrupt-fallout-energy-prices-ercot/